Summary:

- Texas Instruments reported solid Q3 earnings, beating the estimates, but issued a weak Q4 guidance.

- The automotive market continues to be strong, but macro is weighing on the rest of the markets.

- Profitability was the highlight, with Texas Instruments demonstrating it can have substantial operating leverage when demand is high.

- The CHIPS Act is expected to benefit the company materially.

- We discuss why short-term trouble should not be worrying for long-term shareholders.

Ismed Syahrul

Introduction

Texas Instruments (NASDAQ:TXN) reported very solid Q3 earnings but was cautious in its guidance for Q4, which made the market react badly sending the stock down about 5% initially.

None of this should be a big surprise, though. When it comes to the soft Q4 guidance, it should have been expected sooner or later. Texas Instruments is a semiconductor company with a significant portion of its revenue coming from industrials, a cyclical segment. When it comes to the market reaction… well, we already know that the market doesn’t look further than the next quarter, and algos move the stock price right now.

However, the lower-than-expected Q4 guidance doesn’t change our long-term thesis at all. In fact, a decreasing stock price due to short-term troubles is the best that can happen to long-term Texas Instruments’ stockholders right now. Not only will they be able to add at lower prices, but the company has authorized more than $20 billion for repurchases, and management has shown it knows how to use that money right.

Let’s get on with the numbers.

The numbers

The headline results

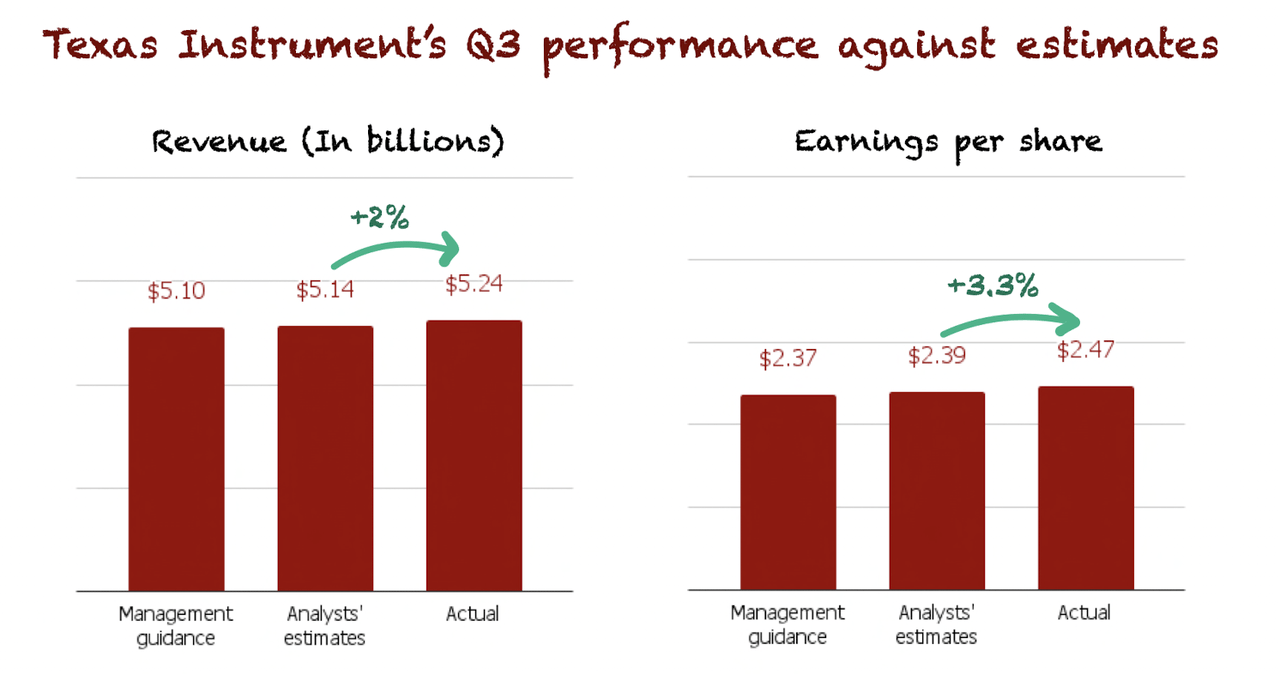

Texas Instruments beats analysts’ top and bottom line estimates. However, the beat was more significant in the bottom line due to strong operating leverage coupled with increased repurchases, which reduced the shares outstanding:

Made by Best Anchor Stocks

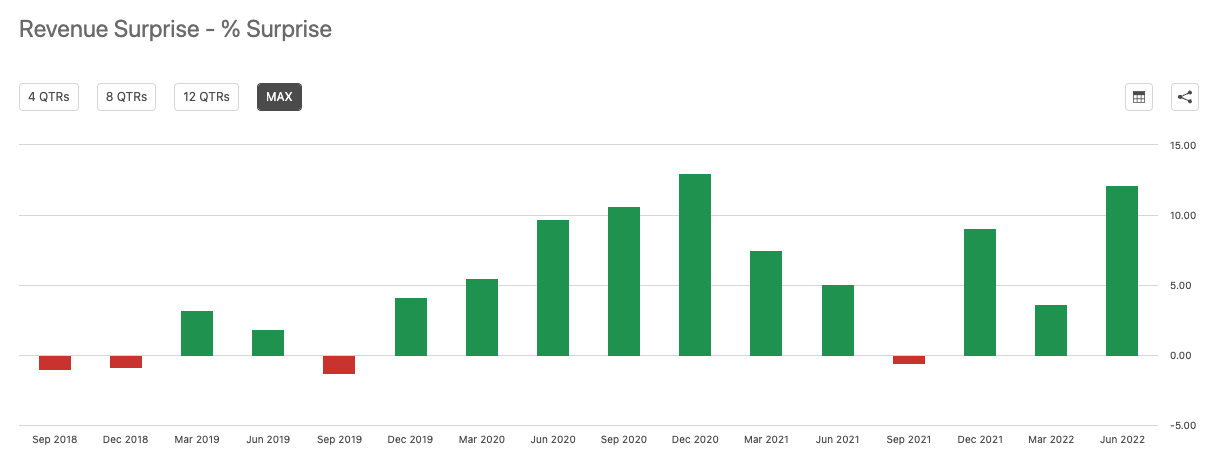

Texas Instruments beating analyst estimates shouldn’t take us by surprise. In the 16 quarters before Q3 2022, the company has a great score in beating revenue estimates as it has managed to beat them 75% of the time. The score is not perfect, we know, but just look at the size of the beats and compare them with the size of the misses:

Seeking Alpha

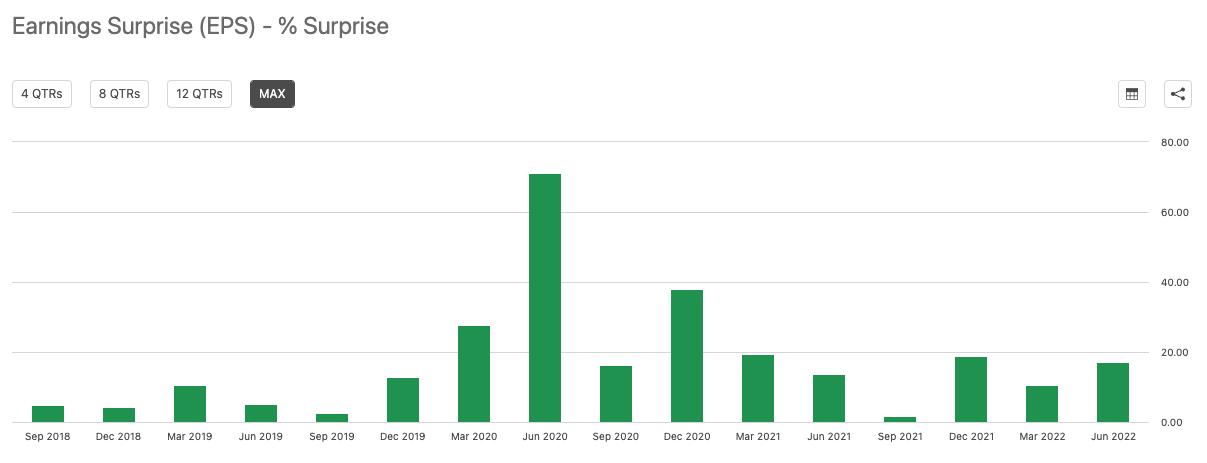

Regarding the bottom line, the company has a perfect score as it has beaten analyst estimates 100% of the time in the last 16 (now 17) quarters. This bottom line outperformance underscores that Texas Instruments is in almost total control of its bottom line, thanks to its operating leverage and its focus on vertical integration:

Seeking Alpha

All in all, another day in business for Texas Instruments: a beat-beat quarter. We always say this, but we’ll repeat it: the underlying company must outperform consistently over long periods for a stock to outperform.

Breaking down sales across segments

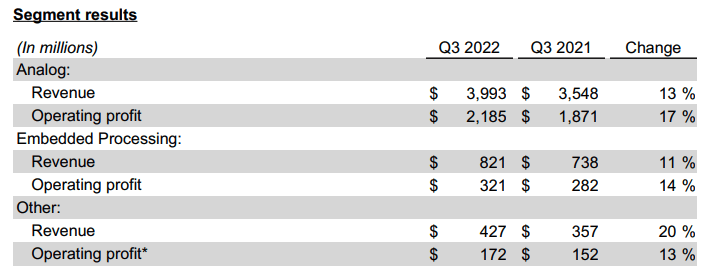

If we dive into the different segments, we can see what has been the trend for the last quarters. Analog continues to perform strongly, while embedded still lags despite its smaller size. The positive side comes from a profitability standpoint, as both managed to expand operating margins:

Texas Instruments’ press release

The company keeps skewing more and more towards analog, its bread and butter. Regarding Embedded’s “muted” performance, management said not long ago they still believe in its potential, or else they would’ve abandoned it long ago in the same way they did with other 6 business lines this century:

Yes. It’s really simple. If I didn’t think it has the ability to add value over the next 10 years, we’d be gone. So you take a look at that business, you look at the potential, and there were things that we didn’t execute well, okay?

And we’ve got changes in place. And I think that team is starting to show the right leading indicators. But we’re pretty simple. We don’t come out on earnings calls talking about leading indicators. Let’s get real results and real growth.

Source: Rich Templeton (Texas Instruments’ CEO) during Citi’s Global Technology Conference

Regarding the different markets Texas Instruments caters to, results were generally positive, but industrial was weaker than expected. These are the quarter-over-quarter growth rates:

-

Personal electronics: mid-teens decline

-

Industrial: flat

-

Automotive: around 10% increase

-

Communications equipment: high single digits increase

-

Enterprise systems: mid-single digits increase

Automotive is the second most important market for Texas Instruments, only after industrial. During the call, management said weakness started to broaden here, which most likely weighed on guidance. The weakness in Personal Electronics was expected after seeing what other semiconductor companies had reported this quarter. Again the highlight was automotive, which remains very strong and will probably be one of Texas Instruments’ most important segment going forward.

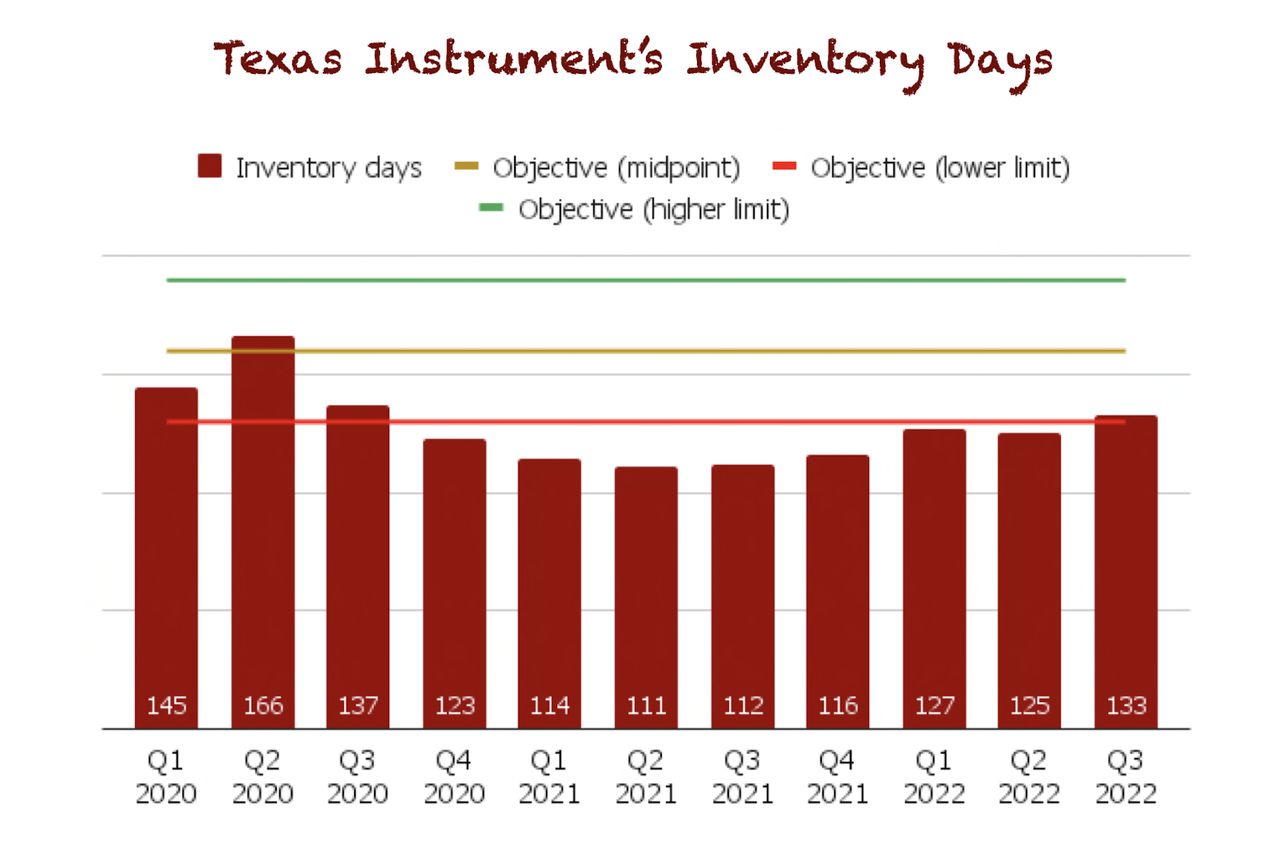

Inventories are finally at the lower limit

Last quarter, we expected an increase in inventory as we thought cyclicality would start to weigh in. Unfortunately, we got the timing utterly wrong, as inventories slightly decreased sequentially in Q2.

However, in Q3, we started to see expectations play out. Days of inventory increased 8 days sequentially, from 125 to 133. This surge, however, makes inventory days just meet management’s lower limit when it comes to inventory:

Made by Best Anchor Stocks

Management even argued there is still a long runway to go when it comes to building inventory:

So I would not be uncomfortable, as I said before, adding another $1 billion, $1.5 billion of inventory over the next several quarters to get us well positioned for the next upturn that invariably comes at some point.

Source: Rafael Lizardi (Texas Instruments CFO) during Q3 2022 earnings call

This shows that Texas Instruments’ management is not afraid to build inventory during downturns. Many investors see inventory build-ups as bad because they typically entail higher costs and an elevated risk of inventory write-downs going forward. The latter, however, doesn’t apply to Texas Instruments as there’s minimal risk of obsolescence in the inventory, with most products having a shelf life of more than 10 years.

This “protection” is excellent because it allows management to build inventory to prepare for the next upcycle (which always comes) without bearing a high risk of write-downs.

Other companies typically take a different approach and try to match the demand outlook with their inventories. So, if demand is weakening, they’ll slow down production. Conversely, when demand strengthens, then they increase production.

Although this strategy might play out well over the short term, it’s not the best if one can think beyond the down cycle. This is because these players are eventually caught with no inventory to sell once the upcycle begins. For example, if you look at the graph above, during COVID, in Q2 2020, Texas Instruments built significant inventory because the company didn’t stop production even as the economy closed. This allowed the company to take market share from competitors who reduced output due to the uncertain economic environment.

I think that Rafael Lizardi, the company’s CFO, put it quite nicely during the earnings call:

So the risk of selection for the inventory is very, very low. The potential upside of having that inventory ready is very high. So that’s why we prefer to have more than less inventory.

The risk-return relationship of holding more inventory is clearly skewed in the company’s favor. It wouldn’t be possible without the low risk of obsolescence.

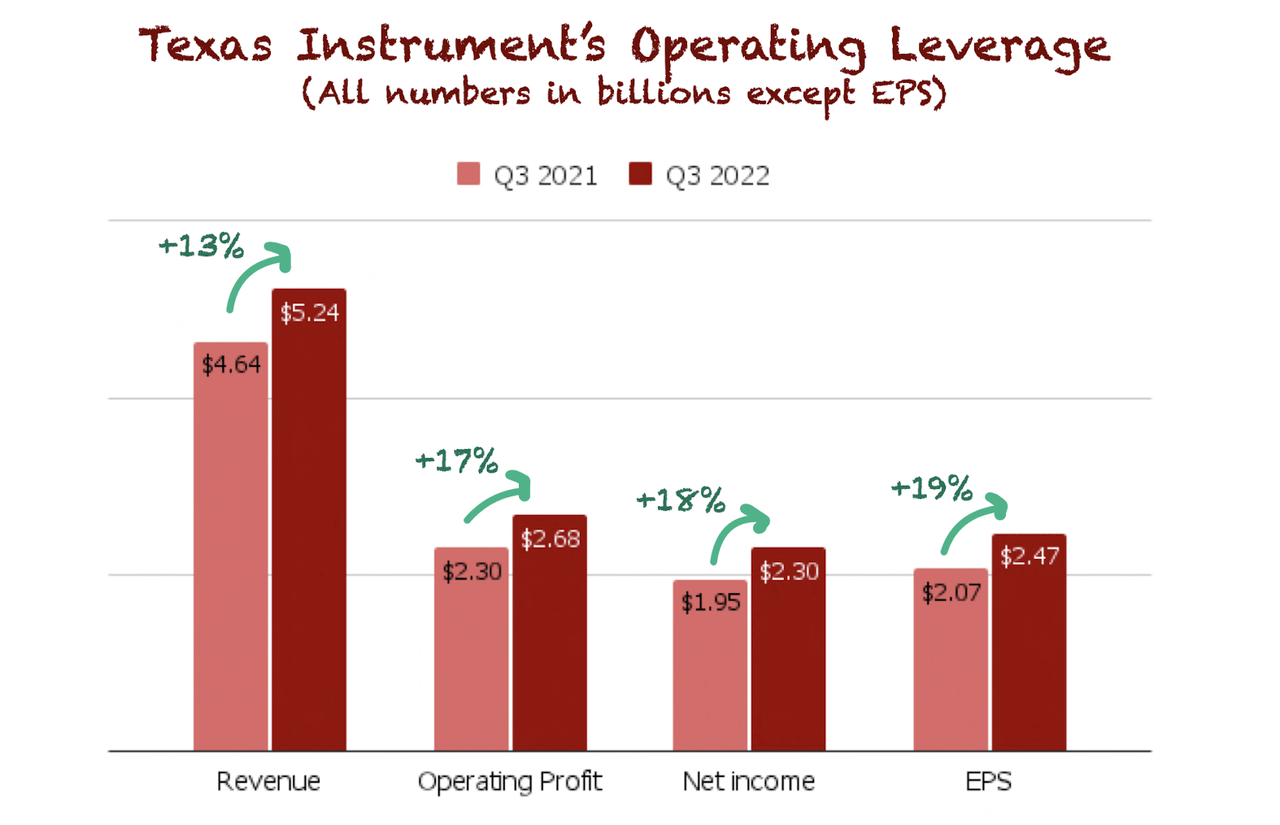

Breaking down profitability – Showing strong operating leverage

Profitability was a highlight for Texas Instruments in Q3. With revenue growing 13% year-over-year, the company grew operating profit, net income, and EPS at a faster clip:

Made by Best Anchor Stocks

Regarding operating profit and net income, the faster growth came from a reduced increase in Research and Development expenses but especially in SG&A, which “only” grew 4.6% year-over-year. EPS saw the additional benefit of a reduced share count.

If we look at margins sequentially, we can see that margins decreased slightly but were very in line with Q2.

The “beauty” of Texas Instruments is that it’s a business that you don’t expect to have margins as high as it has. For context, the net income margin for the quarter was 43%, and I believe there’s still quite a bit of margin upside looking ahead.

Operating leverage is only possible because Texas Instruments owns most of its manufacturing. This means that when production is running high, fixed costs are distributed across a large revenue base, thus increasing margins.

The opposite happens during a downturn, though. While capital-light players in the industry might have more flexibility to adjust to falling demand, Texas Instruments’ costs will be fixed, and margins will decrease if revenue declines. This margin volatility might not look great, but as long-term investors, we prefer the company to control its destiny rather than enjoy stable and somewhat capped margins.

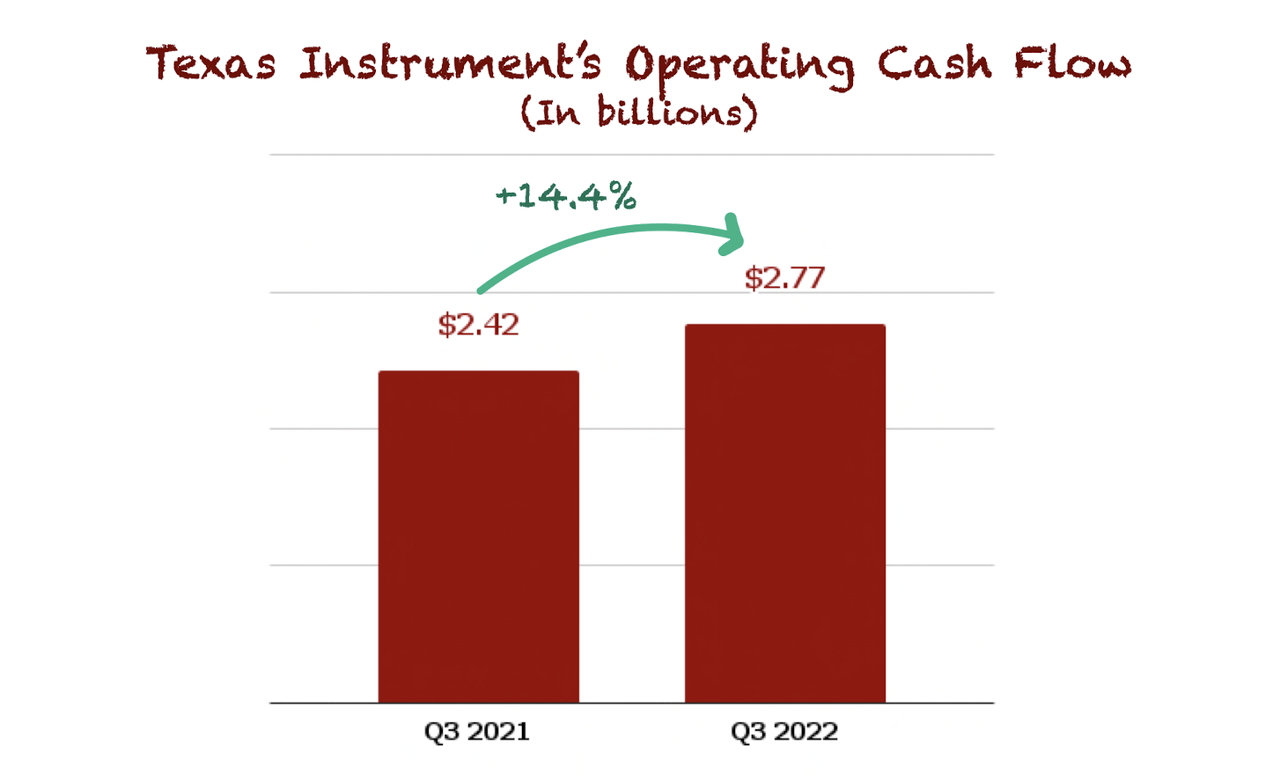

Cash Flows: Strong Free Cash Flow despite surging Capex

Recall that, last quarter, operating cash flow was impacted by a surge in receivables caused by a large portion of the sales coming in at quarter-end. However, this quarter, the situation normalized, and operating cash flow returned to its growth path:

Made by Best Anchor Stocks

We expected a more significant surge in Operating Cash Flow from the receivables of Q2, but a portion of the receivables for Q3 was also pushed out to further quarters.

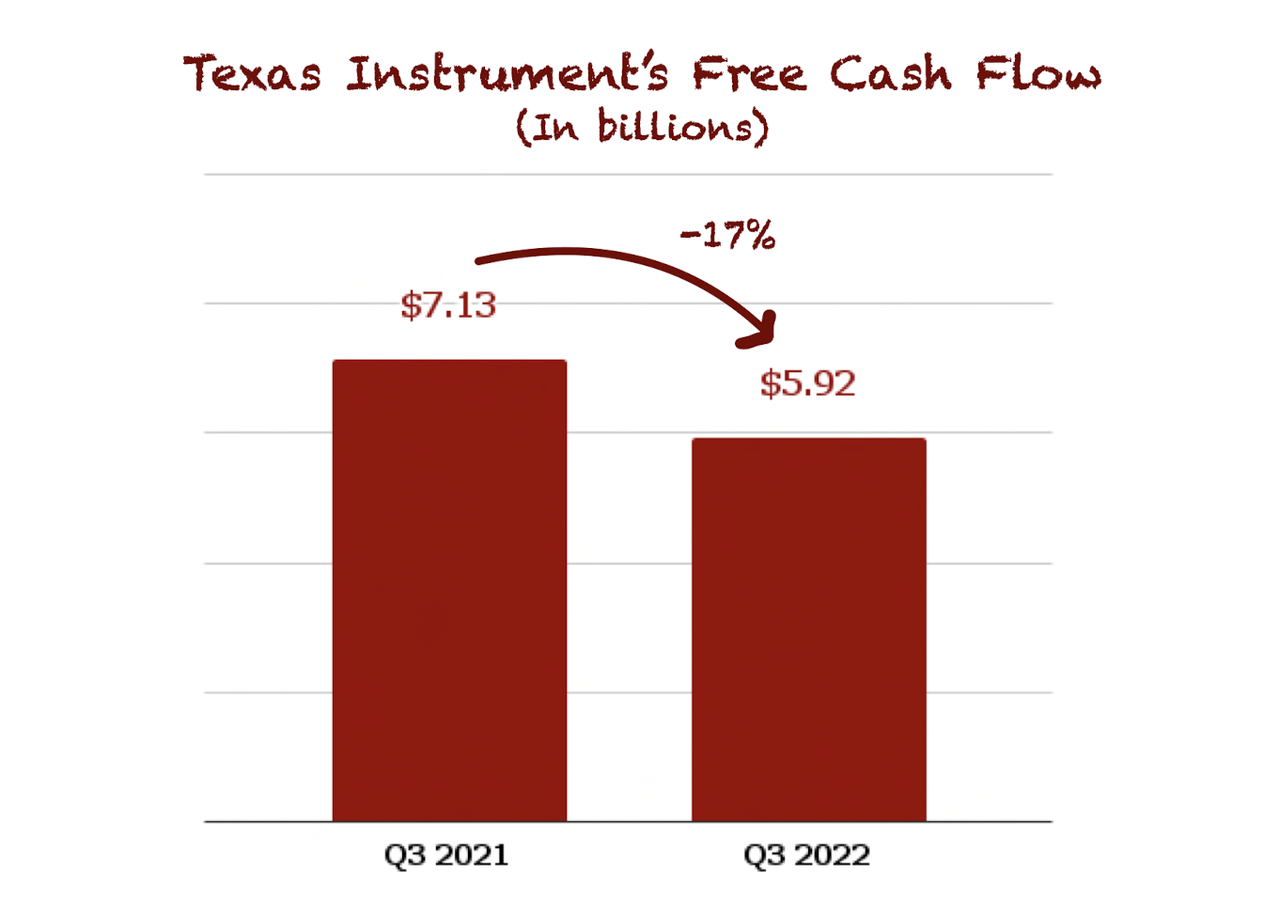

When it comes to Free Cash Flow, the picture is quite different. The company is undergoing an aggressive capacity expansion plan, which has created a surge in Capex, thereby decreasing FCF:

Made by Best Anchor Stocks

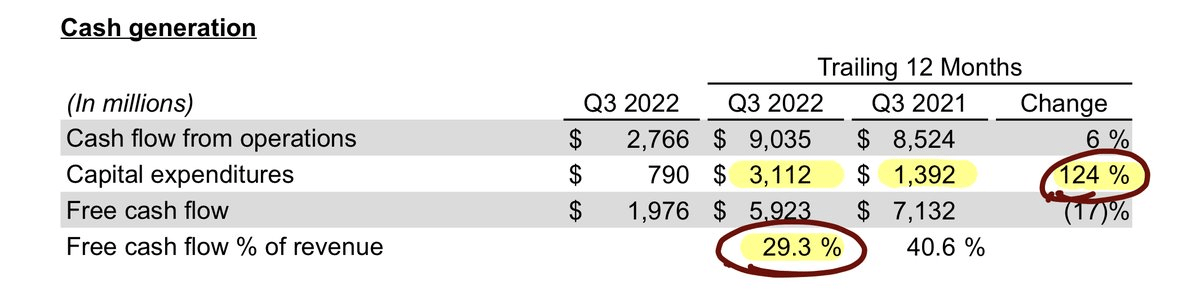

What’s impressive is that, despite a 124% surge in Capex, Texas Instruments still enjoys a 29% free cash flow margin:

Texas Instruments press release

The company is so cash-generative that it can aggressively expand production while at the same time having cash to spare to give back to shareholders. Only a few companies out there can say they are undergoing aggressive Capex plans while enjoying close to 30% cash flow margins.

A solid financial position for whatever comes

The strong cash generation capabilities of the company obviously benefit its financial position. Texas Instruments ended the quarter with a $9.1 billion cash + short-term investments position and debt of $7.9 billion. This results in a net cash position of $1.2 billion:

Made by Best Anchor Stocks

Probably the best thing about this is that this debt carries an average coupon rate of just 2.8%, which is great considering the interest rates we can see today in the market.

This fortress balance sheet protects the company against any potential downturn and reduces the probability that it will have to refinance its debt at higher interest rates. It’s also great for buybacks, as we’ll see later on.

The qualitative highlights

The numbers are always important, but we should focus on the story as long-term investors. This is especially true when looking at cyclical companies. What matters is not the growth during the cycle but the growth through the cycle. Only one word changes in that sentence, but it meaningfully changes our interpretation of the numbers.

The benefits of the CHIPS Act

Management discussed the benefits Texas Instruments will see as part of the recently-passed CHIPS Act. In the current quarter, the company accrued $50 million in the balance sheet to account for the 25% tax credit they are eligible for due to their investments in fabs in the US. This benefit will flow in the coming quarters as less depreciation in the income statement and will be a future cash benefit in the form of lower taxes.

There’s a grant that the company is also eligible for, but the application process opens in February, so management has yet to estimate the potential benefit that it will bring.

We don’t know if the CHIPS Act will achieve its goal of making the US less dependent on external manufacturing of semiconductors. Still, we do know it will bring benefits to several semiconductor companies regardless of its success. Texas Instruments already had significant manufacturing capacity in the US before the CHIPS Act, so not much changes here.

The capacity expansion plan timeline and the Capex plans

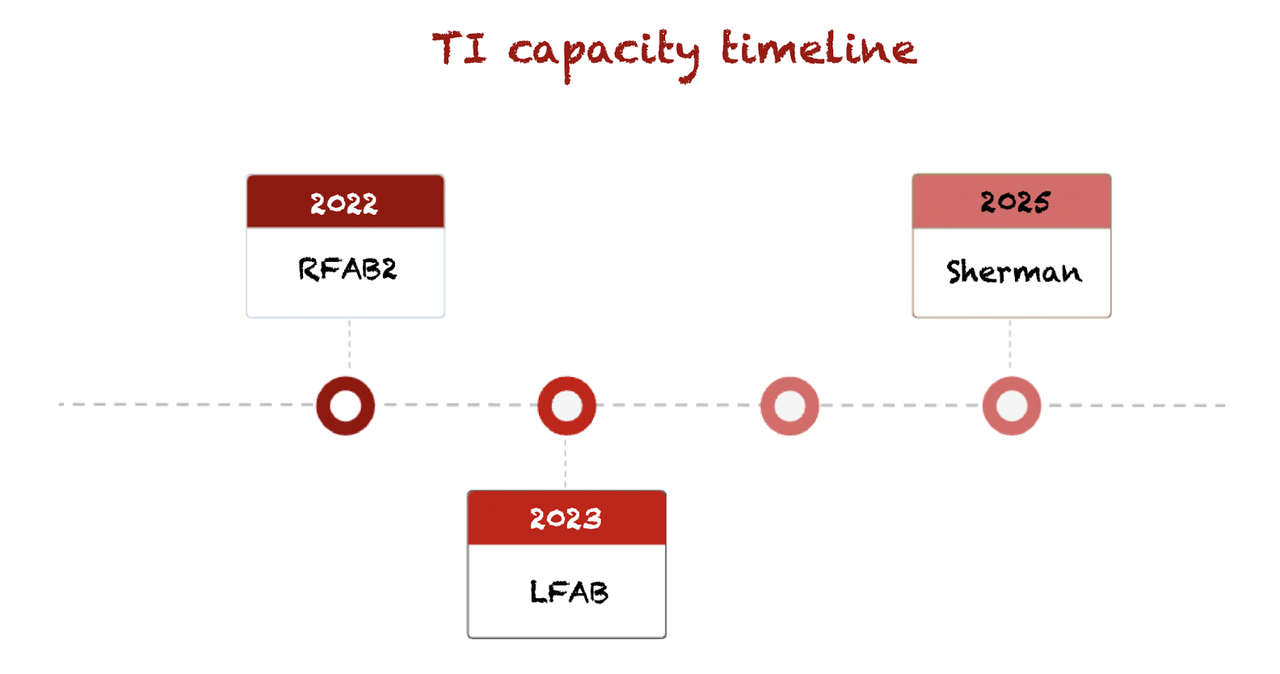

Last quarter we shared the following timeline for the company’s capacity expansion plans:

Made by Best Anchor Stocks

It seems it’s going better than planned, as management announced that RFAB2 is already in production, and it expects LFAB production later this year (before anticipated).

Of course, seeing demand weakening, many analysts asked management if they plan to pursue the same capacity expansion previously planned. Management replied with a resounding yes. While analysts think about the short term, management is building capacity for the long term.

We found it interesting that management might be more optimistic now about the long-term secular tailwinds than they were during last year’s capital management update. An analyst asked management if they planned to spend the same in monetary terms on Capex despite seeing clear benefits from the CHIPS Act, to which Rafael Lizardi replied the following:

Bigger picture, as I said earlier, the CHIPS Act, great legislation. We’re very excited about that. That is going to decrease on a net basis our investment because we’re going to get a 25% reduction from the investments that qualified as manufacturing investments in the United States.

But on the other hand, as I alluded to earlier, our confidence around our long-term growth prospects have only grown over the last 6 to 12 months based on the secular trends based on input from our customers. So we feel really excited about that. The net effect of those two and whatever that does to our CapEx plans, we will tell you about that in February.

Source: Rafael Lizardi (Texas Instruments’ CFO) during Q3 2022 earnings call

Simply put, with the CHIPS Act, the company could pursue the same capacity expansion plan but save 25% due to the tax credits. Therefore, it’s logical to think that Capex will be lower after enacting the legislation. However, management feels so optimistic about the long-term trend that they might end up spending the same dollar amount in Capex, thereby expanding capacity 25% more than previously anticipated. We’ll have to wait until the Capital Management Update to see their decision.

No significant China ban impact – as expected

Another recurrent theme during the call was China. As expected, management confirmed that the recent export bans don’t impact the company significantly due to the nature of the business:

99% of our parts fall on the very lowest category of restrictions, just given the nature of the types of parts that we sell. So we don’t have restrictions on those.

Of course, there are restrictions specific to entities. There is the entity lease that you hear about, the FDP, that’s another list. And we, of course, follow all the regulations when it comes to that. So when an entity goes listed in there, we take that into account and restrict shipments as according to the law.

But given how that works, we don’t expect any meaningful or significant impact to our revenue with those export loss.

Source: Rafael Lizardi (Texas Instruments’ CFO) during Q3 2022 earnings call

This was expected, but there’s a side effect of the export ban. China will ramp up its investments in the semiconductor industry to incentivize domestic manufacturing, which could bring increased competition for Texas Instruments in the future. However, management argued that their competitive advantages stand strong in the US as well as in China, and competition will probably take many years until they can catch up:

At the end of the day, it all comes down to our competitor advantages, right. And it starts with the broad portfolio that we have in the analog and embedded space, you need a huge portfolio to compete effectively, particularly in industrial and automotive. And we have 80,000 or so parts that we sell to 100,000 different customers. So, you need that type of diversity.

Then second is manufacturing and technology. These investments that are positioned 300-millimeter, first, but then all the investments that we are making are just building on that, right. So, we have RFAB2 coming, that just came online. Our new factory in Lehi and the mega site that we just broke ground in Sherman that’s going to have four factories, each one the size of RFAB2.

So, that really puts us in a very strong position to compete against anyone, whether it’s in the United States or in China, okay.

Source: Rafael Lizardi (Texas Instruments’ CFO) during Q3 2022 earnings call

Money is indeed a good means for competitors to catch up, but on many occasions, it takes much more than this.

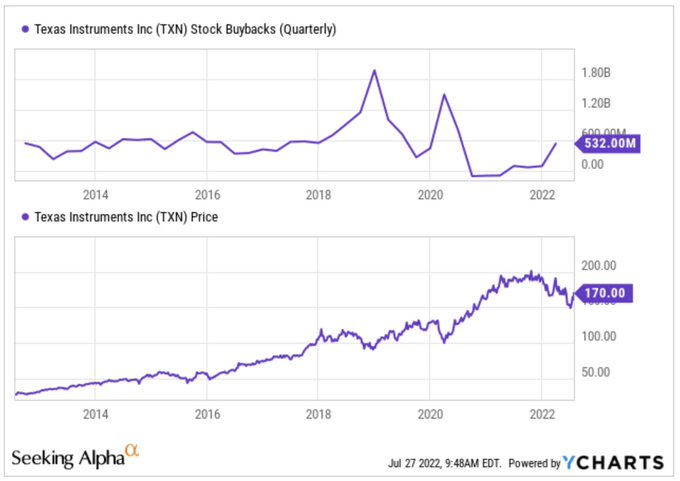

Share repurchases continue hot

Texas Instruments’ management has an excellent reputation for buybacks. Take a look at the company’s buyback history:

YCharts

Management only repurchases shares when they feel the stock is undervalued, and they have ramped up buybacks in the last couple of quarters.

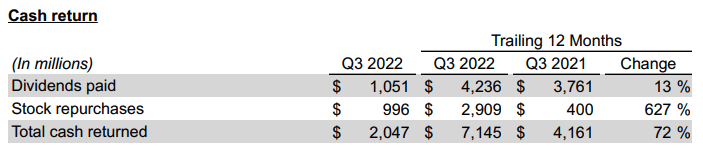

During Q3, the company spent $1 billion in buybacks, which brought the total in the last twelve months to almost $3 billion. This is a 627% increase when compared to the same period last year:

Texas Instruments press release

This is precisely why, as long-term investors, we shouldn’t be too worried about stock price decreases. We know that there’s a $20 billion authorized repurchase plan and that management knows how to time buybacks, so if the stock price crumbles, they will add for us.

The short term might look gloomy, but judging by management’s actions, the long term is as strong as ever.

Guidance: The lowlight but not as relevant for the long-term thesis

Guidance was the lowlight of the release and what spooked the market. Cyclicality is starting to show up, and there’s little we can do about this but hold through the cycle.

Q4 guidance

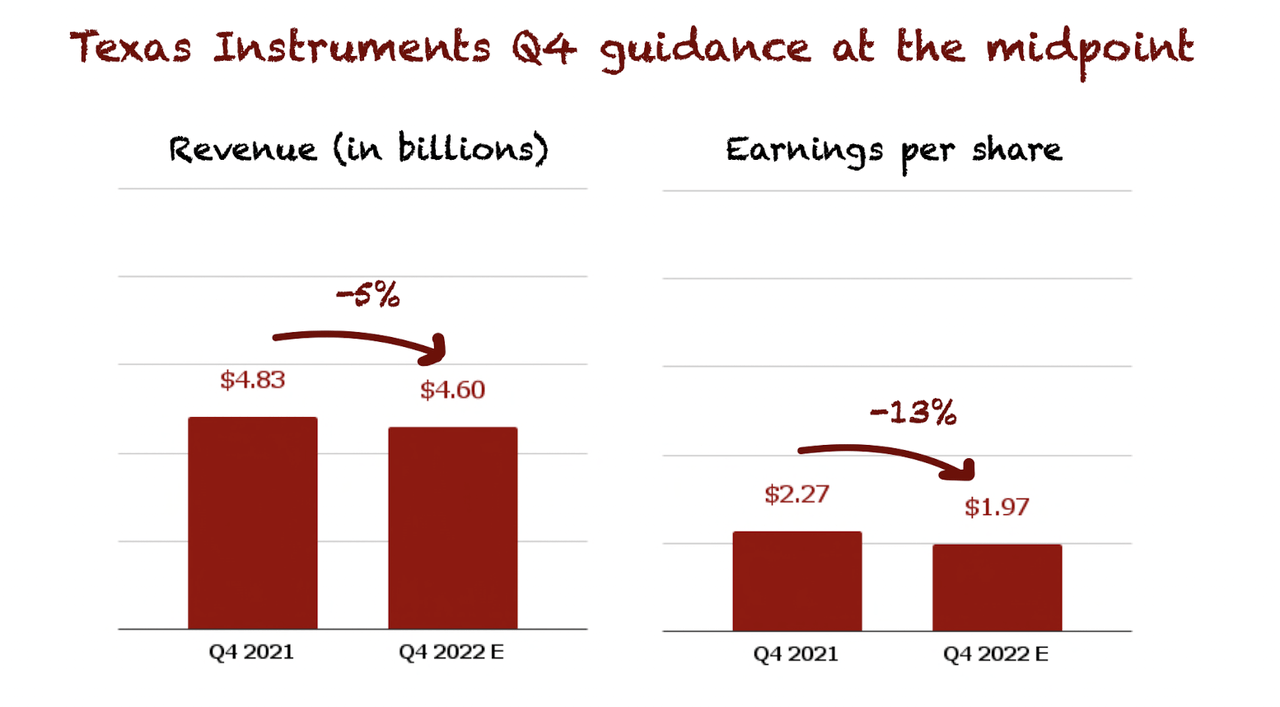

For Q4, management guided revenue between $4.4 billion and $4.8 billion and EPS between $1.83 and $2.11. At the midpoint, this is a sequential and yearly decrease both in EPS and revenue:

Made by Best Anchor Stocks

This guide shows how operating leverage works against the company when demand weakens.

Management expects that all markets will decline sequentially except automotive, which will remain strong:

We expect that most of our end markets will decline sequentially with the exception of the automotive market.

Source: Dave Pahl (Head of Investor Relations) during Q3 2022 earnings call

The moment of the weakening demand has come, and we shouldn’t be surprised. Texas Instruments is exposed to cycles, and investors should be well aware of this. However, as we don’t know when they will come, we prefer to hold through the cycle, systematically adding little by little.

The highlight was automotive, which continues to be strong. However, management expects it will also eventually fall, as it always does. The good thing is that cycles come and go, but the long-term trend remains:

I’d say first, I think when you look at the secular trends inside of automotive, I think all of us know that it will be a great grower for us and we are investing very broadly. So we are just thrilled with the position.

If you look at the second quarter of 2020, our growth there has, off the bottom, been very, very strong. Will that market eventually roll over? It will. I mean, that’s just what happens. And we are not trying to predict when that will happen, we will continue to ship product to customers as they request it.

And we are really focused on making sure we have got capacity in place for them over the long term. So we are not really trying to worry about when that will happen.

Source: Dave Pahl (Head of Investor Relations) during Q3 2022 earnings call

It’s very refreshing to see a management team so focused on the long term without giving too much importance to short-term cycles. Of course, this is only possible when two things happen.

First, the fact that management has a $20 billion outstanding repurchase program makes it easier for them to tell the truth about what’s coming in the short term. If the stock price drops, they’ll reduce the share count meaningfully, so there is no need to mislead the market. Secondly, the strong balance sheet. When you have a $1.2 billion net cash position and strong cash-generating capacity, ignoring cycles becomes a much simpler task.

The yearly guidance

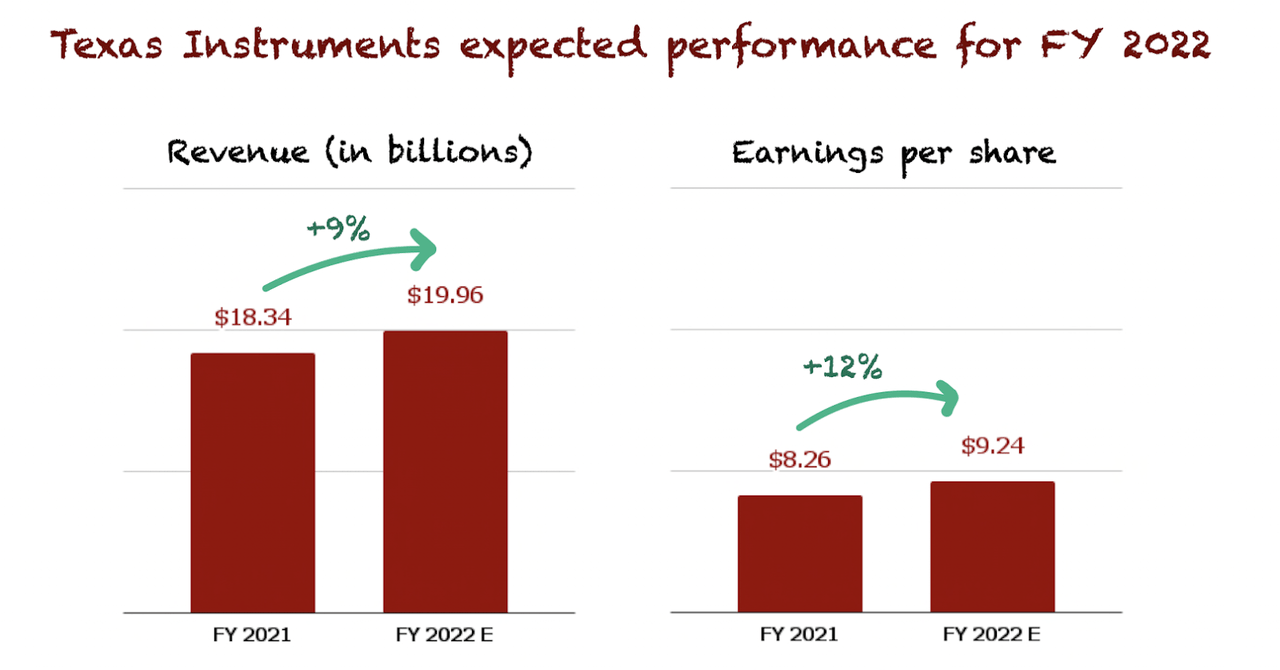

Texas Instruments doesn’t provide yearly guidance, but as they gave guidance for Q4, we can more or less calculate what we can expect for the full year. If the company achieves its midpoint of the Q4 guidance ($4.6 billion), it should end up with full-year 2022 revenue of $19.96 billion, a 9% year-over-year increase.

This doesn’t seem like very strong growth, but you have to consider that Texas Instruments has not been a strong grower and was coming against tough comps. In 2021, revenue grew a whopping 27% year-over-year.

If we do the same with EPS and assume management will be able to meet the Q4 midpoint ($1.97), the full-year EPS should come in at around $9.24, a 12% year-over-year increase.

Made by Best Anchor Stocks

The downcycle has started well into 2022, so it hasn’t impacted the full-year 2022 results that much. However, 2023 might be worse, and we must be prepared to hold through the cycle, knowing that management will “add” to our position on our behalf and that the long-term trend is still intact. And of course, we can add to our own positions. The lower the stock price goes, the bigger the upside potential when the cycle turns again.

I think it’s no coincidence that management has recently approved such a large buyback program. They know what’s coming, and they will do whatever it takes to protect shareholders. Buybacks seem to be a great starting point!

Conclusion

The results Texas Instruments reported were a bit of a mixed bag, but there were no elements that made us change our view about the long-term opportunity. The good thing about being a Texas Instruments shareholder is that we can trust management to reduce the outstanding shares if the market becomes too irrational or if the situation weakens further during Q1 and Q2.

In the meantime, keep growing!

Disclosure: I/we have a beneficial long position in the shares of TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Best Anchor Stocks helps you find the best growth stocks to outperform the market with the lowest volatility. They can anchor your portfolio on the stormy market sea, still allowing you to outperform.

Best Anchor Stocks have a long track record of revenue growth combined with below-average volatility. The first pick is up 16,000% from its IPO but has never been down 30%, not even during in 2008-2009.

Best Anchor Stocks can serve several purposes: stabilize your high-growth portfolio, or add low-volatility growth to your index, dividend or value investing.

There’s a 2-week free trial, so don’t hesitate to join Best Anchor Stocks now!