Summary:

- AGNC Investment rallied post Q1-2024 results as tangible book value improved, and it actually earned the dividend.

- The REIT’s 5.7% economic return metric in Q1-2024 is the key one to focus on.

- We tell you what the REIT did exceptionally well in Q1-2024 and go over our favorite preferred from its suite.

Dragon Claws

One aspect of the market that investors must never lose sight of, is how equity pricing for REITs impacts ultimate value. To put another way, if everyone believes your stock is worth more (for a REIT), it actually increases in real worth. We will look at this today for AGNC Investment Corp. (NASDAQ:AGNC) and tell you why the recent moves increase safety for the preferreds slightly but don’t do much for your common share returns.

Q1-2024

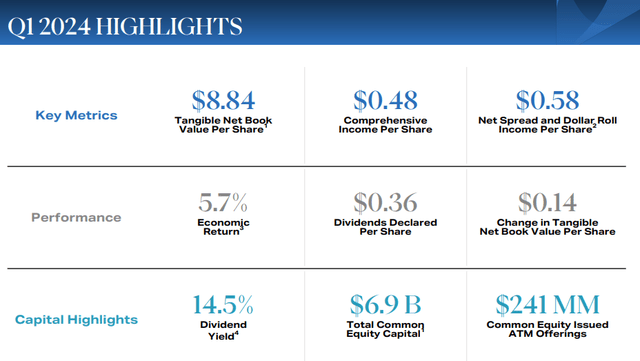

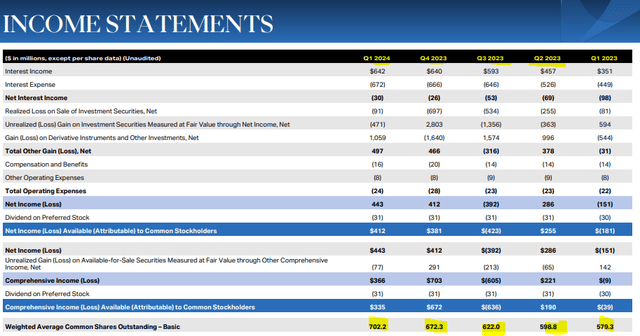

It must have been a relief for shareholders to see an improvement in tangible book value per share for AGNC. The REIT has lost a lot of ground on that metric in the last couple of years, but this quarter showed it moving in the right direction.

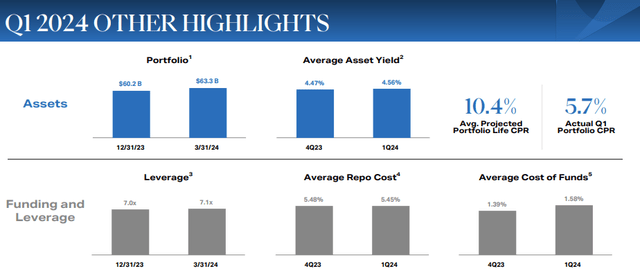

The key metric here, if you ever do decide to follow how AGNC makes money, rather than buy the bull platitudes, was the 5.7% economic return metric. This is one you need to keep your eye on as AGNC discloses this honestly every quarter and this number over time in essence reflects your overall return. The 5.7% in one quarter was splendid and helped drive a nice rally in the stock. What was also notable here was that AGNC’s leverage inched up a bit, as the REIT probably felt just 7.0X leverage was not quite cutting it for them.

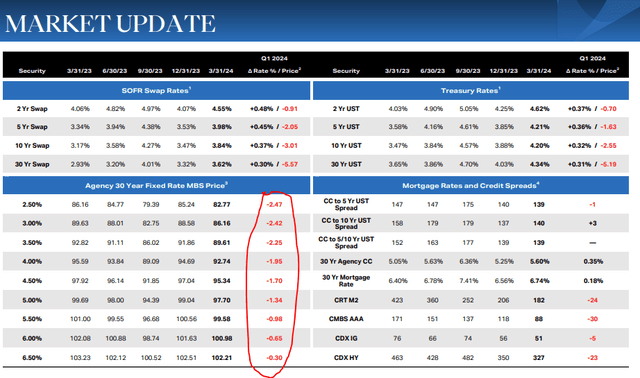

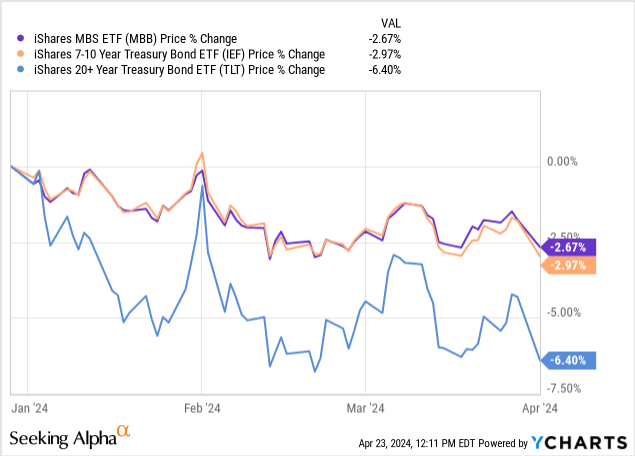

The quarter’s results were also good from the perspective that mortgage-backed securities, or MBS, lost ground during the quarter.

The simple fact, though, was that equivalent longer dated Treasuries (which AGNC shorts as a hedge) lost more ground than the spread came in. We have shown the Q1-2024 movements here of iShares MBS ETF (MBB), iShares 7-10 Year Treasury Bond ETF (IEF) and iShares 20+Year Treasury Bond ETF (TLT) for context.

Overall, it was a quarter that worked for investors, even though the longer duration theme got whacked again.

Outlook

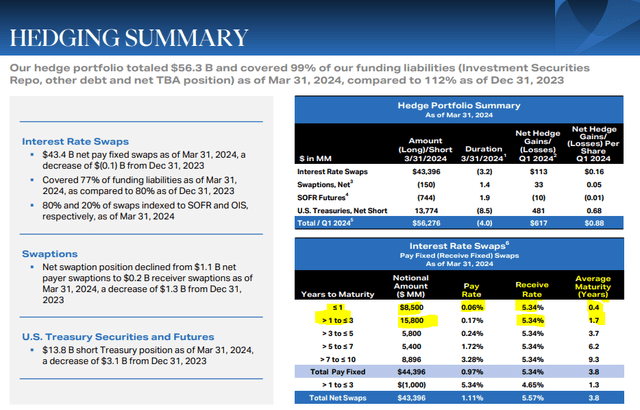

AGNC’s longer-term story is the same. The REIT managed to hedge its interest costs at rock bottom rates, and that decision is proving useful even today. There are two aspects you should be aware of, though. First being that these hedges do run out over time. One easy way to visualize this is the notional amounts highlighted below for less than 1 year and for the 1-3 year timeframe.

If you scroll back through previous quarters, you will see this moving lower steadily. The other, and more important fact, is that all these hedge gains are already part of the tangible book value, so getting excited over them is not going to make you moolah.

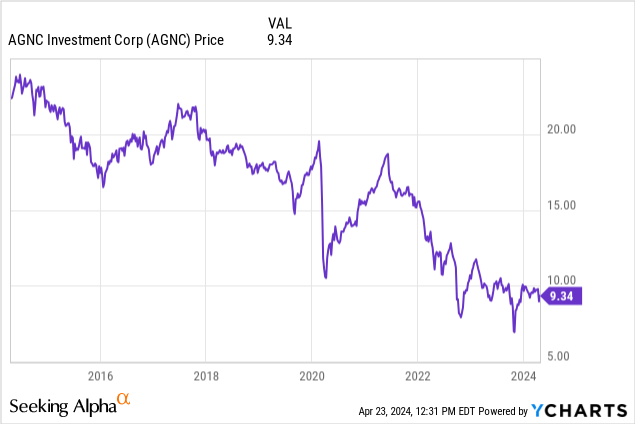

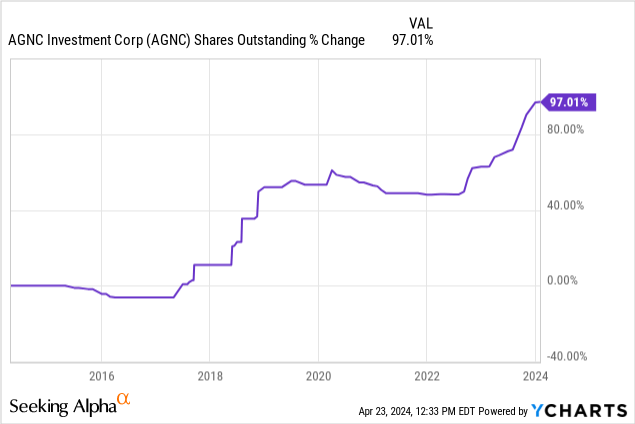

The second part of the long-term story is that AGNC issues equity, and it has really dialed up the amount recently. Share counts have exploded up, and obviously, it has been doing that because investors seem happy to bid this over tangible book value. Why wouldn’t they issue stock here?

This does mean that those that invested way higher up, like at $23, are not going to see any chance of return to that price.

The potential upside, which the bulls have been dreaming of, has gotten diluted repeatedly by stock issuances. Y-Charts has not been updated for this quarter, but you get the point.

The title of the article was referring to this. AGNC sold a lot of stock in Q1-2024 and that improved the relative valuation as the issuances were slightly above tangible book value per share.

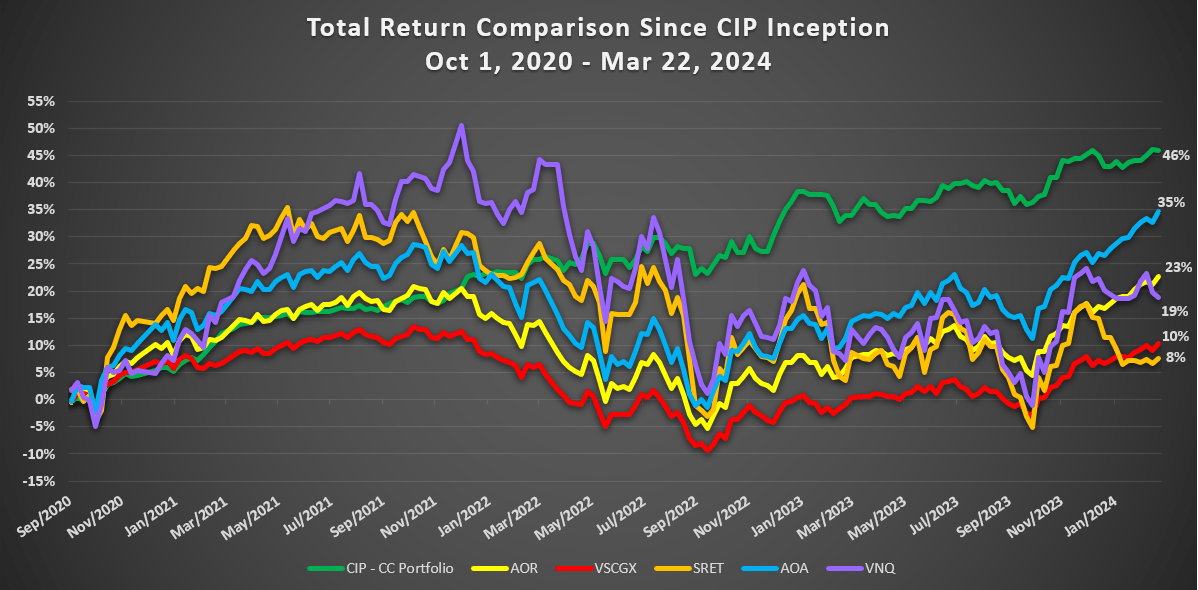

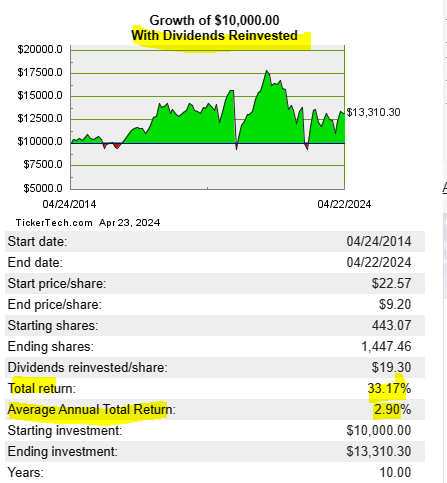

The current tussle here is between MBS being cheap relative to Treasuries and AGNC’s longer-term track record. On the first aspect, yes, they are cheap, and if you want to invest in (Agency) mortgage backed securities versus Treasuries, we encourage you to do so and capture the spread. We would also strongly advise you against leveraging yourself 7:1 on that trade. But that’s precisely what mortgage REITs do. How has that worked out? Well, before you see that, do remember that bulls told you every step of the way in the last decade that this was a great buy. They told you were “locking in” 10% and 15% income streams. You made only 2.9% annually, though.

Split History

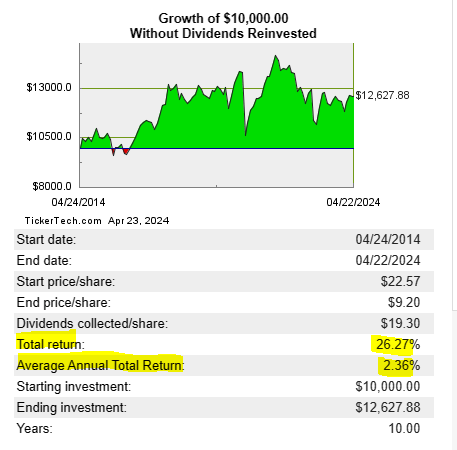

Scratch that. No income investor comes to AGNC to reinvest their dividends. Without that reinvestment (as in consumed the dividends), you made 2.36% annually.

Split History

As we head into the middle of 2024, our earlier thesis that the crowd is wrong about multiple rate cuts, has panned out exactly as we expected. Well, better than we expected.

Financial Times

We would expect this to ultimately weigh on AGNC as its spread income will be pressured as hedges run out. The REIT has also derived benefits from the MOVE index moving lower and the spread between MBS and Treasuries partially unwinding. At this point, risks are firmly to the downside. We maintain this at Hold and would consider moving to Sell over $10.00.

Preferred Shares

AGNC has five listed preferred shares.

- AGNC Investment Corp. 6.12% DP SH PFD F (NASDAQ:AGNCP).

- AGNC Investment Corp. 6.5% DP SH PFD E (NASDAQ:AGNCO).

- AGNC Investment Corp. 6.875% DEP REP D (NASDAQ:AGNCM).

- AGNC Investment Corp. CUM 1/1000 7% C (AGNCN).

- AGNC Investment Corp. 7.75% DP PFD G (NASDAQ:AGNCL).

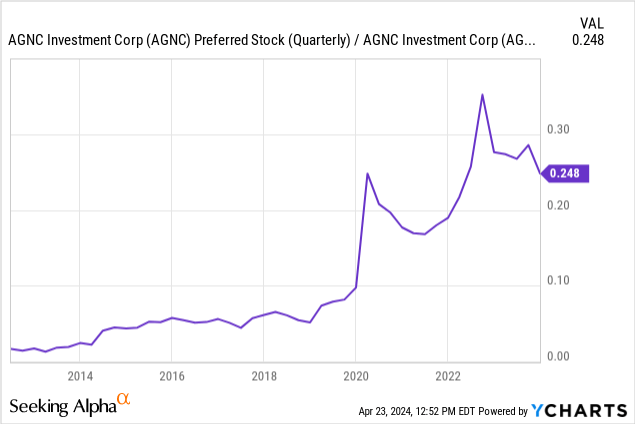

The relentless issuing of common stock has actually improved the relative buffer of these preferred shares. The number below has not been updated for the latest stock issuance, but it still remains a bit too high for our comfort. The ratio in the 2016-2019 timeframe was far better for us.

So we are not currently dabbling here. If we had to, we had to, we would go with AGNCL.

The Annual Fixed Dividend Rate will be 7.75% until the first redemption date, then it will be equal to the sum of the five-year U.S. Treasury Rate on the applicable fixed rate calculation date plus 4.39%, resetting every 5 years thereafter on applicable fixed rate calculation date.

Source: Quantum Online

AGNCL trades at about an 8.5% stripped yield at the current price and the reset, if it happened today, would set it at about 9% on par (4.39% plus current 5 Year Treasury at 4.61%). That would be about 10% on the current price. We think that wide spread to Treasuries makes them an interesting security and one we would choose in the suite.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with an 11-month money guarantee, for first time members.