Adobe: Hold On Or Cash Out Your Profit

Summary:

- Adobe’s stock is up +12.37% since my September 25 buy thesis.

- I’m a profit-centric quantitative analyst. A 10% or higher gain in a month’s time is a take-profit incentive.

- Seeking Alpha Quant has a Hold rating for ADBE. You can wait for the stock to do more gains.

- The new AI features on Creative Cloud applications are ethical. The Adobe Sensei cloud AI platform is awesome.

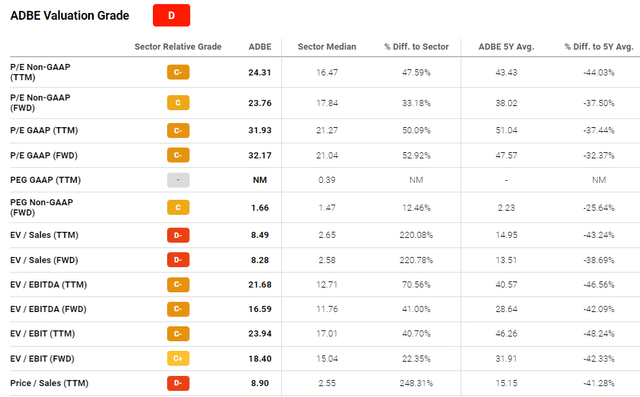

- The -43.21% YTD performance has not erased the fact that ADBE is still relatively overvalued.

Adobe Is A Leader In AI Software putilich/iStock via Getty Images

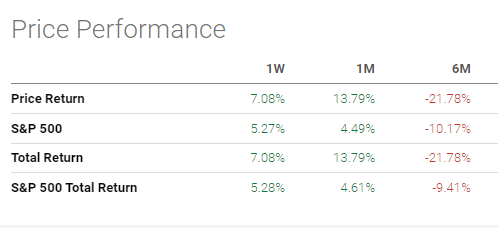

You have my blessings if you want to take profit on Adobe Inc. (NASDAQ:ADBE). This company’s stock is already +12.37% since my September 25 buy thesis. A 10% gain or higher is already a cash-out-paper-gains signal in my book. Seeking Alpha Quant still has a Hold rating for ADBE. It is hinting that traders/investor should be patient and aim for more ADBE gains. The -1.02% closing of ADBE on October 27 means some people took profits.

I agree with the Hold recommendation of Seeking Alpha Quant. Be patient; larger gains are feasible. The rally this month has not dispelled the reality that ADBE’s YTD performance is still -43.21%. There’s decent mathematical probability that Adobe loyalists will push the stock higher before 2022 ends. Let others boost ADBE’s rebound story. Once your paper gains hit your ideal take-profit price range, dump ADBE and buy me a beer.

The rebound narrative is emerging for ADBE. Please appreciate that green number under the 1 month heading. The momentum has changed since my September 25 buy recommendation. I am a customer of Adobe since 1996. I am a well-trained graphic artist/UI designer. My perspective of Adobe is different because I can make money from its products, and not from trading ADBE.

Seeking Alpha Premium

I trust the new AI-related projects of Adobe. Adobe is at the forefront of Artificial Intelligence. ADBE’s wagon is hitched to the fast-growing AI software industry. You should not worry too much about that declining revenue CAGR of Adobe. Get a beer and evaluate Adobe as among the leaders of the $53.54 billion AI software industry. The 41.30% CAGR of AI software is enough reason to ignore Adobe’s very depressing quantitative profitability grade of D+.

Keep The Faith, New AI Features Are Useful

Hold on to ADBE. Management is deftly exploiting the Adobe Sensei cloud AI platform. This is to keep its 26 million Creative Cloud customers happy and very loyal. The machine learning and Artificial Intelligence platform of Adobe Sensei covers Experience Cloud and Document Cloud. I will only discuss how Sensei is helping creative professionals and content creators complete their projects faster.

Keep the faith on Adobe because of its AI-powered Project Clever Composites. Letting AI do automatic image compositing, and then getting paid $30 to $80 to make graphic designs and web/mobile game assets/UIs, is pure genius.

Project All of Me is another game-changer AI feature for Photoshop-heavy users. Sensei AI will add cropped legs and other image parts to make a complete scene. Project All of Me will also remove unwanted accessories to make a portrait more appealing. All of me, Motek Moyen, is already in love with this AI generative feature.

The most important upcoming Sensei feature for Photoshop is generative art. Photoshop’s original code was to edit photos, make composites, and digital painting. It is now becoming an ethical generative art software that will let customers earn money faster.

Going forward, Photoshop will allow lazy designers like me to input text description of a visual object and Adobe Photoshop will create it automatically. The current generative feature version only generates new objects that could be added to an existing image.

Ethical AI Policy Is A Long-Term Winner

My fearless assessment is that Adobe Sensei can already do what DALL-E can do. Adobe is only afraid of the copyright minefield inherent in full AI-generated images created by DALL-E, Stable Diffusion, and Midjourney. Getty Images has already banned AI-generated images due to copyright issues. Adobe’s AI ethics are very clear that it will be responsible.

The problem with DALL-E and others like it is that the neural algorithm was they trained on billions of graphic contents without the explicit permission and knowledge of rightful owners.

Adobe is a founding member of the Content Authenticity Initiative or CAI. One of the objectives of CAI is to ensure that AI generated content does not distort information regarding AI-related content. It subtly means CAI does not want AI-generated content infringing the copyright of others.

The copyright issue based on artistic style is greatly illustrated by Ed Sheeran’s copyright legal problem in the United States. Sheeran’s Thinking Out Loud song is being sued for $100 million in damages. The complainants alleged that song has a style/feel based on Marvin Gaye’s Let’s Get It On.

Fantasy illustrator/digital artist Greg Rutkowski is very unhappy that other people are using his name as text input for Stable Diffusion to generate artworks based on his body of work/personal style. I will be very angry if some AI platform will train its generative financial writing bot on my Seeking Alpha/I Know First/TipRanks articles. They need to pay me first before they start training their AI on my work/style. I will demand a royalty for every investing idea that is AI-generated based on my body of work.

You should be impressed by Project Blink. It is a new AI technology that will let editors use a word processing-like interface to accelerate their video editing chores. The AI of Project Blink will help editors make money faster.

Adobe Express (Adobe’s platform against rival Canva) is getting AI-powered templates recommendations, quick background removal, trimming/merging videos, videos to GIF, and advanced search/recommendation. Adobe Express is important to Adobe’s future because of its template-centric approach.

Like Canva, Adobe Express allows untrained people to make impressive print/web/video content easily. Adobe Express is for budget-constrained customers who cannot afford to hire a professional graphic artist or video editor.

Downside Risk

Adobe’s growing AI efforts for Creative Cloud software might offset its relative overvaluation. ADBE’s YTD performance is -43.21%. The AI of Seeking Alpha Quant still says ADBE has notably higher valuation ratios than its sector peers. There’s no AI algorithm that can refute the valuation stats below.

The forward GAAP P/E of Adobe is 32.17x. This is 52% higher than the information technology’s sector average of 21.04x. This relative overvaluation is risky because Adobe has declining revenue CAGR. A CAGR of 14.87% is lower than Adobe’s 5-year average revenue growth rate of 21.18%.

The $20 billion purchase of Figma means Adobe is not going to pay dividends anytime soon. Adobe will shell out $10 billion in cash and $10 billion in ADBE shares for Figma. Adobe will increase its debt load because its cash is less than $6 billion.

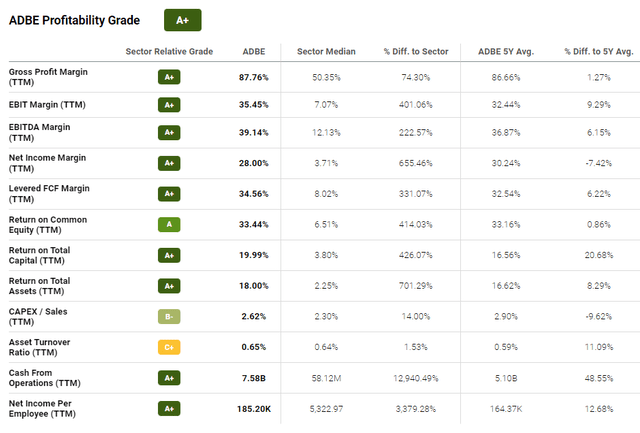

The high profitability of ADBE might be the reason why it still is relatively overvalued. There are many alternatives to Creative Cloud software products. Adobe still touts 87.66% gross margin. Its 28% net income margin is 655% higher than the sector average of 3.71%.

Conclusion

Adobe has an ethical approach to AI software. This is why you should hold on to your ADBE shares. This company is doing AI right by making sure it doesn’t violate the copyright of others. The high profitability of Adobe is the more important metric, not its relative overvaluation.

The high 41.3% CAGR of the $53.54 billion AI software industry is a strong tailwind for Adobe Creative Cloud.

The Sensei AI platform should focus on enabling more AI features for Creative Cloud software products. Creative Cloud subscription fees still account for $9.55 billion of Digital Segment’s annual revenue of $11.52 billion.

Based on the chart below, Creative Cloud remains the biggest growth driver of Adobe. Judge ADBE based on how management is taking care of the 26 million Creative Cloud paying customers. Letting customers use more Sensei AI so that they can make money faster is highly commendable.

Adobe’s stock has a Piotroski F-score of 6. It is efficient. ADBE’s Altman Z-score is 14.26. This AI software leader is a safe investment you can hold on to forever.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.