3M’s Dividend Risk Is Rising, So Buy These 2 Higher-Yielding Alternatives

Summary:

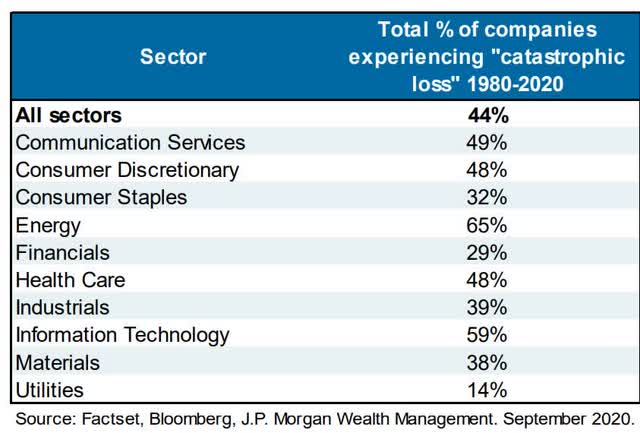

- 44% of US stocks suffer permanent “catastrophic” 70+% declines, and not even dividend aristocrats are 100% safe.

- The Dividend Kings use a 3,000-point safety and quality model looking at over 1,000 metrics to warn investors against potential value traps.

- 3M’s earnings and guidance were terrible, with a dividend payout ratio close to 100% in 2023. We just downgraded our safety score to 63% and the quality score to 91%.

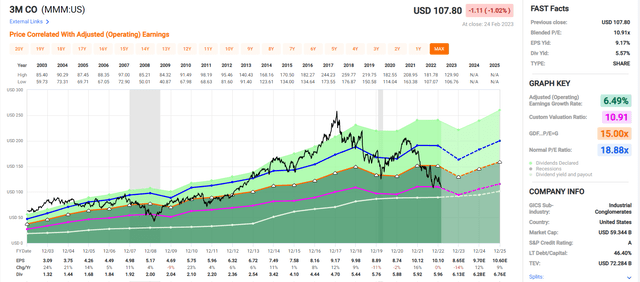

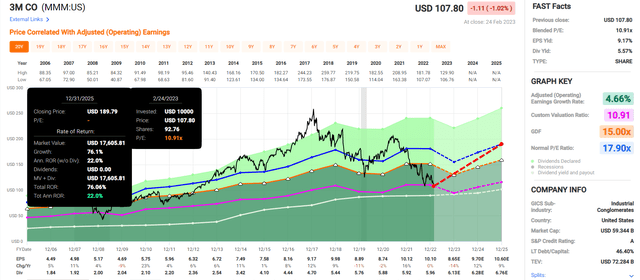

- 3M remains a high-quality though speculative company. It’s trading at the lowest price in 10 years, the lowest PE in 15 years, and the highest yield in 27 years.

- While 3M has 12% to 13% long-term return potential and could potentially soar to almost 80% in 3 years, here are two superior higher-yielding blue-chip options firing on all cylinders.

Kativ

This article was published on Dividend Kings on Monday, February 27th, 2023.

—————————————————————————————

To paraphrase Thomas Jefferson, “Eternal vigilance is the price of financial liberty.”

Even the strongest blue-chips can occasionally fall on hard times. And sometimes, they never recover.

In fact, 44% of all US stocks suffer permanent “catastrophic” losses of 70+% and never recover.

Famous examples of dividend aristocrats that have suffered such dismal fates include:

In 2023 we’ve had 17 companies cut their dividends, including V.F. Corp. (VFC), a dividend king that slashed its dividend by 40% just one quarter after hiking for the 51st consecutive year.

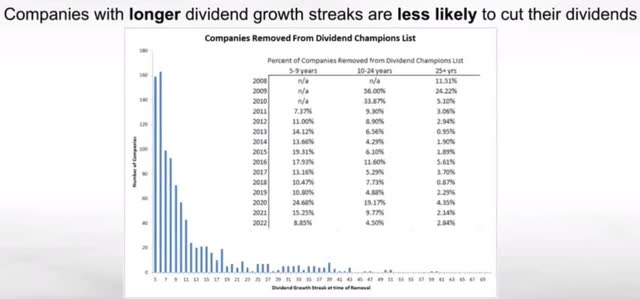

Ben Graham considered dividend streaks an important sign of quality, but on their own they don’t guarantee a dividend is safe.

The Dividend Kings use a 3,000-point safety and quality model that includes over 1,000 metrics. We use this to estimate the probabilities of a dividend cut in regular and severe recessions or even when fundamentals deteriorate outside of a recession.

Today I’m providing an update on 3M (NYSE:MMM), a legendary dividend king who recently hiked for the 65th consecutive year.

3M reported troubling earnings, resulting in a safety and quality downgrade from Dividend Kings. It also sent shares falling 5% last week, to the lowest since May 2013.

- The 5.7% yield is the highest since 1996, 27 years

Let me share with you why 3M remains a high-quality company, but a speculative 91% quality dividend king and offer two higher-yielding and less risky alternatives.

Why 3M’s Safety And Quality Continue To Fall

Let me be clear that neither I nor the analyst consensus expect 3M’s dividend to get cut in the next few years.

We expect 3M to continue delivering token hikes through 2024 before the legal liability overhangs of PFAS and the earplug lawsuits abate in 2025.

However, 3M reported very disappointing results, and don’t just take my word for it.

Despite crediting 3M with an eventual long-term cyclical recovery, guidance wasn’t even close to what we hoped to see in 2023 on the top or bottom lines or in terms of cash…

To say we were disappointed would be an understatement, though we concede 3M has more meaningful exposure to China-related slowdowns at 10% of its sales mix. We estimate 3M will generate its lowest level of operating margins since we’ve kept records—lower than in the Great Recession and at the height of the pandemic. We’re also now expecting about nearly $1 billion in fewer sales than we previously earmarked.” – Morningstar

3M has been in a multi-year turnaround that began when Mike Roman took over as CEO in 2018.

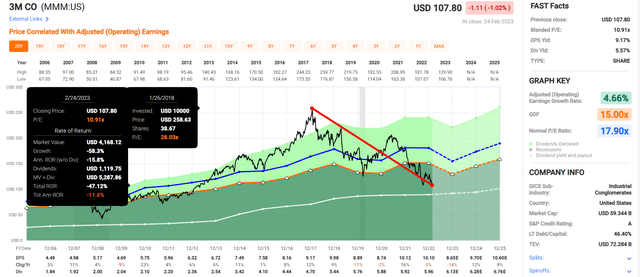

In fairness to 3M, its bear market since 2018 was largely due to the stock being in a historic bubble created by tax cut euphoria and speculative mania about infrastructure spending that never materialized.

3M Began This Bear Market Almost 60% Overvalued

For context, 3M began this bear market 10% more historically overvalued than the US stock market in March 2000, the worst US bubble in history.

Paying 28X earnings for a company historically worth 18X is just asking for trouble.

However, management’s pre-turnaround guidance of 8% to 11% growth hasn’t worked out, and that’s partially due to management mismanagement and partial bad luck.

- an industrial recession in 2018

- the Pandemic crash of 2020

- now a likely recession in 2023 or 2024

On top of this, we have the large legal uncertainty surrounding its PFAS and earplug lawsuits.

Here is an article exploring its legal liability risk in more detail.

We believe that liability in of nearly $3 billion is roughly fair for Combat Arms, based on comparable fact patterns on a per-plaintiff basis, adjusted for inflation. Our number is somewhat higher than the $1 billion 3M initially committed to fund with its settlement trust. We don’t believe 3M will successfully appeal its latest unfavorable bankruptcy ruling. Based on comparable environmental cases, we also earmark about $7.5 billion in legal liabilities related to PFAS.” – Morningstar

3M isn’t likely to pay the worst-case $50+ billion in potential legal costs, as some analysts have warned. However, $10 billion seems like a conservative estimate.

The good news is that this is likely to be stretched out over time. The bad news? It might cost the company about $1 billion per year, which is what it’s been spending on legal costs recently.

And this is where 3M’s safety and quality downgrade comes in.

Why We’re Downgrading 3M’s Safety And Quality Scores

3M Dividend Safety

| Rating | Dividend Kings Safety Score (250 Point Safety Model) | Approximate Dividend Cut Risk (Average Recession) | Approximate Dividend Cut Risk In Pandemic Level Recession |

| 1 – unsafe | 0% to 20% | over 4% | 16+% |

| 2- below average | 21% to 40% | over 2% | 8% to 16% |

| 3 – average | 41% to 60% | 2% | 4% to 8% |

| 4 – safe | 61% to 80% | 1% | 2% to 4% |

| 5- very safe | 81% to 100% | 0.5% | 1% to 2% |

| 3M | 63% | 1% | 2.8% |

| Risk Rating | Low Risk (89th S&P Global percentile risk-management) | A Negative Outlook credit rating =0.66% 30-year bankruptcy risk | 2.5% or less max risk cap- speculative |

Long-Term Dependability

| Company | DK Long-Term Dependability Score | Interpretation | Points |

| Non-Dependable Companies | 20% or below | Poor Dependability | 1 |

| Low Dependability Companies | 21% to 39% | Below-Average Dependability | 2 |

| S&P 500/Industry Average | 40% to 59% | Average Dependability | 3 |

| Above-Average | 60% to 79% | Dependable | 4 |

| Very Good | 80% or higher | Very Dependable | 5 |

| MMM | 100% | Very Dependable | 5 |

Overall Quality

| MMM | Final Score | Rating |

| Safety | 63% | 4/5 safe |

| Business Model | 80% | 3/3 wide moat |

| Dependability | 100% | 5/5 very dependable |

| Total | 91% | 12/13 speculative blue-chip dividend king |

| Risk Rating |

4/5 low Risk |

|

| 2.5% OR LESS Max Risk Cap Rec – speculative |

15% Margin of Safety For A Potentially Good Buy |

3M’s safety and quality scores continue to decline due to stresses on its financials.

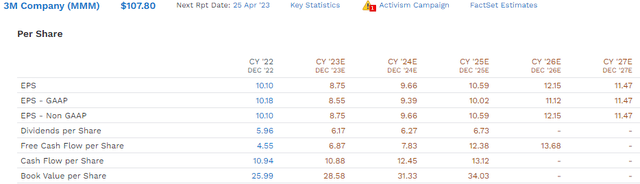

For example, management is guiding for about $4.5 billion in free cash flow in 2023 compared to a $3.4 billion dividend cost.

- a 76% FCF payout ratio guidance

For context, rating agencies consider a 60% FCF payout ratio safe for this industry.

If 3M weren’t facing so much macro uncertainty right now, a 76% payout ratio might not be so bad. However, remember that 3M, even without settling its lawsuits yet, has been paying about $1 billion per year in legal bills.

And management FCF guidance is pre-legal bills.

- Post-legal 2023 potential free cash flow: $3.5 billion vs $3.4 billion dividend

- a potential 97% free cash flow payout ratio

The analyst consensus is that 3M’s actual post-legal bill FCF payout ratio for 2023 will now be 90%, slightly lower than my more conservative estimate.

- in 2022 post-legal FCF payout ratio was 131%

And with MMM exiting PFAS manufacturing, which some analysts estimate generates $100 million per year in free cash flow, 3M’s true payout ratio might be 100% in 2023.

- assuming management hits guidance

- which is unlikely in a recession

A 90% to 100% payout ratio is pushing safety boundaries, and that’s before we even consider rising recession risk.

Elevated Payout Ratios Going Into Recessions Are How Dividend Kings Fail

How often do dividend kings cut their dividends? Since 2008 about one every five years.

It’s rare, but the risk becomes elevated if we go into recession, especially for cyclical sectors like industrials.

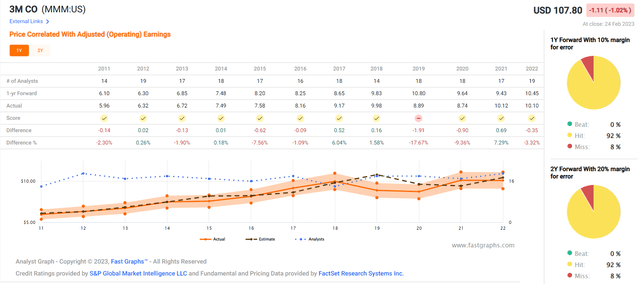

Remember that 3M has been missing estimates, based on management’s ever more conservative guidance, for several years now.

The misses since Roman took over have been around 10%, smoothing for outliers and as high as 18%.

Rating agencies like to see 60% or lower FCF payout ratios for industrials because in a recession if earnings and cash flows fall significantly, there is plenty of safety cushion.

- A 60% FCF payout ratio allows FCF to fall 66%, and the dividend is still covered by cash flow

But what happens if a company’s payout ratio is 90+% going into a recession? And the historical margins of error are 10% to 18%? Then suddenly, the dividend can become unsustainable, at least for that year.

If 3M continues to miss expectations, another year of 100+% payout ratios will put pressure on its balance sheet.

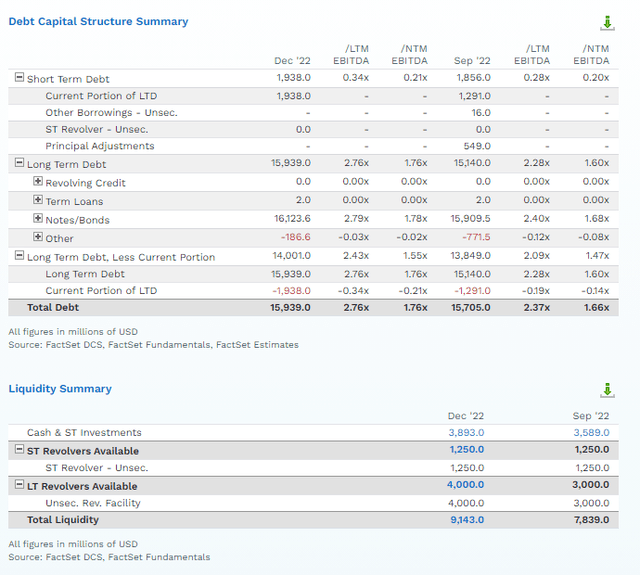

3M’s net debt/EBITDA is 2.2X right now, below the 3.0X rating agencies like to see.

However, it’s elevated for an A-rated company, so S&P has a negative outlook on 3M.

- a 33% chance of a downgrade within 2 years

3M has plenty of liquidity, but the bond market is becoming more concerned about its ability to keep the dividend streak while servicing its debt.

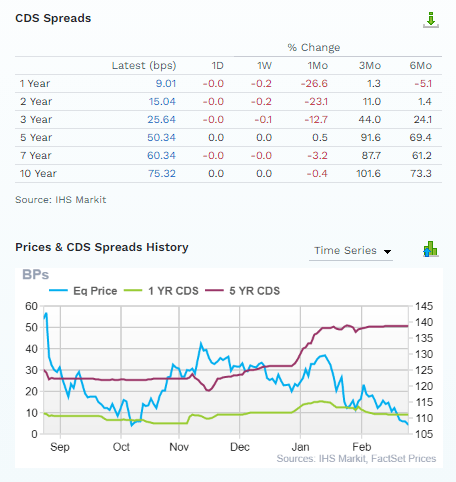

FactSet Research Terminal

Credit default swaps or CDS are publicly traded insurance policies against default and are how the bond market provides us with real-time fundamental risk assessments.

In recent months, 3M’s five to 10-year default risk increased from 60% to 73%, though it remains well below 1%.

Is 3M going bankrupt? Almost certainly not.

- the bond market estimates the risk of this over 30 years is 2.25%

Is 3M going to lose its investment-grade credit rating? Very unlikely.

But could 3M in a recession get a downgrade to A- or even BBB+? Yes.

And could that put pressure on management to cut the dividend? Especially if those legal bills last longer than expected (2025)? The answer is yes.

- thus the safety and quality downgrades

3M Is A Speculative Ultra Value Buy

The good news is that, for now, analysts expect 3M’s turnaround to succeed.

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return |

| 3M | 5.7% | 7.0% | 12.7% | 8.9% |

| ZEUS Income Growth (My family hedge fund) | 4.1% | 10.4% | 14.5% | 10.2% |

| REITs | 3.9% | 6.1% | 10.0% | 7.0% |

| Schwab US Dividend Equity ETF | 3.6% | 9.4% | 13.0% | 9.1% |

| Vanguard Dividend Appreciation ETF | 2.2% | 10.0% | 12.2% | 8.5% |

| 60/40 Retirement Portfolio | 2.1% | 5.1% | 7.2% | 5.0% |

| Dividend Aristocrats | 1.9% | 8.5% | 10.4% | 7.3% |

| S&P 500 | 1.7% | 8.5% | 10.2% | 7.1% |

| Nasdaq | 0.8% | 10.9% | 11.7% | 8.2% |

(Source: DK Research Terminal, FactSet, Morningstar)

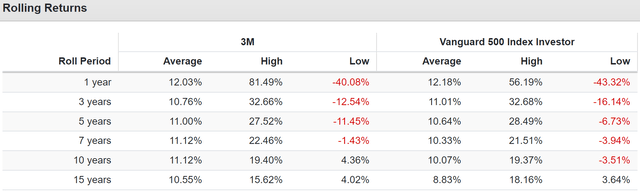

While 3M’s days of 8% to 11% growth are probably behind it, the highest yield in 27 years means that investors MIGHT be able to achieve slightly better returns than 3M has historically delivered.

3M Rolling Returns Since 1985

And 3M is trading at a 40% historical discount to fair value.

The Lowest PE In 15 Years And The Highest Yield In 27 Years

3M is trading at 9.1X cash-adjusted earnings, a private equity valuation for what’s still a very high-quality company.

What does a 40% discount mean for anyone comfortable with 3M’s speculative turnaround and high legal risks?

3M 2025 Consensus Return Potential

If 3M grows as expected and returns to its historical fair value of about 18X earnings, it could deliver 76% returns within three years, or 22% per year.

- Buffett-like return potential hiding in plain sight

That being said, while 3M’s multi-decade best valuation is attractive, we can’t forget that long-term it offers 12% to 13% return potential, and that’s only if it can actually grow at 7% long-term.

Higher-Yielding And Lower-Risk Alternatives To 3M

Here are just two of my favorite higher-yielding and lower-risk alternatives to 3M that offer superior growth characteristics and higher return potential.

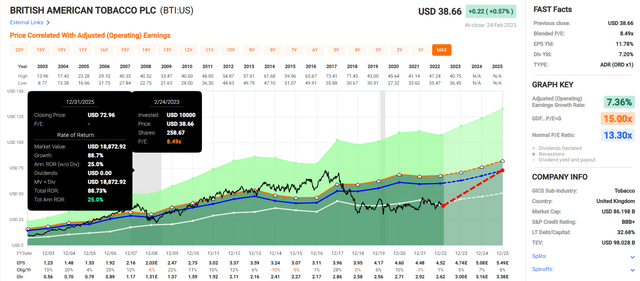

British American Tobacco (BTI): A Global Aristocrat Firing On All Cylinders

Further Reading

Summary Facts

- DK quality rating: 93% very low risk 13/13 Ultra SWAN (sleep-well-at-night) global aristocrat

- Fair value: $63.27

- Current price: $38.66

- Historical discount: 39%

- DK rating: potential Ultra Value buy

- Yield: 7.2%

- Long-term growth consensus: 9.1%

- Long-term total return potential: 16.3%

BTI is about as undervalued as MMM but is growing slightly faster and offers a yield that’s about 50% higher. Thus it’s potential 3-year total return is superior at 89%, or about 25% annualized.

- 3X more than the S&P 500

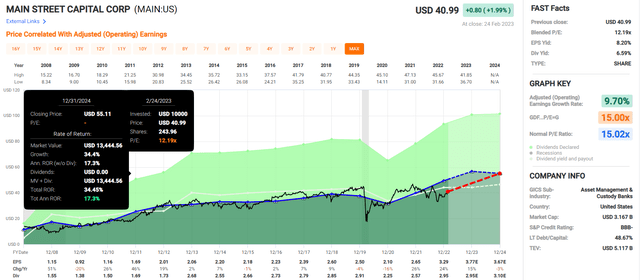

Main Street Capital (MAIN): The Gold Standard of BDC Safety

Further Reading

MAIN is the gold standard of safe BDCs, with a 12-year dividend growth streak and 15 year streak without a dividend cut.

- No other BDC has ever avoided a dividend cut through three recessions

MAIN just reported a 15% growth in interest income and issued a supplemental dividend of $.18 per share.

Summary Facts

- DK quality rating: 88% medium risk 11/13 SWAN (sleep-well-at-night) BDC

- Fair value: $47.67

- Current price: $40.99

- Historical discount: 14%

- DK rating: reasonable potential buy

- Yield: 6.6% (not counting supplemental dividend) – monthly yield

- Long-term growth consensus: 8.0%

- Long-term total return potential: 14.6%

MAIN is a potentially solid financial choice for anyone who doesn’t want tobacco or midstream and wants to avoid speculative turnaround stocks.

One that offers a very attractive 17% annual return potential through 2025.

Bottom Line: 3M’s Fundamentals Continue To Weaken, So Consider Higher-Yielding And Lower-Risk Alternatives

When the facts change, I change my mind. What do you do, sir?” – John Maynard Keynes

There are no sacred cows at iREIT or Dividend Kings. Wherever the fundamentals lead, we always follow. That’s the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

My loyalty is never to any specific company, not even those I have “I’ll die on this hill” confidence about.

My loyalty is only to my readers and subscribers, which means an undying loyalty to the truth, as best as we can ever know it at any given time.

If the fundamentals deteriorate, our safety and quality model, run off the consensus of every analyst, rating agency, and the bond market, will let us know.

And with 3M’s safety and quality falling yet again, I wanted to point out that there are many superior high-yield lower risk, non-speculative opportunities out there.

BTI is just one example of a global aristocrat whose valuation is even better than 3M’s, and whose execution has been far superior.

MAIN is another solid choice, as are numerous midstream blue-chips such as ENB, EPD, MMP, and OKE.

While 3M’s best valuation in 15 years, the lowest price in 10 years, and the highest yield in 27 years make it a potentially speculative Ultra Value buy, that’s only in isolation.

Not even Buffett has infinite investing resources, and for the individual stock portion of your portfolio, you should always choose the best options for your goals and risk profile.

Disclosure: I/we have a beneficial long position in the shares of BTI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Dividend Kings owns BTI in our portfolios.

—————————————————————————————-

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Research Terminal, Phoenix Watchlist, Company Screener, and Daily Blue-Chip Deal Videos.

Membership also includes

- Access to our 13 model portfolios

- my personal correction watchlist

- my family hedge fund

- 50% discount to iREIT (our REIT-focused sister service)

- real-time chatroom support

- exclusive daily updates to all my retirement portfolio trades

- numerous valuable investing tools

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.