Summary:

- Tesla is expanding their product offerings.

- There are numerous potential positive and negative impacts for 2023.

- The Inflation Reduction Act may provide a $7,500 incentive on some vehicles beginning on 1/1/23.

- TSLA trends in EPS, P/E Ratio, and Operating Margin provide good indications for stock price appreciation.

- Even if TSLA’s stock price only moves from $158.00 to $160.00 by June 16th, a 38.6% potential annualized return is possible, including a covered call premium.

Sjo/iStock Unreleased via Getty Images

Investment Thesis

Tesla (NASDAQ:TSLA) should see higher stock prices due to expanded product offerings and production capacity, plus a possible $7,500 incentive. TSLA can provide an excellent return from the covered call premium even if the stock does not move much.

Tesla

Global deliveries in 2021 were a little over 936,000 units. The 2021 breakdown of Tesla’s total revenues by country were U.S. (44.5%), China (25.7%), and Other (29.8%). Tesla has ambitious growth plans, but the output may be restricted by global semiconductor shortages and supply chain issues, at least in the near term.

Its stores do not carry extensive inventories, and many customers choose to customize their vehicles. Tesla has four reportable segments: Automotive sales (84.7% of total 2021 revenues), Automotive Leasing (3.1%), Services & Other (7.1%), and Energy Generation & Storage (5.2%).

TSLA has annual sales of $74.8B with 99.3K employees. They are 44.7% owned by institutions, with 3.0% short interest. Their return on equity is 28.1%, and they have a 25.0% return on invested capital. The free cash flow yield per share is 1.6%, and their buyback yield per share is 0.0%. Their Piotroski F-score is eight, indicating strength. They have a price-to-book ratio of 12.5.

Potential Positive Impacts For 2023

- Tesla is expanding their product offerings. The first deliveries of the Semi were achieved on December 1, 2022, which should be followed by the Cybertruck (late 2023), Roadster, and Optimus robot. The Cybertruck is believed to have reservations of more than 1.5 million. Eventually, Tesla will roll out more affordable sedans and SUV platforms in the coming years.

- Tesla recently opened new plants in Texas and Germany.

- TSLA is a big winner from the Inflation Reduction Act, as most versions of the industry’s two best-selling EVs (the Model Y and Model 3) will probably become eligible for the $7,500 federal EV tax credit, effective January 1, 2023.

- Tesla continually plans to reduce battery costs and boost vehicle range.

- China will reopen eventually.

- Gas prices are higher.

- Tesla has virtually no debt and continues to spend little to nothing on advertising.

Potential Negative Impacts For 2023

- Big automakers are introducing more and more EV vehicles at lower prices.

- A recession may temporarily reduce sales.

- Higher interest rates may temporarily reduce sales.

- Global semiconductor shortages and supply chain issues are improving, but the output may still be restricted.

- Elon Musk has sold over $23 billion in stock this year, presumably to fund Twitter, and he may sell more shares. (The Twitter impact on Tesla will probably fade, especially if a Twitter CEO is announced.)

- TSLA stock ownership is about 44% institutions, 16% insiders, and 40% retail investors, any of whom may not hold shares waiting for a rebound.

- Higher raw material, logistics, labor, and warranty costs may continue to be a headwind.

Q3 Quarterly Results

TSLA announced record Q3 earnings in their October 19th press release.

- Production of 365K vehicles

- Delivery of 343K vehicles

- Operating cash flow less Capex (free cash flow) was $3.3B

- Cash and marketable securities increased by $2.2B to $21.1B

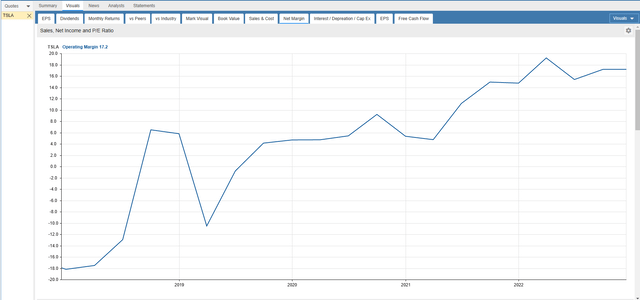

- Operating margin was 17.2%

- Revenue grew 56% vs. last year

Musk mentioned the following about growth on the conference call.

Actually, one caveat, I should say, is growing production by 50% every year because of deliveries — we’re trying to smooth out the deliveries and not have this crazy delivery rate at the end of every quarter, so. In fact, we’re just fundamentally running out of — there weren’t enough boats, there weren’t enough trains, there weren’t enough car carriers to actually support the wave because it got too big. So, whether we like it or not, we actually have to smooth out the delivery of cars intra-quarter because there aren’t just enough transportation objects to move them around.

Musk responded to questions about the product.

So, we’ll be handing over our first production Tesla Semis to Pepsi on December 1. I’ll be there in person.

Yes, exactly; very important, no sacrifice to cargo capacity, 500-mile range. To be clear, 500 miles with the cargo. Yes, 500 miles with the cargo on level ground. Yes, sure. Not up. It’s excellent. But the point is, it’s a long-range truck and even with heavy cargo. And the number of times people tell, no, you can’t — it’s impossible to make a long-range heavy-duty Class A truck. And then, I’ll ask, well, what are your assumptions about what hour kilogram and what hours per mile, and they look at me with a blank stare and then say hydrogen. I’m like, no, that’s not the answer; I was looking for numbers, literally. It’s not a number. It’s [indiscernible] table. You obviously don’t need hydrogen for heavy trucks.

And we’ll be ramping up Semi production through next year. As I think everyone knows at this point, it takes about a year to ramp up production. So, we expect to see significant — we’re tentatively aiming for 50,000 units in 2024 for Tesla Semi in North America. And obviously, we’ll expand beyond North America. And these would sell — I don’t want to say the exact prices, but they’re much more than a passenger vehicle. So, with a few thousand heavy trucks of this nature, it would be worth several Model Ys.

The 50,000-unit forecast for 2024 seems too aggressive. I suspect TSLA will trade above $160.00 in the next year or two, even if the truck forecast is too aggressive.

Good Technical Entry Point

The share price of TSLA traded at $158.00 on December 15th. I’ve added the green Fibonacci lines, using the high and low of the past five years for TSLA. It’s interesting to note how the market pauses or bounces off these Fibonacci lines. They can be one clue as to where the stock price may be headed. TSLA is slightly below the 38.2% Fibonacci retracement level but could go lower. However, I believe that TSLA will trade above $160.00 by June for the reasons in this article.

The fifteen most accurate analysts have an average one-year price target of $288.43, indicating an 82.5% potential upside from the December 15th trading price of $158.00 if they are correct. Their ratings are ten buys, four holds, and one sell. Analysts are just one of my indicators, and they are not perfect, but they are usually in the ballpark with estimates or at least headed in the right direction. They often seem a bit optimistic, so I suspect prices may end up lower than their one-year targets to be on the safe side.

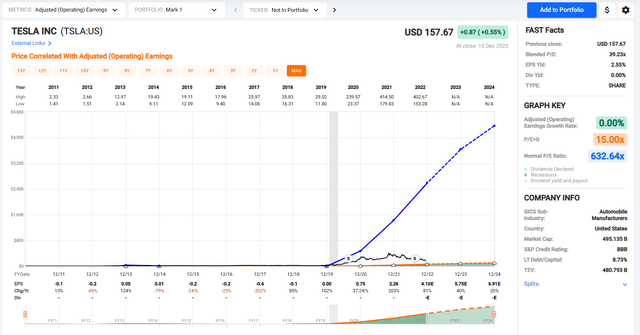

Trends In Earnings Per Share, P/E Ratio, And Operating Margin

The black line shows TSLA’s stock price for the past twelve years. Look at the chart of numbers below the graph to see that TSLA adjusted earnings were $0.00 in 2019, $0.75 in 2020, and $2.26 in 2021. They are projected to earn $4.10 in 2022, $5.75 in 2023, and $6.91 in 2024.

The P/E ratio for TSLA is currently very high. If TSLA earns $6.91 in 2024, the stock could trade at $160.00 if the market assigns a 23.1 P/E ratio. Tesla’s growth rate is so strong that it would not surprise me to see TSLA trading above $160.00 a year or two from now.

TSLA’s operating margin has been increasing for the past five years.

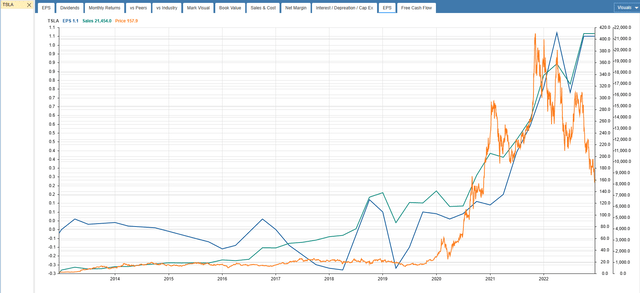

The stock price has not yet caught up with the increasing sales and EPS.

Sell Covered Calls

My answer to uncertainty is to sell covered calls on TSLA six months out. TSLA traded at $158.00 on December 15th, and June’s $160.00 covered calls are at or near $28.60. One covered call requires 100 shares of stock to be purchased. The stock will be called away if it trades above $160.00 on June 16th. It may even be called away sooner if the price exceeds $160.00, but that’s fine since capital is returned sooner.

The investor can earn $2,860 from call premium and $200 from stock price appreciation. This totals $3,060 in estimated profit on a $15,800 investment, which is a 38.6% annualized return since the period is 183 days.

If the stock is below $160.00 on June 16th, investors will still make a profit on this trade down to the net stock price of $129.40. Selling covered calls reduces your risk.

Takeaway

TSLA should see higher stock prices due to expanded product offerings and production capacity, plus a possible $7,500 incentive. Even if TSLA’s stock price only moves from $158.00 to $160.00 by June 16th, a 38.6% potential annualized return is possible, including the covered call premium.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.