Summary:

- JNJ’s agreed acquisition of ABMD at $380 per share came as a surprise to many healthcare focused investors.

- ABMD’s speed of innovation around its Impella segment have been a standout all along, as we’ve previously covered.

- There is still some uncertainty surrounding legal proceedings from selective ABMD shareholders.

- At this point, it’s prudent to rate ABMD a hold until further clarifications on the deal’s finalization are obtained.

deberarr

Investment Summary

Since our last publication on Abiomed, Inc. (NASDAQ:ABMD) where we had a buy thesis fully intact, there’s been several notable developments in the company’s growth route. We had previously touched on ABMD’s various strengths in return on invested capital (“ROIC”) and the speed of innovation around its core Impella heart pump segment. Turning to the present day, and the key update is Johnson & Johnson (NYSE:JNJ)’s agreed buyout of ABMD in November, for an all-cash consideration of $380 per share, valuing the company at $16.6Bn.

Merger & acquisition (“M&A”) activity in the broad healthcare spectrum ticked up in 2022, with substantial growth in M&A revenues from the previous year. JNJ’s acquisition of ABMD is a large step forward for the latter, who will benefit from JNJ’s deep customer networks and wide distribution capacity. It also reduces the execution risk for ABMD in its further innovations around Impella, which is a meaningful tailwind in the investment debate.

I also encourage you to read our other publications on ABMD [excluding the most recent, and newest to oldest]:

- Recovery mode activated

- Valuation drivers justify premium over peers

- A heartbeat away from next uptick

Net-net, with shares drifting above the $380 purchase price at the time of writing, we believe it’s prudent to rate ABMD a hold at this point in time.

ABMD acquisition from JNJ

Turning first to the deal itself, JNJ agreed to acquire ABMD for $380/share in November. For the healthcare giant JNJ, it offers exposure to the innovative domain within cardiovascular intervention, widening its footprint in heart failure in particular. Following the completion of the transaction, ABMD will continue to operate as a standalone business albeit within JNJ’s med-tech division.

ABMD’s core portfolio of cardiovascular intervention technologies provides JNJ with the opportunity to achieve this, without taking on any additional pipeline risk. For ABMD, it reduces the execution risk, as mentioned, and will help retain EBIT margin in our opinion through various cost synergies.

Also embedded into the deal is a $35/share cash milestone payment, comprised of $17.50/share if ABMD exceeds net sales of $3.7Bn in the first quarter of FY27′ to Q1 FY28′, and a $7.50/share incentive upon the FDA’s approval of the Impella’s use in ST-Segment Elevation Myocardial Infarction (“STEMI”) patients by FY28′.

Moreover, there’s an additional $10/share payable if Impella receives recommendation for use in PCI or STEMI with or without cardiogenic shock. Whilst these are long-term milestones, they serve as appropriate benchmarks for the company going forward.

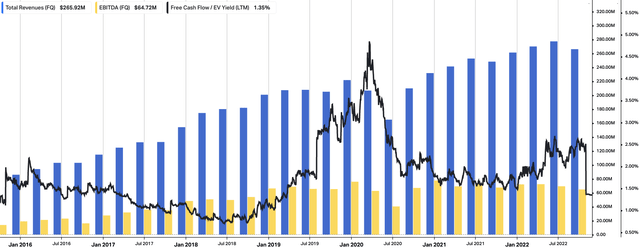

You can see below ABMD’s sequential outperformance at the top-line in the chart below [Exhibit 1]. We had mentioned such strengths in our previous publications, and the long-term growth trend remains well in situ for ABMD based on this presentation.

Exhibit 1. ABMD sequential revenue upsides, representation of long-term value creation around Impella

Data: HBI, Refinitiv Eikon, Koyfin

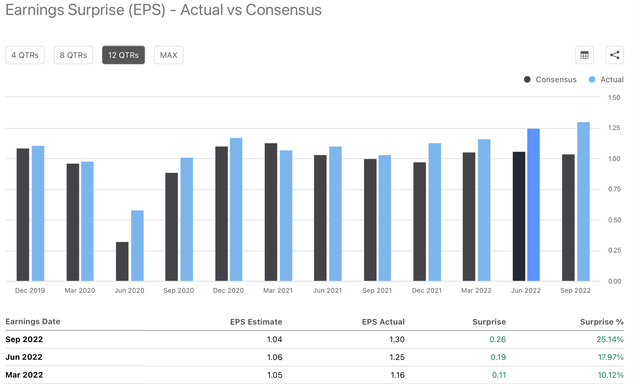

This extends vertically down the P&L to its bottom-line fundamentals, whereby the company has outpaced consensus estimates in every earnings print since Q4 FY19. These are impressive growth percentages that point to ABMD’s cash conversion and speed of innovation around its Impella segment, factors we’ve discussed at lengths in prior publications on the company.

Exhibit 2. ABMD EPS upsides vs. consensus a continual pattern since 2019.

It is unsurprising that, along with key differentiators via its Impella segment, that the company stood out to JNJ.

Data: Seeking Alpha, ABMD, see “earnings”.

Recent developments

The question really now turns to whether there will be another bidder entering the ABMD acquisition race, or if the $16.6Bn offer remains too large to be beaten. Note, at the time of the offer on November 1, it was a 50% premium to the share price ABMD was trading at. Given this point, we believe it is unlikely another entrant will step up to acquire ABMD.

But it’s not all done yet. As with most prospective M&A’s, there are underlying challenges that still need to be sifted through.

First, JNJ extended the expiration date of its original offer from December 13th to December 21st. It was reported on the 13th that, “approximately 19,279,461 shares of Abiomed, representing approximately 42.75% of the outstanding shares of Abiomed’s common stock, have been validly tendered and not properly withdrawn pursuant to the offer”.

Before this, however, on November 16th–18th, several ABMD shareholders filed lawsuits against ABMD in the United States District Court for the Southern District of New York and the District Court for the District of Delaware. The cases, titled, O’Dell v. ABIOMED, Inc. et al; Coffman v. ABIOMED, Inc. et al.; and Jones v. ABIOMED, Inc. et al., respectively, make allegations against ABMD in violating federal securities laws.

Specifically, the tree complaints allege that ABMD “[filed] a materially incomplete and misleading Solicitation/Recommendation Statement on Schedule 14D-9.” In addition, the company also received 8 demand letters, and a draft complaint, from shareholders raising similar claims regarding the respective disclosures mentioned. ABMD and JNJ both stress that all filings were made correctly.

Whether or not this proves to be a spanner in the works remains to be seen, but it does tell us that the transaction may not close as smoothly as intended. Therefore, we’re keeping a very close eye on how matters unfold. As a reminder, the deal is set to close in Q1 FY23.

In short

Net-net, the JNJ’s purchase of ABMD at $380/share looks to be a reasonable proposition for both parties involved. For ABMD shareholders, depending on your entry price, there’s likely to be a sizeable realized capital gain following the sale. However, there are still some hurdles to bypass before that looks to be a reality, and we’d be very interested as ABMD holders to observe the outcomes of the impeding court cases against the company. Whilst not uncommon in these scenarios, just how much of an overhang it may or may not be is a question we don’t have the answer too. Nonetheless, we look forward to providing additional coverage of the acquisition in the respective weeks and months.

Disclosure: I/we have a beneficial long position in the shares of ABMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.