Summary:

- Affirm reaffirms that it’s a category leader in honest finance.

- Headed into Q1 2023 earnings, I said that Affirm would need to take its medicine and downwards revise its outlook for the year.

- That once it came clean with investors, in time, new investors would be more inclined to invest in the company.

- I stand by those comments today. Affirm is a speculative buy.

Mike_Kiev

Investment Thesis

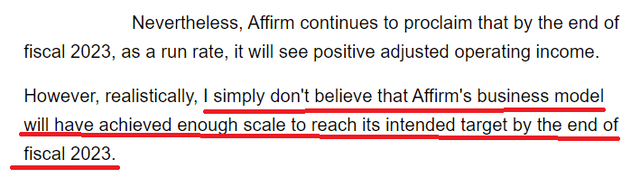

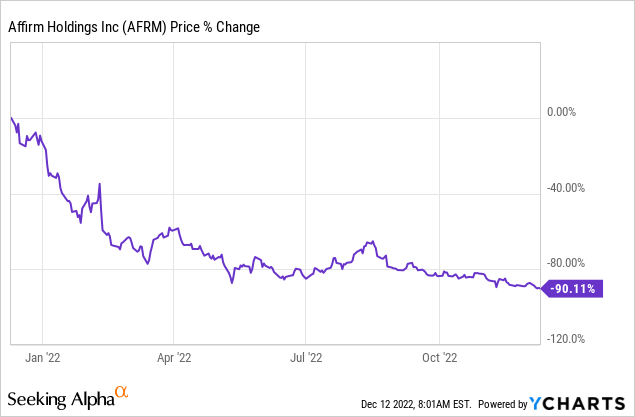

Affirm (NASDAQ:AFRM) continues to see its share price move lower with time. In my previous bullish article, headed into Q1 2023 earnings I said,

I wrote that I believed that Affirm would be forced to downwards revise its outlook for fiscal 2023 and come clean with investors. Once Affirm took its ”medicine”, and downwards revised its guidance, investors would in time welcome its more realistic prospects.

And that’s exactly what happened. Hence, I continue to believe that Affirm is a speculative buy.

Leader in Honest Finance

Affirm has been a most dissatisfactory investment for nearly all investors involved with the name.

Unless someone has been extremely nimble with their trading, I believe that most investors on average are holding a loss in this name. Can you imagine how negative the investor sentiment must be in this case?

I believe that one part of the problem is this,

Affirm is continuing to take share, and we are well positioned for the future as a category leader in honest finance.

For consumers, we responsibly increase their purchasing power and enable them to purchase the things they want and need, without late fees or hidden charges or deceptive financial products.

Affirm’s CFO Michael Linford’s commentary last week, at Special Call, Linford reiterates Affirm’s strategy of being a leader in honest finance. And therein lies the problem.

Investors are no longer willing to buy into this corporate doublespeak.

Revenue Growth Rates In This Challenging Environment

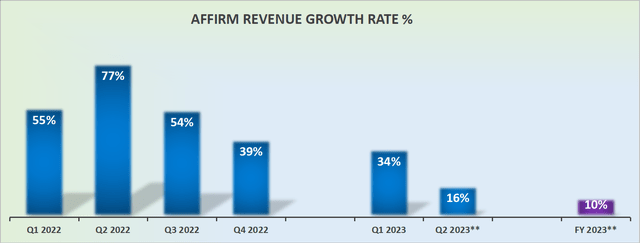

The core of the problem facing Affirm is that the environment rapidly went from extremely favorable to restrictive and uncertain in a short 12-month period.

What’s more, I don’t believe it’s fair to say that Affirm was not a success.

In fact, it’s fair to say that a large portion of Affirm’s success would ultimately bring about its downfall.

My point here is that there was a rapid proliferation of buy-now-pay-later peers. We went from Affirm being one of the leaders in the sector, led by one of the best management teams in fintech, to yet another BNPL provider.

Put another way, this high-growth company went from shooting on all cylinders, with strong active customer adoption and a meaningful increase in transactions per active customer, to a substantial slowdown in operations.

This slowdown was partially due to the macro environment becoming less conducive. But also because too many competitors entered the fray.

Profits Are Too Far Away

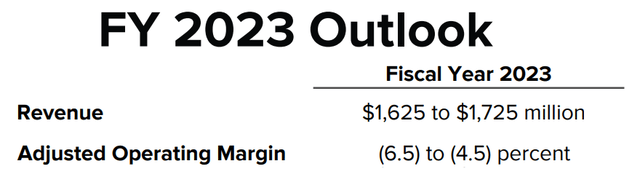

Below we see Affirm’s fiscal 2023 outlook provided at the time of its fiscal Q4 2022 results, back in the summer:

At the high end, Affirm was guiding for a negative 4.5% adjusted operating margin. Of course, there was a general assumption that Affirm would upwards revise this outlook as the year progressed. That’s something that the market rewards, a steady dose of good news over time.

But that’s not what I believed. I believed that Affirm needed to come clean and take its medicine.

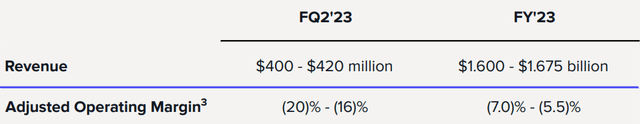

And true to form, rather than upwards revising its fiscal outlook as the year progressed, Affirm ended up doing the opposite. Together with its fiscal Q1 2023 results, Affirm meaningfully downwards revised its profitability profile.

Presently, the expectations are for approximately 5.5% adjusted operating margins, at the high end. And even getting to this figure of negative 5.5% adjusted operating margin in fiscal 2023, in the current macro environment, I believe could prove problematic.

The Bottom Line

This is the core of my message. Until Affirm believes that articulating its strategy in this manner is the way to go, investors will remain skeptical of Affirm’s prospects:

Our vision here is to keep working on any and all financial products that are honest and straightforward for consumers, transparent and that ultimately improve lives.

Affirm is a publicly held business. Affirm has taken investors’ capital to grow its business. And until Affirm’s management believes that they are on the same side of the table as investors and are able to be transparent and honest with outside shareholders, investors will remain disenchanted with the company’s prospects, and the stock will be under pressure.

And for now, Affirm will remain a proxy for ARK-like stocks (ARKK). When interest rates go down, Affirm’s stock will jump higher. But if interest rates remain around 4% to 4.5% for a prolonged period of time in 2023, this stock will remain a black hole.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.