Summary:

- The S&P 500 has performed well in 2023, but healthcare stocks have lagged behind.

- Abbott Laboratories continues to lap difficult comparable quarterly earnings reports, but the core business has been very strong.

- The company has a strong dividend growth track record and solid financials.

- However, the stock is currently overvalued and may not be a good buy at its current price.

Sundry Photography

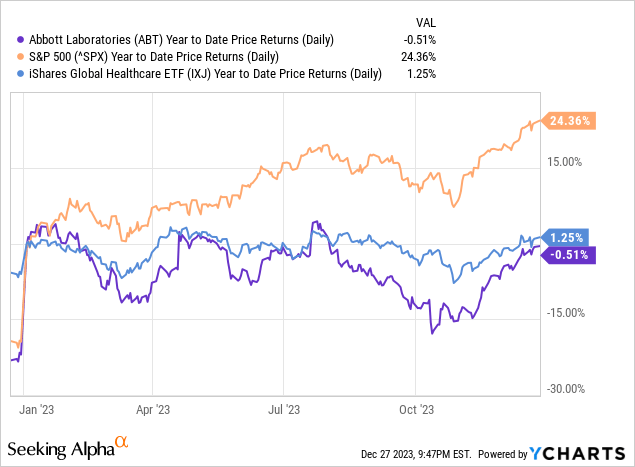

The S&P 500 Index has returned more than 24% in 2023, but healthcare has been a real laggard, barely showing gains for the year. The iShares Global Healthcare ETF (IXJ) is up just over 1% in 2023.

Healthcare is often a favorite area of investment for defensive and income-oriented investors, as these types of companies often provide products and services that are in demand regardless of the state of the economy.

Consistent and growing business models typically can lead to lengthy dividend growth track records. This is the case for one of my favorite names in healthcare, Abbott Laboratories (NYSE:ABT), which is closing in on make its 400th consecutive dividend payment.

I have long considered Abbott Laboratories to be a high-quality company for multiple reasons. First, the company often produces good to excellent quarterly results that reflect its ability to provide leading products to customers. Second, Abbott Laboratories leadership position is reflected in its stellar dividend growth track record.

While the stock is down for the year, Abbott Laboratories has rallied more than 14% over the last three months, with much of the gain coming following the most recent earnings release.

This has caused the valuation to surge, which could give price-sensitive investors pause before buying.

As much as I find the name appealing, is this the right time to purchase shares of Abbott Laboratories given its valuation? This article will examine the most recent earnings result and the company in further detail to answer that question.

Recent Earnings Results and Takeaways

Abbott Laboratories reported third quarter earnings results on October 18th, 2023, with the company outperforming expectations. Revenue fell 2.5% to $10.1 billion, but this was $320 million more than analysts had projected. Adjusted earnings per share of $1.14 dropped slightly from $1.15 in the year ago period, but was $0.04 cents above estimates.

While year-over-year revenue did decline, this was at a much lower rate than preceding quarters. The last three quarterly reports showed a sales decrease of 11.5%, 18.5%, and 12.2%, respectively. The same holds true for earnings-per-share, as the degree to which performance has declined has slowed.

Abbott Laboratories benefited from Covid-19-related sales over the past few years, which acted as a material tailwind to the company’s results in both 2021 and 2022. This explains the year-over-year decreases in the headline numbers for the past four quarters. The company is still lapping difficult comparable periods, but core results remain strong.

For example, the company’s organic growth decreased 1.5% for the third quarter. Excluding Covid-19 testing products, organic growth came in at almost 14%, demonstrating the overall strength of the Abbott Laboratories’ product portfolio.

Looking closer at each individual segment, Nutrition improved 12.4% thanks to recovery of market share for the company’s formula business. Medical Devices surged 24.5% as products in several key categories, including diabetes and heart, continue to see double-digit gains. Established Pharmaceuticals grew 18.4% as the company’s branded generics portfolio has seen high levels of demand in several emerging markets.

Diagnostic declined almost 59% from the prior year, but the headline number is misleading. This segment benefited from the great demand for Covid-19 testing products in prior years that was not seen in the most recent period. Excluding testing kits, organic sales were higher by 13.1% in the third quarter, just below the company-wide figure.

Management expects adjusted earnings per share in a range of $4.42 to $4.46 for 2023, which is near the top end of the company’s prior guidance of $4.30 to $4.50. At the midpoint, this would be a 16.8% decline from 2022, but, again, this is largely due to the impact of Covid-19 testing equipment.

Adjusting for the change in share count, the midpoint of guidance would be a 16% increase in net income from 2019. Given the gains that the company is seeing when excluding Covid-19 related sales, it is likely that the company sets a new high for earnings per share in the very near future.

Helping matters is that Abbott Laboratories has a very strong balance sheet. As of the end of the last quarter, Abbott Laboratories had total assets of $72.1 billion, including cash, cash equivalents, and short-term investments of just over $7 billion. The company does have $15.5 billion of debt, but just $1.05 billion of this is due within the next year.

Given its strong financial position, Abbott Laboratories enjoys an AA- rating from S&P Global Inc. (SPGI) and Aa3 from Moody’s Corporation (MCO), meaning that the major rating agencies view the company as a high-quality name with very low credit risk.

Dividend and Valuation Analysis

Abbott Laboratories has a fantastic dividend growth track record. The first payment of 2024 will mark Abbott Laboratories 400th consecutive quarterly dividend, one of the longest non-interrupted payment streaks found anywhere in the market.

On December 15th, 2023, Abbott Laboratories increased its quarterly dividend by 7.8% to $0.55 per share, extending the company’s dividend growth streak to 52 consecutive years. The length of the company’s growth streak qualifies it as a Dividend King. There are just 54 companies in the market that have the necessary five decades of dividend growth to earn this title. Within healthcare, only Johnson & Johnson (JNJ) has a longer history of raising its dividend.

The company does not maintain its dividend growth streak with small increases, either. Since 2013, the dividend has a compound annual growth rate of more than 14%. The CAGR slows only slightly to 12.7% when looking at just the last five years.

The recently announced increase is down from its medium- and long-term averages, but this is still a sizeable increase.

Shares of Abbott Laboratories yield 2.0% as of the most recent trading day, which is a superior yield to the stock’s average yield of 1.8% since 2013.

The dividend is likely safe as well, as the projected payout ratio of 2023 is 46%. This projection is not too far off from the five-year average payout ratio of 38%. While the expected payout ratio is not within a dangerous area in my opinion, it is higher than normal. This could mean that formerly double-digit dividend growth could be in the higher single-digit range, instead of the CAGRs seen for the last five- and 10-year periods of time.

Shares of the company are trading at nearly 25 times expected earnings-per-share for the year. This is by no means a cheap valuation, even considering the industry-leading position for the company.

Over the last decade, shares have an average price-to-earnings ratio of ~19, according to Value Line.

The average multiple expands to ~25 times earnings when looking at the last five years, but this includes years where earnings were artificially higher due to Covid-19. The contributions from testing kits just are not there, so a lower multiple should be expected given that reality. Therefore, Abbott Laboratories can be considered overvalued at the current price.

Final Thoughts

Healthcare has been one of the worst performing areas of the market this year. Even with a strong rally in recent months, Abbott Laboratories has still underperformed its sector ETF, not to mention the market as a whole.

The company is still facing tough comparable periods due to the demand for Covid-19 test kits, but the declines are deaccelerating. This was seen during the last quarter, as the sequential declines have become less the further away from the worst of the pandemic the company gets. Three segments posted double-digit organic growth rates for the period, with the fourth, diagnostics, doing so when excluding sales for its Covid-19 testing products.

Abbott Laboratories has one of the most impressive dividend growth steaks in the marketplace, demonstrating the company’s commitment to increasing its payouts to shareholders.

That said, shares of the company are not trading at a valuation that I am comfortable with, as it is far ahead of its long-term average price-to-earnings ratio. At a lower price point, I would find Abbott Laboratories much more attractive.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABT, JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.