Summary:

- Affirm is a leading Buy Now Pay Later provider, which has deals with major players such as Amazon and other providers which contribute to over 60% of U.S. retail ecommerce sales.

- The company reported mixed financial results as it mixed both revenue and earnings expectations for Q2, FY23. This was mainly driven by short-term demand challenges, especially from its Peloton merchant.

- Despite these challenges, Affirm has grown its active consumers by 39% year over year to 15.6 million.

- 86% of transactions are also from repeat customers, which is a positive sign for the user experience of its product.

Neilson Barnard

Affirm (NASDAQ:AFRM) one of the leading Buy Now Pay Later [BNPL] providers in the U.S. The company was a pioneer in this space, founded in 2012, two years before competitor Afterpay in 2014. Its founder and CEO is also a living legend named Max Levchin, who was part of the famous “PayPal Mafia”. This was a group of notable individuals who were involved in the early stages of PayPal before going on to accomplish great things and dominate the technology landscape. These players include; Elon Musk [Tesla/SpaceX], Peter Thiel [early Facebook Investor/Palantir], Chad Hurley (YouTube co-founder), Reid Hoffman (LinkedIn co-founder) and of course Max Levchin. In a competitive industry such as BNPL, great management is a necessary differentiator as it’s all about execution. Affirm has executed well so far and partners with half of the top 10 U.S. retailers and ecommerce. This includes Amazon, Walmart, Wayfair, Expedia, Samsung and many more. Despite this strong customer base its revenue is still feeling the pain from the decline home fitness, driven by one of its major merchants Peloton. In this post I’m going to breakdown Affirm’s financial results and its valuation; let’s dive in.

Mixed Financials

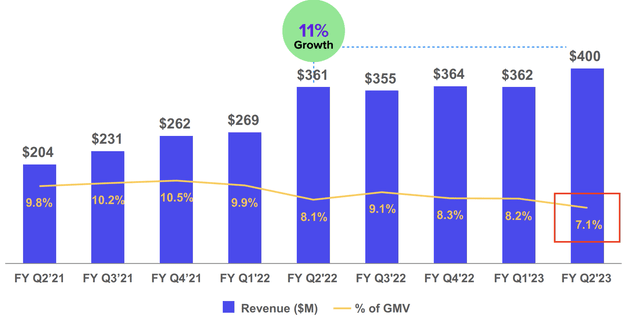

Affirm generated mixed financial results for the second quarter of fiscal year 2023. Its Revenue was $399.56 million, which missed analyst estimates by $16.7 million, despite increasing by 10.68% year over year. A positive for Affirm is if we exclude its Peloton Merchant revenue, revenue actually increased by 21% year over year. Thus it is clear, that the demand drop for Peloton is still impacted Affirm’s revenue substantially.

Revenue (Q2,FY23 )

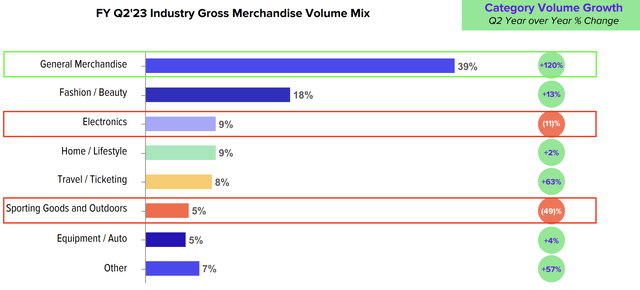

For example Peloton contributed to 30% of revenue in 2020/2021 and thus in prior posts I stated this was a “risk” for the company. However, as an overall business Affirm is in a much stronger position, which I believe is mainly due to its partnership with the largest ecommerce company in the world Amazon scored in 2021. This has helped to massively diverse Affirms product categories with general merchandise contributing to 39% of its gross merchandise volume [GMV] mix and increasing by 120% year over year. On the graphic below you can see I have highlighted that Sporting Goods GMV is down an eye watering 49% year over year, which was mostly driven by Peloton. The Electronics category was also down by 11% year over year. We are seeing a cyclical downturn in the electronics industry (after a boom in 2020) and thus this doesn’t surprise me massively and I don’t deem it to be a long term issue.

GMV Categories (Q2,FY23 report)

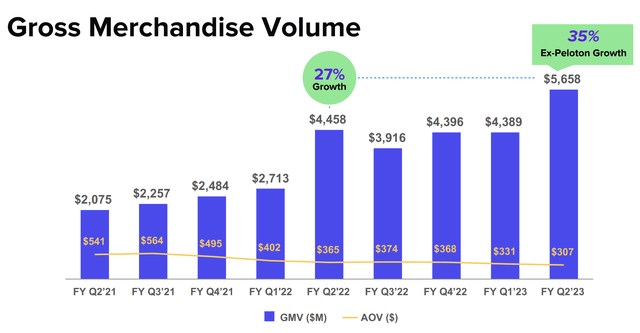

Overall GMV increased by 27% year over year to $5.7 billion or a rapid 35% year over year if we exclude Peloton. Total revenue declined as a percentage of GMV to 7.1%, but this was mostly driven by a higher mix of interest bearing loans and a larger number of retained loans on its balance sheet. Again, I don’t deem this to be a negative as greater loan retention means Affirm can capture more value long term.

GMV (Q2,FY23 report)

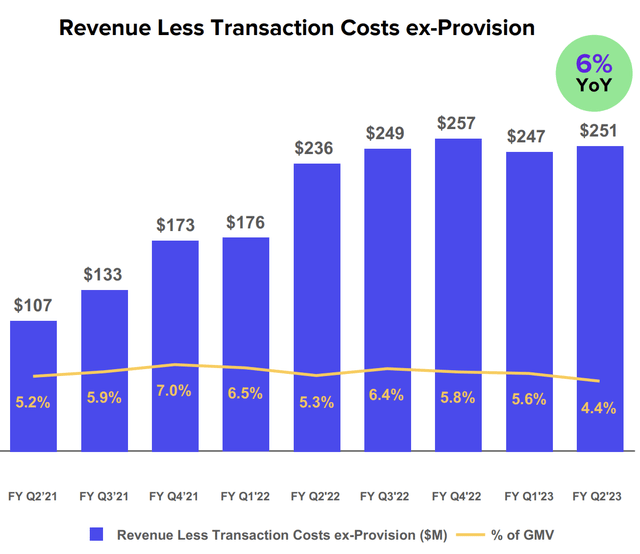

Its Revenue Less Transaction Costs [RLTC] plummeted by 21% year over year to $144 million. However, if we exclude/adjust for a credit loss provision, this metric actually increased by 6% year over year to $251 million. Affirm was a little slow in increasing its prices for merchants in my opinion, which it didn’t start until the second half of 2022. Thus as interest rates rose and consumer product demand dropped, Affirm took a hit. A positive for Affirm is the company has now started to pass through these higher interest rates to customers, with its loan APR increasing from 30% to 36%. This is now at the national “cap rate”, which has achieved bipartisan support to stop “predatory lending”. Affirm’s price increase is still in its early stages, as there is a variety of merchant contracts/agreements which must be put in place. By the end of Q2,FY23 the number of loans offered at the 36% APR, was ~23% and management aims to increase this to 50% by the end of the fiscal year 2023. This should boost revenue and margins significantly for the company which is a positive. However, Affirm must also balance “acceptance rates” as if rates are unaffordable it may cause consumers to mitigate purchases. A positive for Affirm is the company has developed proprietary Artificial Intelligence [AI] technology, which enables them to continuously monitor, accept and track the loans provided. Thus I believe this will act as a competitive advantage for the company, while also helping Merchants and keeping consumer demand steady.

Revenue less transaction costs adjusted (Q2,FY23)

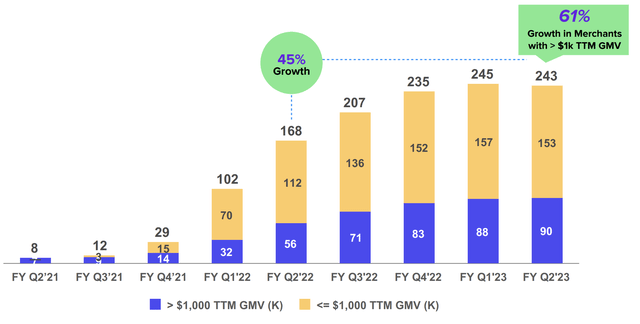

Affirm has managed to increase its merchants by a staggering 45% year over year to 243,000. This is testament to the company’s strong brand and I believe the Amazon deal, offered a “seal of approval”. There was a small amount of churn between Q1,FY23 and Q2,FY23, but this is mainly for its small merchants with less than or equal to $1,000 GMV. I don’t deem this a major issue, as its larger merchants with greater than >$1,000 GMV, increased by a rapid 61% year over year.

Merchants (Q2,FY23)

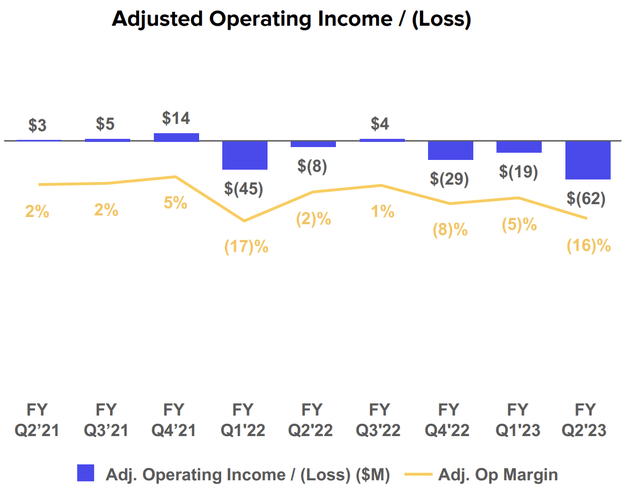

Moving onto margins and expenses. Affirm reported earnings per share [EPS] of negative $1.10, which missed analyst expectations by negative $0.15. Its Operating Loss ballooned from negative $196 million in Q2,FY22 to negative $360 million by Q2,FY23.This looks to be mainly driven by stock based compensation and other share based expenses. On one hand this is “bad” as ~17 million of its stock based compensation [SBC] shares are “out of the money” options currently, due to the stock price of Affirm and many “growth stocks” plummeting. However, a positive is I believe technology companies must pay their employees well (to retain the best) and a key part of this is stock based compensation. Affirms management has also slashed 19% of its workforce which should the edge off. In addition, its Non GAAP Sales and Marketing expenses, have declined by 36% year over year. On an adjusted basis its operating income was negative $62 million reported, which was not “as bad” overall. Despite the current negative income, management has outlined bold plans to reach Non-GAAP profitability by the end of fiscal year 2023. This is expected to be driven by a series of “cost restructuring” measures, which is expected to generate between $77 million and $83 million in cost saving per year. I will discuss more on this in my “valuation and forecasts” section.

Adjusted Losses (Q2,FY23)

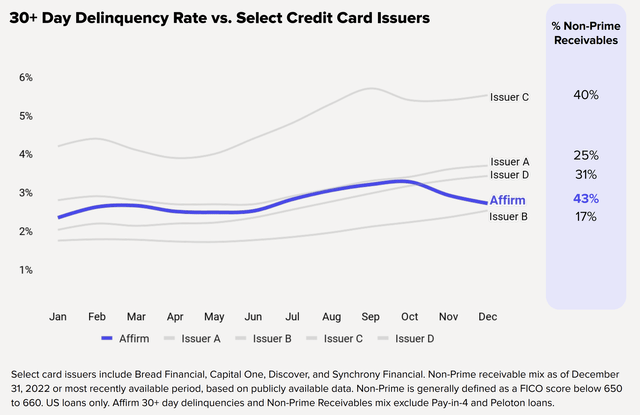

As an extra datapoint, it should be noted that Affirm has a downward sloping 30 day delinquency rate, which is a positive sign. If we compare this to other major credit issuers from Capital One to Discover, you can see they have upward sloping rates, and the majority are much worse than Affirm. I believe this is driven by the aforementioned AI models/software. As the company processes more loans (>70 million at the time of writing) its AI model accuracy improves and the company can optimise its credit offerings.

Affirm Delinquency Rates (Affirm)

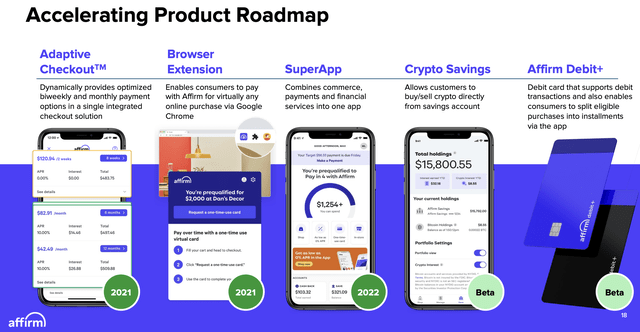

On its balance sheet Affirm has a solid $2.4 billion in cash, cash equivalents and marketable securities, which is solid. The company does have $1.7 billion in Convertible Debt, but this is manageable given the staggered debt profile and strong cash position. Affirm has increased its funding capacity to a solid $11.3 billion, which is up from $10.5 billion at the end of December. This means the company is in a strong position to expand its product offerings and scale, even during a tough economic backdrop. The company has a range of new products on the horizon which includes a crypto savings product and a debt card, which should help to boost platform transactions.

Affirm Roadmap (Q2,FY23)

Valuation and Forecasts

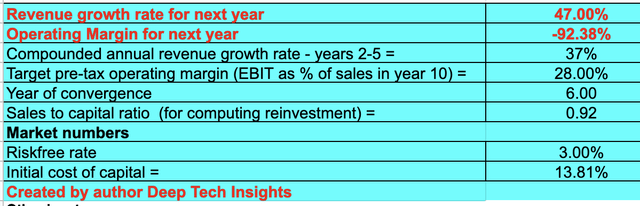

In order to value Affirm I have plugged its latest financials into my discounted cash flow valuation model. I have forecast 47% growth for “next year” which is the next four quarters in my valuation model. This is based on an extrapolation of managements guidance for the next quarter (Q2,FY23) of $360 million to $380 million. I believe this is fairly optimistic given the macroeconomic environment, but management is bullish. I expect the aforementioned new products to help accelerate this, as well as more merchants and customers signed up. In years 2 to 5, I have been a little more conservative and forecast 37% revenue growth rate per year. Ecommerce is currently experiencing a cyclical downturn at the time of writing, thus I forecast a rebound long term. Affirm should benefit from this especially given its huge partnership with Amazon and many ecommerce retailers.

Affirm stock valuation 1 (created by author Deep Tech Insights)

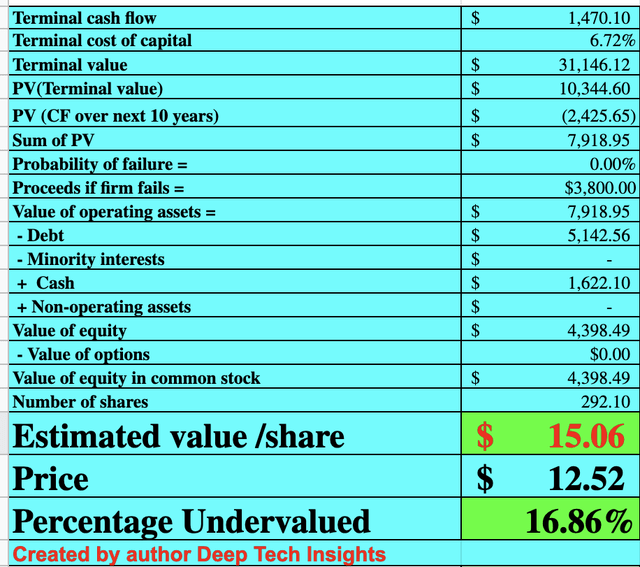

To increase the accuracy of the valuation model, I have capitalized R&D expenses which has lifted net income slightly. However, the company still has many major challenges ahead when it comes to profitability. I have forecast a 28% operating margin over the next 6 years. This may seem optimistic but it is actually in line with management’s long term guidance of between a 20% and 30% operating margin, with GMV growth below 30%. In the recent quarter (Q2,FY23), GMV grew by 27% year over year or 35% year over year excluding Peloton. Therefore this metric doesn’t seem impossible, although it may feel like a stretch from this point. Previously I mentioned Affirm’s rigorous cost restructuring plan and price increases which should help with positive next steps.

Affirm stock valuation 2 (created by author Deep Tech Insights)

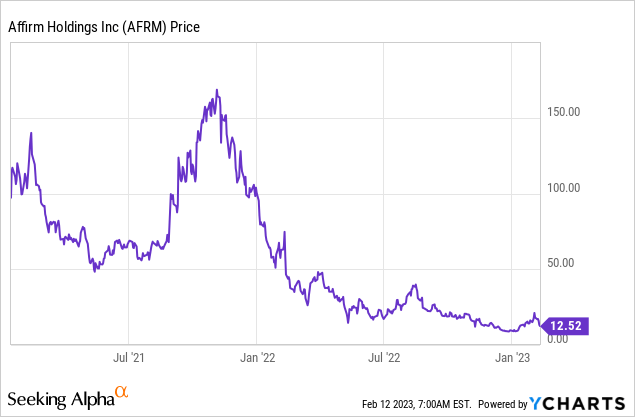

Given these factors I get a fair value of $15/share, the stock is trading at ~$12.52 per share at the time of writing and thus is ~16.86% undervalued, according to my model and forecasts

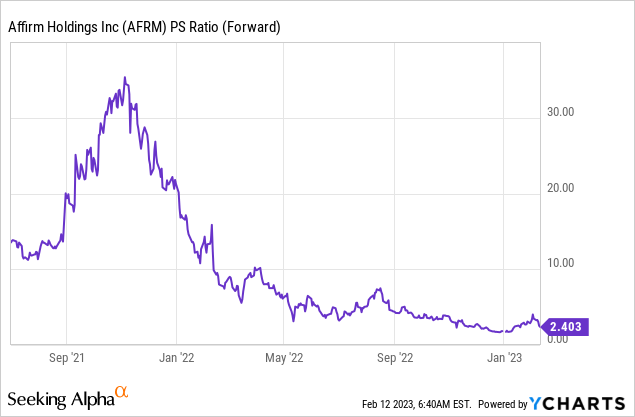

As an extra datapoint, Affirm trades at a price to sales ratio = 2.46x, which is substantially cheaper than previous highs of over 30x.

Risks

Loan Provisions/Recession

Many analysts have forecast a recession in 2023, which will likely cause a slowdown in consumer spending and impact Affirm’s revenue. For most financial companies they tend to build up a large loan provision amount to cover defaults. Affirm has taken a leaner approach which some analysts believe may be more risky. In the earnings call CEO Max Levchin stated;

“We’re not interested in building up giant piles of cash for losses that will make from loans from three years ago, because we don’t really have a whole lot of loans left from three years ago at all. I hope that didn’t sound too admonishing.”

Personally I understand this strategy, as Affirm has such as fast turnover of its BNPL loans that hoarding cash seems overkill. But it is still something to be aware of given the company’s unprofitability and large amount of stock based compensation.

Competition

The Buy Now Pay Later market has become increasingly competitive, which could signal a lack of differentiation in the market. Examples include; Afterpay acquired by Block, for a staggering $29 billion. European based Klarna, PayPal Credit, GoCardless and many more. Interestingly enough, despite Affirm having a partnership with Amazon, the ecommerce giant has partnered with Barclays bank for a “pay in instalments” program in the U.K. This surprises me as despite regulatory differences, I would think Amazon would leverage Affirms technology and white label it, as Affirm operates in the U.S and Canada only.

Final Thoughts

Affirm is a leading BNPL provider and is truly at the cutting edge when it comes to its credit quality selection. Its strong partnerships with major retailers such as Amazon, is a competitive advantage (for the U.S market at least). This is despite the major competitive in the BNPL industry. Its stock is undervalued according to my valuation model. But given the company’s mounting losses, I will deem this a “hold”, until I see signs management’s profitability plans are actually coming to fruition, especially as we are likely entering a “recessionary” environment.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.