Summary:

- Accenture is a global IT services company with over 721,000 employees, serving clients in more than 120 countries.

- The company’s strong position in the AI technology race and its loyal client base will benefit from the increasing demand for AI solutions.

- Accenture’s revenue growth has held up better than its competitors, and its book-to-bill ratio remains strong, indicating future growth potential.

- The stock price pullback may be overdone, as the weaker than expected growth is in part due to clients shifting their budgets from shorter-term discretionary spend into longer-term transformational projects that will take longer to translate into revenues.

- At a free cash flow yield of 4.6%, Accenture is trading at a decent valuation, but not at a deep discount. Potentially attractive for long-term oriented investors.

dem10

Overview

Accenture (NYSE:ACN) is a leading global professional IT services company that helps the world’s leading businesses, governments and other organizations build their digital core, optimize their operations, accelerate revenue growth, and enhance citizen services — creating tangible value at speed and scale. They are an innovative company consisting of over 721,000 talented people serving clients in more than 120 countries. (Adapted from Accenture’s 2022 annual report)

Accenture serves more than 9,000 clients — including 89 of the Fortune Global 100 and more than three quarters of the Fortune Global 500 — spanning the full range of industries around the world. Ninety nine of the company’s top 100 clients have partnered with Accenture for more than 10 years.

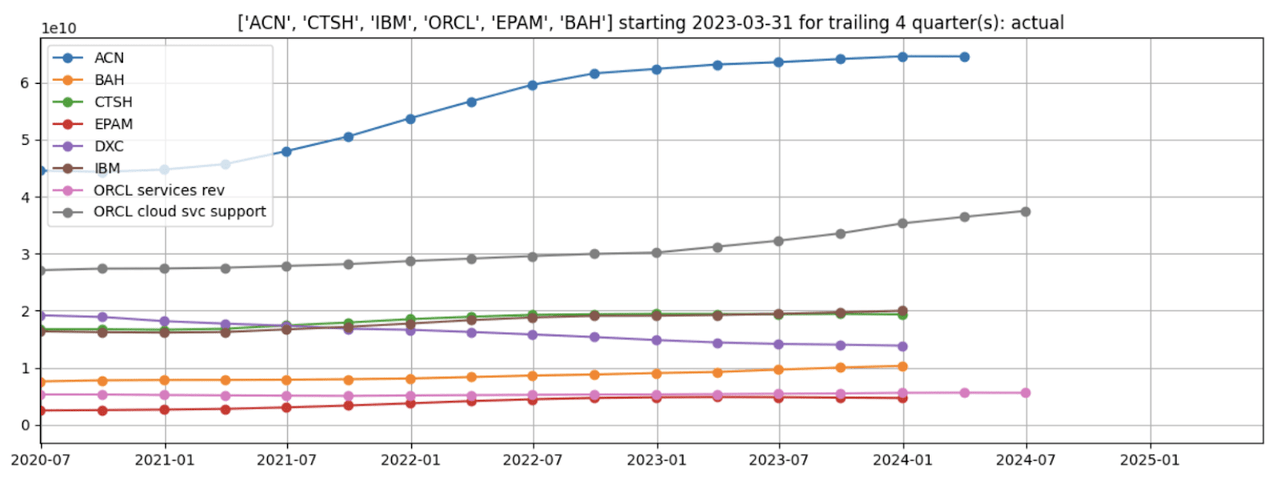

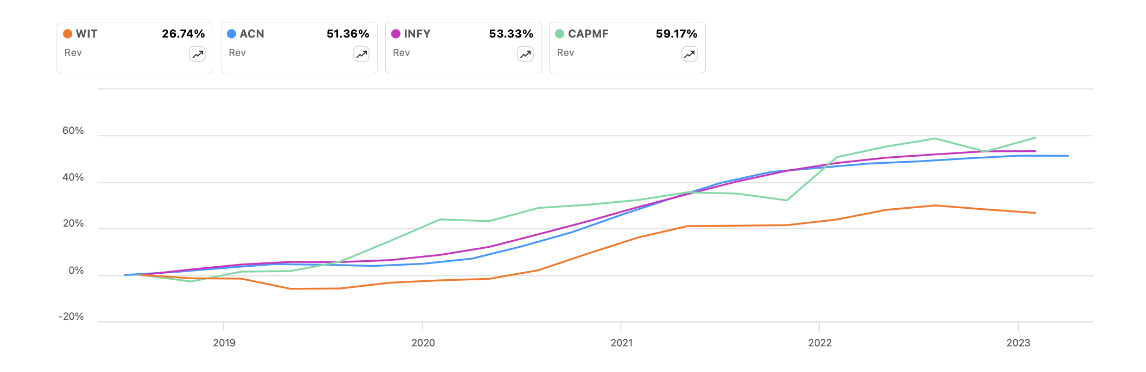

Accenture is the largest amongst its closest competitors at three times the revenues of Cognizant Technologies (CTSH) (figure 1, green line) and IBM’s (IBM) Consulting Services segment (brown line). Oracle’s (ORCL) Cloud Service Support segment (gray line), while smaller, includes the company’s software as a service platforms and is not an apples-to-apples comparison, while Booz Allen Hamilton (BAH) focuses primarily on government consulting contracts.

Figure 1: Comparison of trailing twelve-month revenues

Created by author with public financial data

Thesis and elaboration

Investment thesis

IT spending has consistently yielded high returns and created competitive advantages for businesses (this was covered in-depth in my previous article Accenture PLC: Solid Long-Term Prospects At An (Almost) Reasonable Price).

Over the last two years, powerful large language model artificial intelligence tools — like ChatGPT and others —have taken the world by storm, launching an AI technology race among companies that are intent on widening their competitive lead as well as those that fear falling behind.

This upgrade cycle will disproportionately benefit Accenture, which has a large and long-standing list of loyal blue-chip clients across a broad base of industries and geographies, as well as the deep resources to both develop and acquire best-in-class technology which can be spread across its large client base.

Even though half of the company’s revenues are “consulting” contracts, those revenues are effectively recurring in nature because it is difficult for clients to bring in Accenture’s competitors to perform maintenance or upgrades on a system designed or implemented by Accenture, since doing so would be costly, disruptive, and potentially risky.

Elaboration on thesis

Goldman Sachs noted that “a basket of companies pursuing or enabling AI technology… has outperformed the equal weight S&P 500 by 19 percentage points since the start of [2024]”. This indicates that AI technology is value accretive and will continue to be in demand by business enterprises.

In the last nine months, mainstream AI players such as OpenAI/Microsoft, Google, and Anthropic have released increasingly powerful large language models. Many newer players have jumped into the fray with both general foundational models (e.g., Perplexity, Mistral, Meta, and Elon Musk’s X.AI) and specialized LLMs (e.g., Adobe and Canva for images, Grammarly for text editing, OpenAI Sora for video creation tools). The increasing plethora of choices and complexity make it more difficult for enterprises to deploy these technologies on their own.

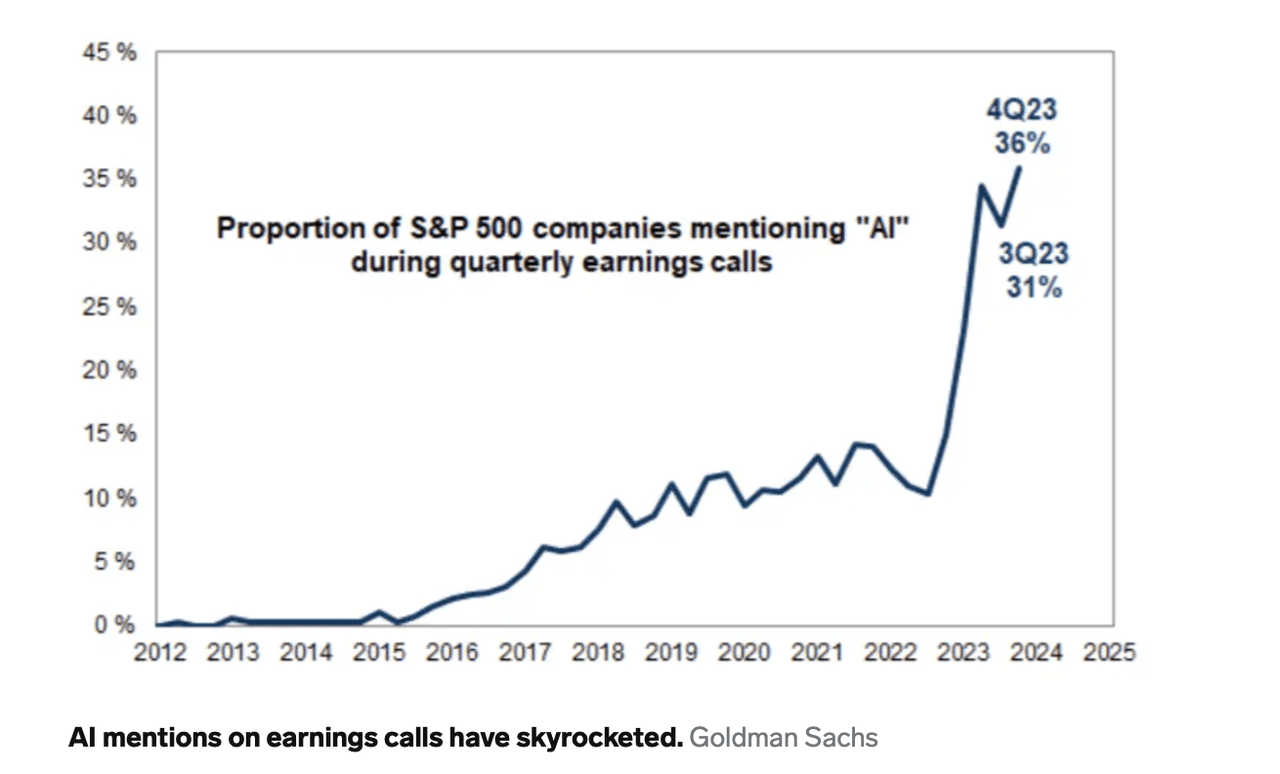

The number of “AI” mentions at S&P 500 company earnings calls reached an all-time high of 36% in the fourth quarter of 2023 (figure 2), according to a study by Goldman Sachs. This is an indication of the high level of the enthusiasm and mind share amongst top management of the largest firms, which have the large datasets to extract value from AI and are typical Accenture clients. Interestingly, the report noted that companies in the energy sector saw the biggest rise in mentions.

Figure 2: Mentions of “AI” in S&P 500 company earnings calls

Accenture’s Generative AI bookings grew $600 million in the quarter, reaching $1.1 billion through the first half the year, becoming one of the fastest growing emergent technologies in the company’s history.

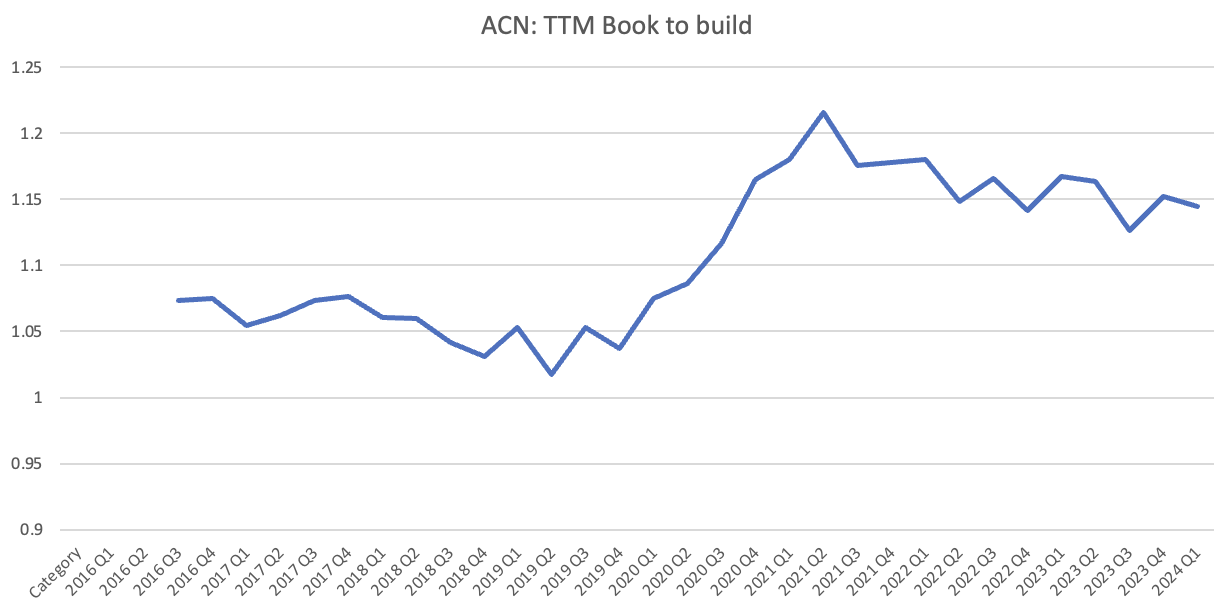

This strong bookings helped bring its quarterly book to bill ratio (i.e., the ratio of new bookings to revenues, a good indication of upcoming work) to a near-record 1.4x, on-par with competitor Cognizant’s 1.4x.

IBM CEO Arvind Krishna made a similar observation in his remarks on the earnings call for the quarter ended March 31, noting that the strong momentum of the book of business for Watsonx and generative AI “eclipsed one billion dollars since [IBM] launched Watsonx in mid-2023″, clarifying that “this remains weighted towards consulting”. As IBM’s Consulting Revenue is just one-third the size of Accenture’s, IBM’s AI bookings represent a larger percentage of consulting revenues compared to Accenture. This could be an indication that IBM may be picking up AI-related revenue more quickly and is a metric I will be watching closely over the next several quarters.

Accenture’s 12 month book-to-bill is 1.14x (figure 3), which is at the same level as IBM’s reported number.

Figure 3: Accenture’s trailing twelve-month book to bill ratio

Created by author with public financial data

Accenture’s Managed Services revenue, which is recurring and earned over a longer period of time, grew faster than its Consulting Services revenue and accounted for almost 50% of total revenue in Q2 of fiscal 2024.

Equally importantly, the staff utilization has remained at 92% on a fairly stable billable employee count, indicating that there is no shortage of billable work.

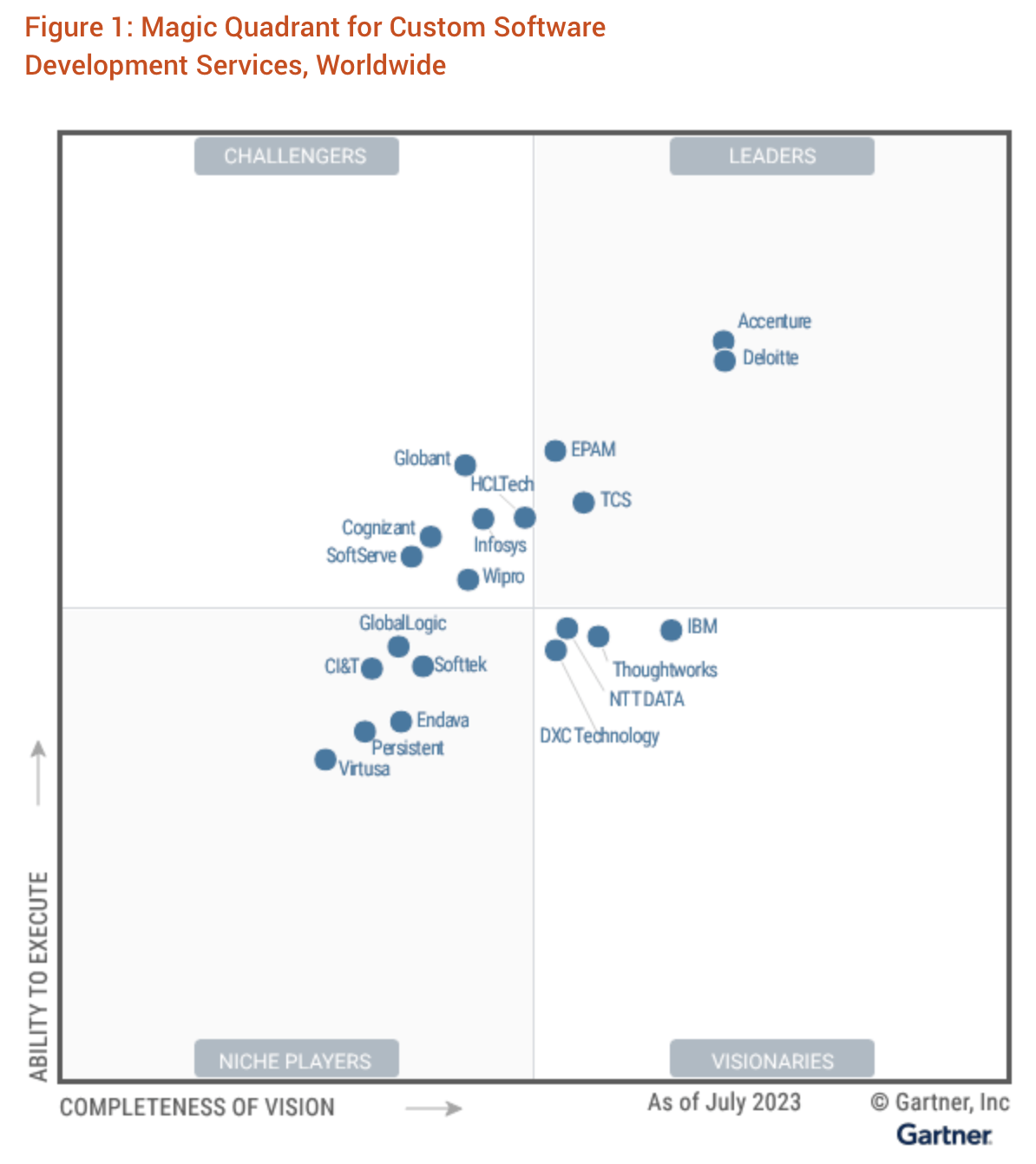

Gartner continues to rate Accenture above its peers in both its vision and ability to execute (figure 4).

Figure 4: Gartner magic quadrant for custom software

Gartner magic quadrant

One of my concerns was Accenture’s ability to develop the knowhow or train enough employees to implement the anticipated volume of AI projects. To this end, the company has made $2.9 billion of acquisitions over the last 6 months, including Udemy–a leading online training firm it can leverage to build the expertise of both its own and clients’ employees. To date, Accenture has built a staff of 53,000 skilled data and AI practitioners (against their goal of 80,000 by end of fiscal year 2026), representing about 6% of total employees.

Sharp pull back after recent run-up

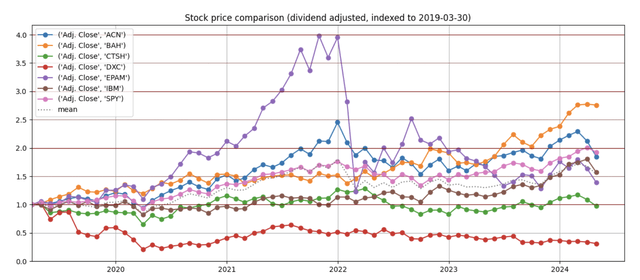

Accenture stock has been one of the stronger performers over the last 5 years. Since my article in August 2022, the stock reached a high of $388 on March 7 before pulling back -22% to $303 today (figure 5, blue line). This pullback was triggered by the company’s announcement that its revenue for the quarter ended February 2024 was $15.8 billion-–flat in both U.S. dollars and local currency compared to the second quarter of fiscal 2023, and the lowering of its fiscal year revenue growth guidance from 2-5% down to 1-3% growth.

Stock prices of its closest comparables, Cognizant Technologies (CTSH) (green line) and EPAM Systems (EPAM) (purple line) experienced similar declines, while DXC (DXC) (red line)–the merger of CSC Index and HP Consulting– has suffered from long term market share loss. IBM’s (IBM) Consulting segment also reported flat revenue (but up 2% for constant currency) for the quarter ended March 2024 (IBM’s stock fell 10% following the earnings report).

Figure 5: Stock price comparison

Created by author with public financial data

Weak revenue growth is an industry-wide issue

Revenue Growth

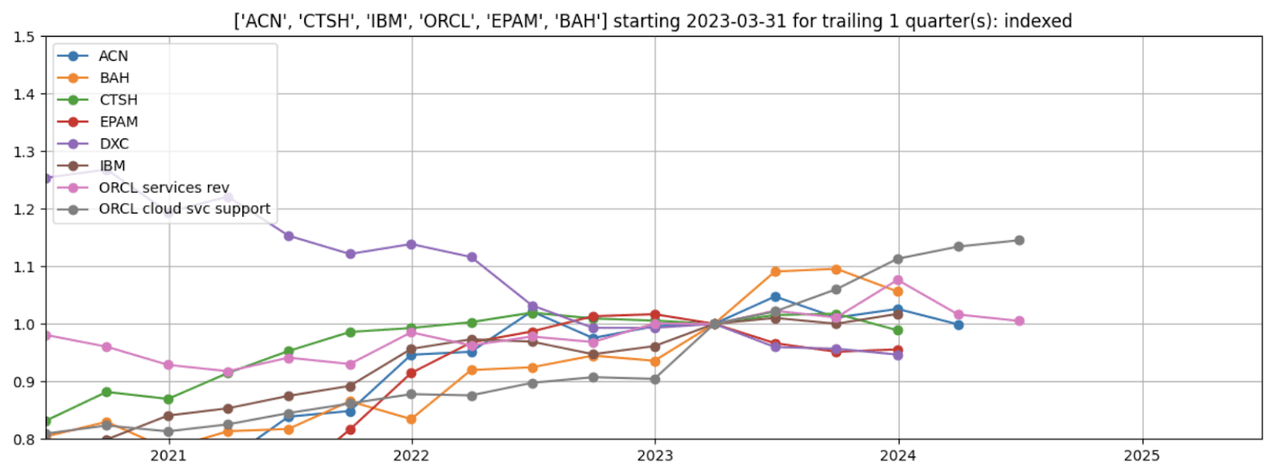

The soft revenue growth over the last year is not limited to Accenture. The quarterly revenues of its closest competitors, Cognizant, DXC, and EPAM, have all fared worse over the period (figure 6). While Oracle’s Cloud Service Support segment revenues grew strongly, it is not a direct comparable as it includes Oracle’s online platforms. Similarly, as previously discussed, Booz Allen’s (BAH) primary focus is on the government market.

Figure 6: Comparison of trailing one-quarter revenues, indexed

Created by author with public financial data

Over the last two years, Accenture’s revenue has also held up better than its direct competitors on a trailing twelve-month basis (figure 7).

Figure 7: Comparison of trailing twelve-month revenues, indexed

Created by author with public financial data

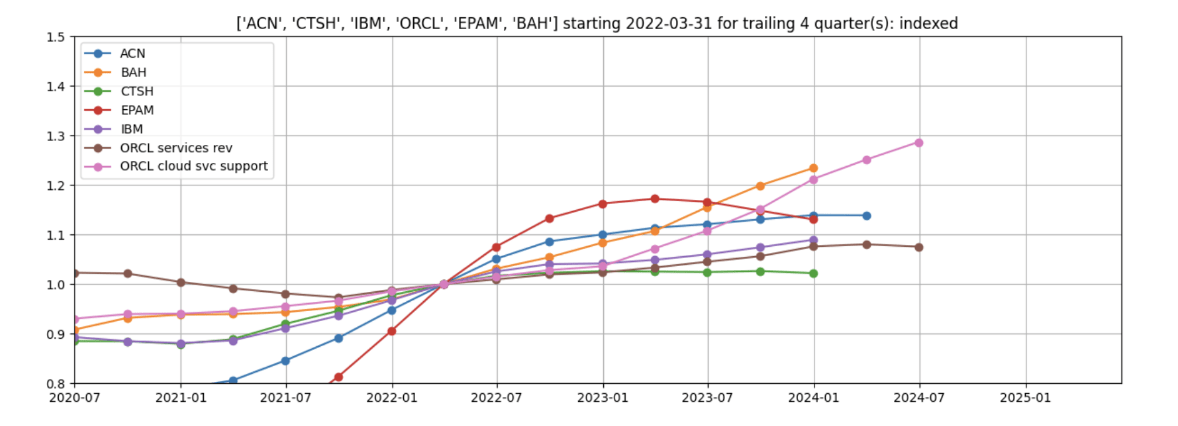

The growth of Accenture’s non-US listed competitors have also moderated. Paris-based Capgemini (OTCPK:CAPMF) and Indian firm Infosys (INFY) grew at similar rates as Accenture, while Wipro (WIT) grew at just half the rate. (Accenture’s actual revenues is almost three times that of Capgemini) (figure 8).

Figure 8: Comparison of revenue with non-US listed competitors

Seeking Alpha chart

Growth By Industry Exposure

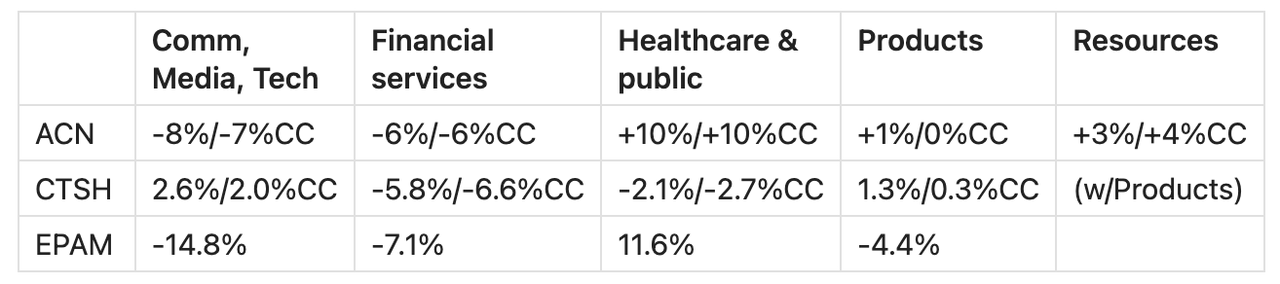

For the quarter ended February 2024 (figure 9):

-

Banking was revenue down by 6% as client earnings were burdened by high interest rates that squeezed their net interest margins, causing a temporary wait and see pause on discretionary work

-

Communications, media, and tech revenue was down by 7% but Accenture appears to be gaining market share as its competitors’ revenues are down even more.

-

Consumer products was generally flat

-

Resources and healthcare are strong (up 4% and 10% in local currency)–the latter driven by the opportunity to use LLMs to streamline payer administrative processes, automate clinical documentation, and even enhance clinical decision support systems.

Cognizant and EPAM both reported similar trends (figure 9), while IBM does not break down consulting revenues by industry.

Figure 9: Comparison of most recent year-over-year industry growth by segment

Created by author using public financial data

Source: Created by author with public financial data

Management discussion

An uncertain environment

On their most recent earnings calls, the CEOs of Accenture, Cognizant, and IBM each cited tighter and slower client spending as they navigate an uncertain macro environment due to challenging economic, geopolitical and industry-specific conditions. As mentioned above, this is particularly acute in financial services as banks and other lending institutions found their revenues squeezed as they are unable to raise their lending rates as quickly as their interest-rate dependent expenses. Communications, media, and technology companies, particularly in the US and EMEA, have also pulled back on spending because, according to Cognizant, many companies in this space have taken on too much debt to fund growth and face a debt wall that may require refinancing at today’s higher borrowing rates.

In any event, the ongoing need to stay ahead of competitors is putting pressure on businesses to continue spending on technology. As such, as in previous cycles, companies will step up spending, particularly on discretionary projects, when confidence returns.

EPAM is in a different situation–clients have pulled back due to the uncertainty created as it was forced to relocate its large base of employees located in Ukraine following the Russian invasion.

EPAM’s CEO Arkadiy Dobkin explained in the recent 1Q 2024 earnings call:

“[W]e didn’t realize that impact of the war raised risk profile for EPAM and uncertainty that we will be able to navigate the war. So a lot of calls clients were doing in the middle of 2022 which kind of delaying decision with us or actually going to — starting to replace, not put a new repeats to us”

Reallocation of spending towards longer term projects

The CEOs of Accenture, Cognizant, and IBM each noted the clients’ shift of budgets away from shorter projects towards larger, transformational projects. This falloff of smaller deals offset the backlog created by the large deal wins.

Key takeaways from recent earnings calls:

– Short term projects (<$10 million) are typically discretionary and produce revenue more quickly as they are typically completed and billed the same period.

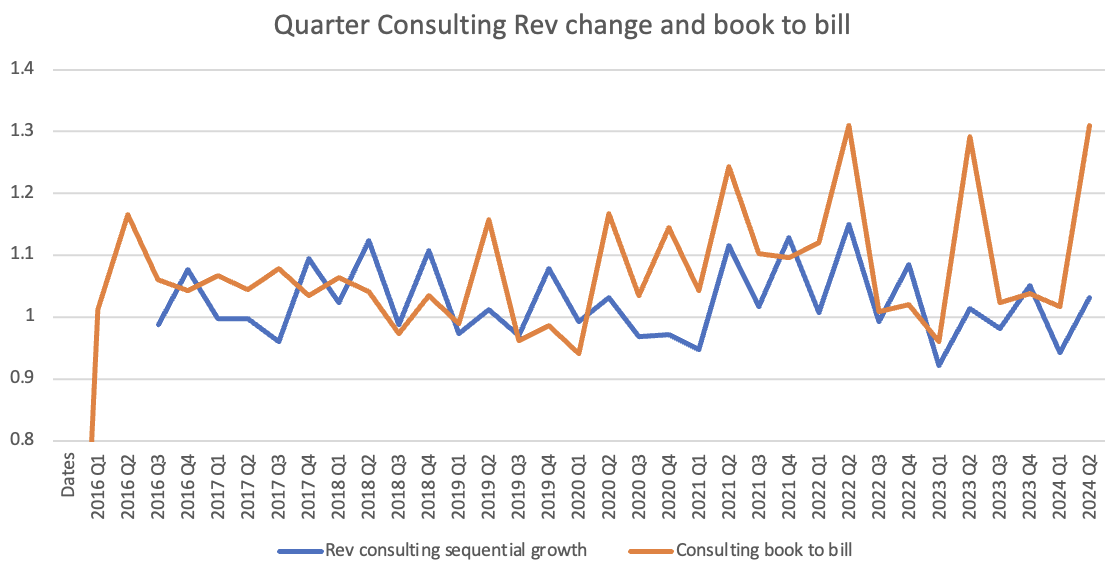

– As clients come to grips with the long term investments needed to build out their cloud-based, core digital infrastructure before they can implement AI across their enterprise, they are shifting their budgets to larger transformational projects, as evident by the rising book-to-bill ratio in figure 2. The large projects have a slow takeoff but enter into a sharp s-curve as the work ramps up. Furthermore, as larger deals are executed over a longer time period, they provide a solid backlog for future years.

On the Accenture earnings call for the quarter ended February 2024, an analyst noted that other parts of tech (such as for software licenses) are doing better than services. Accenture CEO Julie Sweet noted that the cost of services can be significantly higher than the software licenses, a possible conjecture is that they have chosen to hold off on the implementation of these shorter term projects to spend their constrained budgets on transformational projects that have longer term, more far-reaching benefits, and greater impact on Accenture’s intermediate revenues and earnings.

There is still plenty of demand for digital core buildups

GenAI runs on top of a solid, cloud-based digital core that includes a modern ERP (enterprise resource planning) software platform. However, according to Accenture management, only 40% of workloads are in the cloud, of which around 20% of those roughly have not been modernized.

Furthermore, some clients have not installed it on the prerequisite platforms. As AI technology is a relatively small component of what is needed, experienced and proven implementers of digital core systems like Accenture will continue to be beneficiaries of this trend.

Financial overview

Revenue

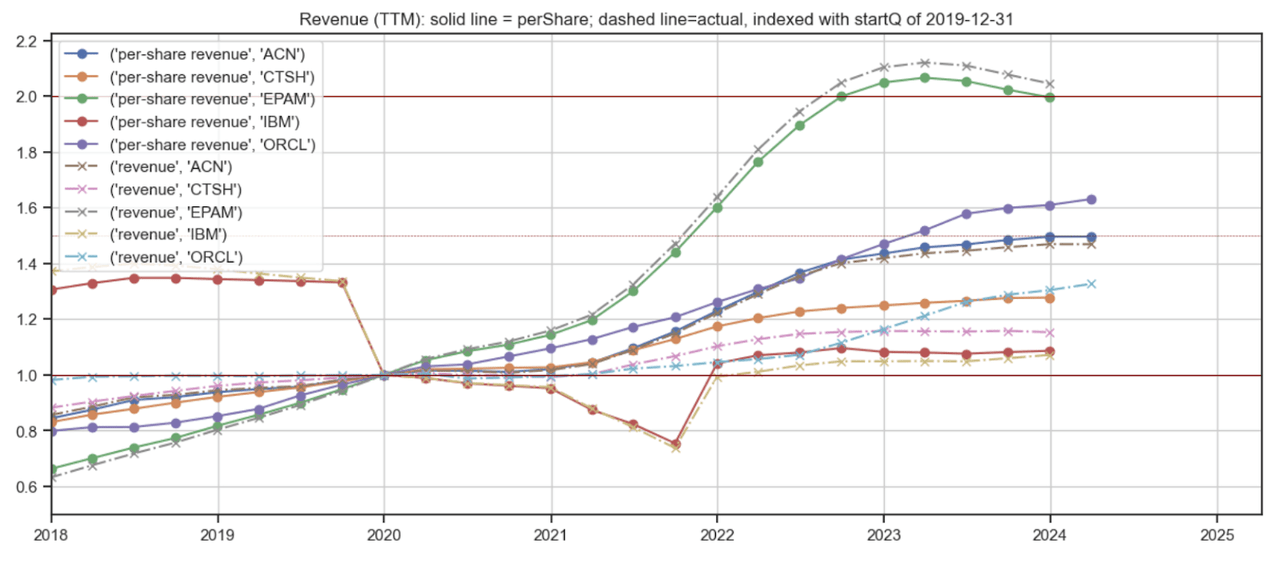

Accenture’s revenue growth (figure 10, brown dashed line) over the last four years is only behind EPAM, which is about one-tenth its size. Oracle outgrew Accenture on a per-share revenues due to its aggressive share buyback program which reduced share count by 20% over the same four year period and by a third over the last 6 years.

Figure 10: Revenue comparison

Created by author with public financial data

Operating margins

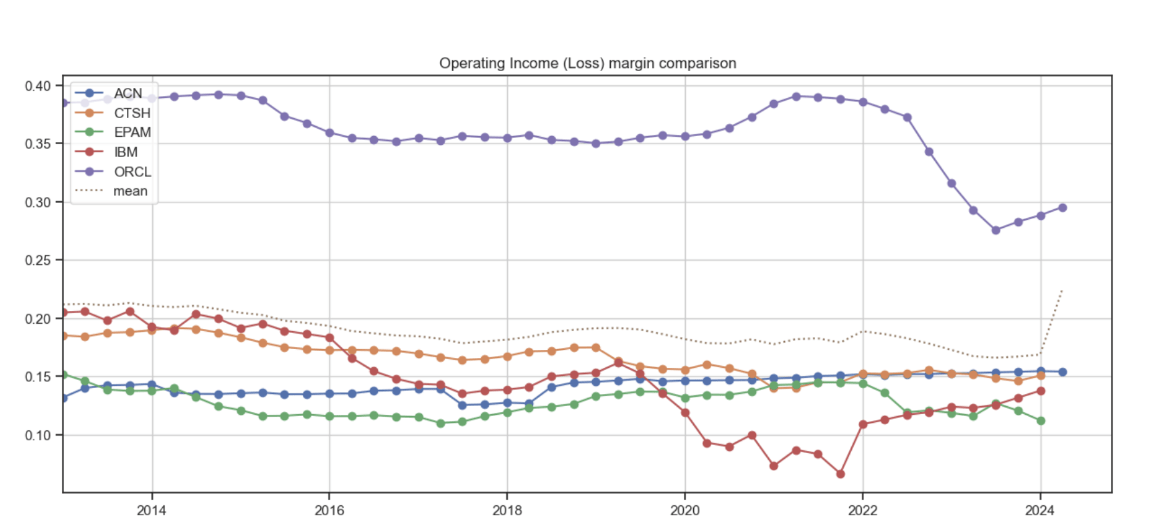

Of the US-listed firms, Accenture is the only one with consistently expanding operating margins over the last decade (figure 11, blue line), up about 500 basis points.

Figure 11: Operating margin comparison

Created by author with public financial data

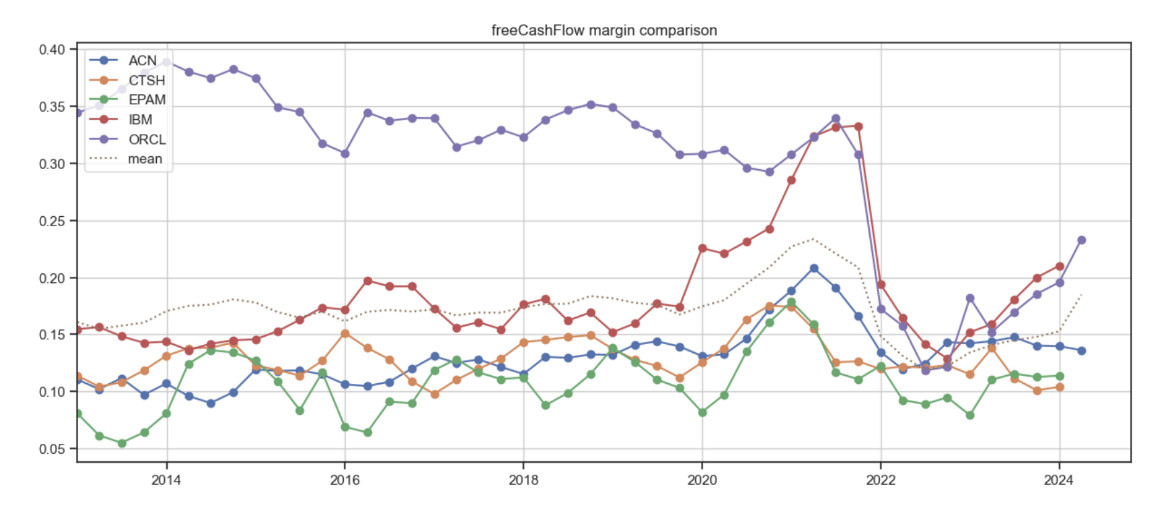

Accenture’s free cash flow (cash flow from operations) expanded by ~400 basis points over the last decade (figure 12, blue line).

Figure 12: Free cash flow margin comparison

Created by author with public financial data

Valuation

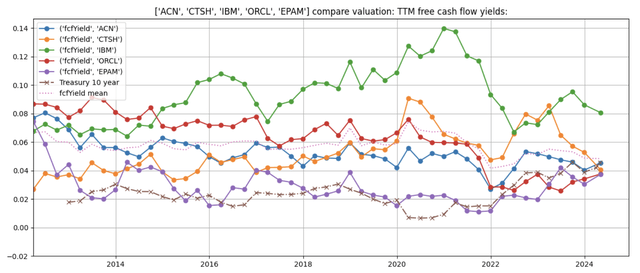

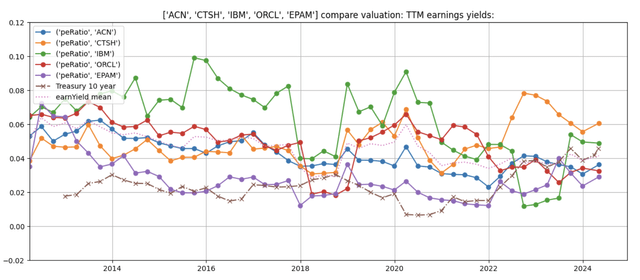

Accenture’s free cash flow yield of 4.6% (figure 13, blue line) is roughly the median of its US-listed peers. Similarly, its earnings yield (figure 14, blue line) (the inverse of the PE ratio) is slightly lower (i.e., more expensive) the median of its peers.

Even though Accenture’s earnings yield is current around the middle of its 12-year historical range, its free cash flow yield (my preferred measure) is at the lower end of its 12-year historical range.

Figure 13: Free cash flow yield comparison

Created by author using public financial data

Figure 14: Earnings yield comparison

Created by author using public financial data

Comparing historical growth to valuation: Even though Accenture’s free cash flow yield of 4.6% (Figure 13, blue line) is just slightly lower compared to past periods with similar growth, the free cash yield spread over the 10-year treasury yield of ~4.5% (brown dashed line) is negligible due to the high interest rate today. As an investor can get a similar yield from risk-free 10-year treasuries, Accenture shares are not undervalued today unless its earnings grows steadily over the intermediate term.

Outlook

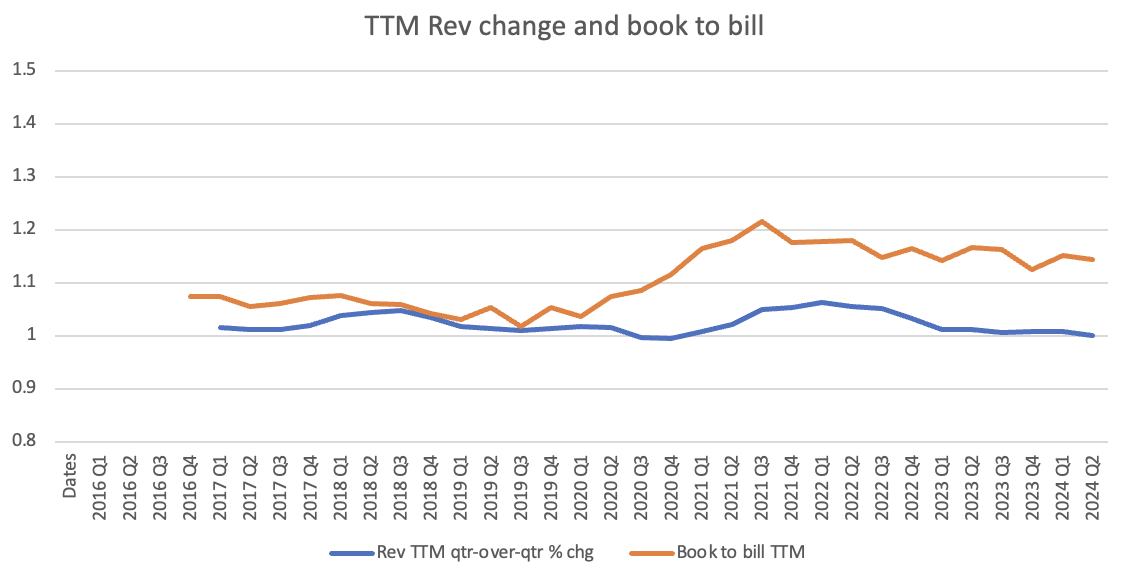

Book to bill ratio

The book to bill ratio, which is the ratio of the total value of new orders to the total value of billed orders, is generally be a good leading indicator of near to intermediate term revenue potential. A ratio of greater than one indicates growing demand as more orders are coming in than are being fulfilled.

Accenture’s book to bill ratio on a trailing twelve month basis is strong but has been on a downtrend since the end of 2021 (figure 15, orange line).

Figure 15: Relationship of historical TTM revenue change and book to bill

Created by author with public financial data

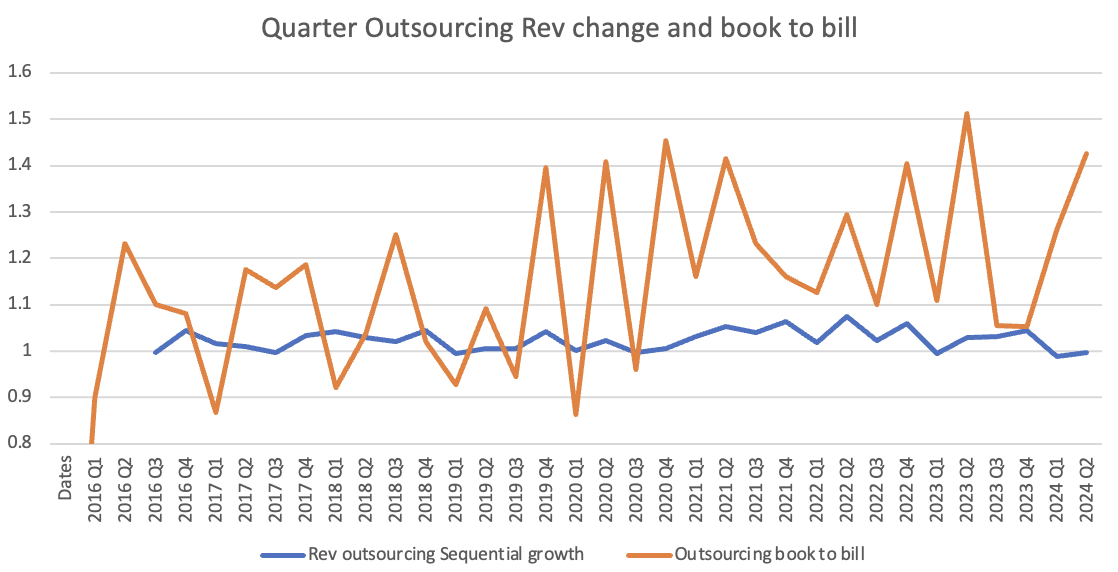

Accenture’s outsourcing segment projects are typically longer term projects in which bookings take time to convert into revenue. The company’s outsourcing book to bill ratio, which is holding up (figure 16), should provide a steady base of revenues over the near term.

Figure 16: Relationship of historical quarterly outsourcing revenue change and book to bill

Created by author with public financial data

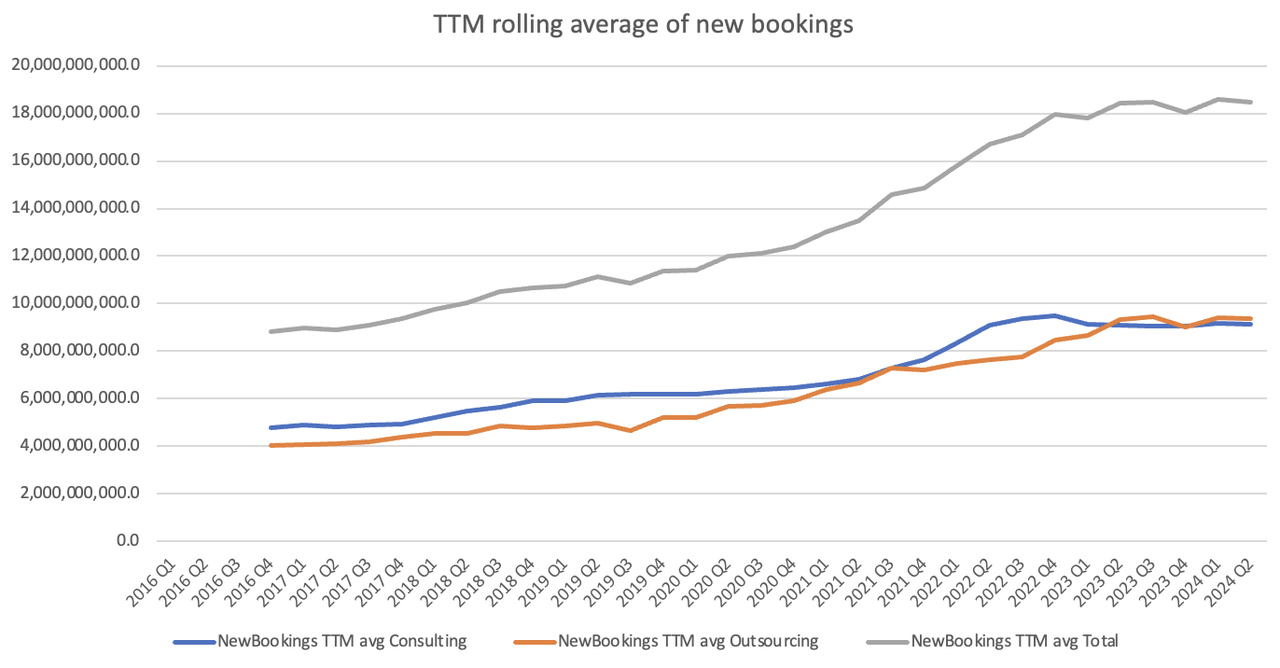

Consulting bookings, which translate into revenue more quickly, typically jump in the calendar quarter ending February as most contracts are signed at the beginning of the year after IT department annual budgets are approved. While the recent consulting book-to-bill ratio appears to be holding up (figure 17), the absolute dollar value of bookings for consulting has actually flattened (figure 18, blue line).

Figure 17: Relationship of historical quarterly consulting revenue change and book to bill

Created by author with public financial data

Figure 18: Rolling 12-month average dollar value of bookings by segment

Created by author with public financial data

As the CEO of Cognizant noted on the Q4 2023 earnings call:

It’s not just about the large deals but it’s also about the small deals…. If [the smaller $0 to $5 million discretionary deals] fall off, they kind of neutralize what you win on the large deals”.

Risks and concerns

(1) Can Accenture deliver best in class AI solutions to its clients?

A failure to develop best in class solutions or botched implementations could cause reputation damage and erode client trust, and create a potential opening for competitors to narrow Accenture’s industry-leading position.

Mitigating factors: Accenture has been aggressively acquiring leading AI technologies to supplement its own internal R&D efforts and intellectual property. In addition, it has built a staff of 53,000 skilled data and AI practitioners (representing about 6% of total employees) and acquired training company Udemy to help build up the expertise of both its own and client employees. These efforts increase the likelihood of successful implementations and the ability of clients to operate its implemented solutions.

(2) Continued weak client spending

Accenture and its competitors have attributed slower growth to cautious client spending in this uncertain economic climate. However, this trend is likely to be short-lived. Data-driven IT solutions remain a critical differentiator for businesses, and the pressure to leverage them to gain advantages over competitors will only intensify.

In conclusion

Given the disappointing revenue growth reported in the last quarter, the drop in Accenture’s stock price is justified. However, the pullback may be overdone, as the weaker than expected growth is in part due to clients shifting their budgets from shorter-term discretionary spend into longer-term transformational projects that will take longer to translate into revenues.

At a valuation yield of 4.6%, it is trading at a decent price but not at a deep discount considering that risk-free ten-year US Treasuries yield approximately 4.5%. However, given the company’s industry-leading position and longer-term growth potential as clients step up their IT and AI spending to stay competitive, I believe Accenture may deliver attractive returns for patient, long term investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ACN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.