Summary:

- The Battle of Safe Havens is heating up, with all participants moving up over the last couple of months or so.

- In this note, I’ll share my updated view on the Apple vs. Microsoft vs. Treasury bonds debate.

- With the bond market and Q3 reports pointing to an earnings recession, I continue to remain somewhat bearish on Apple and Microsoft due to their premium valuations.

- While buying long-term treasuries for price appreciation ahead of a recession is a sensible move, I continue to prefer short-term treasuries, with the capital being earmarked for buying a potential crash in equities next year.

- In a nutshell, I prefer near-term bonds to park my cash (earmarked for future equity purchases). Also, I rate Apple and Microsoft “Neutral/Avoid/Hold” at current levels.

Diy13/iStock via Getty Images

Introduction

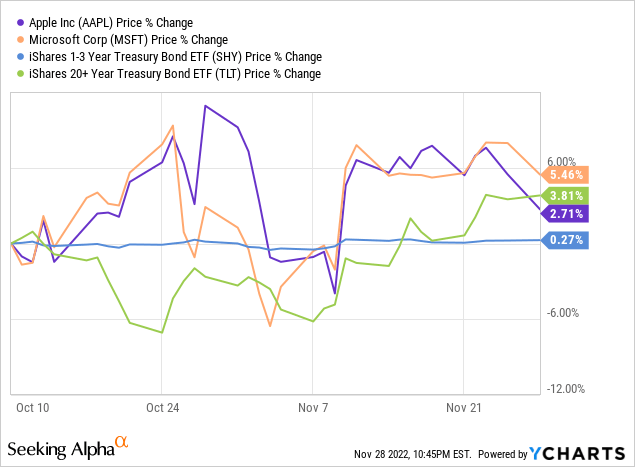

Since my last update on the “Battle of Safe Havens” on 10th October 2022, Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), and Treasury bonds have all risen in value, with interest rates receding somewhat in recent days as inflation shows signs of cooling off.

Before we review the current state of the battle of safe havens, I strongly recommend you go through my past coverage of this debate (if you haven’t done so already):

- Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens

- Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens Round-2

- Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens Round-3

Alright, let’s get started!

What Is The Market Telling Us?

There’s a famous saying in the market – “Don’t fight the tape”, which means traders/investors should not bet against the market trend. As a long-term investor, I couldn’t care less about Mr. Market’s short-term shenanigans; however, I do like to analyze market action from time to time as that allows me to optimize my investing operations.

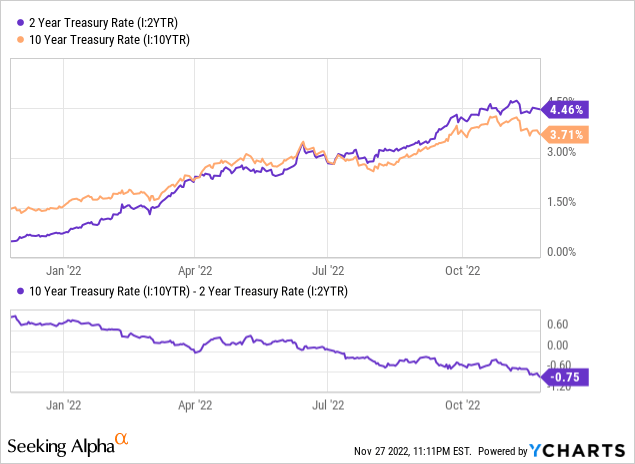

As you may know, the Fed has been aggressively raising interest rates this year. Consequently, the yield curve inverted back in July, and this inversion has been getting broader. Now, an inverted yield curve is generally viewed as the bond market telling us – “a recession is coming”. And when the bond market says something, investors should listen; after all, the notional value of debt markets in the US is twice as much as the equity markets.

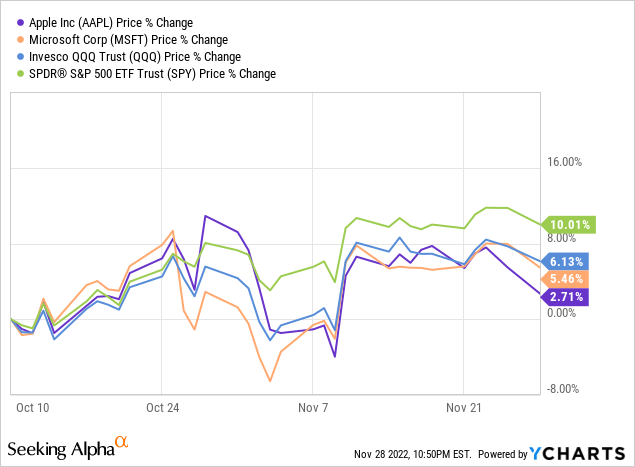

While the bond market is busy screaming the R-word, equities are rallying like there’s no tomorrow! Since hitting new lows for 2022 in mid-October, major equity indices have been on a tear higher, with S&P 500 (SPY) up ~10%. However, the tech-heavy QQQ ETF (QQQ) is up only ~6%.

Clearly, technology stocks are faring worse than the broader market. Over the last fourteen years or so, tech stocks have been leading the bull market, but market generals like Apple and Microsoft are now turning into relative underperformers. Yes, a couple of months do not make a trend; however, I think there’s sound logic behind this relative underperformance.

Why Are The Tech Generals Faltering?

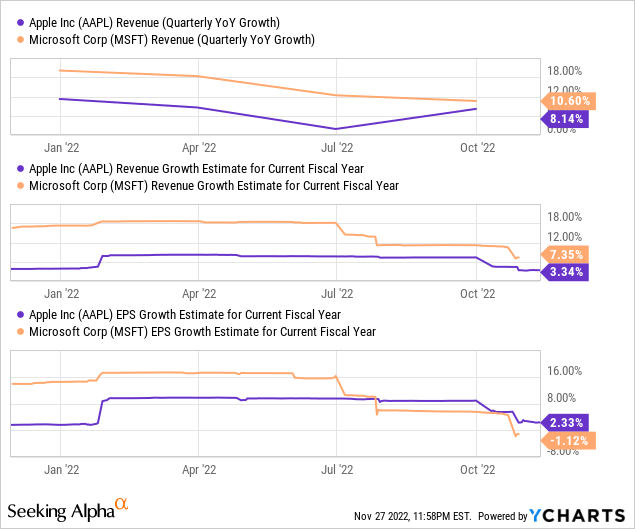

For starters, Apple, Microsoft, and most other mega-cap tech names are seeing a massive growth slowdown. And some of them are already in an earnings recession, as evidenced by the Q3 quarterly reports.

| PE ratio | Forward-PE Ratio | Q3 Y/Y Revenue Growth (%) | Q3 Y/Y EPS Growth (%) | |

| Apple | 23.6x | 23.1x | +8.14% | +4.03% |

| Microsoft | 26.05x | 25.36x | +10.60% | -13.28% |

Source: What Is The 2023 Forecast For Tech Stocks? (Data as of 27th Nov)

A strong dollar is definitely hurting these global technology giants, but don’t let those less-worse-than-feared constant-currency numbers fool you. Amid a challenging macro environment, the business momentum for tech generals like Apple and Microsoft is slowing down, and we may still have a ways to go.

As you may know, Apple is facing production woes in China, which could create an iPhone volume shortfall of ~5-10%, maybe even more – depending on the protests at Foxconn’s facility in Zhengzhou, China. Further, Microsoft is struggling with a significant slowdown in PC markets, and cloud growth is decelerating too.

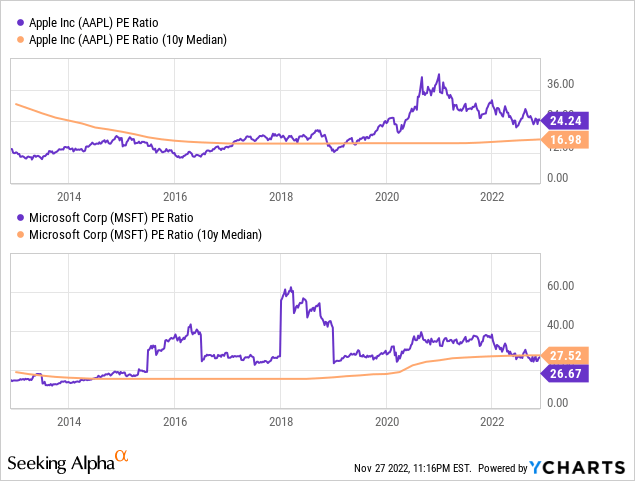

While Apple and Microsoft are losing business momentum, their stocks continue to trade at premium valuations of ~25x P/E. To provide some context, Apple and Microsoft have traded at ~10-30x P/E throughout the 2010s, and the long-term trading multiple for S&P-500 is ~15-16x.

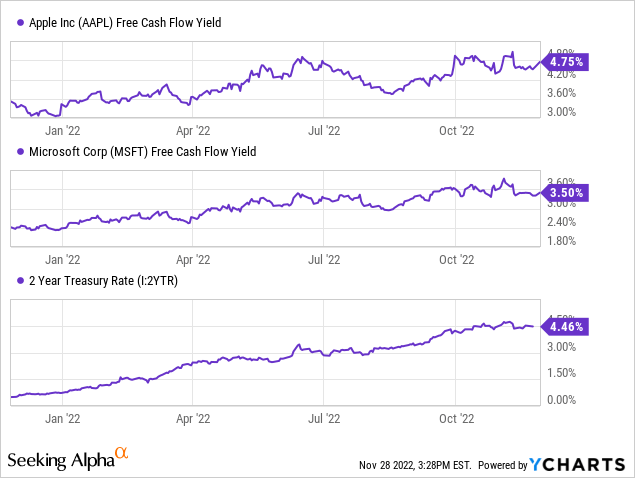

Considering the fact that we are no longer operating in the era of free money, Apple and Microsoft’s stocks offer little to no margin of safety at all. With the 2-Year Treasury Rate at ~4.5%, the equity risk premium on offer from Apple (FCF yield: 4.75%) and Microsoft (FCF yield: 3.5%) is non-existent!

At TQI, we own a little bit of both Apple and Microsoft within our Buyback-Dividend portfolio; however, we are not adding more capital to these names despite a large cash (treasury) position of ~50% of AUM. And here’s why:

| TQI’s Fair Value Estimate | Current Price | Upside (+) / Downside (-) | |

| Apple | $105.98 | $148.11 | -28.44% |

| Microsoft | $156.27 | $247.49 | -36.85% |

Source: Author’s SA Marketplace – The Quantamental Investor

According to TQI’s Valuation Model, both Apple and Microsoft have ~30-40% downside from current levels, and we haven’t accounted for a recession. In my view, the risk/reward for a near to medium-term investment in Apple and Microsoft is highly unfavorable right now.

That said, I think Apple and Microsoft are good long-term DGI investments, but we should see far better prices in 2023.

Final Thoughts

Here’s the call I made in early to mid-October:

In the “Battle of Safe Havens”, cash has been the winner so far; however, surging treasury rates are making treasury bonds a viable alternative to equities. If I had to choose between Apple, Microsoft, and the 2-yr treasury bond, I would go with the 2-yr treasury bond for the medium term.

And for now, I am sticking with this call. With the Fed still planning additional rate hikes, I like the idea of buying short-term treasuries over long-term bonds, Apple, and Microsoft to ride out an inevitable economic recession.

Key Takeaway: I continue to rate Apple and Microsoft “Neutral/Avoid” at current levels.

Thanks for reading, and happy investing. Please share your thoughts, questions, and/or concerns in the comments section below.

Disclosure: I/we have a beneficial long position in the shares of AAPL, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our marketplace service – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

TQI’s core idea is to generate wealth sustainably through tailored portfolio strategies that meet investor needs across different investor lifecycle stages. Each of our five model portfolios comes with thoroughly vetted investment ideas, embedded risk management, and specialized financial engineering for alpha generation.