Summary:

- Recent “failure” of lead compound opens up new windows.

- Let’s talk about the pipeline; new methods of attack, first-in-class.

- Existing partnership could generate 10x current market cap in milestones and royalties, not to mention a portion of sales proceeds.

- Other comforting facts. (A dozen more reasons why I think now is the time to invest).

According to Aerpio Pharmaceuticals (ARPO) website, they are a bio pharmaceutical company focused on advancing first-in-class treatments for ocular diseases.

Personally, I think the description is far too narrow and base my opinion on both the company’s recent strong secondary readouts from a “failed” drug trial and its partnership with Gossamer Bio (GOSS).

While it was the initial one-day 71% haircut on March 18, 2019, that first put this company on my radar (ultimately bottoming out at $.88 on March 29), it was the value proposition the drop created that had me buying in.

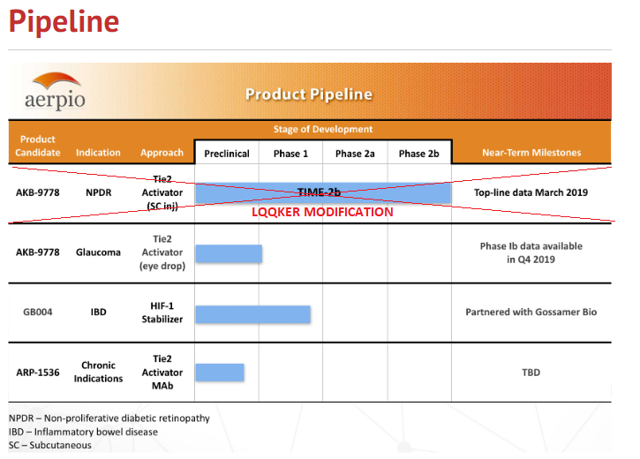

Here’s the company’s current pipeline:

Figure 1: Product Pipeline (Source: ARPO website) with annotations by author

Now, let’s talk about above pipeline.

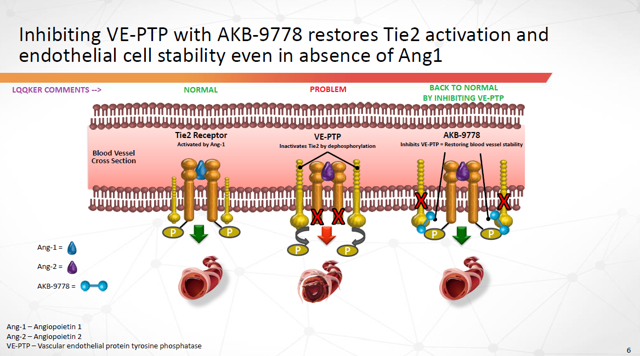

I. Drug: AKB-9778

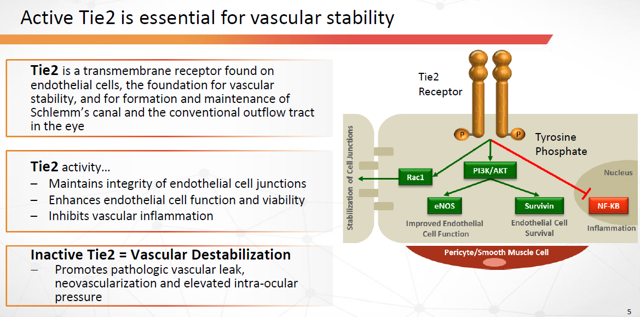

AKB-9778 is a small molecule inhibitor of VE-PTP, the most critical negative regulator of Tie2 in diseased blood vessels. AKB-9778 binds to and inhibits the intracellular catalytic domain of VE-PTP that inactivates Tie2. Inhibition of VE-PTP has shown the ability to activate the Tie2 receptor irrespective of extracellular levels of its binding ligands, angiopoietin-1 (agonist) or angiopoietin-2 (antagonist), and may represent the most efficient pharmacologic approach to restoring Tie2 activation.

The Tie2 pathway was discovered 20 years ago. Since that time, considerable scientific evidence has established active Tie2 as a key regulator of vascular stability.

Figure 2: Inhibiting VE-PTP with AKB-9778 restores Tie2 activation and endothelial cell stability even in absence of Ang1 (Source: ARPO Corporate Presentation dated April 10, 2019) with annotations by author

Figure 2: Inhibiting VE-PTP with AKB-9778 restores Tie2 activation and endothelial cell stability even in absence of Ang1 (Source: ARPO Corporate Presentation dated April 10, 2019) with annotations by author

When one window closes (“A”), others open (“B” and “C”)

A) AKB-9778 for Non-Proliferative Diabetic Retinopathy (“NPDR”) Status: CANCELLED

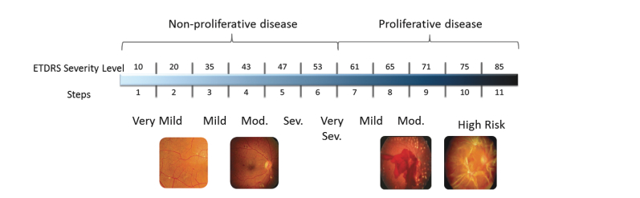

On March 18, 2019, the company revealed its TIME-2b trial for the treatment of NPDR had failed to meet its primary endpoint: To improve underlying Diabetic Retinopathy by 2 or more steps on the ETDRS Diabetic Retinopathy Severity Scale (or “DRSS”) in both eyes.

Figure 3: ETDRS Severity Scale (Source: ARPO Form 8-K dated January 8, 2018)

The resulting carnage:

ARPO received its aforementioned 71% haircut. Then, four days later, their Chief Medical Officer Stephen Pakola resigned [having now assumed the same position at REGENXBIO (RGNX)].

Regarding the failed trial, Aerpio would provide additional color on April 10 at the 18th Annual Needham Healthcare Conference (where the company released an updated corporate presentation). Then, even more color was provided on May 2nd at the 2019 Annual Meeting of The Association for Research in Vision and Ophthalmology (ARVO 2019).

Details from the “failure” of the AKB-9778 TIME-2b trial:

- Regarding the primary endpoint, the drug outperformed the placebo by a factor of 2.54 to 1 (9.61% successful 2-step response vs 3.77% placebo). But with a P-value of 0.27, this 167 patient trial did not meet statistical significance at the conclusion of its 48-week trial period.

However, it was not all bad news account…

B) AKB-9778 for Primary Open-Angle Glaucoma (“POAG”) Status: GO

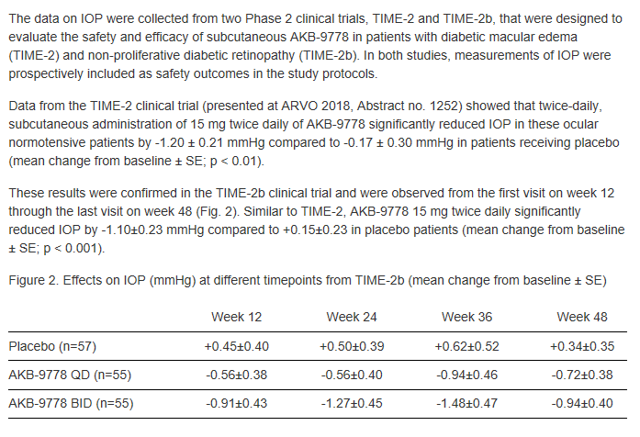

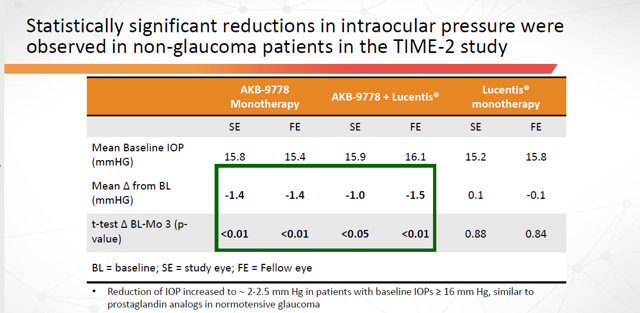

During the TIME-2b trial and the one that preceded it (TIME-2), measurements were also taken of participants Intraocular Pressure (“IOP”). In both cases, IOP was significantly reduced and statically significant:

- TIME-2 AKB-9778 Reduction in IOP: -1.20 mmHG vs -.17 placebo p-value < 0.01, statistically significant

- TIME-2b AKB-9778 Reduction in IOP: -1.10 mmHG vs .15 placebo p-value <.001, statistically significant

Figure 4: IOP Data from Time-2 and Time-2b trials (Source: ARPO Presentation at 2019 Annual Meeting of The Association for Research in Vision and Ophthalmology on May 2, 2019)

- QD = drug administered 1x daily at 15mg (15mg total)

- BID = drug administered 2x daily at 15mg (30mg total)

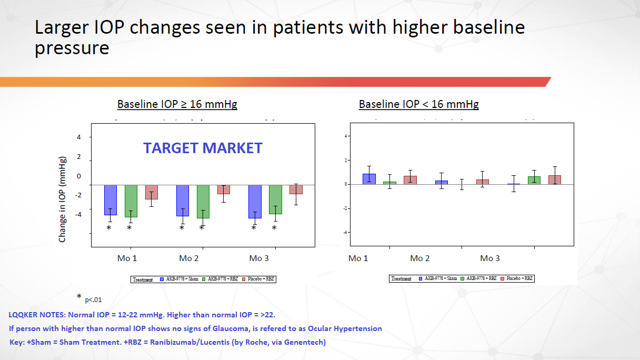

Additionally, the largest changes in IOP were seen in patients with the higher baseline pressure… which is exactly what you’d want to see since this represents the company’s target market.

Figure 5: Larger IOP Changes in Patients with Higher Baseline Pressure (Source: ARPO Corporate Presentation dated April 10, 2019) with annotations by author

Based on the above accumulated data, Aerpio has now submitted an Investigational New Drug Application with the FDA with hopes of initiating an ocular topical drop formulation of AKB-9778 during 2Q’19 for the treatment of open-angle glaucoma with results anticipated by year-end 2019.

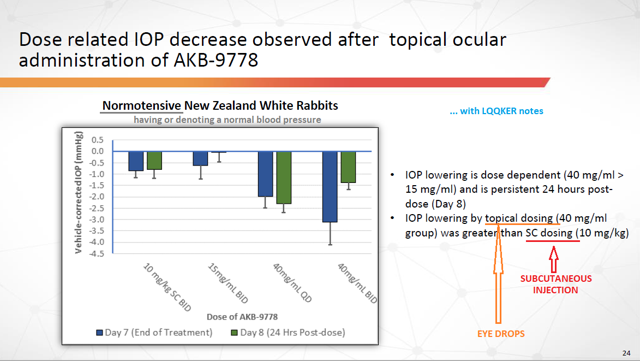

As a reminder (and to reemphasize), the IOP figures seen above resulted from trials (TIME-2 and TIME-2b) which were administered subcutaneously (via injection). Therefore, it would be prudent for a reasonable person to wonder if similar results might not carry over with a change in formulation and administration (via eye drops). Thus far, however, results seem encouraging.

Here’s a company slide showing the effect the drug had on the IOP of rabbits with normal blood pressure:

Figure 6: IOP Decreases after Topical Ocular Administration of AKB-9778 (Source: ARPO Corporate Presentation dated April 10, 2019) with annotations by author

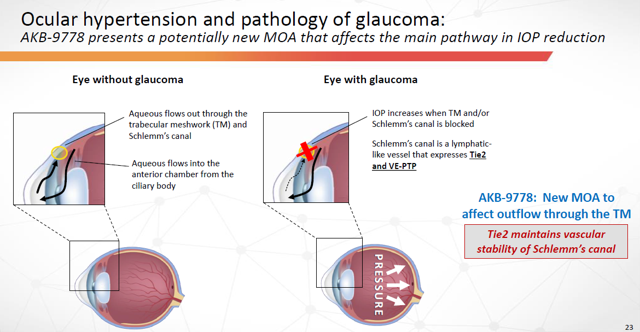

AKB-9778 would also represent a new method of attack against Glaucoma… by activating Tie2 to maintain vascular stability throughout the eyes trabecular meshwork and Schlemm’s canal.

Figure 7: AKB-9778 Presents potentially new Method-Of-Attack that affects the main pathway in IOP reduction (Source: ARPO Corporate Presentation dated April 10, 2019)

Figure 7: AKB-9778 Presents potentially new Method-Of-Attack that affects the main pathway in IOP reduction (Source: ARPO Corporate Presentation dated April 10, 2019)

Figure 8: Tie-2 is Essential for Vascular Stability (Source: ARPO Corporate Presentation dated April 10, 2019)

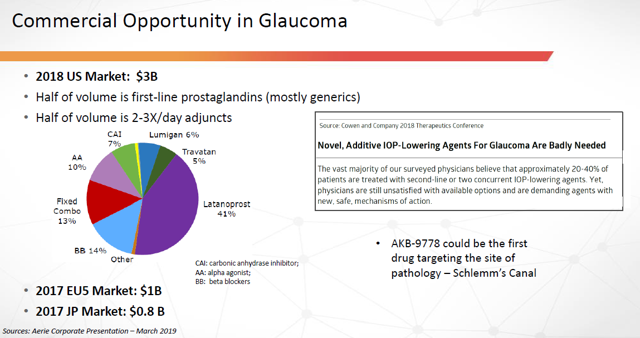

If all goes well, here’s an idea of the market size that awaits:

Figure 9: Commercial Opportunity in Glaucoma (Source: ARPO Corporate Presentation dated April 10, 2019)

As can be seen in the above chart, Latanoprost (Xalatan) is currently the most prescribed medication for this condition. It’s manufactured by Pfizer (PFE) and was the 92nd most prescribed medication in the US in 2018, with over 7.5 million prescriptions filled. As recently as 2016, it was the 79th most prescribed drug, with over 9 million prescriptions filled.

And, for an idea of how a successful new drug in this arena can improve the fortunes of a stock, look no further than Aerie Pharmaceuticals (AERI).

Figure 10: AERI stock price (Source: Finviz) with annotations by author

Aerie had its first-ever FDA approved drug Netarsudil (Rhopressa) approved on Dec. 18, 2017. It was approved for the reduction of elevated IOP in patients with open-angle glaucoma or ocular hypertension.

More recently, on March 12, 2019, AERI had a 2nd drug (Rocklatan) approved by the FDA. Rocklatan is simply a combination of Rhopressa + Xalatan. Aerie is glowing about Rocklatan’s prospects (read/listen to earnings transcript), but there is some concern regarding its side effects.

AERI expects 2019 revenue from sales of Rhopressa and Rocklatan to come in between $110 and $120 million. Meanwhile, the company has a current market cap of $2.0 billion!

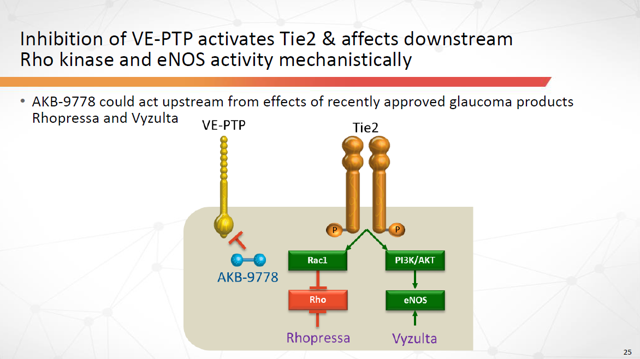

Interestingly, AKB-9778 could act upstream from the effects of some of the recently approved glaucoma products, including Rhopressa.

Figure 11: AKB-9778 Could act upstream from recently approved glaucoma drugs (Source: ARPO Corporate Presentation dated April 10, 2019)

For more information regarding the categories of eye drops designed to treat glaucoma, click here. Note: This info was published prior to AERI’s formulations, so you will not find a mention of their drugs here.

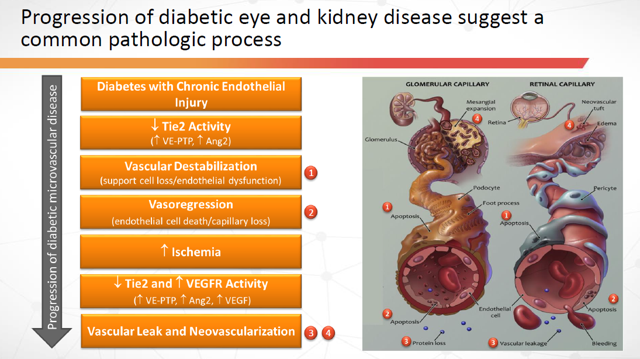

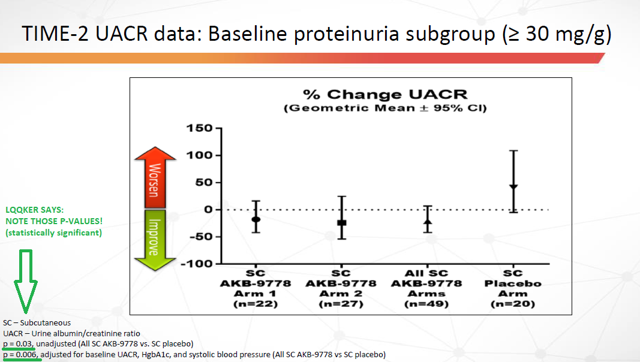

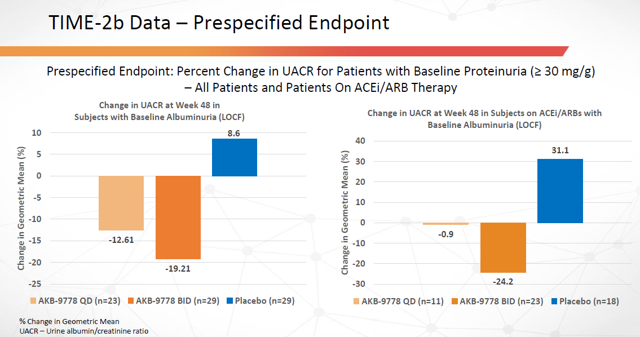

C) AKB-9778 for Diabetic Nephropathy (“DN”) Status: SEEKING PARTNER

So, was there any other beneficial data gleaned from the Time-2 and “failed” Time-2b trials? You bet there was! There was reproduced evidence of improved kidney function observed in the Urine Albumin-Creatinine Ratio (“UACR”) of patients. In current biology, two key markers used to identify chronic kidney disease are UACR and eGFR.

Additionally…

Figure 12: Progression of Diabetic Eye and Kidney Disease suggest a common pathologic process (Source: ARPO Corporate Presentation dated April 10, 2019)

From TIME-2:

Figure 13: Time-2 trial data: Percent Change in UACR (Source: ARPO Corporate Presentation dated April 10, 2019) with annotations by author

From TIME-2b:

Figure 14: Time-2b trial data: Percent Change in UACR (Source: ARPO Corporate Presentation dated April 10, 2019)

Armed with the above positive data, along with a desire to be prudent with their financial resources, ARPO has elected to seek a pharma partner before proceeding further with subcutaneous AKB-9778 as an indication to slow diabetic nephropathy.

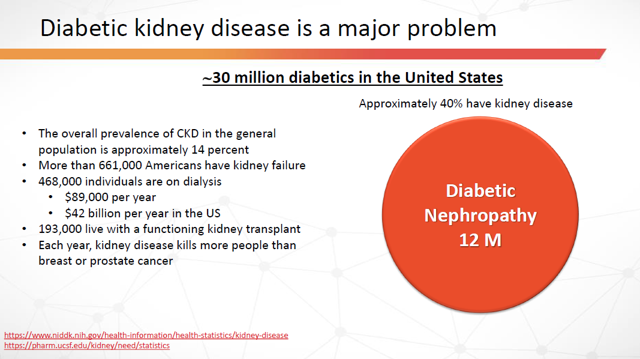

Regardless, here’s an idea as to the potential market size:

Figure 15: Kidney Disease Prevalence in the United States (Source: ARPO Corporate Presentation dated April 10, 2019)

II. Drug: ARP-1536 for Wet Age-Related Macular Degeneration (“wet AMD”) and Diabetic Macular Edema (“DME”)

ARP-1536 is a humanized monoclonal antibody (“Mab”) that targets the extracellular domain of VE-PTP. The drug is currently in the preclinical stage of development. In preclinical models, ARP-1536 activated the Tie2 receptor in a dose-dependent manner with a preclinical efficacy profile similar to AKB-9778.

Aerpio plans on developing ARP-1536 in combination with anti-VEGF therapy for the treatment of Wet Age-Related Macular Degeneration and Diabetic Macular Edema.

Based on the long half-life of monoclonal antibodies, ARP-1536 has the potential to be administered on a monthly to quarterly basis.

Current standard of care:

The current standard of care for wet AMD and DME are frequent, monthly, or every other month, injections of anti-VEGF agents into the eye. Popular drugs currently used to treat these conditions include ranibizumab (Lucentis) and aflibercept (Eylea). While both are effective at reducing retinal thickness, fluid and swelling may recur with discontinued therapy.

2017 Sales Figures: Lucentis: $1.5 billion. Eylea: $5.9 billion.

Additionally, both drugs are now approved for multiple indications, hence the large sales numbers. Lucentis is manufactured by Genentech, a division of Roche (OTCQX:RHHBY) while Eylea is manufactured by Regeneron (REGN).

Remembering that Aerpio has stated ARP-1536 has preclinical efficacy profile similar to AKB-9778… let’s look at a slide in regards to changes in IOP seen with AKB-9778 as it related to Lucentis:

Figure 16: Time-2 trial data: Statistically significant reduction in IOP (Source: ARPO Corporate Presentation dated April 10, 2019)

Also note these particulars from the Mayo Clinic:

- Retrospective analysis of intraocular pressure data from two phase III trials indicates that IOP should be monitored in patients with wet AMD age-related macular degeneration who receive Lucentis.

- Several publications have since reported long-term sustained elevation of IOP in a small subset of patients who received intravitreal injections of anti-VEGF agents for the treatment of neovascular wet AMD.

- This study indicates that for some patients, intravitreal injections may have an effect on IOP, possibly because of the injection volume, the injected drug or both. Sustained elevation can occur after either a single or repeated intravitreal injections, may require IOP-lowering therapy, and may develop in patients with no history of glaucoma.

Naturally then, there’s a chance that Aerpio’s ARB-1536 could address both these issues simultaneously.

Regarding DME specifically, several additional therapies have been used to treat this indication. Namely, corticosteroids (such as triamcinolone, fluocinolone, and dexamethasone), which are all administered via injections into the eye.

More recently, within weeks of one another in September 2014, a couple novel sustained-release corticosteroids were also approved by the FDA for use in treating DME: fluocinolone (Iluvien) and dexamethasone (Ozurdex). While these new drugs have reduced the number of injections required to obtain and maintain clinical responses, they have not overcome the shortcomings of corticosteroids. (FYI: Iluvien last up to 36 months, Ozurdex 6 months)

Iluvien is manufactured by Alimera Sciences (ALIM) which uses a method of administration developed by EyePoint (EYPT). Ozurdex is manufactured by Allergan (AGN). Of the two, Ozurdex has gained the most traction thus far with 4Q’18 net revenues of $29.3 million.

Corticosteroid treatment is associated with a significant increase in cataract formation and a rise in intraocular pressure, eliminating these agents as potential therapies in many patients.

Lastly, the typical response in wet AMD and DME from anti-VEGF therapy is that only 30-40% of patients will improve their visual acuity by 15 letters or more, referring to the number of letters, arranged in lines that the patient can read on the ETDRS eye chart. This leaves a significant portion of the patients with inadequate control of their disease.

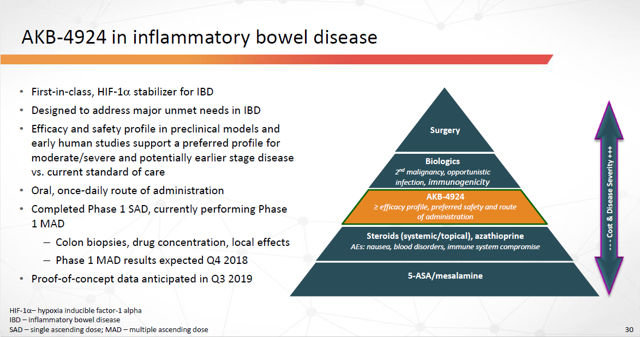

III. Drug: AKB-4924, or GB004, for Inflammatory Bowel Disease (“IBD”)

This is where things get even more exciting.

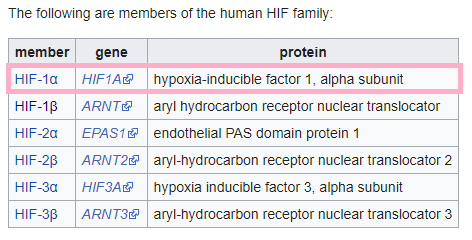

AKB-4924 is a prolyl-hydroxylase (“PHP”) inhibitor. Inhibition of PHP enzymes stabilizes hypoxia inducible factor (“HIF”) transcription, which is crucial for regulating a variety of cellular activities in response to oxygen stress.

Here are the types of HIFs:

Figure 17: Members of the Human HIF Family (Source: Wikipedia) with annotations by author

Unlike other HIF stabilizers in clinical development (which stabilize HIF-2 and stimulate erythropoiesis), AKB-4924 selectively stabilizes HIF-1a, which plays a key role in the intestinal wall.

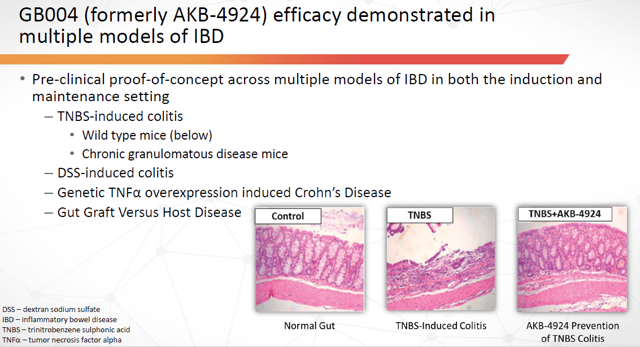

In preclinic models, AKB-4924 demonstrated both profound anti-inflammatory and mucosal wound healing effects. The drug promoted both resolution of intestinal inflammation and restoration of intestinal epithelial barrier function.

As of today, there are no FDA-approved therapies targeting the intestinal epithelial barrier function. AKB-4924 would be first-in-class.

AKB-4924 is being developed as a once-daily, oral treatment for Inflammatory Bowel Disease. IBD is a group of inflammatory conditions of the gastrointestinal tract. Namely, ulcerative colitis (“UC”) and Crohn’s Disease.

Now, some slides:

Figure 18: AKB-4924 in Inflammatory Bowel Disease (Source: ARPO Corporate Presentation dated April 10, 2019)

Figure 19: AKB-4924 Prevention of TNBS Colitis (Source: ARPO Corporate Presentation dated April 10, 2019)

Figure 19: AKB-4924 Prevention of TNBS Colitis (Source: ARPO Corporate Presentation dated April 10, 2019)

Armed with these early results, it didn’t take long for Aerpio to find a suitable and willing partner.

On June 24, 2018, Gossamer Bio and Aerpio joined forces with the announcement of a $420 million exclusive licensing agreement with “GB004, Inc”, a wholly owned subsidiary of GOSS.

The deal included an upfront $20 million payment to Aerpio along with regulatory and sales milestones of up to $400 million. Additionally, ARPO is entitled to royalties based on worldwide net sales, ranging from the high single digit to mid-teen percentage. To boot, Gossamer will be responsible for all remaining development, regulatory, and commercialization expenses for GB004 (formerly known as AKB-4924). See Aerpio’s Form 8-K dated June 25, 2018, for additional information.

So, what did Gossamer have to say about the partnership with Aerpio? (Italics added by author for emphasis):

We are pleased to have found GB004 after thoroughly assessing a substantial number of opportunities. This program represents an important addition to the Gossamer portfolio of drug candidates aiming to address unmet medical needs.

… Faheem Hasnain, Gossamer Bio’s Executive Chairman

and

The HIF-1 alpha stabilization mechanisms represent truly novel biology with multiple putative benefits and a potential paradigm-changing approach to treating IBD patients.

… Sheila Gujrathi, MD, Gossamer Bio’s CEO

And, here’s even more recent quotes from GOSS CEO Sheila Gujrathi, these taken from GOSS’s May 14, 2019, conference call:

The clinicians we spoken to are designing our clinical program have been very excited by GB004 oral valid administration and the novel differentiated mechanism of healthcare we are pursuing.

and

While we have also change some potentially important immunomodulatory effects of GB004 in preclinical model. GB004 is not a mechanism of action it is unique and that enhances epithelial barrier function and repair rather than active purely immunosuppressive mechanism.

For a little back story on GOSS’s Executive Chairman and CEO… previously, they were teamed up and working together at Receptos (RCPT) in the roles of CEO and CMO when the company was acquired for $7.2 billion by Celgene (CELG) on July 14, 2015.

Interestingly, the prize most cherished by Celgene was the Receptos drug RPC1063 (Ozanimod), a ph.III oral treatment for… you guessed it, a form of IBD, ulcerative colitis! CELG also hopes the drug will be able to treat multiple sclerosis. Nearly four years later, however, CELG is still working to get the drug approved.

Going back to the Aerpio and GOSS partnership, and in case you were wondering, the “GB004, Inc” structure was simply a business preference or strategy preferred by GOSS. Each of their indications are set up this way in order to give GOSS the flexibility to sell off their drug assets piecemeal if another suitor where to come along. The company wanted the ability to say “yes” to an offer without necessarily losing the entire company in the process… as they’d just gone through with RCPT. Of course, if GB004 or “GB004, Inc” is sold, Aerpio will have the option to participate in the sale too.

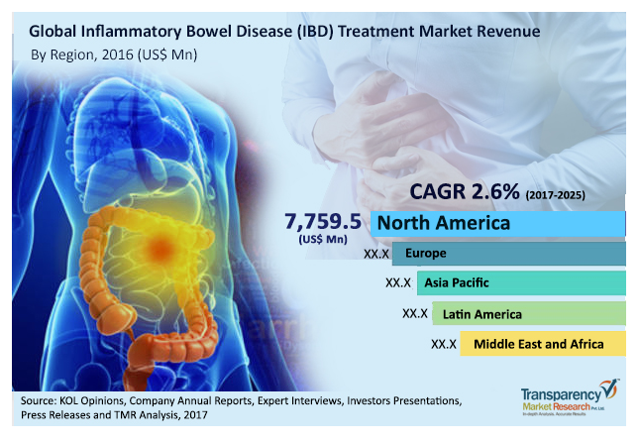

Meanwhile, here’s an idea of the market opportunity that awaits in IBD:

Figure 20: Global Inflammatory Bowel Disease Treatment Market Revenue (Source: KOL Opinions, via Titan Chronicle)

Other Comforting Facts. (A dozen more reasons why I think now is the time to invest.)

1. Cash Levels and Burn Rate. At end of Q1, 2019, ARPO had $53.4 million in cash and cash equivalents. The company expects this amount to be enough to fund operations to mid-2021. Helping, was the announcement on April 1, 2019, that they were reducing their workforce by 11 employees… which represented a whopping 41% of their employees. Aerpio also stated this was (only) expected to cost them $900k in related cost and severance. So, as you can see, this company is running very lean. I like that. A lot!

2. Milestone Payments. Above cash runway figure does not take into consideration any future milestone payments… the first of which is scheduled to be paid at the start of the phase II trial for GB004… which should occur 1H’20 based on current GOSS projections.

3. Market Cap. At the current price of $1.01 (as of this writing), the company has a minuscule and underappreciated market cap of only $41 million with 40.6 million shares outstanding. Thus, the company is currently trading under cash.

4. No debt.

5. The company has no manufacturing facilities and relies on 3rd parties to manufacture and supply their drug products. The good: Saves lots of money. Better to be R&D-heavy than facility-heavy, especially at this stage.

6. The company currently has Chief Scientific Officer, Kevin Peters, MD wearing two hats. He has also assumed the role of recently departed Chief Medical Officer, Stephen Pakola. The good: Saves lots of money.

7. Patent-heavy. Company has secured 28 US patents with 21 pending, along with 235 foreign patents with 111 pending. These figures do not count patents that have been licensed to third parties. The patents cover compositions of matter, methods of use, drug formulation, and methods of manufacture. Patents issued and pending are expected to expire on various dates between 2027 and 2039, without taking into consideration possible patent term adjustments or extensions.

8. Insiders with skin in the game. Executive officers, directors, and principle stock holders, along with their respective affiliates, owned 44.7% of the common stock at year end 2018.

9. Not currently involved in any material legal proceedings.

10. Financial house already in order. In Feb. 2018 company secured rights to issue $150 million in common stock, preferred stock, debt securities, warrants, or units via a shelf offering. Under this arrangement, the company has sold 13,388,200 common shares and raised $48.1 million thus far. Subsequently, on Feb. 21, 2108, the company secured rights to an ATM (at-the-money) financing arrangement. Thus far, the company has not tapped into the ATM.

So, why am I listing this under Other Comforting Facts? Because it’s better to already have a flexible plan in place when healthy (that will allow you to sell securities at-the-market) than to be at the mercy of loan sharks later when you’re already in need of funds. That’s when things can get ugly.

The company also has outstanding warrants whereas warrant holders can purchase up to 317,562 shares at $5.00/each. These warrants were issued to the pre-merger note holders of Zeta Acquisition Corp II (a shell company) when Aerpio was in process of merging and up-listing to becoming a public company in 2017. The warrants expire on 03.15.20.

To provide even more history, Aerpio first came into existence when they were spun off by Akebia Therapeutics Inc. (AKBA) in 2012. Subsequently, Akebia would later merge with Keryx Biopharmaceuticals (KERX) in 2018.

Per Aerpio’s certificate of incorporation, the company is authorized to issue up to 300 million shares of common stock and 100k shares of preferred stock. Currently the company has 40.6 million shares of common outstanding and 0 shares of preferred outstanding.

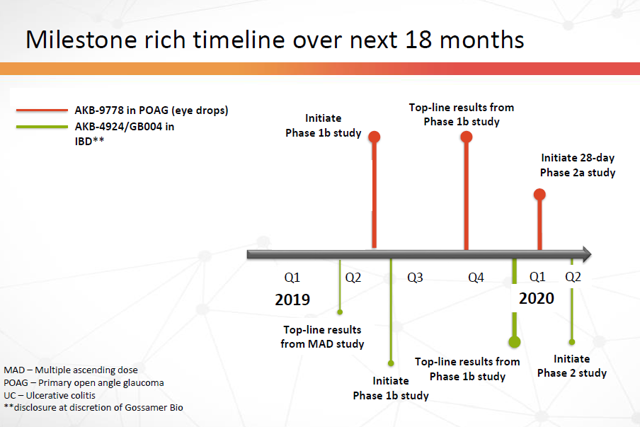

11. Steady flow of (what I expect to be) a positive news flow over the next 18 months (and beyond).

Figure 21: Milestone rich timeline over next 18 months (Source: ARPO Corporate Presentation dated April 10, 2019) with annotations by author (removal of one already-completed event)

12. On-Balance Volume (“OBV”). Though the stock remains down roughly 75% since the brutal sell-off that occurred after the “failure” of AKB-9778 on March 18, it now appears to be under heavy accumulation… an accumulation that started immediately after setting an all-time intraday low of $0.88 on March 29. As can be seen in the chart below, it would seem that roughly six million shares have been bought up over the past seven weeks… roughly half of what was sold off during the meltdown. Additionally, short interest has never risen above 1% throughout the entire fiasco.

Figure 22: (Source: TD Ameritrade) with annotations by author

In Closing…

Hope you enjoyed the article. While I cannot guarantee where the stock heads from here, my best guess is that it lies somewhere between up and (hopefully) considerably up. However, keep in mind that it’s a small-cap bio-tech stock, and these companies are in constant need of cash to fund operations. But the two-year cash runway, trading under cash value, and seemingly robust (albeit young) pipeline have me willing to allocate some funds into this name for the intermediate term, say 12 months, whereas all the points I brought up in this article could then be reassessed.

Personally, I first started buying into the stock after its initial plunge on March 18. At the time, I was thinking, worst case scenario, Aerpio will end up announcing the cancellation of all their Tie2 programs. Even thinking this was a possibility (albeit a minor one), I chose to buy as I felt the company’s GB004 GOSS partnership alone was worth more than the $40 million market cap the company was trading at. I then sat on my hands to wait for more color to be provided by both ARPO and GOSS before deciding if I wanted to add more shares. That color has since been provided by both companies and I have continued to add shares. While I was initially hitting the ask, more recently, I’ve been sitting on the bid at specific price points. I already have all the shares I need, so am now only low-balling with GTC orders. With my cup now full, I felt now was the time to share this wealth with everyone else… let’s just hope it becomes more than just a wealth of information.

May all your trades be profitable. Good day!

Disclosure: I am/we are long ARPO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.