Amazon: Could Hit COVID Lows But Don’t Be Unduly Worried

Summary:

- The market remains unconvinced over whether Amazon could recover in 2023, as AMZN underperformed the S&P 500 since the market’s October lows.

- The market likely anticipated relatively weak retail sales data in November as consumers turned more cautious over discretionary spending.

- Hence, Amazon needs AWS more than ever to turn its profitability growth around. Could its new Graviton chips help its enterprise customers lower compute costs meaningfully?

- Amazon’s advertising business could also be a critical driver in 2023, helping to lift the gloom over its retail business.

- With easier comps moving forward and a stock price collapse in 2022, investors have likely reflected significant pessimism.

georgeclerk

Amazon (NASDAQ:AMZN) stock has struggled for performance, even though the S&P 500 (SPX) (SP500) has bounced off its October lows remarkably. Hence, the leading constituent in the Consumer Discretionary ETF (XLY) has failed to convince buyers that it formed its bear market lows in November.

With its valuation still at a 10Y low, investors must be wondering what they need to do to get its recovery going as it closes in on its COVID lows.

CEO Andy Jassy has been busy over the past month. Amazon has moved quickly to slash costs further, with its well-reported layoffs and rationalizing some spending on its “moonshot” bets.

However, it hasn’t done much to placate investors, as the market remains focused on whether its e-commerce business is on track to recover in 2023.

The company’s advertising business remains well-placed to navigate a much more challenging ad environment in 2023. Updated eMarketer forecasts indicate that Amazon’s retail media ad business could grow by nearly 19% in 2023, despite the digital advertising industry downturn. Also, Insider reported that Amazon snagged some of Meta’s (META) ad budget from DTC brands, as they moved nearly “30% of their holiday spend.” DTC Brands have grown increasingly cautious about Meta’s signaling challenges, suggesting that Amazon’s ad business could be a critical underpinning in its recovery process.

However, despite a robust performance in the Black Friday-Cyber Monday weekend, investors’ focus has likely turned to how Amazon could navigate a hawkish Fed through 2023. Accordingly, retail sales data “fell in November by the most in nearly a year in a broad-based decline reflecting the strain of inflation and a shift toward spending on services.” Accordingly, consumers’ spending data showed less expenditure on “holiday categories including electronics, clothing and sporting goods.”

We assess that it’s still too early to determine structural factors with the usually robust consumer spending data. However, despite that, AMZN’s stock price collapse has likely reflected a significant extent of ongoing weakness. Hence, we wouldn’t be unduly worried even if consumer spending data weakens further, as that’s in line with the Fed’s prognosis of a weaker economy in 2023, based on its revised summary of economic projections.

Fed Chair Jerome Powell and the FOMC’s hawkish stance through 2023 indicates that any expectations of a pivot are pre-mature. Notwithstanding, we believe that AMZN’s underperformance against the SPX since its November bottom suggests that some extent of its 2023 execution risks have likely been reflected.

Some investors could be inspired by Amazon’s recent forays into TikTok’s (BDNCE) arena with its “Inspire” feature, allowing users to “scroll as you roll,” in its bid to compete more aggressively in social commerce. However, before investors get overly excited about whether this platform could transform Amazon’s e-commerce fortunes, they need to consider whether it’s a dominant platform for Gen Z usage.

eMarketer aptly highlighted that investors need to temper their expectations about the potential success of Amazon retail’s latest offering. It accentuated:

Douyin and TikTok were entertainment platforms first that then turned strong levels of user engagement into a sales vehicle. Amazon, on the other hand, is a shopping platform first-meaning that people visit its site because they have a specific purchase in mind, not because they’re in the mood to scroll through a never-ending series of product videos. Amazon would be better off devoting its resources to improving the customer experience over social commerce features that are unlikely to drive significant revenue growth. – eMarketer

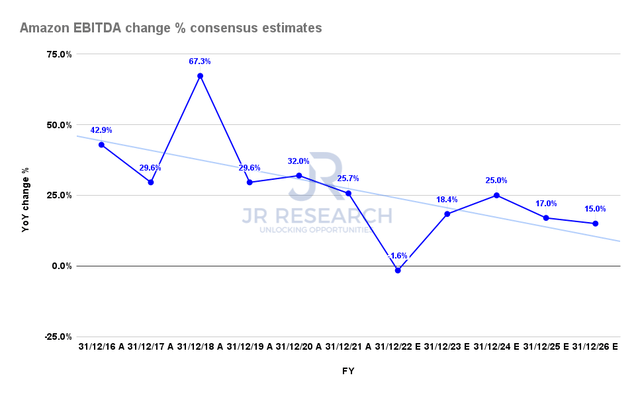

Amazon EBITDA change % consensus estimates (S&P Cap IQ)

Could AWS turn it around for Amazon in 2023? Unfortunately, it couldn’t do enough in 2022, as Amazon’s EBITDA is expected to fall by nearly 2% YoY, down significantly from 2021’s 25.7% uptick.

With less challenging comps from FY21’s malaise, investors could expect AWS to undergird the company’s recovery in its profitability in 2023. However, enterprise spending would likely continue to be parsed carefully by the C-suite through 2023, as we could potentially enter a recession (our base case).

Hence, even JPMorgan (JPM) highlighted that its Q4 estimates on AWS could be “optimistic,” as a weaker economy could hurt its growth further. Despite that, we believe AWS remains the company’s most promising driver to undergird its recovery, strengthening its competitive position against Microsoft Azure (MSFT) and Google Cloud (GOOGL) (GOOG).

Notably, AWS unveiled its latest Graviton chips, improving its IaaS edge further as part of its infrastructure advantage against its hyperscaler peers. Amazon is protecting its competitive edge and market share against its arch-rivals with new chips that could help them save more on compute costs. Given worsening macro headwinds and enterprise budgets getting scrutinized, it could proffer AWS a critical advantage.

Moreover, The Information reported recently that Microsoft’s software bundling strategy is getting pushed back, mitigating one of its strategic SaaS advantage against AWS’ infra-led push. Hence, we believe there could be upside surprises for investors if Amazon could help its customers lower their cloud computing costs constructively, given worsening macro headwinds.

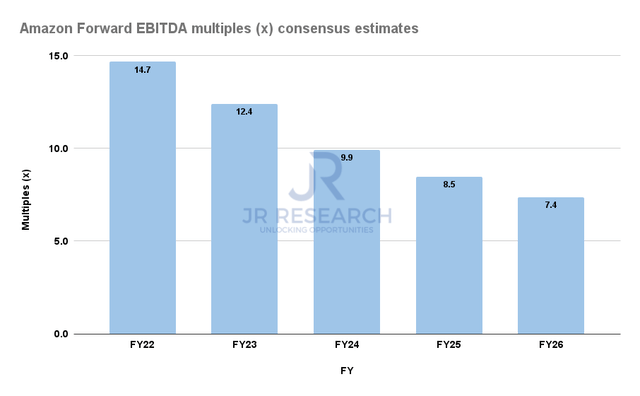

AMZN last traded at an NTM EBITDA multiple of 13x, well below its 10Y average of 22x, and under the two standard deviation zone of its 10Y average.

Hence, there’s little doubt that AMZN’s valuation has been significantly battered, as the market priced in its weak execution in 2022 astutely.

But could there be more pain ahead for AMZN?

AMZN Forward EBITDA multiples consensus estimates (S&P Cap IQ)

AMZN’s forward EBITDA multiples suggest that Street analysts have penciled in a marked recovery in its profitability growth prospects through FY26. Accordingly, based on its FY24 EBITDA multiple of 10x, we believe AMZN seems undervalued.

However, it depends on whether AWS could recover its operating leverage, which surprised to the downside, as discussed in our previous article. With Amazon running much lower retail margins relative to AWS, it’s imperative for Amazon to recover its operating leverage quickly to justify its valuation.

Investors should note that Amazon’s e-commerce peers posted an NTM median EBITDA multiple of just 8x. Hence, investors are urged to assess its cloud computing business closely, as it could determine the pace of its recovery through 2023.

Our price action analysis suggests that investors should not rule out a re-test of its COVID lows. The market appeared ready to digest its growth premium further, likely anticipating a relatively tepid Q4 earnings card.

However, we view a potential re-test constructively, which could help form its eventual bottom before staging a potential bullish reversal toward a medium-term recovery.

Maintain Buy, but as always, layer in over time.

Disclosure: I/we have a beneficial long position in the shares of AMZN, META, MSFT, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!