Summary:

- I have previously argued that Amazon would need more operating discipline to build a sensible business model in the e-commerce business.

- Although I appreciate the recently communicated efforts surrounding cost optimization, I don’t believe the impacts are enough to justify a more bullish outlook.

- Given a slowing demand environment, expanding profitability may be difficult even under the consideration of a successful cost optimization.

- As long as Amazon fails to report material improvements in operating profitability, I expect AMZN shares to be under pressure.

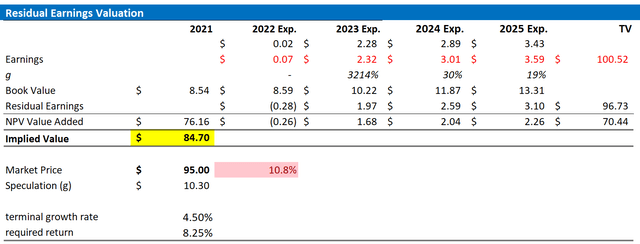

- On the backdrop of minor EPS adjustments I raise my target price to $84.70 share, versus $83.37 prior. But I reiterate my ‘Sell’ rating.

4kodiak/iStock Unreleased via Getty Images

Thesis

I have previously argued that Amazon (NASDAQ:AMZN) is overvalued as compared to fundamentals and highlighted that the company would need more operating discipline to build a sensible business model in the e-commerce business.

Although (as an investor) I appreciate the efforts surrounding job cuts and logistic footprint optimization, I don’t believe the impacts are enough to justify a more bullish outlook – especially considering that any cost optimization benefits are likely offset by a slower demand environment.

For reference, Amazon stock has significantly underperformed the market YTD, being down approximately 45%, versus a loss of 16% for the S&P 500 (SPY).

Seeking Alpha

On the backdrop of minor EPS adjustments I raise my target price to $84.70 share, versus $83.37 prior. But I reiterate my ‘Sell’ rating.

Cost Optimization Is Necessary

For a long time investing in Amazon was all about growth, and market participants didn’t really care about the e-commerce giant’s anemic profitability. However, as a consequence of rising interest rates and macro-challenges, sentiment changed rapidly and aggressively in 2022.

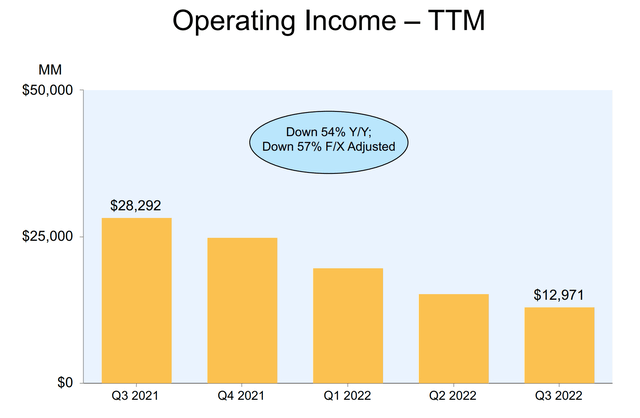

Investors took note – and also started to care – that Amazon’s operating profitability in 2022 (TTM reference) contracted by 54% as compared to the same period in 2021. Adjusted for any currency exposure the loss of operating profitability would be even more significant – 3 percentage points more.

Amazon’s Q3 2022 Reporting

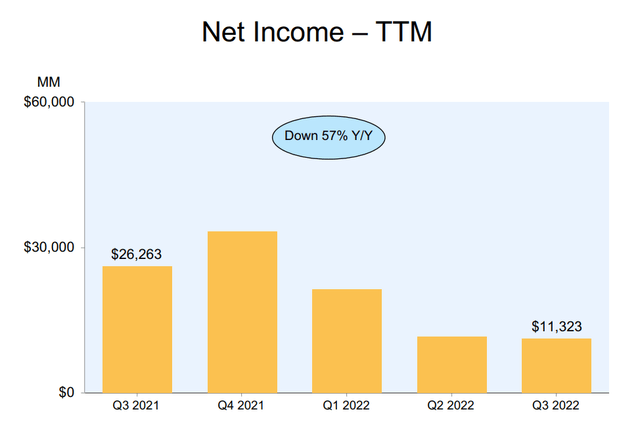

Amazon’s net income for the trailing twelve months is only slightly above $11 billion. For reference, Amazon’s market capitalization is currently valued at $950 billion.

Amazon’s Q3 2022 Reporting

Moreover, investors should consider that almost the entire profit is supported by Amazon Web Services, while the retail business operates with a negative operating margin. For reference, here are the Q3 numbers:

- North America segment operating loss was $0.4 billion, compared with operating income of $0.9 billion in third quarter 2021.

- International segment operating loss was $2.5 billion, compared with operating loss of $0.9 billion in third quarter 2021.

- AWS segment operating income was $5.4 billion, compared with operating income of $4.9 billion in third quarter 2021.

Responding to such disappointing numbers, management (unsurprisingly) communicated the possibility of cost optimization efforts.

Our senior leadership team regularly reviews our investment outlook and financial performance, including as part of our annual operating plan review, which occurs in the fall each year …

… As part of this year’s review, we’re of course taking into account the current macro-environment and considering opportunities to optimize costs.

According to various reports, Amazon expects to cut about 10,000 jobs, which represent approximately 3 per cent of the company’s corporate workforce. Moreover, the e-commerce giant has estimated that capital expenditure on e-commerce infrastructure will likely be approximately $10 billion lower in 2022 as compared to 2021.

Although necessary and appreciated (from an investor’s point of view), the announced cost savings program might not be enough to materially improve Amazon’s profitability. I would like to point out that the e-commerce giant’s workforce is estimated at around 1.5 million, the majority of which are working in warehouses and other logistics facilities. These workers are notoriously important for Amazon’s business model – and accordingly very hard to lay off. In fact, not only do I doubt that Amazon will achieve material cost savings in the retail business, I argue that the cost basis could even increase, as inflation pressures for higher wages. According to Bloomberg reporting, labor unions are already planning to ‘stage walkouts over pay and conditions’.

Slowing Demand Amplifies Profitability Concerns

Amazon’s cost pressure are amplified by growth concerns caused by a slowing demand environment, which makes expanding profitability difficult even under the consideration of a successful cost optimization.

Headwinds related to the macro environment are well noted by the market. However, I believe investors might underappreciated the ‘structural’ consideration that Amazon’s retail expansion might be approaching market saturation.

For reference, after an impressive expansion during the pandemic in 2020 and 2021, Amazon’s e-commerce sales have slowed aggressively in Q1, Q2, and Q3 of 2022 – intermittently even recording negative growth. Reflecting on these developments, Amazon’s second Prime Shopping Day in October could certainly be considered an attempt to prop up numbers.

But still, I would like to point out that Amazon’s Q4 sales guidance was very disappointing: the company expects revenues for the period to be only $140 billion and $148 billion, which is as much as $15 billion lower than the median analyst estimates of $155 billion. Operating income for the December quarter is expected to be around $4 billion, which is approximately $1 billion below consensus.

Still Expensive – Raise Target Price

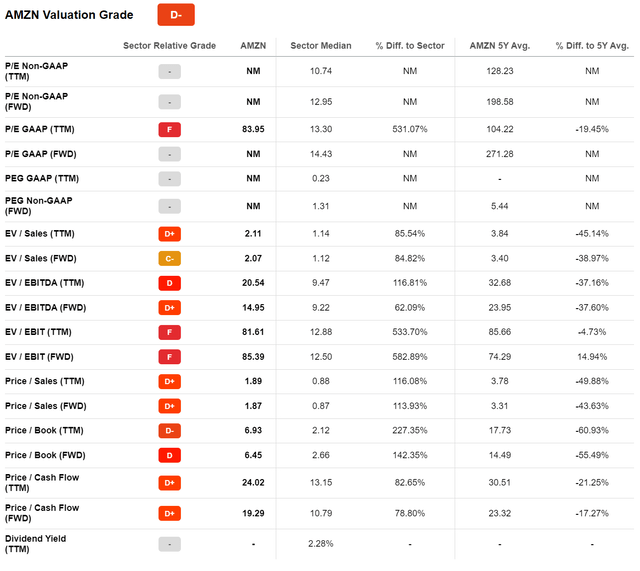

Considering Amazon’s multifaceted challenges, the stock is still trading very expensive. According to data compiled by Seeking Alpha AMZN is currently priced at a one year forward EV/Sales of approximately 2.1x and an EV/EBIT of about 85.5x. As compared to the relevant sector median, these multiples are at a premium of about 84% and 580% respectively.

Seeking Alpha

Although I slightly upgrade my EPS expectations for Amazon (to show appreciation for the company’s cost cutting ambitions), I still find it very hard to believe that Amazon’s almost 50% sell-off from all-time highs provides a buying opportunity as compared to fundamentals.

Personally, I calculate a fair implied share price of $84.70 (versus about $83.37 prior)

Author’s EPS Expectations

Conclusion

Due to low profitability, I have previously argued that investor sentiment towards Amazon stock might assume a more bearish color.

… For a long time, investors did not really care about AMZN’s profitability. In fact, as I understand it, it has for a long time been a meaningless metric for Amazon, as the company almost appeared proud of the fact when they recorded negative earnings. Investors have been conditioned to accept it. But as recessionary conditions are biting, and investors will undoubtedly demand more discipline, Amazon’s lack of profitability focus may prompt a repricing of the stock – lower.

Although the argument is slowly playing out, and Amazon has started to respond with cost savings programs, I don’t believe that the thesis has been appreciated sufficiently.

Investors should consider that Amazon is a CAPEX intensive business model with low operating margins. (I do not think that Buffet would approve such a combination). As long as Amazon fails to report material improvements in operating profitability, I expect AMZN shares to be under pressure. And as a consequence, I reiterate a “Sell” rating for Amazon stock, although I slightly raise my base case target price to $84.70 from $83.37 prior.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: not financial advise