Summary:

- Amazon’s recent performance has spurred many different opinions, which is what makes the market.

- Some have said that it is no longer a growth stock.

- But sounding a transformative company’s death knell during severe headwinds may not benefit long-term investors.

- What do the numbers say?

ismagilov

Making the market

On any given day, we can find headlines that predict the demise of the market or massive gains incoming. Investors are starting to see Jerome Powell’s picture in their sleep. Primarily, these are meant to draw eyeballs and are of little use to long-term investors. This recent article discusses the need for focused goals and a cool head to maximize long-term profits.

But Seeking Alpha does things differently, making it valuable and unique. Contributors bring fresh ideas and unshackled assessments from the ground up. And different points of view make the market…well…a market!

Amazon is under fire – for a good reason

Amazon (NASDAQ:AMZN) has drawn praise and criticism for decades, which is heating up again. Some have gone as far as to say that this is no longer a growth stock, and its best days are behind it. But what do the numbers say?

To be clear, Amazon stock isn’t one of my highest conviction picks or near largest holding – but it is in the top ten.

Amazon has faced relentless headwinds for two years now, and forecasting its long-term demise during this time appears shortsighted. These headwinds include:

- Billions in costs from massive labor shortage;

- Logistical bottlenecks crimping profits;

- Record inflation and rock-bottom consumer sentiment;

- Skyrocketing CAPEX spending to keep up with growth;

- Foreign currency losses, an onrushing recession;

- and on and on.

With this perspective, it seems a significant accomplishment that the company grew the top line by 9% in 2022 (13% in constant currency).

We are here to talk growth, so let’s get to it.

The top line

Amazon’s sales were boosted significantly by the pandemic and the rush to the cloud. The top line has grown 83% since 2019 – more than:

- Google-parent company Alphabet (GOOG)(GOOGL) at 75%;

- Microsoft (MSFT) at 58% (FY 2019 to FY 2022);

- Apple (AAPL), Meta (META), Netflix (NFLX), and many more.

AWS

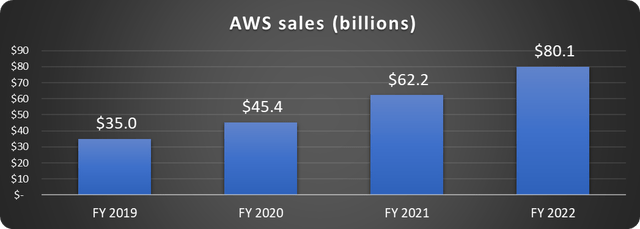

Amazon Web Services (AWS) has been the company’s crown jewel recently; however, headwinds are also hitting this sector.

Companies are scaling back IT spending in anticipation of a recession. Nevertheless, the total market is expected to double over the next five years, and Amazon holds 34% of it.

Growth in AWS slowed to 20% in Q4, but one quarter amid recession planning does not a long-term trend make.

Data source: Amazon. Chart by author.

We were spoiled by the jump in 2021 as companies took advantage of economic stimulus, but this segment is not in secular decline. A conservative 15% compound annual growth rate (slightly lower than the expected global market growth) would double revenue in five years and yield $32 billion in operating profits based on a conservative 20% margin.

Advertising

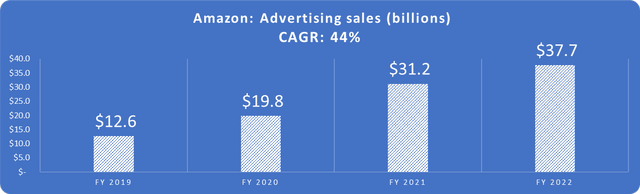

Companies need to maximize advertising efficiency in today’s economy. Wasteful mass advertising is on the decline, and targeted advertising is rising. This is why I am extremely bullish on The Trade Desk (TTD) and Google. Amazon ads are no different. Advertisers are directly reaching “ready-to-purchase” consumers with these spots.

Amazon didn’t even report advertising results separately until 2021. In 2022 they hit $38 billion in sales, or 7% of the total, as shown below.

Data source: Amazon. Chart by author.

And unlike retail sales, these have much higher margins.

Amazon Prime meet Buy with Prime

Subscription services thrive as customers see value in Prime services. Initiatives like broadcasting Thursday Night Football and the new Buy with Prime should continue to spur signups. Amazon reported more than 200 million Prime members in 2021, which is much higher now. In fact, dividing the $35 billion in 2022 revenue by the subscription price puts the number over 250 million.

Buy with Prime could be the next massive growth area.

Amazon.

Amazon is getting into the third-party logistics (3PL) game, and given its scale, it could make a significant splash. With Buy with Prime, retailers can place a Buy with Prime button ((shown above)) on their website allowing customers to purchase their goods through Amazon’s network.

Customers can use their Prime payment methods and get free two-day shipping and easy returns. The retailers get Amazon’s name recognition and let Amazon’s logistical network do the receiving, storing, and shipping of goods.

Retailers will pay Amazon fees for these services. Remember, many of these retailers already pay for other 3PL providers. Given its logistical efficiency, Amazon should be price competitive.

Amazon just opened Buy with Prime up to all interested retailers on January 31st, and the potential market here is enormous.

Not only will Buy with Prime generate revenue, but it will also boost Prime subscriptions.

Growth in the right areas

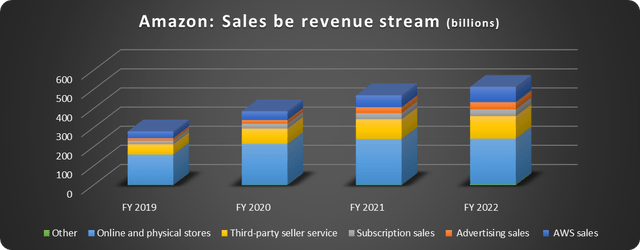

What some mistake for slowing growth is a transformation from a product-based to a service-based structure. Low-margin product sales are slowing, and Amazon is growing where it counts, as shown below.

Data source: Amazon. Chart by author.

Physical and online retail made up 56% of sales in 2019 but only 46% in 2022. This is extremely telling of where the future lies and would be even more pronounced were it not for the massive pandemic bump in retail sales. Amazon is not just an eCommerce retailer.

Meanwhile, Amazon stock is still trading like it’s 2019. This offers long-term investors a favorable risk-reward proposition.

Shareholders will probably see more turbulence in the short term as the headwinds aren’t over. But Amazon’s transformation is well underway, and the long-term profits could be terrific.

Disclosure: I/we have a beneficial long position in the shares of AMZN, TTD, GOOG, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors’ goals, financial situations, timelines, and risk tolerances vary widely. The stocks mentioned may not be suitable for all. As such, the article is not meant to suggest action on the part of the reader. Each investor should consider their unique situation and perform their own due diligence.