Summary:

- Ambarella, Inc.’s Q2 guidance was lower than expected, leading to an initial selloff of the stock.

- The main concern is the timing and extent of the inventory correction in the market.

- The company’s revenue growth rates have been negative, raising questions about analyst optimism, as well as, the company’s ability to reignite its growth rates.

sankai

Investment Thesis

Ambarella, Inc. (NASDAQ:AMBA) delivered guidance for Q2 that was slightly lower than expectations, and investors were extremely quick to sell off AMBA stock, sending it lower by nearly 20% premarket. The shares have since recovered and are down only 11%.

The main concern revolves around the timing and extent of the sector’s inventory correction.

Indeed, given all the enthusiasm for the semiconductor space, particularly on the back of Nvidia Corporation’s (NVDA) recent results, investors had wanted to be blown away by Ambarella’s fiscal Q2 2024 guidance, particularly with respect to its AI (artificial intelligence) prospects. Instead, Ambarella, Inc.’s guide ended up being below consensus estimates.

Succinctly put, an investment in Ambarella requires a lot of patience.

Why Ambarella? Why Now?

Ambarella specializes in the development of semiconductor products for high-definition video processing. It provides system-on-a-chip (”SoC”) semiconductors and software for AI applications.

In short, Ambarella’s SoCs are designed to compress video and image data efficiently.

During the earnings call, there was a practically mandatory allusion to how Ambarella will benefit from the AI transformation. Here’s an excerpt,

Our transformation into an AI company is well underway, with AI already representing 45% of our total revenue last year and an estimated 60% this year. Now with our CV3 platform, we are expanding into a new phase of AI market development.

Recall, Ambarella’s CV3 (Computer Vision) is its advanced computer vision technology responsible for visually perceiving the environment and analyzing the collected data. And indeed, management was able to highlight a key partnership with Continental for its CV3 SoC.

This allowed management to content that,

Customer feedback on end-demand remains generally healthy. However, at the same time, customers also continue to aggressively manage down their inventory levels. (emphasis added)

And therein lies the problem. Despite healthy demand for Ambarella’s CV, this isn’t translating into compelling growth rates near term.

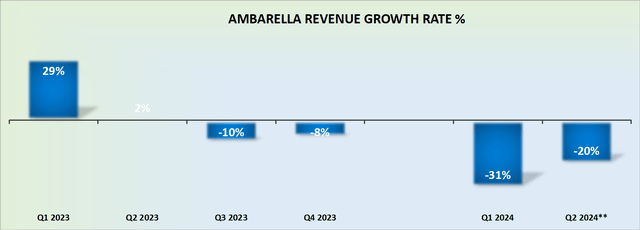

Revenue Growth Rates Not Picking Up

Ambarella’s Q1 2023 revenues were ever-so-slightly better than expected but still ended down 31% y/y. But this wasn’t the reason why investors sought to abandon this holding.

What investors found particularly unappetizing was that its revenue growth rates for the quarter ahead pointed to yet another quarter of negative 20% y/y growth rates.

This has two implications.

SA Premium

In the first instance, nobody wants to be investing in a semiconductor business that’s reported such significant negative y/y revenue growth rates.

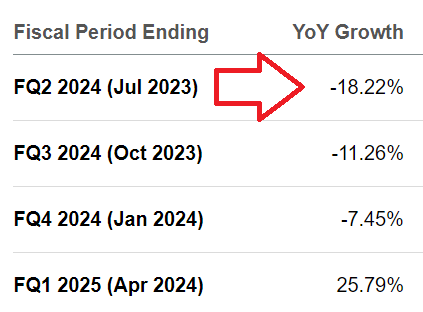

And secondly, and perhaps most critically, this brings into focus the question of whether or not analysts were not too optimistic with regard to Ambarella’s revenue growth rates.

After all, Q2 2023 was supposed to be a much easier comparison than Q1. And if Q2 is pointed towards negative 20%, this implies that the rest of 2023 will most likely report mid-teens negative y/y revenue growth rates.

Put another way, investors have been asked to be patient with the company as it finds its footing and finds a way to reignite its growth rates. But in the current market environment, investor patience is in very short supply.

Next, we’ll turn our focus to Ambarella’s profitability profile.

Profitability Profile

Ambarella’s non-GAAP gross profit margins were down slightly at 63.1%, compared with 63.8% for the same period in fiscal 2023. Therefore, not so different on a y/y comparison.

Indeed, what really put investors off was that Ambarella’s non-GAAP gross margins in fiscal Q2 2023 were 64.5%, while the guidance for the upcoming quarter points to approximately 63% at the midpoint. Meaning that the upcoming quarter could see around 100 basis points of non-GAAP profit margin contraction.

Of course, the argument could be made that Ambarella may be being conservative with this guidance. But keep in mind that Ambarella’s non-GAAP gross profit margin guidance provided in the previous quarter, fiscal Q4 2023, pointed to 63% at the midpoint, and that’s nearly precisely what Ambarella ultimately this quarter reported.

In sum, I don’t believe that we should necessarily presume that Ambarella is being conservative with its guidance.

The Bottom Line

Ambarella, Inc.’s guidance for fiscal Q2 2024 fell slightly below expectations. The concern centers around the timing and extent of an inventory correction.

The company’s profitability profile also faced scrutiny, with a slight decline in gross profit margins anticipated for the upcoming quarter.

While I’m not personally invested in Ambarella, Inc. stock, if I were invested, I wouldn’t be a seller on the back of this earnings result.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.