Summary:

- Abercrombie & Fitch is readying their Q4 and Fiscal Year results on Mar. 1, 2023.

- The company recently announced strong holiday sales, up 1-2% from last year’s quarter, and above previous estimates of a 2-4% drop.

- I reiterate my previous “Hold” rating, and don’t think a position should be taken after the recent rally to $28 – I forecast a $27 target over an 18-month term.

mizoula/iStock Editorial via Getty Images

Introduction

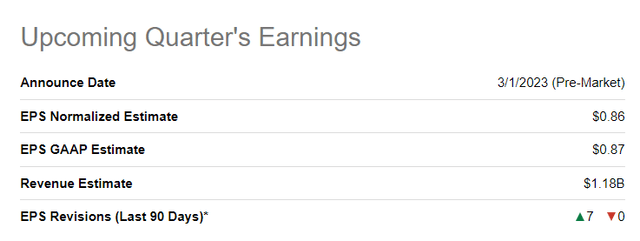

Abercrombie & Fitch (NYSE:ANF) is scheduled to release Q4 and FY2023 earnings on Mar. 1, 2023. The company saw revenues increase in Q4 after a better than expected holiday season, but tightening margins and elevated inventory may keep the stock from soaring. Ahead of the earnings, I forecast a share price of $27 over a 12-18 month time frame, up from my previous “Hold” rating in November. The company remains supported by several brands, though two key brands make up the majority of sales; Hollister, the quintessential apparel brand of the global teen consumer, and Abercrombie, the longstanding flagship brand focusing. This review showcases some of the industry developments from the holiday season and looks at expectations heading into earnings season. Wall street analysts are bullish, with 7 analysts recently revising estimates upwards, but keep in mind, previous expectations were rock bottom.

Seeking Alpha – Earnings Forecast

Recent Developments

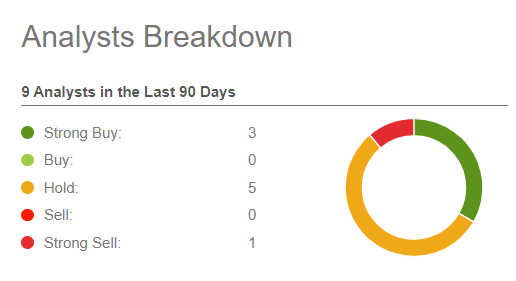

ANF recently reported holiday revenue figures that exceeded previous expectations for the quarter ended December 31, 2022, announcing a 1-2% jump compared to the previous year. Expectations were a decline of 2-4%. ANF also noted that updated operating margins guidance was set at 6% to 8% vs. a prior range of 5% to 7%. The company didn’t break down revenue by sales channel or brand, but given how low expectations were heading into the holiday season, any positive news was welcome. ANF also recently refreshed their board, by recently announcing Helen Vaid, CEO of Foundry Brands and former Pizza Hut executive, to the board. In general, any growth in revenue is a positive development. However, in this case, the increases are not as significant compared to the wider industry and it’s uncertain whether promotional efforts have contributed to them. Across the U.S., retail sales grew 5.3%, which was below inflation and last year’s huge 13.5% jump, but still strong nonetheless. It’s challenging to predict if the strong revenue figures will generate momentum for the stock, given that its shares have already risen by more than 20% since earnings were announced, indicating that the peak may have been reached. Analysts are not overly optimistic about the stock, although this could also suggest that expectations are lower for year-end results.

Seeking Alpha – Wall St Rating

What to Watch for

In the upcoming earnings release there are a few metrics and trends to keep an eye out for. The first would be FY2023 guidance. ANF executives last provided detailed guidance in November for Q4, and some of the key forecasts included assuming that “inflation-related pressure on consumer demand continues”, revenue growth in low single-digits (post holiday update), significantly reduced inventory that will be “will be flat by the end of the year“, an average unit price that will rise, and more. Unique insights into the individual brands, and whether current trends persist, will help to more accurately predict the business’s long-term viability. The Q4 results will provide information on the performance of margins, and executives will elaborate on their guidance for the entire year.

Management will likely provide an industry outlook to give us an overview of the retail apparel sector and make projections about consumer behavior in light of sustained high inflation and interest rates. The company’s margin decline and demand guidance will be crucial factors in determining whether the retail environment is promotional and potentially concerning. However, if margins hold up or even improve, and positive consumer spending trends emerge, the company’s stock price, with its higher beta, could rise quickly. While it is difficult to predict with certainty, recent sales data and leadership comments hint at potential inventory clearing in Q4, suggesting that sales may exceed expectations, but margins may suffer. Depending on the extent of the margin decline, the stock could experience a slide. The options chain for March 3rd as of 10:00am on Feb. 28 show more volume on the puts side (notably at $25), which implies that investors expect a slide post earnings. In my estimation, it’s too early to make a big bet – the model below forecasts a $27 share over a 12-18 month term, which implies minor upside.

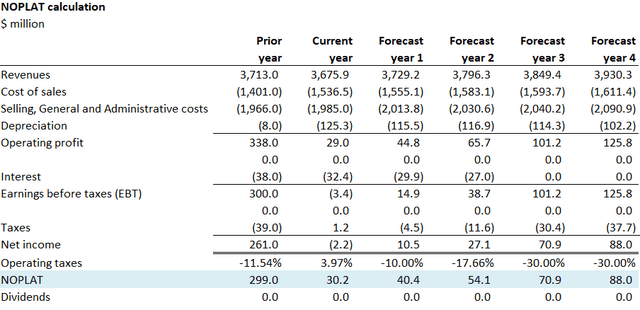

Model Shows Minimal Upside

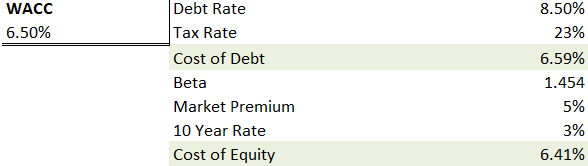

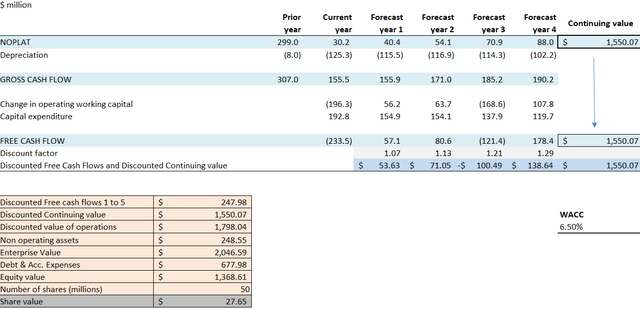

ANF stock has ripped higher recently, but the model doesn’t showcase a ton of upside from here on out. Given their recent performance, I anticipate that their cost of debt could be above 8% if they attempted to leverage in this environment, but given their capital structure and liquidity, I doubt that they will need debt any time soon.

Author WACC Forecast

I forecast the continuing value of ~$1.6B, given a 1% revenue decline this year and blended revenue growth of ~2% for four years, as inflation continues to hit consumer discretionary spending. I hold other cost ratios equal from the previous model post Q3, other than the slight increase in revenue projections. The model shows that a $27 share price (see below) can be supported with fundamentals and a FY2023 EV/EBITDA forecast of ~12.8.

Author Income Statement Forecast Author Cash Flow and Share Price Forecast

Conclusion

ANF has been performing exceptionally well in over the past few months, and the focus will turn to gross margins, particularly after revenue sales during the holiday season showed promising results. Another point of interest for investors will be the inventory levels to see if the management has delivered on their promise of reducing inventory from the last earnings call. The company’s progress across various business lines may lend some impetus to the stock, but it’s challenging to envision any significant price movements without positive news. Currently, the near-term options chain indicates that investors have a slightly negative outlook, but this sentiment may shift quickly based on the upcoming results. At this time, I do not believe that purchasing ANF stock is a wise decision, and if you currently hold the stock, it’s best to wait until after the earnings report to make any decisions.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.