Summary:

- Buying stocks in companies we know and use may not always apply.

- Law of large numbers applies to every company, even Amazon.com, Inc.

- A mature company is not necessarily a bad investment, but price is key.

- PEG is the key metric for stalwarts, especially ones that don’t pay dividends.

HJBC

Seeing this article trending on Seeking Alpha brought back memories of listening to (on Audible) one of my first books on investments, “One Up on Wall Street” by Peter Lynch. The article in question, on Tesla, Inc. (TSLA), is an interesting read, although I am not sure I look at Tesla as a “10 bagger” anymore. But the article did get me thinking on the fallacies of using famous and generally well-accepted principles on the wrong stocks at the wrong time, which is the theme of this article.

- Principle: Buying shares in companies that you know and use.

- Made Famous By: Peter Lynch

- Ticker Covered: Amazon.com, Inc. (NASDAQ:AMZN)

Why Amazon?

It may be hard, if not impossible, to find a more polarizing stock than AMZN on Seeking Alpha. The bulls love their Amazon (with a heavy dose of hindsight bias) while the bears pull up numbers faster than Pythagoras may have in the “Before Common Era” days. Sometimes, I wonder if the love-hate relationship is down to the difference between “Amazon” and “AMZN.”

That is, consumers see hundreds and maybe thousands of those “A to Z” trucks driving around and hear “AWS” more often than they could count. But, those are all about “Amazon,” the company. Will that necessarily translate into good returns here on for “AMZN,” the stock? (For the rest of the article, please note when I say “Amazon,” I mean the company. “AMZN” strictly refers to the stock).

The Dichotomy

In his book, “One Up on Wall Street,” Lynch talks about how he (and his fund) benefitted from buying shares in companies that he and his close affiliates were familiar with. More specifically, Mr. Lynch benefitted from his wife’s personal experience as a consumer of the wildly successful L’eggs stockings, as he bought shares of Hanes, then a publicly traded company.

But, when you are everywhere, doing everything, the question “What next?” is natural. At the same time, when you have an ecosystem as powerful as Amazon’s, the “What next” may not matter as much if the company leverages its existing resources towards better profitability. I will present two powerful reasons in favor of Bulls and two in favor of Bears. I conclude the article with my thoughts on how to best handle “AMZN” over the next few years.

The Bulls Say

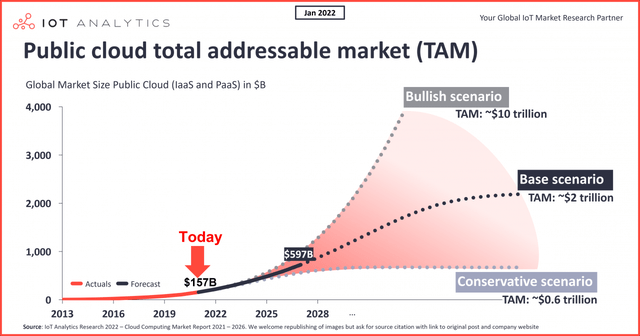

- Cloud – Scratching The Surface: Yea, would you believe that? The Total Addressable Market (“TAM”) for Public Cloud is expected to reach $2 Trillion as the base case in the future. As a reminder, AWS’ revenue in 2022 was a paltry (in comparison to TAM) $80 Billion. So, by this potential, Amazon and the rest of the cloud players could potentially be scratching the surface of a golden goose that is profitable today alright but one that could lay 10 times the eggs in the future.

Cloud TAM ( (iot-analytics.com))

- Advertising: One of the few positives in Amazon’s recent quarterly results was the company’s growth in advertising revenue. The ad business brought in $11.6 Billion in revenue in the fourth quarter and that represents a 19% increase YoY. It is hard to believe but advertising is already the fourth largest segment in terms of revenue behind e-commerce, third-party sellers, and AWS. Amazon is the strong and peppy challenger to powerful incumbents Alphabet Inc. (GOOG) and Meta Platforms, Inc. (META) and is bound to take some share off of the established players over time.

Amazon Revenue Split (fourweekmba.com)

The Bears Say

- Valuation: Any bear case for AMZN starts and almost ends with valuation. I mean, how can a company that has been operating as a public company for more than 25 years still be investing for future growth, forsaking profits. Despite falling nearly 50% from its all-time high of $186, AMZN is still trading at a forward multiple of 67.

- Competitive Landscape: As shown in the revenue chart above, Amazon is enjoying first-mover advantage in some while it is enjoying the sprightly-new comer status in the others. But the common theme is, every single segment is crowded with powerful names. When everything you do is commoditized as more players enter, your margin and volume are both bound to be under pressure. I don’t think we need further explanation here beyond listing out the names below.

What Do All These Mean For Investors?

I believe AMZN is entering a phase where it will be a terrific “rangebound” stock to trade around market and stock sentiments. Bulls and Bears will both have the chance to win a few as long as they understand they cannot win it all. Amazon’s future prospects are not as unquestionable as in the past any more to warrant ridiculous multiples.

Does that make the stock an outright sell? Not for me, as the market tends to overshoot on both sides. As an example, Meta Platforms Inc. has nearly doubled since November 2022 and that is a company with more fundamental challenges than Amazon. I am not saying AMZN will double from here given the company’s size, but it will present profitable opportunities to trade. If you believe AMZN is only on a downward spiral here, just imagine any of the following:

- An AWS spin-off

- More cost cutting efforts (especially in retail)

- Jeff Bezos returning in some capacity.

All these are conjectures but well within the realm of possibility.

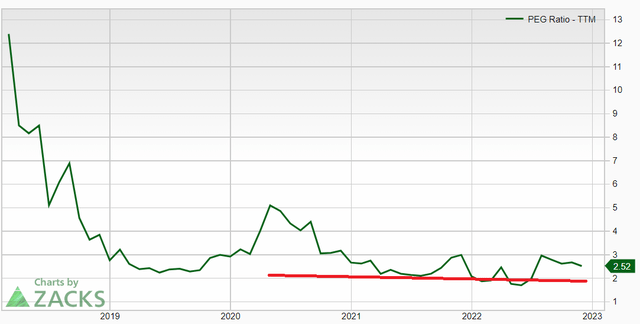

But, what is that trading range I am talking about? How to find it? Well, let’s get back to Peter Lynch for answers. Lynch called companies like Amazon as “Stalwarts.” That is, well-established and stable companies that still offer long-term growth opportunities. Lynch’s key metric to buy stalwarts is based on Price-Earnings/Growth ratio, popularly known as PEG. The chart below shows AMZN’s PEG over the last five years. In hindsight, those were some egregious valuations, buoyed by a combination of Fed’s Zero Interest Rate Policy (“ZIRP”), Jeff Bezos’ hold (or charm) on Wall Street, and the allure that Amazon could never do anything wrong.

AMZN Historical PEG (Zacks.com)

But that trend has likely reversed forever, as shown by the red line above. As things stand now, the fact that the PEG is ~ 1.50 while forward estimates have been falling is a good sign that AMZN is not all that overvalued here. Valuation matters. But given the company’s general clout, I expect the stock to almost always trade at a slight premium (say PEG between 1.5 and 2).

Conclusion

I am leaving you with a little table that you can plug and play on your spreadsheet. All you need to monitor are:

- current share price

- forward multiple (current share price divided by forward EPS)

- expected earnings growth rate -I tend to use the average expected over the next five years

- PEG – forward multiple divided by expected earnings growth rate.

Obviously, forward EPS and expected earnings growth rate are both estimates and can be susceptible to the whims of the company, market, and analysts. Feel free to build in your own margin of safety by discounting the growth rate. For example, Amazon at $100 with an expected earnings growth rate of 42%/yr over next five years is a moderate buy for me with a PEG of 1.50. Now, should Amazon go to $80 with estimates remaining the same or going up, it’d present a back-up your truck moment while the stock going up in vacuum with numbers (earnings and multiple) going the other way is a clear sign to lock in the profits.

To conclude, I believe Amazon is entering a phase of its business where AMZN stock is likely to be rangebound for a while. PEG is one of the best known metrics to use when evaluating stalwarts that don’t pay a dividend, as the dividend discount model or base-yield calculations (think a stalwart like Coca-Cola (KO)) don’t apply. While Lynch’s “buy what you know” may not apply to AMZN anymore, his method to evaluate stalwarts (adjusted a bit for today’s conditions) still stands the test of time.

Disclosure: I/we have a beneficial long position in the shares of AMZN, TSLA, META, GOOG, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.