Summary:

- The most proven dividend growth stocks can be equivalent to a money tree for shareholders.

- Even as demand for its COVID-19 diagnostic tests continued to fall, Abbott Laboratories outpaced the analyst consensus in the third quarter.

- The company’s interest coverage ratio through the first three quarters of 2023 was nearly 30.

- Shares of Abbott Laboratories could be trading at a 5% discount to fair value.

- The stock could be poised to deliver 60%+ greater total returns than the S&P 500 over the next 10 years.

A tree with $100 U.S. banknotes as leaves. DNY59

Familiar readers are probably well aware that I am a dividend growth investor. For the last 15 years, I have known about the strategy. It wasn’t until I finished my first two years of undergrad and began to generate excess income that I started investing, however. But in the last six years, I have been laser-focused on stuffing my portfolio with many of the best businesses in the world.

This is because I have both theoretically and practically found that owning these types of companies for the long haul tends to work out very well for shareholders. By this, I not only mean that shareholders benefit from capital appreciation and grow their net worth over time. Just as importantly, the dividends paid by top-notch businesses often rise at a faster rate than inflation. Combined with diligent saving and dividend reinvestment, it’s my sincere hope and belief that this will allow me to achieve at least basic financial independence in my 30s.

As I’m just 26 years old, I don’t know whether or not I will be blessed with a family of my own one day. This would inherently raise the amount of investments that I would need to secure financial independence for said family, but the idea is to plan with that day in mind.

One example of a business that is featured within my portfolio is Abbott Laboratories (NYSE:ABT). In the literal sense, there is no such thing as a money tree. However, Abbott is about as close to the real deal as they come. The company just upped its quarterly dividend per share by 7.8% to $0.55 earlier this month. For context, this represented the 52nd consecutive year that the Dividend King sent a higher dividend to its shareholders.

For the first time in three months, I will revisit Abbott’s fundamentals and valuation to explain why I am reiterating my buy rating.

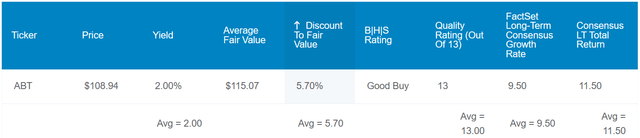

Abbott’s 2% dividend yield isn’t probably going to catch the attention of most income investors in this high rate environment. Nonetheless, this starting income is still higher than the 1.5% yield of the S&P 500 (SP500).

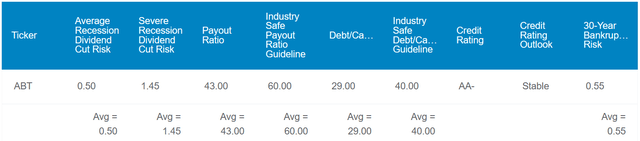

Not to mention that this dividend should have plenty of room to move higher in the years to come. For one, Abbott’s 43% EPS payout ratio is considerably below the industry-safe 60% EPS payout ratio set forth by rating agencies.

Additionally, the company’s 29% debt-to-capital ratio is comfortably less than the 40% debt-to-capital ratio preferred by rating agencies. This explains how Abbott enjoys an AA- credit rating from S&P on a stable outlook. According to Dividend Kings, that implies the probability of the healthcare titan defaulting on debt over the next 30 years is just 0.55%.

Thanks to these factors, Dividend Kings also pegs the risk of a dividend cut from Abbott in the next recession at merely 0.5%. Even a severe recession only raises this probability to 1.45%.

In my view, strong fundamentals alone are never enough to justify a buy rating. Thus, it shouldn’t come as a surprise to learn that shares of Abbott appear to be slightly undervalued. Based on the average of its historical dividend yield and P/E ratio, Dividend Kings estimates the diversified healthcare company to be worth $115 each. From the current $110 share price (as of December 27, 2023), this suggests Abbott is priced at a 5% discount to fair value.

If the stock returns to fair value and the underlying business grows as analysts expect, here are the returns that it could generate for shareholders in the coming 10 years:

- 2% yield + 9.5% FactSet Research annual growth consensus + 0.5% annual valuation multiple upside = 12% annual total return potential or a 211% 10-year cumulative total return versus the 8.6% annual total return potential of the S&P 500 or a 128% 10-year cumulative total return

Performing Well In A Tough Environment

Abbott Q3 2023 Earnings Press Release

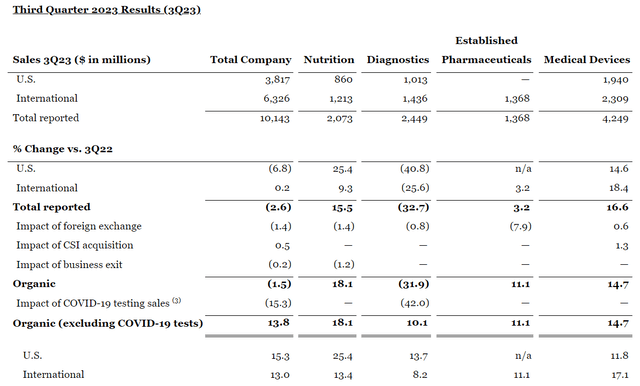

One of the characteristics of an excellent business is that they rarely fail to top the expectations of analysts. When Abbott reported its results for the third quarter ended September 30 on October 18, it delivered for shareholders. The company posted $10.1 billion in total net sales in the quarter, which was 2.6% lower than the year-ago period. However, Abbott still beat the analyst consensus by $320 million.

Initially, a lower topline isn’t what I like to see. The good news is that there was a good reason for the company’s decreased net sales during the third quarter.

Now that COVID-19 testing demand has peaked, the same COVID diagnostic tests that drove growth for the last few years are now weighing on Abbott. The company’s diagnostics segment net sales dropped 32.7% year-over-year to $2.4 billion for the third quarter. Factoring this out of the segment’s results, diagnostic segment organic net sales rose by 10.1% over the year-ago period.

The rest of Abbott’s business also did well in the third quarter: Nutrition segment net sales surged 15.5% year-over-year to $2.1 billion during the quarter. This was fueled by the recovery of the infant formula business in the U.S. following the voluntary recall of products last year, as well as respectable growth from Ensure.

Established pharmaceuticals segment net sales edged higher by 3.2% over the year-ago period to $1.4 billion for the third quarter. Finally, medical devices segment net sales climbed 16.6% higher year-over-year to $4.2 billion in the quarter. New indications and recently launched products were the catalysts behind these results.

Moving to the bottom line, Abbott’s adjusted diluted EPS decreased by 0.9% over the year-ago period to $1.14 during the third quarter. This surpassed the analyst consensus by $0.04. A nearly 20-basis point uptick in non-GAAP net profit margin to 19.7% coupled with a lower share count helped to mostly mitigate the impact of a lower net sales base.

Moving forward, the future looks bright for Abbott. For one, the initial brunt of the decline in its COVID testing business has been absorbed at this point. Secondly, Abbott is continuing to steadily launch new products to bolster its core business. That’s why FactSet Research thinks that adjusted diluted EPS can grow by 9.5% annually long term.

If that wasn’t enough, Abbott is also a financial fortress. The company’s interest coverage ratio through the first nine months of 2023 was 27.8. That’s an exceptionally high interest coverage ratio, which suggests Abbott should have no problem servicing its debt in the future.

Dividend Growth Can Continue

In just the last 10 years of its dividend growth streak, Abbott has remained an exceptional dividend grower. During that time, the quarterly dividend per share has rocketed 292.9% higher to the current rate of $0.55.

This is because Abbott has generated $2.8 billion in free cash flow through the first nine months of 2023. Compared to the $2.7 billion in dividends paid over that time, this equates to a 96.1% free cash flow payout ratio.

At first glance, this seems to be cutting it close. However, Abbott’s operating cash flow through the first three quarters was down by over 40% due to the decline in its COVID-19 testing business. Also, capital expenditures are up 24% as the company is working to return to significant growth (details in previous two paragraphs sourced from page 8 of 36 of Abbott’s 10-Q filing).

As Abbott’s investments begin to pay off and the core business continues to grow, I expect to see a recovery in operating cash flow. Capex should also eventually come back down to a more normalized level. For these reasons, I’m not worried about the dividend.

Risks To Consider

Abbott’s fundamentals are vigorous enough to earn it a 13/13 quality rating from Dividend Kings. Even so, the business does face risks that are worth mentioning.

Due to the evolving nature of healthcare, Abbott routinely dedicates around 7% of its total net sales to research and development. This usually leads to the new product launches needed to drive growth, although there are no guarantees. If Abbott can’t keep launching value-adding products, it could lose market share and struggle to grow.

Abbott also operates in an industry that is especially vulnerable to litigation. If any major lawsuits were to arise against the company, this could also weigh on growth prospects. Any unfavorable settlements to Abbott could also hurt its financial position, which could result in a credit rating downgrade if material enough.

Summary: A Decent Entry Point For A Wonderful Business

Abbott is arguably among the best dividend growth stocks that money can buy. Within the healthcare sector, the company’s 52 consecutive years of dividend growth is bested by only Johnson & Johnson (JNJ) and its consumer health spinoff, Kenvue (KVUE).

The icing on the cake is that Abbott is about 5% undervalued from the current share price. These reasons serve as the foundation of why I am maintaining my buy rating for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABT, JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.