Summary:

- Since our December Buy call, ABNB has skyrocketed over 50% as the market factored in significant pessimism.

- Investors cheered as Airbnb delivered a rock-solid quarter, but their excitement might be short-lived as the company’s adjusted EBITDA growth is expected to hit a significant speed bump in 2023.

- Now that ABNB’s valuation has not only normalized but also exceeded our previous price target, it’s imperative for investors to seriously consider reducing their exposure.

Carl Court

Airbnb, Inc. (NASDAQ:ABNB) attracted a significant post-earnings buying frenzy even though the mood was somber at the end of 2022.

Accordingly, Wall Street analysts were rather pessimistic about Airbnb’s performance pre-earnings, as the consensus price target (PT) fell to a low of $126.9 in early February.

Moreover, Morgan Stanley (MS) downgraded ABNB to a Sell rating in early December, arguing that its checks indicated “decelerating supply growth.”

Therefore, Airbnb made it a point to accentuate its robust listings’ growth in 2022, reaching 6.6M global active listings, up by 900K for the year ex-China.

Accordingly, active listings increased by 16% YoY in FQ4 and up 26% against FQ4’19. As such, CEO Brian Chesky reminded investors in its earnings commentary that Airbnb saw “tremendous growth in supply,” rebutting the thesis put out by the Morgan Stanley team.

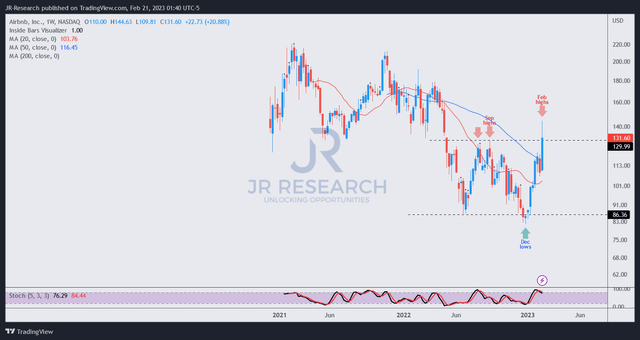

We highlighted in our previous December article that “the market has likely priced in significant pessimism against Airbnb’s execution risks.” Therefore, we aren’t surprised that ABNB surged more than 50% at last week’s highs since we upgraded it into a Buy and also exceeded our PT.

As such, we believe it’s time to update investors on whether they should join the momentum spike last week or sit out first for a pullback.

Management highlighted that it remains in a growth phase, suggesting that investors should not expect a new stock repurchase authorization aside from the $500M remaining from its current $2B program.

Hence, it will be critical for investors to assess how management intends to spend the $9.6B in cash and equivalents as of FQ4 on new growth initiatives to spur growth in the medium term.

It’s clear that the company is highly committed to driving the appeal and simplicity of attracting more active hosting onto its platform. Management highlighted that among its core priorities in 2023 include “raising awareness, making it easier to get started, and providing better tools for hosts.”

As such, the company is willing to continue investing in its host community by “primarily (giving) away most of (Airbnb’s) product service and innovation to (the hosts).”

Also, CFO Dave Stephenson highlighted that the company will “keep enough cash for potential M&A opportunities, which could exist.” Does that suggest that Airbnb’s organic growth cadence could slow moving ahead?

There’s little doubt that Airbnb posted a highly remarkable quarter, beating both lines on revenue and profitability, while delivering a better-than-expected outlook.

However, the market is not dumb, right? ABNB has significantly outperformed the market since the end of 2022 toward its highs last week. Hence, we believe savvy market operators likely used the highly pessimistic market conditions in December to load up, anticipating more robust performances from Airbnb in FQ4 and 2023.

Therefore, we assessed that ABNB’s near- and medium-term optimism was reflected in the earnings surge. As such, investors must be highly cautious if they intend to join last week’s late buying frenzy. Why?

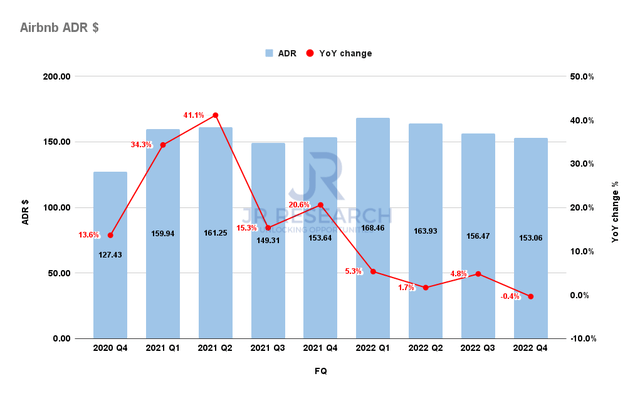

Airbnb expects its average daily rate or ADR to continue coming under pressure in 2023 due to “increasing downward pressure from mix shift, as well as new and improved pricing and discounting tools.” Hence, the company guided toward an adjusted EBITDA margin that’s largely in line for FY22, highlighting a potentially substantial slowdown in adjusted EBITDA growth in 2023.

Accordingly, the revised Wall Street consensus estimates indicate an adjusted EBITDA margin of 34.7% for FY23, in line with FY22’s 34.6%. As such, it implies an adjusted EBITDA growth of 14.8% for FY23, down from FY22’s 82.2%.

Despite that, the company is confident in optimizing its OpEx to mitigate the aforementioned ADR headwinds to improve profitability. Chesky and his team have also earned their credibility as he accentuated that Airbnb is “one of the few tech companies that aren’t doing layoffs.”

As such, the company is confident that it has “a long list of things to invest in to drive further profitability.”

Notwithstanding, with the surge in and subsequent normalization of its valuation, we believe market operators will scrutinize how this “long list of things” will help to drive its operating leverage growth beyond FY24, which is critical for investors considering jumping on the bandwagon.

ABNB price chart (weekly) (TradingView)

ABNB last traded at an NTM EBITDA multiple of 22.8x, well above its peers’ median of 13.3x (according to S&P Cap IQ data).

As such, we believe it looks fully valued now, with reward/risk no longer attractive.

Coupled with downside risks due to a potentially sharp slowdown in adjusted EBITDA growth, we believe it’s opportune for investors who followed our December call to take some exposure off the table.

Moreover, ABNB’s price action is unconstructive and could form a false upside breakout or bull trap, indicating market operators could use the recent spike to cut exposure.

Rating: Sell (Revise from Buy).

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you’ll also gain access to exclusive resources including:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!