Summary:

- The lead drug (Nuplazid) is enjoying aggressive sales growth and thereby trumping competitors.

- In taking success to the next level, Acadia is expanding Nuplazid’s label for schizophrenia and Alzheimer’s psychosis.

- There is also another advanced molecule (trofinetide) that is poised to deliver the solution to Rett syndrome.

wildpixel/iStock via Getty Images Acadia

It is my observation that those who sell such stocks to wait for a more suitable time to buy back these same shares seldom attain their objective. They usually wait for a decline to be bigger than it actually turns out to be. – Phillip Fisher (Warren Buffett’s mentor)

In biotech investing, you should look for “novelty.” That is to say, an innovator making a drug having a unique mechanism of action is more likely to deliver you blockbuster results. After all, there is not much demand for another “me too” molecule. The profits margin of biosimilars is also razor thin. To make money with biosimilars, you’d need to ramp up tremendous volume which is not practical for a young and small company.

That being said, I want to revisit Acadia Pharmaceuticals Inc. (NASDAQ:ACAD). You can appreciate Acadia because its lead drug (Nuplazid) has a unique mechanism of action. More importantly, Nuplazid has generated great clinical data that is backing its utility. Over the years, Nuplazid already reached nearly half-way toward the Promised land of blockbuster. Sales would be ramp-up with Acadia’s upcoming label expansion. Amid various developments, this is prime time for you to reconsider the stock. In this research, I’ll feature a fundamental analysis of Acadia and share with you my expectation for this intriguing growth equity.

About The Company

As usual, I’ll provide a brief overview of the company for new investors. If you are familiar with the firm, I recommend that you skip to the subsequent section. Operating out of San Diego California, Acadia Pharmaceuticals is focused on the innovation and commercialization of medicines to serve the unmet needs of various central nervous system (i.e., CNS) diseases.

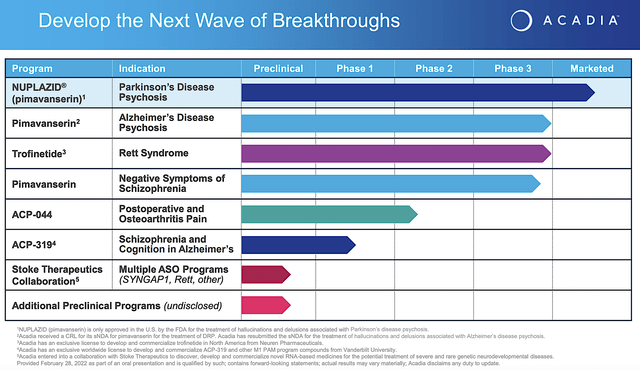

As the crown jewel of the pipeline, pimavanserin (i.e., Nuplazid) is already approved and successfully launched as an atypical neuroleptics for Parkinson’s related psychosis. As an inverse agonist and antagonist of the serotonin receptors, 5-HT2A (and to a lesser extent 5-HT2C), Nuplazid offers a unique approach to treating this condition. Beyond Parkinson’s, Acadia is expanding Nuplazid’s label for psychosis related to Alzheimer’s disease as well as negative symptoms associated with schizophrenia. There are also other pipeline molecules to deliver sustain growth in the coming years.

Corporate Strategy

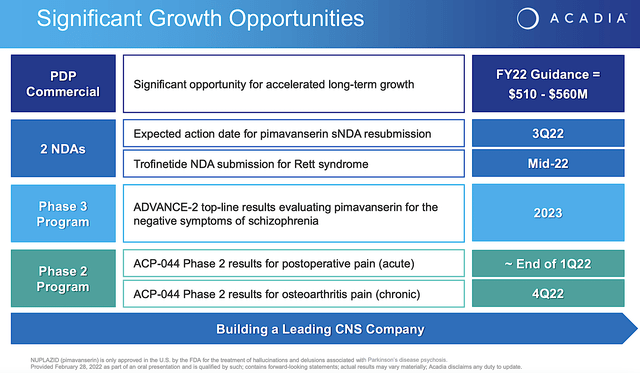

Shifting gears, let us analyze the corporate strategy because it’d give you a big picture view of your investment. As you know, Acadia already has an FDA approved drug (Nuplazid) for Parkinson’s psychosis. Despite that sales growth are increasing aggressively, you know that Acadia is expanding its label for other conditions like Alzheimer’s psychosis and negative symptoms of schizophrenia.

You can appreciate that this is a prudent corporate strategy, as it’s risk deleveraged. Growing by label expansion is similar to Phillip Fisher’s growth approach of sprouting out branches from a tree truck (i.e., expanding similar business lines). The expertise and experience garnered from prior success would be translated into future development. For instance, there is established know-hows as well as safety/efficacy data for the drug.

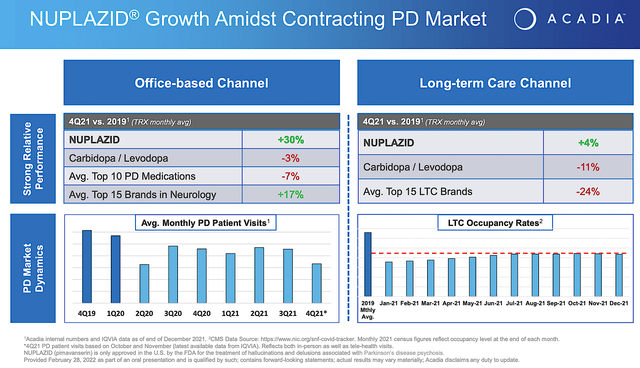

Nuplazid for Parkinson’s Psychosis

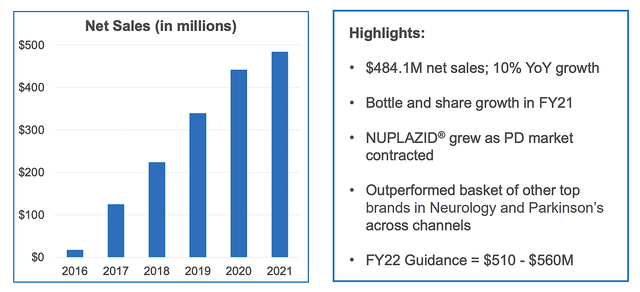

Given that the Nuplazid’s indication for Parkinson’s psychosis is a major value driver, let us analyze its latest commercialization progress. From the figure below, you can see that despite a contracting Parkinson’s disease (i.e., PD) market, Nuplazid is able to enjoy tremendous growth in the past few years. Precisely speaking, Nuplazid enjoyed a 30% growth compared to the 7% contraction for the top 10 PD drugs from 2019 to 2021. Compared to the top 15 neurology drugs, Nuplazid still trumped their 17% growth rate.

What the aforesaid statistics tell you is two fold. First, Nuplazid is a great drug with strong market traction. In other words, Nuplazid has to work very well and is safe for patients to adopt it at such a high rate (while competitors are retreating). Secondly, Acadia must have been doing a great job in launching the medicine. Specifically, the company now have a significantly sized sales/marketing team to adequately unlock the value of this great drug.

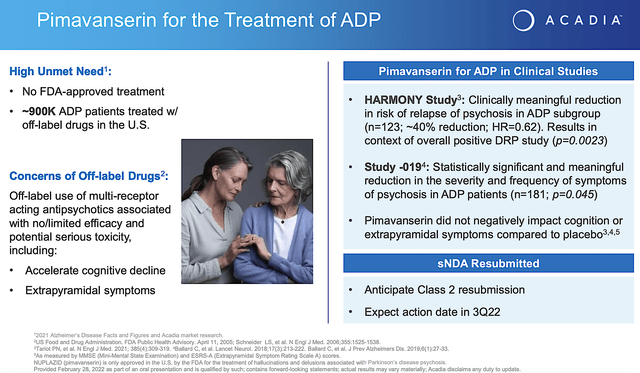

Nuplazid for Alzheimer’s Disease Psychosis

As you know, Alzheimer’s drugs have been such a hot topic in recent years with the drugs of Cassava Sciences (SAVA) and Biogen (BIIB)’s on most news outlets. Nevertheless, there is no certainty regarding those medicines. What is more cleared for you is Nuplazid’s upcoming approval for Alzheimer’s disease psychosis (i.e., ADP).

From the figure below, you can appreciate that Nuplazid proved clinically meaningful reduction in risk of relapses in ADP. In the Study019, Nuplazid demonstrated the reduction in severity and frequency of disease symptoms. Given that the p-values are all less than 0.05%, you know that efficacy is real rather than random occurrences. Coupled to the fact that there is no FDA approved medicine for ADP, you can bet that Nuplazid is in a great position to capture a monopoly.

Looking ahead, Acadia already resubmitted their application that now has an expected Prescription Drug User Fee Act (i.e., PDUFA) date set sometimes in Q3. Leveraging my Integrated System of Forecasting, I ascribed a 65% (i.e., more than favorable) chance of approval. I based my rationale on prior data, my decades of forecasting experience, and my intuition. In a nutshell, you are most likely going to see approval. I noted in the prior research,

Don’t let my 65% throw you off. My forecast is based on categorical rather than numerical per se. As such, my 65% equates to an 85% numerically. As I keep track of my forecasting over the years, you can see my records to get a feel for what to expect from the upcoming event.

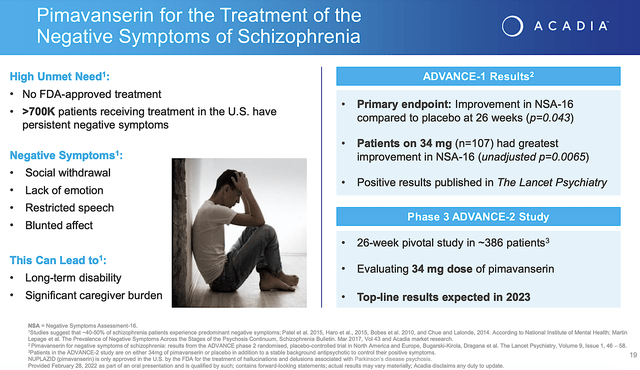

Nuplazid for Schizophrenia

As part of Nuplazid’s label expansion, the potential indication for schizophrenia is quite interesting. Let me explain. The conventional neuroleptics work for positive symptoms rather than negative symptoms. Being extremely difficult to treat, negative symptoms entail social withdrawal, lack of emotion, poverty of speech, and a flat affect. Remarkably, Nuplazid demonstrated the robust results for improvement in negative symptoms as indicated by NSA-16 at the Week26 follow up. As the p-value is less than 0.05, you’d know that the efficacy is due to Nuplazid rather than random chances.

Now, the company is conducting the Phase 3 (ADVANCE-2) study on 386 patients. The top-line results are expected in 2023. If positive (and I believe it will be), Acadia share price would enjoy a huge surge.

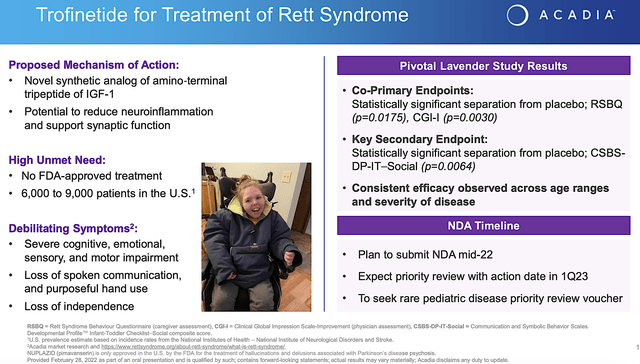

Trofinetide for Rett’s Syndrome

Beyond the Nuplazid franchise, Acadia also has another advanced molecule (i.e., trofinetide). As a synthetic version of amino-terminal of a growth hormone IGF-1, trofinetide has the potential to reduce the damaging inflammatory process in the brain. In the Phase 3 (Lavender) study, trofinetide cleared both primary (i.e., RSBG) and secondary (i.e., CSBS) endpoints with strong statistical significance.

Though most investors do not give this franchise attention, it can surprise you. Having a prevalence of only 6K to 9K patients in the US, Rett syndrome is an orphan (i.e., rare) condition. As such, it positioned trofinetide to receive a premium reimbursement. That aside, there is no FDA approved treatment which heightens the demand for the drug. The symptoms are also debilitating to drive the demand for treatments even higher.

Riding robust data, Acadia planned to submit a New Drug Application (i.e., NDA) by mid-2022 (i.e., in June). Additionally, the company seeks to receive pediatric rare disease voucher for priority review. Even without a priority review, you’re looking at a PDUFA date sometimes in Q1 next year.

Competitor Landscape

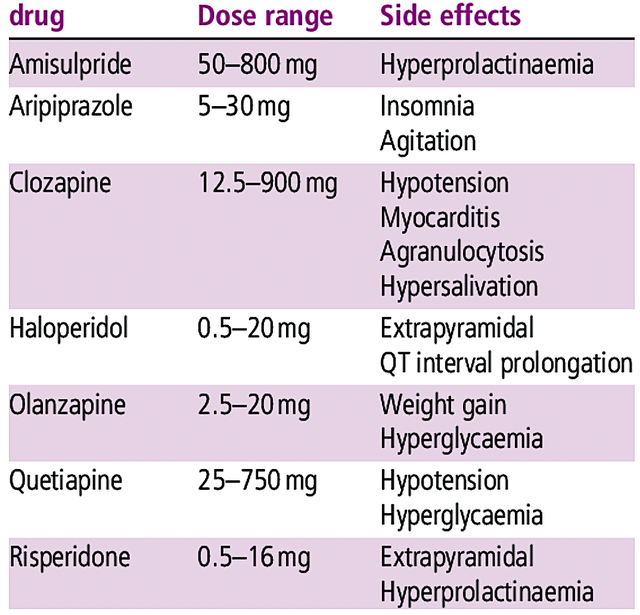

About competition, goes toes to toes with conventional neuroleptics like risperidone (Risperdal), quetiapine (Seroquel), olanzapine (Zyprexa), ziprasidone (Zeldox), paliperidone (Invega), aripiprazole (Abilify) and clozapine (Clozaril). I noted in the prior research,

Most of these drugs have substantial adverse effects that limit their utility. For example, patients taking these drugs on a long-term can start to produce milk (i.e., prolactinoma).

The more intense competition comes from the novel drugs like Caplyta of Intra-Cellular Therapies (ITCI) and AXS05 of Axsome Therapeutics (AXSM). These newer drugs have better efficacy/safety profiles. They are also more differentiated. Despite strong competitive pressure, there is plenty of room in this space to allow multiple blockbusters.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 4Q2021 earnings report for the period that ended on December 31.

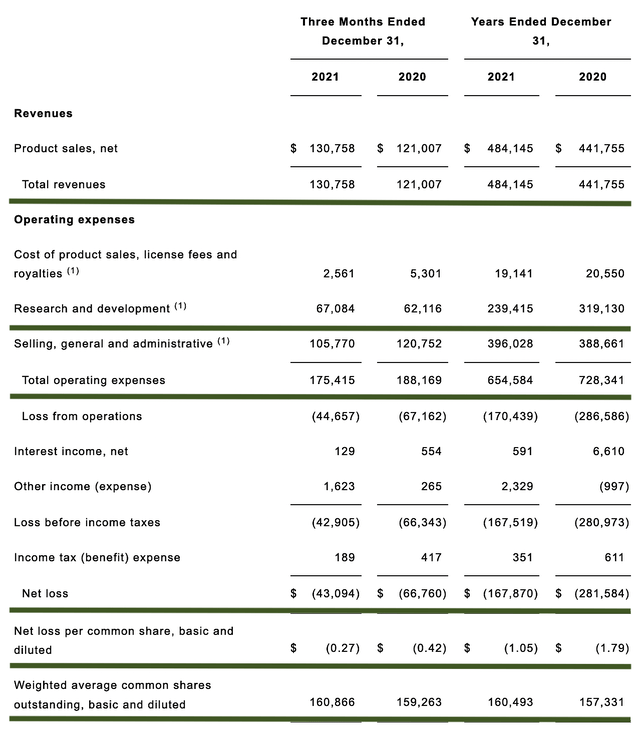

As follows, Acadia procured $130.7M in revenue compared to $121.0M for the same period a year prior. On a year-over-year (i.e., YOY) basis, the revenue increased by 8.0%. On an annual basis, the revenues for the respective Fiscal 2021 and Fiscal 2020 revenues tallied at $484.1M and $441.7M.

Viewing the figure below, you can see that growth rate from Fiscal 2016 has been highly aggressive and linear. With the Fiscal 2022 guidance of $510M to $560M in revenue, you know that you already have a drug about to surpass the mid-point toward blockbuster. Interestingly, you can expect next year sales to leap much closer toward blockbuster results due to the upcoming label expansion for ADP.

That aside, the research and development for quarterly comparison registered at $67.0M and $62.1M. I view the 7.8% R&D increase positively because the money invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $43.0M ($0.27 per share) net loss compared to $66.7M ($0.42 per share) net decline for the same comparison. On a per-share basis, the bottom line improved by the remarkable 55.5%. As the company is already generating increasing revenue, you can appreciate that they are narrowing their bottom line depreciation. That way, they can bank net profits in the next several years.

About the balance sheet, there were $520.7M in cash, equivalents, and investments. Against the $175.4M quarterly, OpEx, there should be adequate capital to fund into Q2022. Simply put, the cash position is weak relative to the burn rate. And with that, you can expect the company to raise capital sometimes in Q3.

While on the balance sheet, you should check to see if Acadia is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 159.2M to 160.8M, my math reveals a 1.0% annual dilution. At this rate, Acadia easily cleared my 30% cut-off for a profitable investment.

Valuation Analysis

It’s important that you appraise Acadia to determine how much your shares are truly worth. Before running our figure, I liked to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. For a medical diagnostic device, I focus on market penetration and sales. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 160.8M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

Nuplazid for Parkinson’s psychosis |

$1B (Estimated from the $11.5B global Parkinson disease market) |

$375M | $23.32 | $20.99 (10% discount because Nuplazid is succeeding in launch) |

| Nuplazid for Alzheimer’s disease psychosis | $1B (based on the $25B global Alzheimer disease market) | $250M | $15.54 | $10.87 (30% discount because the drug has yet to gain approval) |

| Nuplazid for schizophrenia (negative symptoms) | $500M (based on the $7.9B schizophrenia market) | $125M | $7.77 | $4.66 (40% discount because the drug has yet been approved and clearance to treat negative symptoms is a high hurdle) |

| Trofinetide for Rett’s syndrome | $500M (small market size but orphan status enabling a premium reimbursement) | $125M | $7.77 | $4.66 (40% discount because the drug has yet been approved) |

| Younger pipeline assets | Will wait for more advancement before valuing | N/A | N/A | N/A |

|

The Sum of The Parts |

$41.18 |

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for Acadia is whether the company can continue to ramp-up Nuplazid sales to become a blockbuster. The more immediate risk is the upcoming FDA decision regarding Nuplazid sNDA for Alzheimer’s by Q3. There is a 35% chances of a negative decision. If that’s the case, you can see your shares tumble by 50% and vice versa.

That aside, there’s also a similar risk that ADVANCE-2 might not post strong top-line results in 2023. Acadia might also not be able to gain trofinetide approval for Rett syndrome in 1Q2023. As a young grower, Acadia might expand its pipeline too aggressively and thereby run into a potential cash flow constraint.

Conclusion

In all, I recommend Acadia as a buy with 4.7/5 stars rating. On a one to two-years horizon, I expect the updated $41.18 price target (i.e., PT) to be reached. Acadia Pharmaceuticals is a story of growth success. Since Nuplazid was launched in 2016, sales growth have steadily gained traction. On this trajectory, you can expect it to surpass halfway toward blockbuster by yearend 2022. In the thick of a market decline due to the pandemic, Nuplazid sales posted the remarkable 30% growth while competitors retraced in the red. Better yet, Acadia is aggressively expanding Nuplazid label for Alzheimers and schizophrenia. By Q3, you should anticipate a positive decision from the FDA. Second time tends to be the charm. In 2023, there are several intriguing catalysts stacked on top of one a other. The first is the expected approval of trofinetide for Rett syndrome in Q1. Then, there’s also the data catalyst for the ADVANCE trial to be reported sometimes in 2023.

As usual, I’d like to remind investors that the choice to buy, sell, or hold Acadia is always yours to make. In my view, you should either hold the stock “as is” or purchase some more shares to average down for the long-term upsides.

Author’s Note: This article is an abridged version of an article originally published for members of the Integrated BioSci Investing marketplace on April 25, 2022.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: As a medical doctor/market expert, I’m not a registered investment advisor. Despite that I strive to provide the most accurate information, I neither guarantee the accuracy nor timeliness. Past performance does NOT guarantee future results. I reserve the right to make any investment decision for myself and my affiliates pertaining to any security without notification except where it is required by law. I’m also NOT responsible for the action of my affiliates. The thesis that I presented may change anytime due to the changing nature of information itself. Investing in stocks and options can result in a loss of capital. The information presented should NOT be construed as recommendations to buy or sell any form of security. My articles are best utilized as educational and informational materials to assist investors in your own due diligence process. That said, you are expected to perform your own due diligence and take responsibility for your action. You should also consult with your own financial advisor for specific guidance, as financial circumstances are individualized. That aside, I’m not giving you professional medical advice. Before embarking on any health-changing behavior, make sure you consult with your own doctor.

Thanks for reading! To read the full article, CLICK HERE. To get the latest articles, please hit the orange “Follow” button on top.

Be sure to check out our private investment research community, Integrated BioSci Investing.

Dr. Tran’s analyses are the best in the biotech sphere, well worth the price of subscription.

Very professional, extremely knowledgeable and very honest … I would highly recommend this service and his stock picks have been very profitable.

Simply put, this is worth every penny. Just earlier today, one of the companies recommended by Dr. Tran got acquired for a nice 50% premium.

Click here for a FREE TRIAL.