Summary:

- Abiomed came in with another set of robust earnings yesterday, with double-digit growth from top to bottom.

- Earnings remain steady, however, the company exhibits the profitability features investors are paying a premium for.

- Valuations are supporting, and we look to be paying a ~300bps premium for access to the above premia investors are searching for in FY22.

- We remain unchanged on our previous rating of buy and valuation of $388, respectively.

JFsPic/iStock via Getty Images

Investment summary

The long-term buy thesis for Abiomed, Inc. (NASDAQ:ABMD) remains fully intact following the company’s Q1 FY23 earnings posted yesterday. After a double-digit gain from the top to bottom line, the company also saw strengths in non-GAAP reconciliations and continued to generate a substantive return on investment, generating an above-average $46 million in NOPAT from last year’s invested capital. Valuations are supportive, and we are paying ~300bps premium to obtain access to these quality factors that investors are paying a premium for in FY22. We reiterate that ABMD is a buy [since October 2020] and valuations remain unchanged at $388 per share.

Exhibit 1. ABMD 6-month price action

Q1 FY23 earnings in-line with long-term cadence

For the first quarter of its FY23, ABMD printed YoY top-line growth of 10% to $277 million. In constant currency (“cc.”), this was a 12% gain over the year. Global product revenue also spiked 10% (12% cc.) with an 11% gain in ex-US turnover. Europe and Japan in particular led sales growth contributing $33 million and $13 million to the top respectively. Whereas US sales were slightly behind with a 9% YoY growth. Underpinning domestic growth was an uptick in patient utilization.

The company saw ~110bps gross margin compression to 81% which saw a down-step in gross profit to $224 million, well above long-term averages. Note, that in Q1 FY22, ABMD acquired the remaining interest in its preCARDIA asset for $82.8 million. In its accounting for preCARDIA, booked the fair value of the acquisition as relating to the acquired in-process R&D asset. It, therefore, capitalized the $115 million expense of the transaction, recognizing it as an asset.

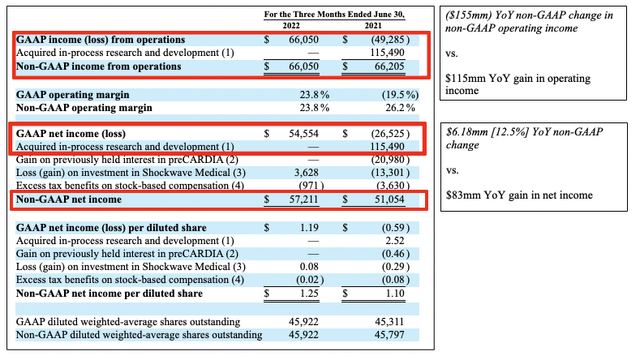

This is important, as in its non-GAAP reconciliation for Q2 FY21, ABMD recognized this in an adjustment to GAAP net income, as seen in the table below from its Q2 FY22 8-K. Instead of printing a loss of $27.5 million, non-GAAP net income was $51 million for the period. It did the same for the loss or gain on its Shockwave Medical investment, recognizing $3.6 million on this position in Q2 FY22.

As a result, its gain from year to year is a little more compressed than it seems on GAAP measures. As seen below, after reconciling non-GAAP net income in both Q2 FY21 and Q2 FY22, the YoY change is around $6 million versus the large jump reported on the income statement.

Exhibit 2. Non-GAAP reconciliations

Data: ABMD 10-K August 4, 2022

Management confirmed FY23 guidance and calls for 13-17% growth at the top, calling for ~$1.2 billion in revenue at the upper end. It also forecasts GAAP operating margin to land within 23-24%, which would generate $81 million in operating profit should the company hit this target.

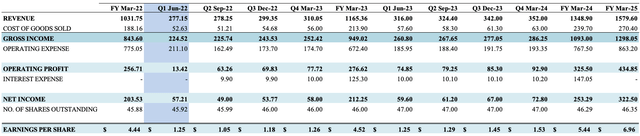

Exhibit 3. ABMD forward earnings forecasts FY23-FY25

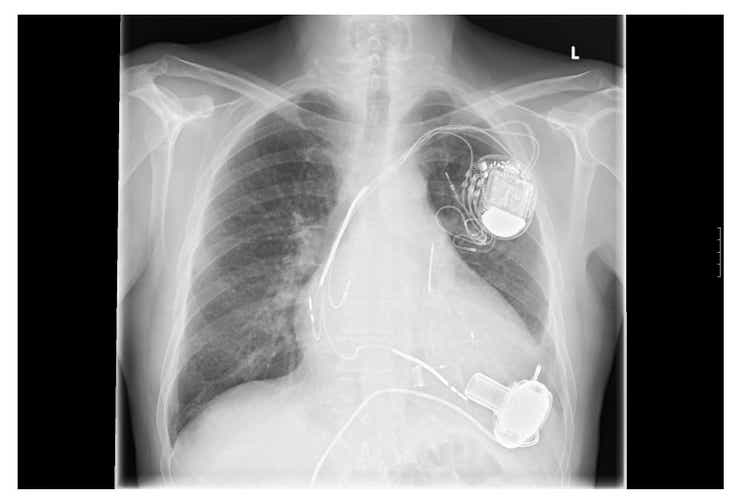

Impella continues pumping

The Impella story continues to deliver clinical trial and regulatory momentum for the company. The latest data for the ventricular support system was presented at the Society for Cardiovascular Angiography and Interventions (“SCAI”) 2022 Scientific Sessions. Findings from a large meta-analysis, that demonstrated the link between pre-PCI Impella and improved outcomes for acute myocardial infarction cardiogenic shock (“AMICS”), were illustrated in the International Journal of Cardiology.

The company also advised in its filing that it has received FDA approval for its planned RECOVER IV randomized controlled trial. Per the company’s filing:

“RECOVER IV will compare all-cause mortality at 30 days in patients with STEMI-CS with an Impella-based treatment strategy initiated prior to PCI vs. a non-Impella-based standard of care treatment strategy. The trial is designed to provide the clinical evidence needed to achieve a Class I guideline recommendation for Impella use in AMI cardiogenic shock.”

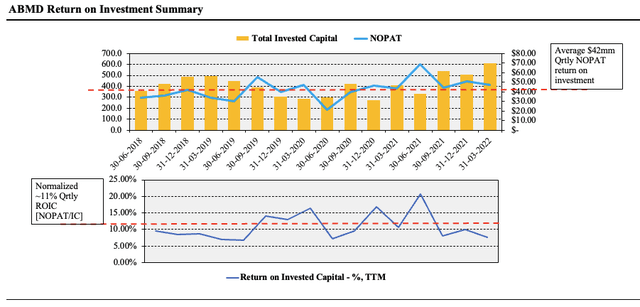

Profitability continues to be a standout

Investors have turned to bottom-line fundamentals and measures of profitability in FY22. In this vein, ABMD fits the bill and offers attractive economics in the return on its investment. Here we examined the amount of NOPAT generated from the previous year’s invested capital. As seen in Exhibit 3, trends have been shifting upwards for the past 2-years on a sequential basis, with ABMD averaging a $42 million in quarterly NOPAT conversion since FY18. On this return, the 5-year normalized ROIC is 10.92%, well above the industry average and company WACC of 6.7%. As such, ABMD compounds capital at an average of ~11% per quarter, and this is attractive in the current climate with an increasing cost of capital.

Exhibit 3. ABMD return on investment continues to push higher and normalizes at ~11%

Data: HB Insights, ABMD SEC Filings

Valuation

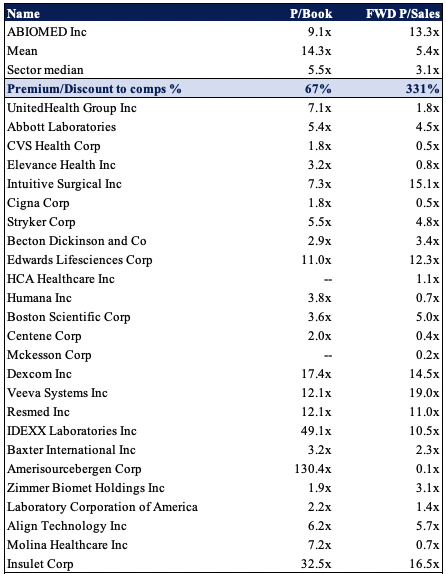

Shares are trading at a premium to the GICS Industry peer median across numerous multiples. It is priced at more than 9x book value and trades at 13x forward sales. As seen in the table below, ABMD’s peer group is full of high-quality names trading at very respectable valuations.

Exhibit 4. Multiples and comps

Data: HB Insights

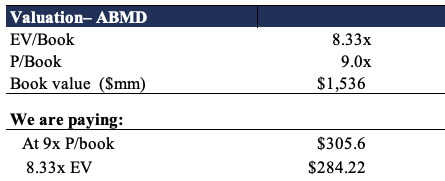

Moreover, paying the 9x book value, and corresponding 8.3x enterprise value (“EV”) to book value, would see us theoretically paying $284-$305, with an arithmetic mean of $294. As such, we believe that we could be paying around a fair price for the stock. We are essentially paying a ~300bps premium for an ~11% average quarterly ROIC, ongoing top-bottom line growth and forecasted operating margins to grow in times of cost inflation. Moreover, on a qualitative basis (discussed in our previous analyses here, here, and here) the company’s speed of innovation around the Impella segment continues to be a differentiating factor that weighs in heavily on the forward-looking investment debate. In our previous analyses, we set a price objective for $388 for ABMD and this remains our long-term valuation of the stock.

Exhibit 5.

Data: HB Insights Estimates

In short

ABMD continues to exhibit quality equity premia that investors are paying a premium for in FY22. As investors increasingly shift away from rewarding high-beta, high-growth names and back onto bottom-line strengths, ABMD remains differentiated with the economics tied to its Impella segment. It has averaged an ~11% quarterly ROIC over the 5-years to date whilst growing FCF and earnings all the same. We also note the company’s recent clinical trial and regulatory momentum that is likely to inflect onto the share price.

Valuations are also supportive, and for access to all of the above, we are expected to pay a 300bps premium to the company’s book value of equity. It then becomes a question of one’s equity risk budget. We value the stock at $388 per share based on previous analyses that remain largely unchanged. On the culmination of these factors, we rate ABMD a buy.

Disclosure: I/we have a beneficial long position in the shares of ABMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.