Abercrombie & Fitch: Sharp Rallies Should Be Sold

Summary:

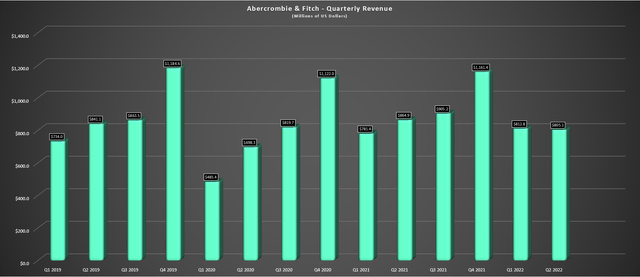

- Abercrombie & Fitch released its Q2 results last week, reporting quarterly revenue of $805.1 million, a 7% decline from the year-ago period.

- While the company had a solid quarter from its Abercrombie segment with its ninth consecutive quarter of AUR growth, Hollister’s performance was disappointing.

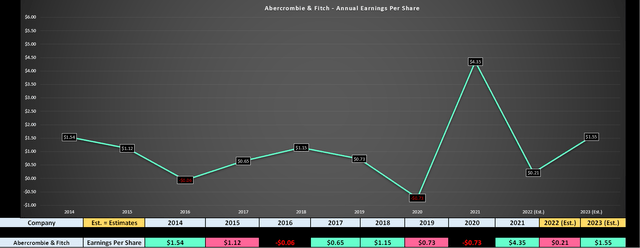

- The result is that earnings estimates have fallen considerably, with ANF on track to see a more than 90% decline in annual EPS from record levels in FY2022.

- With the stock medium-term oversold, a rally is certainly possible, but I would view any rallies above $20.80 before year-end as selling opportunities.

anouchka

Just over three months ago, I wrote on Abercrombie & Fitch (NYSE:ANF), noting that while the weaker margins would contribute to much lower earnings in FY2022, the stock would become interesting below $16.30 per share near support. However, I did not expect the stock to release an even more disappointing report in Q2, with revenue down 5% year-over-year and quarterly earnings per share moving deeply into negative territory with a net loss of $0.30. Given this more challenging outlook, I have reversed my previous outlook, with a much lower share price needed to bake in an adequate margin of safety.

Abercrombie & Fitch – Brands (Company Website)

Q2 Results

Abercrombie released its Q2 results in late August, reporting quarterly revenue of $805.1 million, a 5% decline from the year-ago period. While the company’s Abercrombie segment posted a solid quarter with its highest Q2 sales in seven years ($368.2 million) and enjoyed 5% sales growth, its slightly larger Hollister segment (including Gilly Hicks & Social Tourist) had a very rough Q2. This was evidenced by a 15% year-over-year decline in sales to just ~$436.9 million, with H1 sales for the segment down over 9%. Compared to the company’s guidance of flat to 2% compound annual sales growth for the segment from 2022-2025, these results certainly didn’t live up to expectations.

Abercrombie – Quarterly Revenue (Company Filings, Author’s Chart)

Digging into the results a little closer, management appeared pleased with the results from its Abercrombie segment, which enjoyed its ninth consecutive quarter of AUR growth (and best since 2005), led by strength in Abercrombie Adults. Meanwhile, Abercrombie women’s posted its best Q2 sales in over a decade, and the company continues to see lots of activity on social media such as TikTok. Finally, the company’s newest sub-brand, Your Personal Best (active-wear), performed well across both genders. For those unfamiliar, Your Personal Best was launched earlier this year and includes leggings, shorts, tanks, gym bags, and baseball camps with a neutral color palette.

Abercrombie & Fitch Outfits (Company Website)

Unfortunately, the strength at Abercrombie was more than offset by sales at Hollister, which index towards lower-income guests, with the segment catering mostly to teens. The company noted that it saw a shift away from core categories into higher trending categories and that guests were doing more browsing than buying. The result was Hollister saw lower-than-expected conversion and basket sizes, and Abercrombie noted multiple times in its Q2 Conference Call that its guests were making more judicious decisions due to having limited money to spend. For now, the major shift noticed has been from bottoms (a top-selling category previously) to tops and dresses.

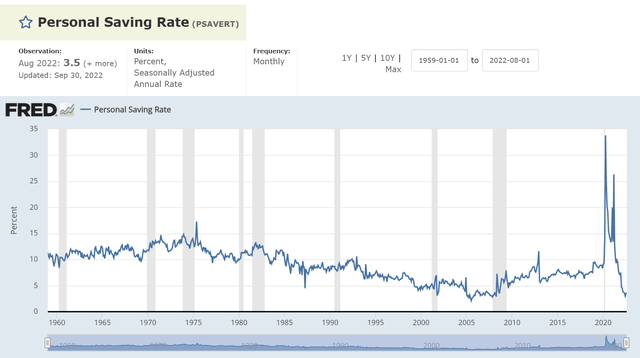

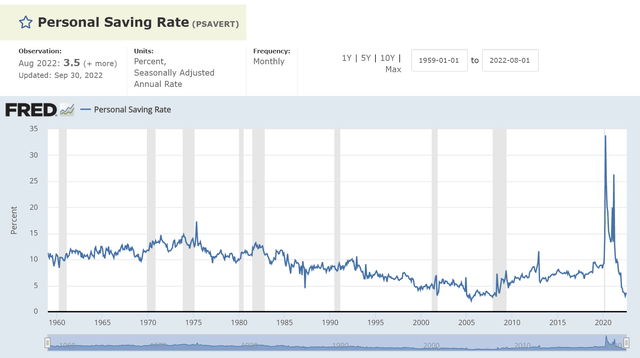

To address this shift, Hollister has adjusted orders into higher-trending categories, and it’s also recently launched a new payment method that allows teens to shop for their clothes and send their carts to their parents to pay using Share2Pay. In a trial, customers that shared their bags through Share2Pay placed orders at twice the rate of other customers, which is encouraging. That said, it’s not just teens that are cash-strapped; it’s also adults, with personal savings rates plunging to new lows impacted by rising gas, utility, grocery, and mortgage costs. So, while this might help a little in this lagging sentiment, I would be surprised to see this be a major needle-mover.

Personal Savings Rates (FRED St. Louis Fed.Org, BLS)

Inventory & Margins

Given the more difficult quarter from a demand standpoint, Abercrombie finished Q2 with inventory up 70% year-over-year to $708 million, which sounds like a very significant jump. However, it’s worth noting that the company was lapping lower production from Vietnam, leading to its lowest inventory levels in nearly a decade. In addition, it’s important to note that while the company needed to utilize markdowns at Hollister to clear some inventory, 92% of inventory is current, defined as back-to-school and early fall products, new goods, or long-life items, with this figure in line with historical levels.

Given the weaker-than-planned quarter combined with higher product costs and some foreign exchange headwinds, Abercrombie saw gross margins dip to 57.9%, a more than 700 basis point decline year-over-year. Meanwhile, operating margins dipped into negative territory, leading to a quarterly net loss per share of $0.30 vs. $1.70 in the year-ago period. This prompted Abercrombie to reel in its FY2022 guidance considerably, now guiding for $3.7 billion in sales (down mid-single digits year-over-year) vs. a previous outlook of flat to up 2%. Meanwhile, operating margins are expected to be 1.0% to 3.0%, down from 5-6% previously, reflecting lower AURs needed to keep inventory current.

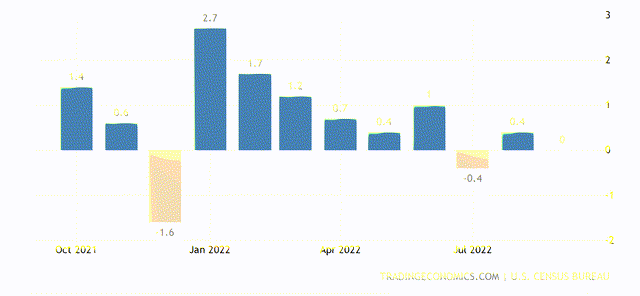

US Retail Sales (Trading Economics, Census Bureau, BLS)

Assuming this was a one-off quarter, we could look past the weak Q2 2022 numbers and ignore the softness. However, the full-year outlook is clearly much softer than previously guided, and this isn’t a surprise when retail sales continue to lag estimates and consumers are getting hit from nearly every direction. The other major headwind is the wealth effect reversing. When consumers feel richer (rising values in investment accounts, rising home prices), they’re more likely to spend or give higher shopping budgets to their kids to spend (which applies to ANF’s Hollister segment). Unfortunately, with home prices teetering and red ink in investment accounts, consumers are feeling less rich, which could keep pressure on this less affluent segment of Abercrombie’s business.

So, what’s the good news?

While the macro environment remains challenging, the company’s Abercrombie segment continues to perform well, and the current issues look to be temporary. This is because the Abercrombie segment has seen a very positive transformation with consistent customer growth, and while Hollister is struggling in the current recessionary environment, this shall pass. In fact, the company appears quite confident in this being temporary, sticking to its FY2025 goals of $4.1 – $4.3 billion at 8.0%+ operating margins. In addition, the company has been doing a solid job executing on its buyback program, purchasing ~1.0 million shares at $18.00, with lots of flexibility left, with $240 million left under its authorization.

Abercrombie – Earnings Trend (YCharts, FactSet, Author’s Chart)

While the steady share repurchases and future repurchases aren’t doing much to help the FY2022 results with declining sales and meaningful margin compression, they should help to grow annual EPS long-term. This is because there’s room to cancel a significant amount of outstanding shares if the buyback program is consistently executed below $17.00, given its size, suggesting we could see a beat on FY2023 annual EPS estimates ($1.55). It’s also nice to see the company being opportunistic with the buyback program vs. Zumiez (ZUMZ), which used up far too much of its cash at extremely unfavorable prices. That said, with annual EPS set to decline over 90% this year, it’s hard to be bullish short-term.

Let’s look at the valuation to see whether this sharp decline in earnings is already priced into the stock:

Valuation

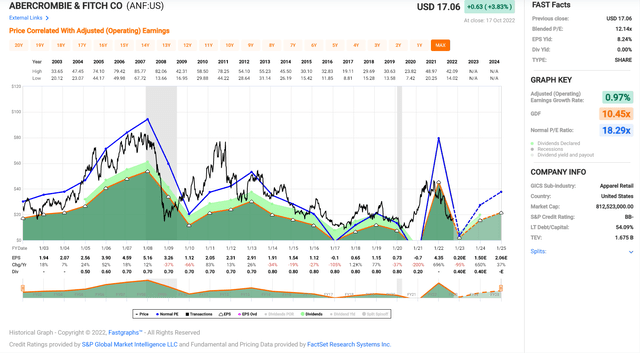

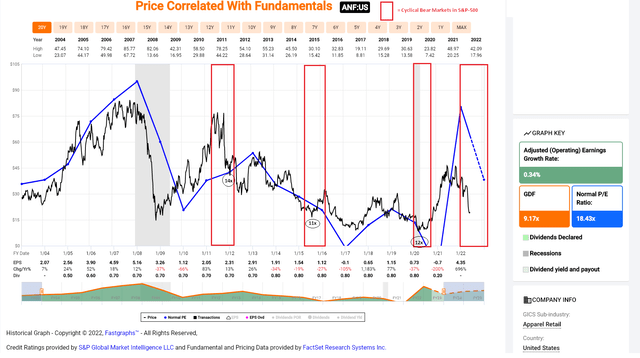

Looking at the chart below, we can see that Abercrombie has historically traded at an average earnings multiple of ~18.3, which would suggest that the stock is very reasonably valued based on FY2023 earnings estimates ($1.55). However, we typically see a significant contraction in multiples during cyclical bear markets for the S&P-500, which is the present case, and especially those related to recessionary environments. In fact, Abercrombie has historically traded down to a median earnings multiple of 11x during cyclical bear markets over the past decade (2011, 2015, 2020), suggesting that assuming ANF should trade in line with its 20-year average in a very challenging macro environment is presumptuous.

Abercrombie – Historical Earnings Multiple (FAST Graphs)

Abercrombie – Multiple Compression In S&P-500 Cyclical Bear Markets (FAST Graphs, Author’s Notes)

Based on what I believe to be a more conservative earnings multiple of 12.6, which is 5% above the stock’s median trough during cyclical bear markets, Abercrombie has less than 25% upside to fair value. This is based on FY2023 annual EPS estimates of $1.55, which translates to a conservative fair value for the stock of $19.55. Obviously, these earnings estimates could be too low, and this multiple might be too conservative. In those cases, there is an upside to more than $21.00 per share. However, I prefer to be as conservative as possible when deriving fair value in an unusual environment, and with the Federal Reserve hiking into a major slowdown with personal savings rates at multi-year lows, this is the definition of an abnormally economic environment.

US Personal Savings Rates (FRED St. Louis Fed, Bureau of Labor Statistics)

While an 18-month price target of $19.55 suggests ANF has a 15% upside from here, I prefer only to start new positions when stocks are trading at a significant discount to fair value to bake in a margin of safety. After applying a 35% discount to fair value, ANF would need to decline below $12.70 per share to become attractive from a valuation standpoint. Obviously, there’s no guarantee that a decline of this magnitude will materialize, and leaving bids at these levels could be an opportunity cost. Still, with the S&P-500 trading below its key moving averages, I believe it makes sense to get the right price or pass entirely, and I don’t see enough value to justify putting capital at risk on ANF at $16.90 per share.

S&P-500 Weekly Chart (TC2000.com)

Technical Picture

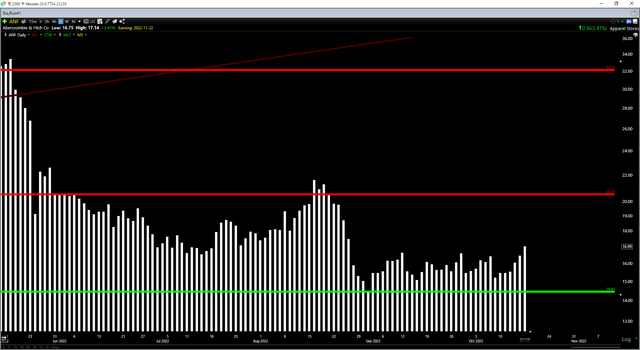

Moving over to the technical picture, there’s no question that ANF is medium-term oversold, having corrected more than 65% from its Q4 2021 highs. However, one could argue that the stock never belonged above $40.00 in the first place, let alone $45.00, so the magnitude of the correction is less relevant. From a reward/risk standpoint, though, which matters most from a swing-trading standpoint, ANF’s recent rally has placed it near the mid-point of its expected support/resistance range, with support at $14.45 and resistance at $20.50.

ANF Daily Chart (TC2000.com)

Given that I prefer a minimum of a 6.5 to 1.0 reward/risk ratio to justify entering new positions, ANF is nowhere near a buy zone with $3.50 in potential upside to resistance and $2.55 in potential downside to support (1.37 to 1.0 reward/risk ratio). However, if the stock declines below $15.15 before December, it would enter a lower-risk technical buy zone. That said, this would be a swing-trading opportunity only for ANF, given that the ideal buy zone is at $12.70 or lower from a valuation standpoint. To summarize, I would view rallies above $20.80 before year-end as profit-taking opportunities and pullbacks below $15.15 before December as buying opportunities.

Summary

Abercrombie had a rough Q2 report, and the macro backdrop remains unfavorable, with a significant pullback in consumer spending and clothing being a category that’s hit especially hard, even if not as hard as furniture/appliances and travel. Given this less favorable positioning combined with a more volatile market environment with the S&P-500 in a cyclical bear market, it makes sense to focus on the best names and ensure a margin of safety if buying names that aren’t industry leaders. So, for investors looking for exposure to retail/apparel, I prefer Capri Holdings (CPRI) with a much stronger earnings trend and the stock trading at less than 7x FY2023 earnings estimates.

Disclosure: I/we have a beneficial long position in the shares of SPY, CPRI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.