Summary:

- AWS high sales growth and profit margins will continue to increase overall profitability.

- Emerging market maturation will lift international profitability.

- Third-party seller services will boost margins, particularly as fulfillment pressures subside.

- Moderating shipping costs will expand gross profit margin.

THEPALMER/E+ via Getty Images

Thesis

Amazon (NASDAQ:AMZN) exhibits competitive advantages across a variety of its businesses. As a result of investing heavily over more than two decades to solidify its favorable position, the company is likely to expand profits significantly over the next several years. High margin services, such as advertising, that leverage existing capabilities or infrastructure are growing at a faster rate than lower margin product sales, such as those from Whole Foods. Loss leading offers, such as sports coverage to boost Prime memberships, are likely to dwindle. Capital expenditures in both digital and physical infrastructure should continue to moderate after the pandemic boom. Lastly, labor compensation will stabilize as both hiring and inflation slow.

The following sections dissect factors that are likely to drive higher margins in the future:

- AWS high sales growth and profit margins will continue to increase overall profitability

- Emerging market maturation will lift international profitability

- Third-party seller services will boost margins, particularly as fulfillment pressures subside

- Moderating shipping costs will expand gross profit margin

Competitive advantages, future margin expansion, and relatively low valuation on a historical basis make Amazon worth holding. Since the company has innovated multiple new product categories whose market size and rate of adoption are uncertain, earnings and cash flow forecasts are likely to be speculative and inaccurate. As a result, the stock will remain volatile for the foreseeable future. However, Amazon will continue to be the leader in public cloud services, the largest web retailer, and one of the largest publicly traded companies. The wide moats associated with its businesses entail that risk-reward is skewed positively.

AWS

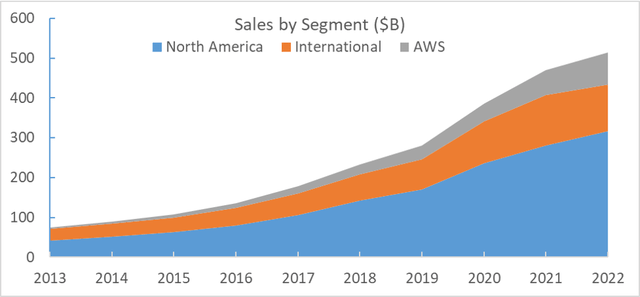

Since 2013, Amazon sales multiplied 6.9x from under $100B to over $500B. As shown in the table and chart below, although each division grew rapidly, AWS significantly outpaced the rest of the businesses.

|

International |

North America |

AWS |

Total |

|

|

Sales expansion |

3.9x |

7.6x |

25.8x |

6.9x |

Amazon 2013-2022 Annual Reports

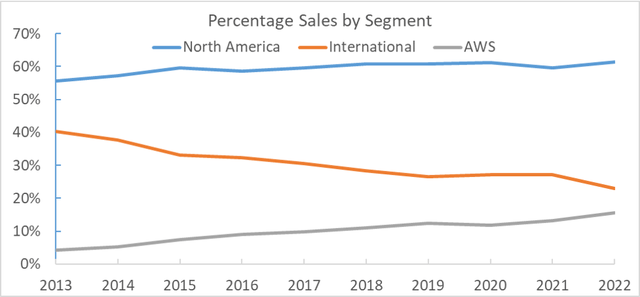

As a result of this massive growth, AWS increased from 4% to 16% of sales over this period. In contrast, International sales have fallen from 40% to 23%, and North America has remained relatively constant.

Amazon 2013-2022 Annual Reports

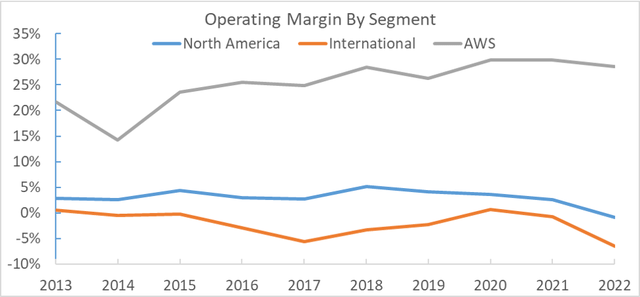

AWS is expanding its already high margins; whereas, the other segments have low margins that stayed relatively constant or decreased. As a result of these trends, Amazon margins should be pushed higher as AWS sales and margins continue to outstrip the other segments.

Amazon 2013-2022 Annual Reports

In the 2022 Q4 earnings call, management claimed that AWS year-over-year growth in dollars is still higher than any competitor and 90-95% of IT spending remains on-premises. Economies of scale should continue to drive corporate cloud adoption, and Amazon should continue to benefit the most as the market expands.

International

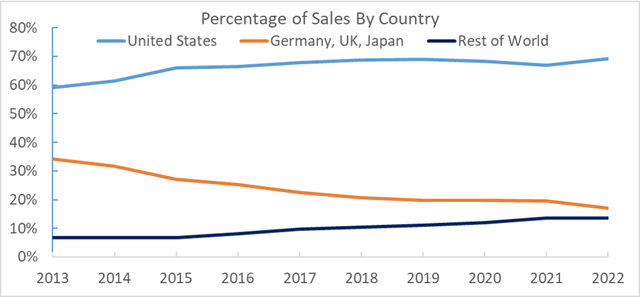

The chart below splits international sales into two buckets: 1) Germany, UK, and Japan; 2) Rest of the World. These roughly approximate developed (excluding the US) versus emerging markets. Emerging markets represent an increasing percentage of sales; whereas, developed countries’ share of sales is declining.

Amazon 2013-2022 Annual Reports

In the 2022 Q2 Earnings Call, management mentions that emerging economies such as India, Brazil, and the Middle East have much shorter operating tenures than the US. The company is still investing heavily to drive expansion in such areas as local language video content for Prime Video, payment methods, transportation services, and internet infrastructure. As these markets mature, the expenditures should decline and margins should improve. In summary, the combination of rapid sales growth and improving margins in emerging markets should enhance overall profitability in the long term.

Third-party Seller Services

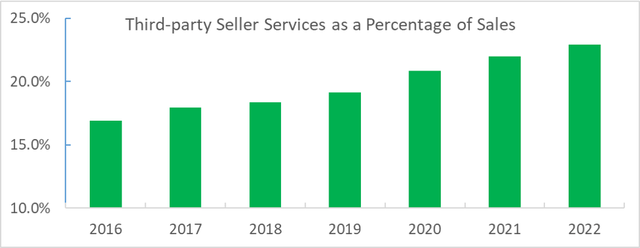

Third-party seller services have increased as a percentage of revenue since 2016.

Amazon 2016-2022 Annual Reports

Amazon accounts for the services it provides to third-party sellers on a net basis and includes commissions, fulfillment, and shipping fees. Since the third-party retains ownership of the inventory, cost of sales is lower than when Amazon is the seller; whereas fulfillment expenses will be a higher percentage of sales.

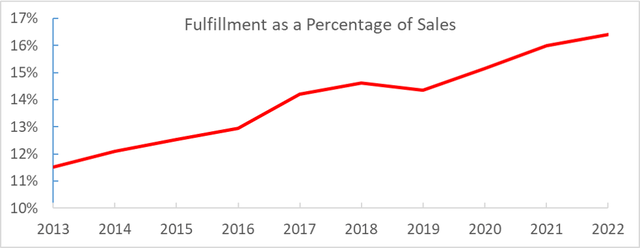

This partially explains why fulfillment expenses as a percentage of sales increased from 11.5% to 16.4% from 2013 to 2022. As the graph below shows, this metric appeared to level off around 14% in 2017 to 2019. The demand during the pandemic led to increased investment, higher wages, and less efficient operations. In the 2022 Q4 earnings call, management stated that the pandemic resulted in the fulfillment footprint doubling. The further costs increase in 2020 through 2022 reflects this. Going forward, fulfillment expenses seem unlikely to grow at the same rate as sales.

Amazon 2013-2022 Annual Reports

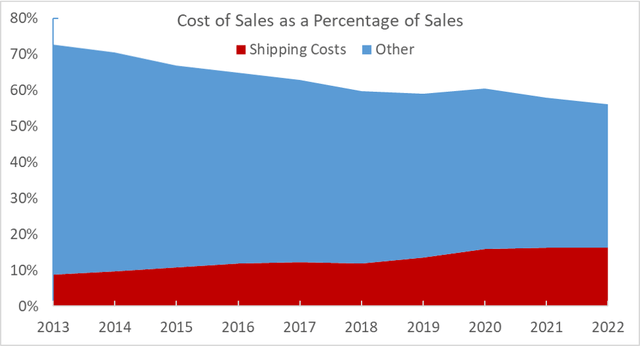

As will be seen in the next section, the increase of third-party sales has coincided with the decrease in cost of sales as a percentage of revenue. This trend is likely to continue and should increase margins in both the North America and International segments.

Cost of Sales and Shipping Costs

As mentioned in the previous section, third-party seller services should lower cost of sales as a percentage of revenue, and the following chart corroborates this. However, other parts of cost of sales area are increasing. These include shipping costs as well as certain digital media content costs such as video and music. Shipping costs have increased from 8.9% to 16.2% of sales from 2013 to 2022. In the 2022 Q4 earnings call, management indicated that their last-mile transportation network grew to approximately the same size as UPS during the pandemic.

Amazon 2013-2022 Annual Reports

These costs are likely to moderate in the long term for the following reasons:

- Amazon delivery services will mature and continue to replace third-party delivery services

- Third-party rates should decrease after pandemic and energy supply disruptions subside

- Amazon is unlikely to introduce additional disruptive shipping offers such as single day shipping

Short-Term Considerations

As discussed in the 2022 Q4 earnings call, high inflation and interest rates in the US have curtailed spending on goods, reduced ecommerce volumes, and lowered cloud spending in areas such as mortgage processing, cryptocurrency, and advertising. Amazon’s stock price decline last year accounts for these issues. However, Amazon is susceptible to a US economic downturn, and there are possible scenarios that the market may not have priced such as:

- Banks tightening business and consumer lending as defaults rise

- Further decreases in commercial, retail, and residential real estate prices

- Further increases in credit card and auto lending defaults

- Pullbacks in leverage loans, high yield, and commercial real estate debt

From a long-term perspective, Amazon is a Buy. However, there may be a significantly better entry point later this year. For this reason, Amazon is a Hold.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.