Summary:

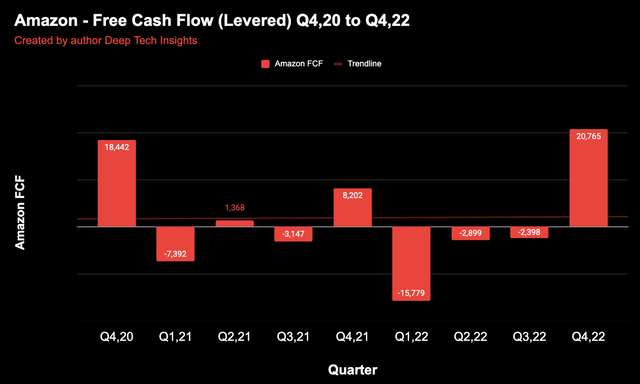

- Amazon’s free cash flow has improved massively from negative $15.48 billion in Q1 ’22 to positive $20.8 billion by Q4 ’22.

- On March 20th, Amazon announced a further 9,000 job cuts which I estimate will result in severance costs of ~$320 million.

- A positive is the company is undergoing a major restructuring and thus when the dust settles in H2 2023, Amazon should be leaner, and thus earnings are likely to improve.

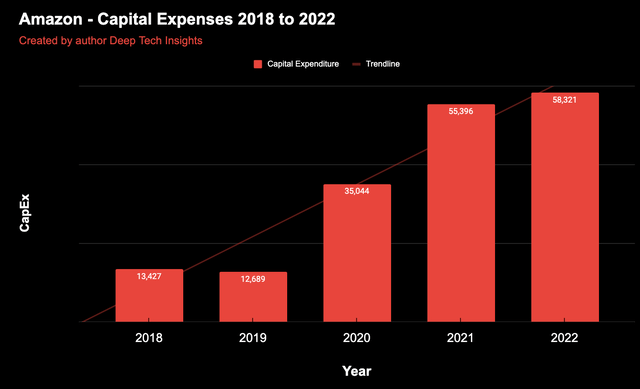

- Amazon’s capital expenditure looks to be now stabilizing, after a major 66.6% increase over a two-year period to $58.3 billion in 2022.

jetcityimage

Amazon (NASDAQ:AMZN) is the world’s largest e-commerce company. The business’s prior decade of dominance has been impacted by a number of headwinds driven a series of macroeconomic factors. However, now it looks as though the tide is turning as I see a few metrics which look to be turning around for Amazon. One factor is exchange rates (which impacted international revenue) and another is free cash flow which bottomed out in Q1 2022 but has been on an upward trend ever since. In this post, I’m going to break down the reasons AMZN stock could be the “Ultimate Turnaround” stock for late 2023 and into 2024. Let’s dive in.

Will Amazon Turnaround?

Revenue Slowdown to Potential Growth

Starting with revenue, Amazon reported revenue of $149.2 billion, which increased by just ~8.58% year over year. This was substantially slower than the 14.6% YoY growth rate reported in the third quarter of 2022. Now this “slowdown” was mainly impacted by foreign exchange rate headwinds, which caused international revenue to plummet by 8% year over year to $34.5 billion. If we zoom out, the USD to EUR exchange rate peaked at €1.03 to $1 in late September 2022 and fell throughout Q4 ’22 and into Q1 ’23. As the fall was gradual, Amazon would have only partially felt the benefit of this on its International revenue. However, in Q1 ’23, the starting point is lower which should be a positive for FX impact. Of course, geopolitical factors such as an end of the Ukraine war, could cause further strength in the euro which would be a positive sign for FX rates. As although, Ukraine uses a different primary currency (the hryvnia), many surrounding countries use the euro, and thus panic selling occurred as the war began. In the fourth quarter of 2022, Ukraine’s military managed to push Russian forces out of various occupied regions which was a positive sign. As the old saying goes, “what can’t go on forever must eventually stop”.

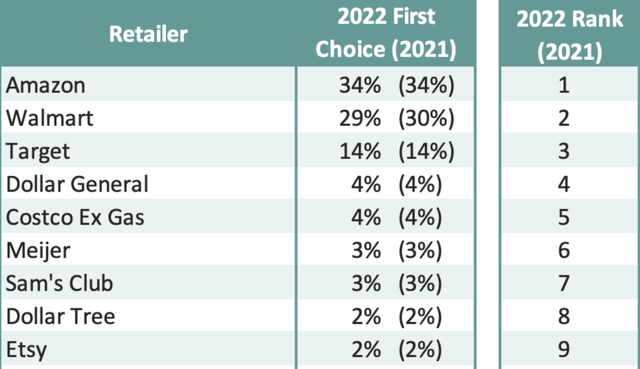

On a constant currency basis, Amazon reported total revenue growth of approximately 12% year over year in Q4 ’22. This was still ~2.7% slower than the growth rate reported in Q3 ’22. Of course, this is mainly driven by the “recessionary” environment, which is part inflation/interest rates and part psychological. Thus, this likely caused consumers to curb spending; of course, this would be partially offset by the boom in e-commerce sales throughout the holiday shopping season in Q4 ’22. For example, across the “Cyber 5” period between Thanksgiving and Cyber Monday, Amazon was reported as the number one retail company capturing 34% of the consumer wallet spend, in the general merchandise category for the U.S. This was in line with 34% in 2021 and thus it shows that Amazon’s market position is still unchallenging. With inflation on a downward trend, this is a positive sign for the future of e-commerce, which accelerated in 2022.

Amazon Cyber 5 General Retail (Earnest data)

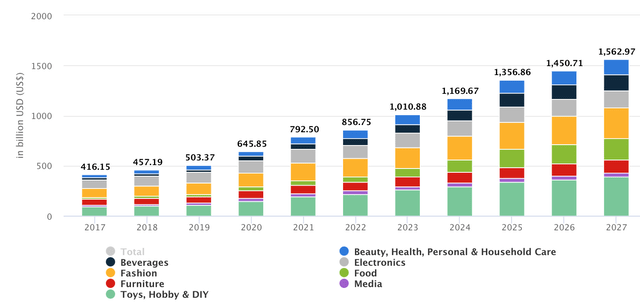

From an economic perspective, I also believe it makes sense to analyze payment processor data, as this effectively offers a bird’s eye view of the flow of payments. In this case, I recently dissected an interview by VC firm Greylock with Patrick Collison, the founder of Stripe (one of the most popular payment processors in the world). Paraphrasing Collison, he stated that most people believe “Europe’s economy is terrible right now”. However, the data from his company shows that this is not the case, and consumer spending is still strong. Now of course, this is more of a macro point but Amazon has recently (in 2023) expanded its partnership with Stripe and will process a “significant portion of Amazon’s total payments volume”. Therefore, the words of Collison are very insightful into the state of play of consumer spending. This also makes sense given U.S. households have ~$1 trillion in savings, according to Citadel data. Then if we combine this with the forecast that the U.S e-commerce industry will continue to grow at an 11.51% CAGR, we see Amazon is in a strong position.

US ecommerce industry forecast (Statista data)

Cloud is the Growth Turbine

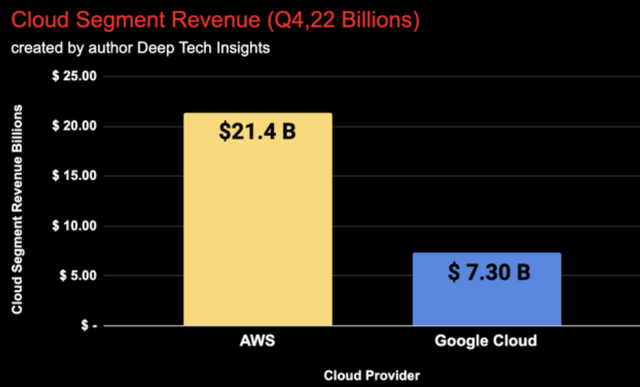

Amazon Web Services [AWS] is the industry leader in the cloud, with $21.4 billion reported in revenue as of Q4 ’22. This metric towers the third largest player in the industry, Google Cloud, which generated “just” $7.3 billion in Q4 ’22, as you can see from the chart I created below.

AWS vs Google Cloud (Created by author Deep Tech Insights)

The AWS revenue growth rate was 20% in Q4 ’22, which was slower than the 28% reported in Q3 ’22 but this was still solid overall. In addition, it should be noted Amazon operates with a “consumption-based” model which flexibly adjusts to both high and low demand. During a macroeconomic slowdown, lower demand, and thus slower revenue growth, is expected. However, part of Amazon’s value proposition is the offering of this flexibility and the company even actively helps companies reduce costs in various areas. For example, Amazon employs specific analysts to help lower costs for their enterprise customers. This may seem crazy but it makes complete sense. Rather than a customer churning to a competitor, Amazon will help them save money and in return benefit from a long-standing relationship. This is part of Amazon’s “scaled economics shared” philosophy which passes on cost savings back to the customer. Given the Cloud industry is forecast to grow at a rapid 19.9% CAGR, up until 2029, I forecast Amazon to benefit from this trend.

Earnings Challenges and Trends

Amazon has faced a tough time with regards to its profitability over the past couple of years. The company reported just $2.737 billion in operating income for Q4 ’22, which was down 20.9% year over year. However, a silver lining is this was an ~8% improvement over the $2.5 billion reported in Q3 ’22. Therefore, this could be an indication of an inflection point for the business. Amazon reported a 9.34% increase in its operating expenses to $146 billion in Q4 ’22. However, this was mainly driven by one-off expenses such as ~$640 million in severance packages related to the layoff of 18,000 employees. Recently (March 20th 2023), Amazon CEO Andy Jassy announced a further layoff of 9,000 employees, as part of a restructuring. If I estimate the equivalent severance, that gives me a figure of $320 million, which will impact Amazon’s profitability in Q1 ’23. However, once the dust settles as we move into the latter half of 2023, Amazon should benefit from a leaner workforce and organization. In addition, it makes sense to keep perspective on the job cuts; 27,000 people may seem like a lot and I feel empathetic for all those affected. However, Amazon went on an aggressive hiring spree doubling its workforce from 798,000 in Q4 ’19 to 1.6 million by Q4 ’21. Of course, this was a mistake in hindsight but at the time it made sense as Amazon had benefited from the lockdown, as brick-and-mortar retail closed down. If we didn’t start to see high inflation (which caused the Fed to raise rates), the good times would have likely continued.

The King of Cash Flow

Moving onto cash flow trends, Amazon’s free cash flow looked to have bottomed out at negative $15.48 billion in Q1 ’22. Since that point, the losses narrowed and the company reported a staggering improvement with positive free cash flow of $20.7 billion in Q4 ’22, on a levered basis.

Amazon Free Cash Flow (created by author Ben at Deep Tech Insights)

Capital expenditure jumped by a staggering 176% from $12.689 billion in 2019 to $35 billion by the end of 2020. This then increased by a further 58% in 2021 to $55.4 billion. This makes sense as Amazon was aggressively investing to expand its fulfillment center footprint and AWS infrastructure. Thus, these investments are not exactly “wasted” and Amazon is poised to benefit in the future. In addition, capital expenditure has started to stabilize, increasing by just 4.7% in 2022. Moving forward, I expect Amazon’s CapEx to start to decline, and CFO Brian Olsavsky stated in the Q4 earnings call, the company has “tightened up” its CapEx and will continue to do so more moving forward.

Valuation Model

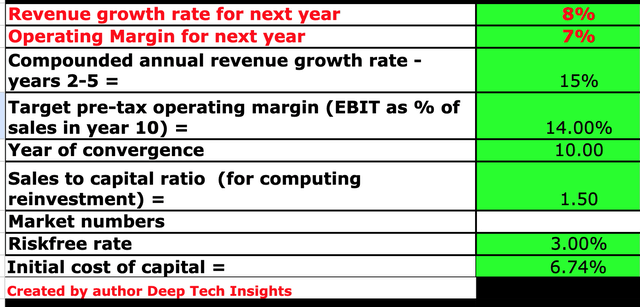

I have plugged Amazon’s financial data into my discounted cash flow model and revised by estimates. I have revised my prior estimates by 1% upwards to 8% revenue growth for “next year” or the next four quarters. This is based upon an extrapolation of the top end of management guidance for Q1 ’22. For years 2 to 5, I have forecast a faster growth rate of 15% per year. I have based this on the share of holiday spending data previously cited and a forecasted rebound in e-commerce, as economic conditions are likely to improve long-term, along with foreign exchange rates. I also believe cloud segment [AWS] growth will dip in 2023, as consumption slows before a strong rebound in years 2 to 5.

Amazon stock valuation 1 (created by author Ben at Deep Tech Insights)

For 2023 or “next year”, I have revised upwards my operating margin forecast from 3% to 7%. The 3% figure was based upon the (2.4%) margin generated in Q4 ’22. However, I believe the figure will now be closer to the 7% margin figure, which is in line with the full-year 2022 margin. This is based upon a reduction in “one-off” expenses related to severances and fulfillment center costs, which I expect to taper off towards the latter half of the year, as Amazon finishes its restructuring. Over the next 10 years, I have forecast a 14% operating margin. This is optimistic but driven by the high-margin AWS segment, and Amazon’s advertising business which I forecast will continue to grow. The advertising market is currently going through a cyclical decline but Amazon still managed to increase its advertising revenue by 20.8% year over year. As the advertising market rebounds, I forecast this growth to accelerate. Keep in mind the operating margin figures also include an adjustment for R&D expenses which I have capitalized.

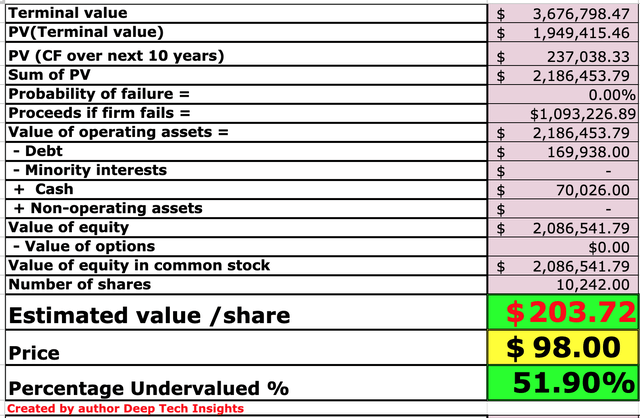

Amazon stock valuation 2 (created by author Ben at Deep Tech Insights)

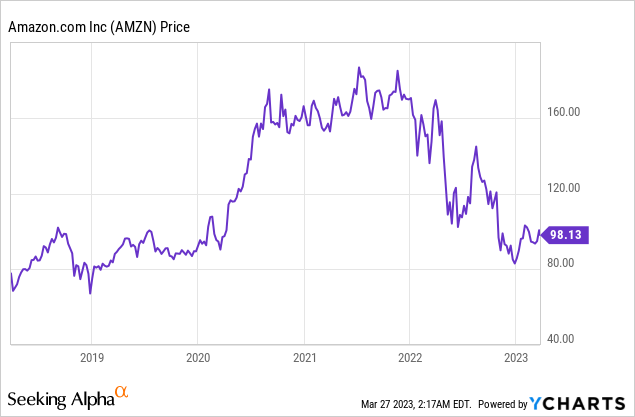

Given these factors, I get a fair value of ~$204 per share. The stock is trading at ~$98 per share at the time of writing and thus is ~52% undervalued.

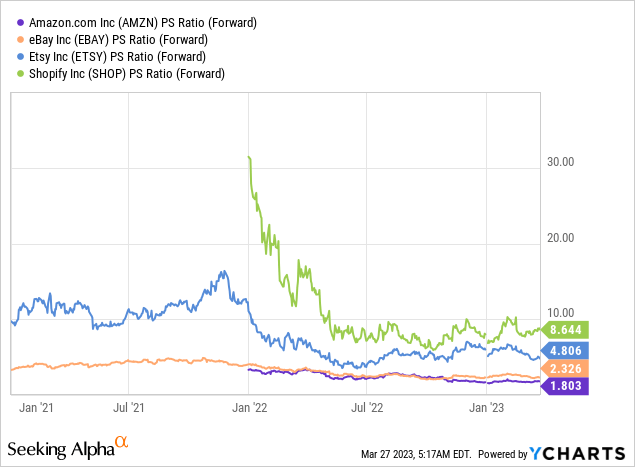

Amazon also trades at a forward price to sales ratio = 1.80, which is 44% cheaper than its 5-year average. This is also cheaper than other e-commerce stocks in the industry, as you can see from the chart below.

Risks

The biggest risk for Amazon is a prolonged recession and/or inflation which will likely keep e-commerce demand subdued, while also keeping input costs related to fulfillment high. Many analysts believe the U.S. will have a recession in late 2023. In terms of competition, I believe Amazon is still dominant but there is a new e-commerce player in town which has been growing rapidly. The company is named Temu, which is part of Chinese e-commerce player PinDuoDuo or PDD holdings (PDD). Although it is still a fraction of the size of Amazon, its rapid growth and cheap prices (cheaper than Amazon in some cases) could make this company a future contender. I covered Temu in detail recently in my PDD post and I highly recommend you check out that post here, as we could have a disrupter on our hands.

Final Thoughts

Amazon is a tremendous company that has aggressively invested in growth over the past couple of years. I believe the sales slowdown the business is facing is mainly driven by cyclical factors (exchange rates and the economy) and thus not a permanent detriment to the company. I did mention a rapidly growing Chinese competitor (Temu) but this company doesn’t have Amazon’s vast fulfillment network which I believe is a strong competitive advantage. Amazon’s super cash flow improvements is a positive sign and given my valuation model and forecasts indicate the stock is undervalued intrinsically at the time of writing, I will deem Amazon to be a great long-term investment.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.