Summary:

- Ambarella is being impacted by macro headwinds that have kept revenue flat.

- Its edge AI vision chip technology is gaining customers and design winds in a strong Electric Vehicle market.

- While Ambarella guided flat revenues for the next quarter, CY 2023 will see a ramp in EV-driven revenues as inventory corrections subside.

alexsl/E+ via Getty Images

Ambarella (NASDAQ:AMBA) reported FQ3 Non-GAAP EPS of $0.24, which beat by $.04. Revenue for the third quarter of fiscal 2023 was $83.1 million, down 10% from $92.2 million in the same period in fiscal 2022. For the nine months ended October 31, 2022, revenue was $254.3 million, up 5% from $241.6 million for the nine months ended October 31, 2021. FQ4 revenue is guided to be between $81.0 million and $85.0 million, vs consensus of $86.38 million.

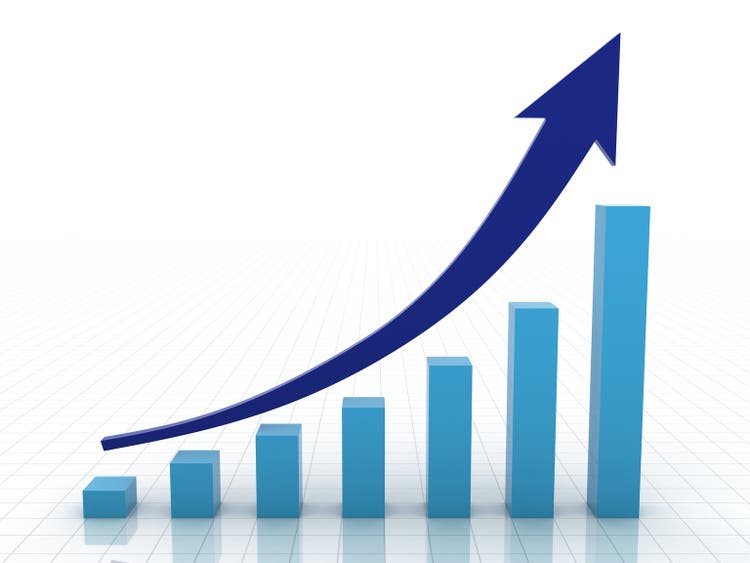

Table 1 shows the company’s revenues by its two segments.

Ambarella

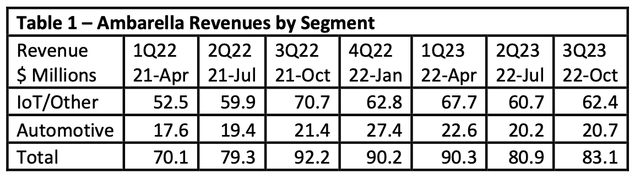

While Table 1 shows revenue by segment, Chart 1 addresses the Automotive market, which will be strong because of AMBA’s advanced technology benefiting the Electric Vehicle market, which is discussed below and the focus of this article.

Chart 1

Ambarella

Chart 1 shows QoQ change (blue line) and the positive growth is an indicator that AMBA’s auto sector should show positive growth in CY2023.

Ambarella’s Better Solution

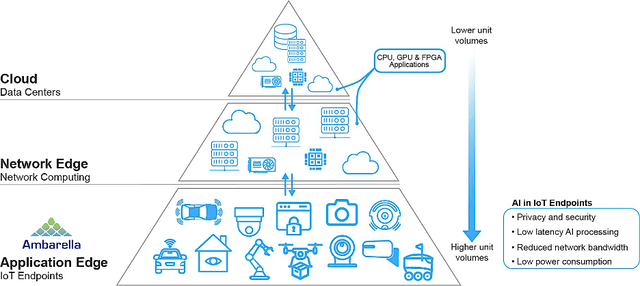

Ambarella thinks it has a better solution to Computer Vision (“CV”), which is primarily executed with graphics processing units (“GPU”), field programmable gate-arrays (FPGA) or general-purpose microprocessors (“CPU”) in servers or datacenters.

This approach requires large amounts of data to be transported from an end-point electronic system or device into the network infrastructure, where the data may be stored, processed, and then sent back to the end point, creating added delay, power consumption and incremental expense from data communications, server processing and storage. In some applications, unacceptable levels of latency are introduced by the transportation of this data, minimizing or, in some cases, eliminating the utility of the product.

AMBA believes that CV requires a fundamentally different SoC architecture versus the GPU, FPGA and CPU approach commonly utilized in the datacenter.

Company efforts have focused on creating advanced AI (artificial intelligence) technology that enables edge devices to visually perceive the environment and make decisions based on the data collected from cameras and, most recently, other types of sensors. Its CV SoCs integrate its state-of-the-art video processor technology together with its recently developed deep learning neural network processing technology, which AMBA refer to as CVflow®.

Chart 2 illustrates the strategy, and the important word here is latency. Data delivered to the cloud, analysed, and returned takes a few seconds, creating latency unacceptable in applications that require real-time inference analysis and detection.

Chart 2

Ambarella

For example, someone driving in a vehicle using ADAS (Advanced Driver Assistance Systems) that needs to make a braking maneuver would need to communicate to the cloud. Meanwhile, at 50 mph, the vehicle would travel 75 feet if it took 1 second for the data to be transmitted from the vehicle to the cloud and back to the vehicle. If the processor was in the vehicle and latency was 100 ms, the vehicle would travel 7.5 feet.

Conversely, inference analysis can be performed in real-time via edge computing devices specifically designed for split-second autonomous decision-making as well as in-vehicle deployment.

Strong Customer Interest and Growth

Ambarella Dr. Fermi Wang noted a number of customer wins in IoT and Automotive in the recent earnings call, including:

- On November 18th, German automotive tier 1, Continental, announced that it will offer Advanced Driver Assistance Systems based on our CV3 AI domain controller SoC family.

- Also during the quarter, we announced another win in Japan with Toyota, who began shipping its Yaris and Yaris Cross models,

- Mercedes-Benz began shipment of vehicles in China and Korea with a car recorder from Korean tier 1 supplier Mobile Appliance. Based on Ambarella’s H22, the car recorder includes both an ultra-HD front camera and a QHD rear camera.

- Motorola announced its new AVA Flex camera based on Ambarella’s CVflow AI vision SoCs. The AVA Flex includes Wi-Fi connectivity and cloud-based video management for ease of deployment, while supporting AI features such as occupancy counting and anomaly detection.

Strong Automotive Market Potential

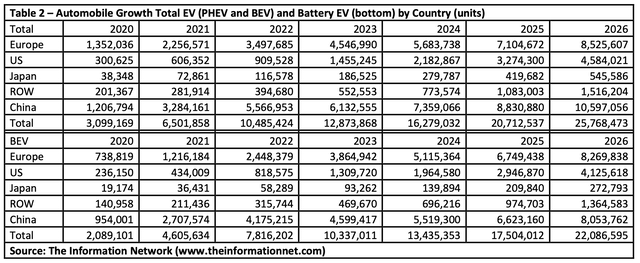

Table 2 shows the potential growth in EVs (PHEV and BEV) and BEV (battery EV) between 2020 and 2026 by country. Battery EVs will dominate in all countries, and in 2026, PHEVs will only represent 8.6% of all EVs.

The Information Network

Investor Takeaway

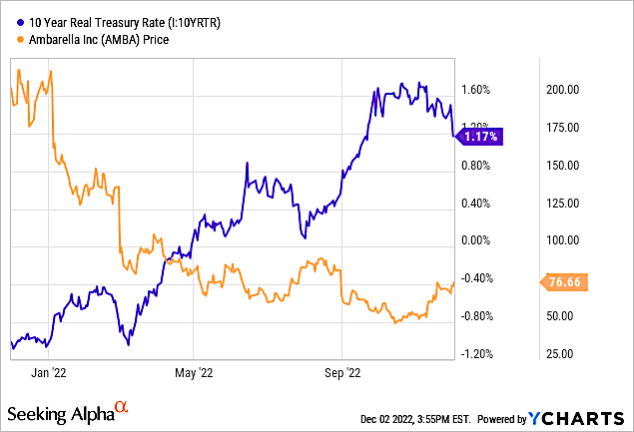

Ambarella, like all businesses, is impacted by an economy highlighted by high inflation and interest rates that have been a headwind for consumer purchasing as discretionary spending has been cut.

One of the biggest impacts on the company has been high inflation that has been an increase in the 10-year Treasury rate, the most substantial being investor sentiment. When investors have high confidence in the markets and believe they can profit outside of Treasury securities, the yield will rise as the price falls.

This correlation has been strong in 2022. Although analysts at Morningstar found minimal correlation between the 10-year treasury and technology stocks over a 15-year period, since January 2022 the rise in the 10-year due to inflation fears has significantly impacted technology stocks. Thus, as I stated above, if looking to buy the dip in tech stocks, you want to wait for the 10-year to top out.

In Chart 3, I show the share price of AMBA for a 1-year period compared to the 10-year Treasury Rate. We see an inverse relationship for the past year, as AMBA share price has changed in an opposite direction to the 10-year. I have discussed this relationship in numerous Seeking Alpha articles.

Chart 3

YCharts

Once economic drivers no longer impede growth, AMBA is well-positioned to resume its strong growth in its sectors. Strong customer demand and design wins in 2022 alone will propel the company forward.

Until the 10-year Treasury rate stops correlating with stock share price, and that could happen next month when the Fed increases rates only 50 instead of 75 basis points, I maintain a Hold on the company.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This free article presents my analysis of this semiconductor sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here and start a risk free 2 week trial now.