Summary:

- Acadia reported solid earnings for Q3, 2021 despite COVID-19 headwind lashing its Parkinson’s Disease Psychosis [PDP] earnings.

- Acadia’s completed Type A Meeting with the FDA has opened the door for a targeted next step.

- NUPLAZID approval in treatment of Alzheimer’s Disease [ADP] would be a big deal and is a real near-term possibility.

- Acadia has released positive data on its pivotal Lavender trial for trofinetide, its experimental Rett syndrome therapy.

cagkansayin/iStock via Getty Images

Over the last year, ACADIA Pharmaceuticals (NASDAQ:ACAD) shareholders have taken a real licking, those hardy souls who have endured the pain may soon feel that Acadia will go on ticking. During its Q3, 2021 earnings call, (the “Call”) Acadia signaled important near term news that could start to move the stock back towards its recent glory days.

Acadia’s Q3, 2021 earnings provided a bouquet of good news for investors.

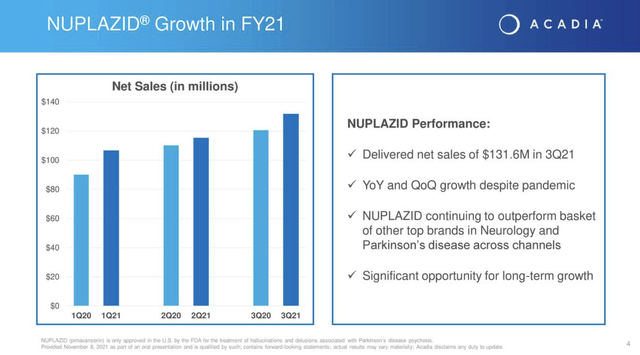

Acadia is a one-trick pony from a revenue standpoint. Its NUPLAZID (pimavanserin) in the treatment of hallucinations and delusions associated with PDP is the trick which Acadia has honed to perfection. As shown by Acadia’s Q3, 2021 earnings presentation (the “Presentation”) slide 4 it has trickled out growing sales throughout the pandemic challenges:

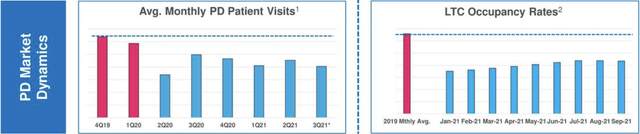

The pandemic has undercut Acadia’s opportunities to grow its PDP indication by impeding PDP patient’s access to care. The excerpt below from Presentation slide 8 shows this in two ways:

The pandemic has cut down both PD patients’ average monthly visits to their doctors and long term care [LTC] occupancy rates. CEO Davis explained the dynamics of Acadia’s two channels for growing its PDP patient population at some length during its Q3, 2018 conference call.

The pandemic has cut down both PD patients’ average monthly visits to their doctors and long term care [LTC] occupancy rates. CEO Davis explained the dynamics of Acadia’s two channels for growing its PDP patient population at some length during its Q3, 2018 conference call.

At the time specialty pharmacy’s represented 2/3 of Acadia’s market. It took much longer to develop revenue through the cadence of doctor visits. The LTC market responded more quickly to promotions:

…given that it’s a more contained channel with a quicker feedback loop between physicians, patients and caregivers.

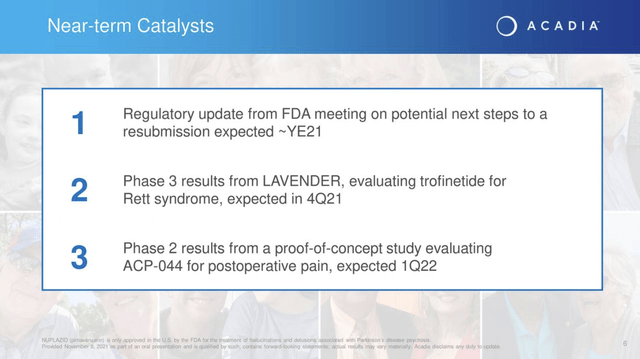

The Presentation, slide 6 lists the following as Acadia’s important near term catalysts:

The first two listed, addressing pivotal trial results, stand to impact Acadia’s near term price trajectory. The third is a significant pipeline development but is less likely to have significant near term price implications.

The first two listed, addressing pivotal trial results, stand to impact Acadia’s near term price trajectory. The third is a significant pipeline development but is less likely to have significant near term price implications.

Acadia is making slow headway on its big challenge of expanding its approved indications for pimavanserin.

In “Acadia’s Big Date” I recount how its once ample pipeline of possible indications for its pimavanserin has been recently decimated, noting:

… In 07/2019, its phase 3 in adjunctive treatment for schizophrenia failed to meet its primary endpoint. This knocked (slide 18) some 700,000 patients off its potentially addressable market. Then, more disquieting news occurred the following summer; in 07/2020, Acadia announced failure to meet its primary endpoint in treatment of major depressive disorder ….

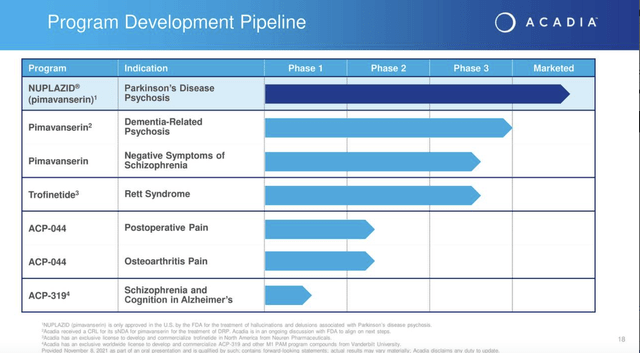

Its current pipeline as shown by Presentation slide 18 below lists just two more pimavanserin shots on goal:

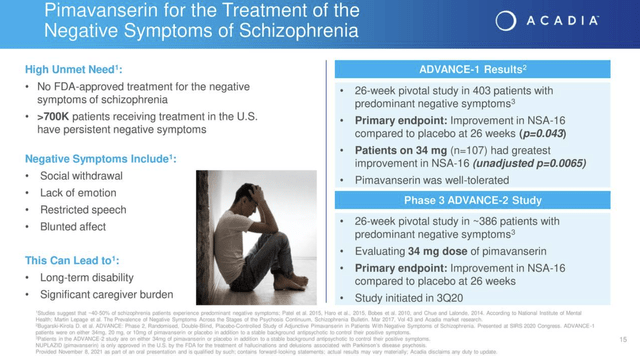

Presentation slide 15 below sets out its pivotal trials for negative symptoms of schizophrenia:

Its ADVANCE-1 study is complete. Its ADVANCE-2 is ongoing. Listed at clinicaltrials.gov as NCT04531982; its brief summary reads:

To evaluate the efficacy and safety of adjunctive pimavanserin compared with adjunctive placebo in the treatment of negative symptoms of schizophrenia

It has an estimated completion date of March, 2023. Its estimated enrollment on clinicaltrials.gov is 426 patients, rather than 386 as shown on slide 15.

Acadia has a reasonable near term path forward which meets the FDA’s requirement.

The nearest opportunity for an indication expansion for pimavanserin is in the DRP indication. As Acadia has made clear recently, with particular emphasis during the call, the FDA has no interest in approving DRP as a single indication. It will evaluate psychosis springing from specific maladies as it has done in approving PDP.

As CEO Davis stated it during the Call:

The FDA made it clear that today they are looking at individual subgroups of dementia rather than DRP as a single group.

CEO Davis realizes that his only play is to run with this requirement, albeit he does not agree with it. The FDA is willing to discuss how to proceed without the necessity of running a new trial. CEO Davis expects to meet with the FDA on this subject before the end of the year.

Acadia has decided that it has sufficient data on Alzheimer’s disease psychosis [ADP] to support an independent filing on ADP. He noted:

Our database includes two independent clinical studies providing evidence of pimavanserin antipsychotic efficacy in Alzheimer’s disease psychosis, study O19 in the HARMONY study. Together, these studies demonstrate improvement in psychotic symptoms and reduction of risk of relapse of psychosis in ADP patients.

Insofar as dementia associated with AD makes up from 60-80% of all dementia patients in the US as noted in the Call an AD focused NDA would not work that much of a letdown from a broader DRP NDA.

Acadia’s 08/2018 acquisition of trofinetide is developing nicely.

When I first covered Acadia its pipeline could be summed up in a word, “pimavanserin”. In 08/2018 it signed a deal with Neuren Pharmaceuticals Limited (OTCPK:NURPF) to acquire its trofinetide which was completing its phase 2 development, NCT02715115.

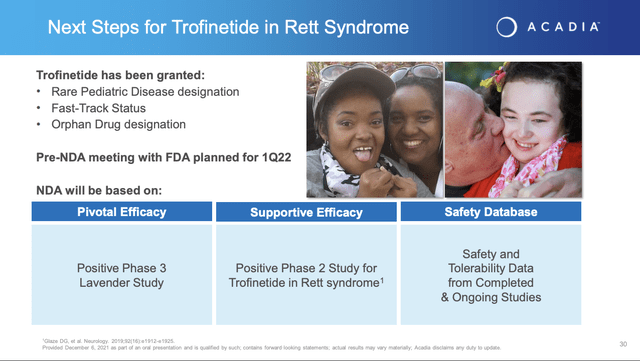

In accordance with the deal Acadia opened a phase 3 study of trofinetide, NCT04279314. On 12/6/2021, Acadia issued its press release announcing top line results from this trial thereby satisfying its near term catalyst commitment 2 as set out in the slide above.

The release lead with the following bullet points:

– Trofinetide met co-primary efficacy endpoints demonstrating statistically significant improvement over placebo in the Rett Syndrome Behavior Questionnaire (RSBQ) (p=0.0175) and the Clinical Global Impression of Improvement (CGI-I) (p=0.0030)

– Trofinetide met key secondary endpoint demonstrating statistically significant improvement over placebo in CSBS-DP-IT–Social (p=0.0064), caregiver scale of ability to communicate

– Pre-New Drug Application meeting with the U.S. FDA planned for the first quarter 2022

That was the good news. Less positive was the following:

Study treatment discontinuation rates related to treatment emergent adverse events (TEAEs) were 17.2% in the trofinetide group as compared to 2.1% in the placebo group. The most common adverse events were diarrhea (80.6% with trofinetide vs. 19.1% with placebo), of which 97.3% in the trofinetide arm were characterized as mild-to-moderate, and vomiting (26.9% with trofinetide vs. 9.6% with placebo), of which 96% in the trofinetide arm were characterized as mild-to-moderate. Serious adverse events were observed in 3.2% of study participants in both the trofinetide and placebo groups.

Acadia issued a 31 slide Lavender study results presentation describing the detailed symptoms of Rett Syndrome, the Lavender trial and trofinetide’s MOA. The Lavender presentation included the following as one of its closing slides:

Conclusion

Acadia has been a tough hold for its shareholders following its big CRL sell-off back in 03/2021. It has shown zero inclination to recover its >$25 price point since that time.

Its two near term catalysts, its FDA meetings to discuss a potential NDA filing for trofinetide and to discuss the possibility of a path forward for an ADP indication for pimavanserin could put it back on track.

Disclosure: I/we have a beneficial long position in the shares of ACAD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may buy or sell shares in Acadia over the next 72 hours.