Summary:

- I am buying shares of regional bank Capital One Financial as investors fear a broader meltdown of the U.S. financial system.

- The key reason for me to buy shares is because COF is trading at a serious discount to the bank’s normalized (or average) price-to-book ratio.

- Consumer-focused deposit base and strong liquidity/capital position imply revaluation potential.

- As the 9th largest bank in the country by assets, the U.S. government and the Fed are not going to allow a failure of COF.

Heather Shimmin

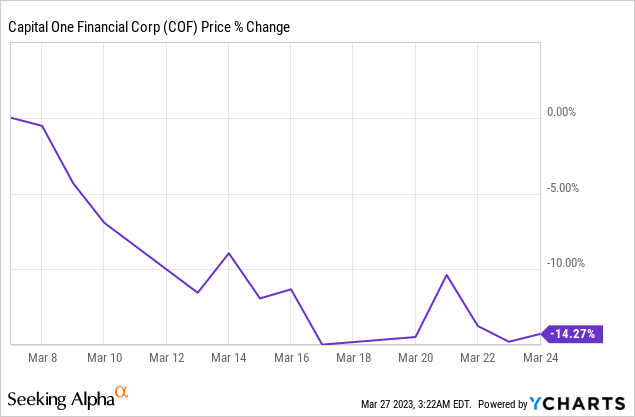

Shares of Capital One Financial Corp. (NYSE:COF) have dropped sharply in March as a number of banks failed and the FED was forced to make additional liquidity available to U.S. depositary institutions. This sell-off, broadly speaking, has created numerous opportunities to buy well-run regional banks like Capital One Financial, in my opinion. The community bank is the ninth-largest bank based on assets in the U.S., making it highly unlikely that the FED or the U.S. government would allow Capital One Financial to fail. The market is still largely fearful of touching regional banks, even those that have stable deposit bases and strong liquidity… which is why I believe investors have an opportunity here to buy shares of Capital One Financial stock at an attractive discount to book value!

Capital One Financial has a strong deposit/liquidity/capital position even without the FED

Capital One Financial has seen its valuation drop by 14% in March in response to a series of bank failures that have startled investors around the world and renewed fears over a new financial crisis. Capital One Financial, however, is a well-run bank with significant liquidity and, ironically, the bank’s large balance sheet helps protect the bank from stress in the financial system. This is because Capital One Financial is the 9th largest bank in the U.S. banking market based on assets and therefore systemically important. Given the recent actions of the U.S. government and the FED to provide emergency liquidity to the U.S. financial system after the failure of Silicon Valley Bank, regulators sent a strong signal of support to banks and investors.

The main reason why I bought Capital One Financial relates to the bank’s strong capital and liquidity position, which is now more important than ever.

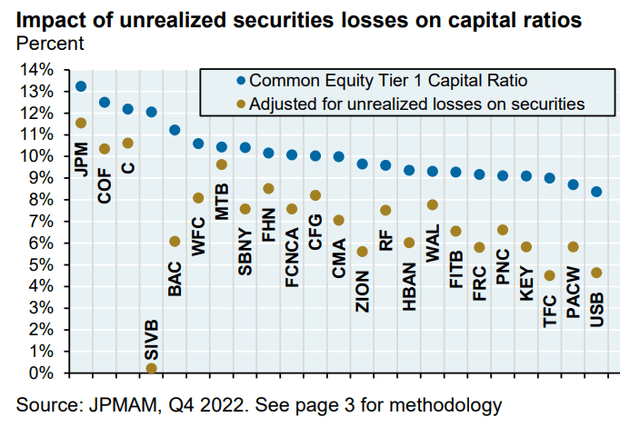

According to JPMorgan Securities, Capital One Financial has one of the best capital ratios in the U.S. financial system with a Tier 1 capital ratio of more than 10%, when adjusted for unrealized losses in a bank’s securities portfolio — unrealized losses on U.S. Treasuries and mortgage-backed securities were the chief reason for Silicon Valley Bank’s failure on March 9, 2023. Tier 1 ratios are measures of financial resilience and since all banks must report them, it is easy for analysts and investors to compare a bank’s relative capital strength.

JPMorgan Securities ranked major banks for its vulnerability related to unrealized securities losses and Capital One Financial actually presented the third-best capitalization ratio, after JPMorgan (JPM) itself and Citigroup (C). Interestingly, Capital One Financial performed well better in the capital ratio ranking than Bank of America (BAC) and Wells Fargo (WFC), two systemically important, closely-watched and heavily-regulated banks.

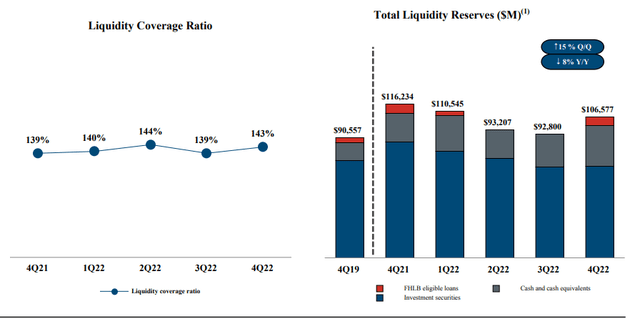

Additionally, Capital One Financial has a very strong liquidity. To the credit of the FED, the deposit backstop likely prevented worse in March and companies can now access the FED’s Bank Term Funding Program which was made available to help U.S. depositary institutions fund deposit withdrawals. However, even without the deposit backstop, Capital One Financial had access to more than $106B in liquidity at the end of the year and likely sufficient liquidity to deal with deposit outflows.

Consumer-focused deposit base

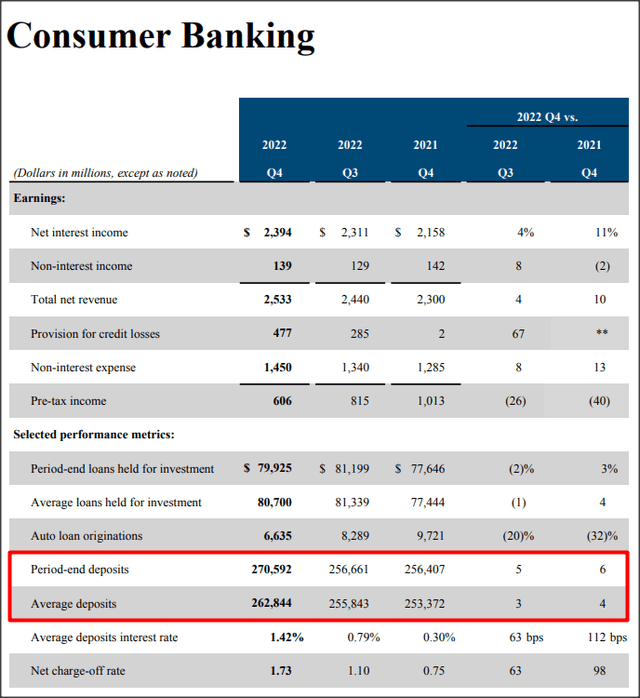

The majority of Capital One Financial’s deposits are held by its consumer business, not by the commercial business which is an important distinction. Due to the implosion of Silicon Valley Bank, mostly venture-backed companies with deposits in excess of the $250,000 FDIC insurance limit have withdrawn cash from regional banks and shifted funds to banks with higher perceived safety, such as Bank of America. Regional banks like First Republic Bank (FRC) or Western Alliance Bancorporation (WAL) reported high shares of uninsured deposits, making those banks especially vulnerable to deposit flight.

The case is different for Capital One Financial. The regional bank had $333.0B in deposits as of December 31, 2022, of which $270.6B related to its consumer business. These deposits are therefore mostly covered by the FDIC insurance limit and not at risk of getting withdrawn. With a near 81% share of deposits in the consumer segment, I believe the risk of deposit withdrawals is very low.

Capital One Financial’s valuation vs. U.S. bank

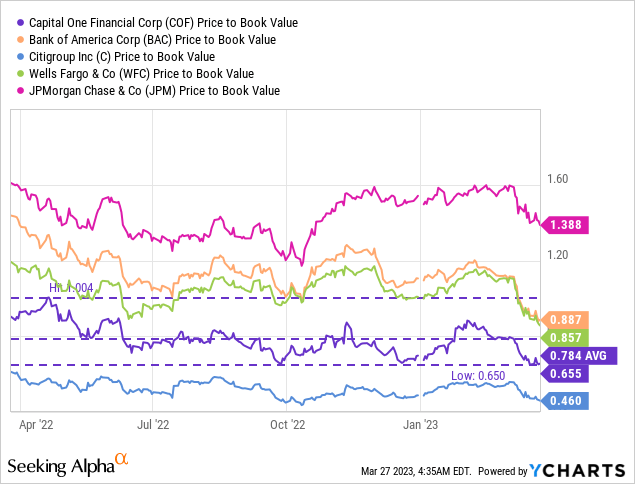

Capital One Financial has seen a decline in its market cap and therefore also in its key valuation metric, the price-to-book ratio. The bank’s price-to-book ratio declined from an average of 0.78 X in the last year to 0.66 X in as little as two weeks. The bank’s shares now trade at a 34% discount to book value although Capital One Financial has enormous liquidity and has access to the FED’s emergency liquidity. Additionally, the JPMorgan capital ratio ranking indicated that Capital One Financial offers better capital protection than banks such as Bank of America and Wells Fargo. Given that COF trades at a larger discount to BV than those two (larger) banks, I believe the risk profile is favorable here.

Risks with Capital One Financial

Capital One Financial is a systemically important bank due to its large balance sheet including more than $453B in assets. The government is not going to let a bank like Capital One Financial fail as the consequences would be disastrous. What would change my mind about Capital One Financial is if the regional bank saw some major and unexpected deposit outflows or if the bank for some reason would have to raise equity capital and dilute shareholders.

Final thoughts

Money is made when investors panic, which is clearly the case here, and this is why I am buying. Capital One Financial had enormous liquidity as of December 31, 2022, not including the recently opened FED liquidity facility called Bank Term Funding Program. The bank itself has a consumer-focused deposit base which greatly limits the risk of deposit withdrawals at times of a crisis and Capital One Financial compares favorably in JPMorgan’s capital ratio ranking. As a result, I believe the risk profile is favorable and COF stock currently offers a very large discount to BV!

Disclosure: I/we have a beneficial long position in the shares of COF, PACW, FRC, SCHW, FITB, USB, WAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.