Summary:

- ABNB partnered with REITS, developers, and landlords to offer Airbnb-friendly apartments for stays up to 180 days.

- The excellent initiative might also build upon the company’s expanding profitability, and the company continued to guide growth in headcount through 2023.

- It highlights ABNB’s resilience during peak recessionary fears at a time when most tech companies are undergoing drastic restructuring.

- However, the optimism might be digested in the short term, attributed to the lower ADR guidance through 2023 in the recent FQ4’22 shareholder letter.

- Traders looking to lock in some gains may consider doing it here since we may see another February 2023 bottom test to the low $100s.

Maxxa_Satori

We previously covered Airbnb (NASDAQ:ABNB) here. While its bookings have taken a temporary hit thus far, things might improve from H1’24 onwards, once the Fed potentially pivots with an interest rate cut. Notably, the nimble team continued to prove why the stock deserved its premium, attributed to the multiple recessionary initiatives that might resonate well with hosts, renters, and consumers alike. Its entrance to the long-term rental property market might also lift some of the regulatory headwinds faced by short-term rentals thus far.

For this article, we will focus on ABNB’s strategic choice in partnering with REITS, real estate developers, and landlords alike, in launching Airbnb-friendly apartments for stays of up to 180 days. We reckon this approach may potentially boost the company’s top and bottom lines ahead, due to its potential entry into the long-term rental market and its real estate partners’ global footprint. Combined with its expanding profitability, the company continues to deliver excellence thus far.

ABNB Continues To Be A Robust Long-Term Investment, Especially Aided By REITs

In the recent FQ4’22 earnings call, our attention was drawn to one particular detail, since it tied closely with our previous investment thesis – ABNB’s eventual entrance to the (long-term) rental property market, as expounded by Brian Chesky, CEO of ABNB:

We started saying if we made our buildings Airbnb friendly, would it make the building more appealing, especially to young people that are moving to markets in certain cities. And so we did a partnership. We started with working with Greystar, Equity Residential, over 10 other companies, and we’ve launched. We have 175 buildings in like Houston, Phoenix, Jacksonville — and the vast majority of these units are kind of — we expect if they were put on Airbnb, that would be a typical kind of ADR. They’re usually 1 bedroom studios. (Seeking Alpha)

The rapid pace was surprising, since ABNB only announced “Airbnb-friendly apartments” in late November 2022. Notably, with the access of up to 175 buildings by February 2023 and the sum likely to grow moving forward, there are massive tailwinds for adoption moving forward, especially since there is “a lot of inbound from real estate developers” themselves.

The ABNB management had also provided more color on the partnership structure, with subtenants to sign a sublease at predetermined days annually, for now at approximately 180 days. Notably, the landlords would also receive a cut on the sublease commission, further sweetening the deal for all parties involved.

As a result, it appeared that the idea similarly resonated with real-estate developers and companies alike, due to the rapid development and potential economic benefits. Notably, Greystar alone owned up to 219.5K units of rental properties and Equity Residential up to 79.59K apartments at the time of writing, suggesting the potential scale of their success moving forward.

This strategy may also fill an excellent gap in the US rental market, with only 12.4% comprising six months leases and 59.6% for twelve months leases, based on data released on September 2022. As early tests had proven successful, ABNB showed that it was able to innovatively expand its offerings beyond the original vacation segment and the 28-day long stays recently introduced during the pandemic.

ABNB may finally penetrate a market previously dominated by REITs and private landlords, while similarly smoothing out their ruffled feathers. There had been long-term clashes since 2017, due to the “unlawful rental of apartments” without landlords’ permission, which often resulted in complaints or lawsuits.

It is no wonder then, that ABNB expects the ongoing partnership with REITs and private landlords to result in “leases generally being more friendly to Airbnb” moving forward. We posit that the partnership may potentially extend beyond the current Airbnb-friendly apartments, to single-family homes, luxury properties, and condominiums, amongst others.

With many of these REITs and developers also owning properties globally, we reckon this approach may also be duplicated internationally, potentially expanding ABNB’s market opportunities and top/bottom line growth. Naturally, risks remain, depending on how different states’ and countries’ regulations will be shaped surrounding the new model of rental apartments. However, we are cautiously optimistic, since ABNB has won over these REITs and landlords alike.

We have been further convinced by the company’s stellar execution as well, achieving an excellent expansion in the adj EBITDA margins to 34.5% in FY2022, compared to FY2020 levels of -7.4% and FY2021 levels of 26.6%. This impressive feat was particularly attributed to the aggressive cost management at the start of the pandemic and the subsequent remote work strategy for the past three quarters.

The same restraint was also visible in ABNB’s stable Stock-Based Compensation expenses at $253.61M by FQ4’22, against FQ3’22 levels of $234.36M and FQ4’21 levels of $225.70M. Combined with the robust balance sheet of $9.62B in cash/equivalent and minimal long-term debts of $1.98B by the latest quarter, the company will be well positioned to weather through the short-term uncertainties.

Most importantly, ABNB confidently guided growth in headcount between the 2% and 4% range in 2023. This is impressive, given that the global tech industry has been undergoing drastic cost restructuring across the board, including pay cuts, layoffs, lease closures, and even reduced capital expenditures.

With the company still expecting to grow and flourish during a time with an uncertain macroeconomic outlook, we remain bullish about ABNB in the long term.

So, Is ABNB Stock A Buy, Sell, Or Hold?

ABNB 1Y EV/Revenue and P/E Valuations

ABNB is currently trading at an EV/NTM Revenue of 7.91x and NTM P/E of 37.54x, lower than its 1Y mean of 8.02x and 55.31x, respectively. Based on its projected FY2024 EPS of $3.96 and current P/E valuations, we are looking at an aggressive price target of $148.65. This suggests a 15.4% upside potential from current levels.

ABNB 1Y Stock Price

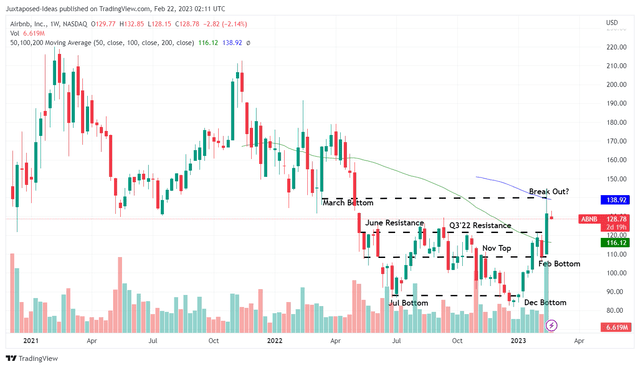

This is impressive, since ABNB has recorded a tremendous rally of 56.1% to $128.78 since the December 2022 bottom of $82.49. The stock also broke through its previous Q3’22 resistance levels of $120s to reach the previous March 2022 bottoms of $140s.

Nonetheless, we reckon that it is more likely that the optimism may be digested in the short-term, attributed to the lower ADR guidance through 2023 in the recent FQ4’22 shareholder letter:

In Q1 2023, we anticipate slightly lower ADR than we had in Q1 2022. For the remainder of the year, we expect ADR will face increasing downward pressure from mix shift, as well as new and improved pricing and discounting tools. (Airbnb)

Therefore, despite our bullish long-term view on ABNB, we prefer to exercise some caution and rate the ABNB stock as a Hold here, due to the reduced margin of safety. Traders looking to lock in some gains may consider doing it here, since we may see another February 2023 bottom test to the low $100s in the short term. Do not chase this rally.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.