Summary:

- Ambarella has been smashed since guiding to flat revenue for the next couple of quarters due to supply chain issues.

- The chip company now has $700 million in auto backlog and another pipeline of $1.1 billion.

- The stock has dipped to 6x forward sales providing the ideal entry point.

Maria Vonotna/iStock via Getty Images

In just a couple of months, Ambarella (NASDAQ:AMBA) has fallen over $125 from the yearly highs, which is amazing for a stock that only traded above $100 for a brief period back in last 2014. The AI vision company has finally hit the sweet spot in the automotive sector, but supply chain issues are now slowing down sales growth to start FY23. My investment thesis switches back to Bullish on the chip stock around $90.

Minor Headwinds

Ambarella crashed after reporting FQ4’22 results due to weak guidance. The chip company has a history of rolling through cycles where a hit product quickly rolls off and the company has to find another hit product.

In this case, Ambarella was hit by supply chain issues, specifically at Samsung (OTCPK:SSNLF), leading to revenue weakness. Per the CEO on the FQ4’22 earnings call:

Looking to fiscal year 2023, geopolitical and public health headwinds persists, and the market forecasters predict real global GDP and the semiconductor industry growth rates will decelerate. There is a continuation of supply chain challenges. And in February, we were informed our 14-nanometer supply from Samsung will be constrained. At this time, we anticipate an adverse impact to our video processing revenue of approximately $5 million in Q2.

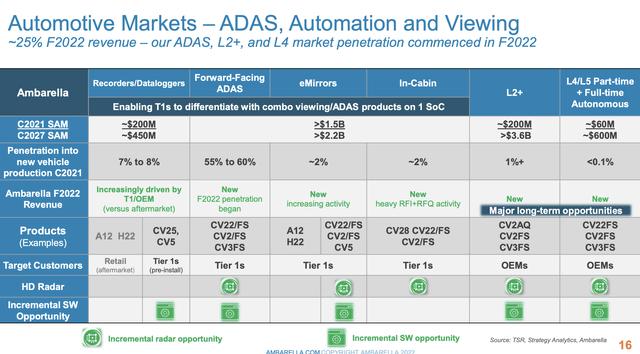

The company is quickly shifting to supplying the automotive market where the sector is headed to using Lidar, radar and camera vision chips to improve the safety of vehicles. The computer vision chips of Ambarella fit great into the ADAS and autonomous driving technology needed in the future.

The automotive market is still years away from full AVs, but for now Ambarella is benefitting from ADAS demand. January quarterly revenues surged 49% to reach $90.2 million. Unfortunately, the chip company guided FQ1’23 revenues to sequentially flat while suggesting FQ2’23 revenues will take a $5 million hit from the supply issues at Samsung. The end result is sequentially flat revenues for up to 3 quarters for what was supposed to be a booming automotive business.

Ambarella has deals with auto manufacturers such as Hyundai Motor (OTCPK:HYMTF), NIO (NIO) and Rivian Automotive (RIVN) as recently announced as using CV chips. Rivian recently disappointed the market with reducing vehicle production this year to only 25K units in a sign of how supply chain issues are impacting auto manufacturers whether due to Ambarella chips, or not.

The auto market is a major game changer for Ambarella that has constantly built product lines up to the $100+ million annual revenue range to only have related customers shift to cheaper solutions or generally lose business. The automotive market has already contributed to the TAM expanding from $4 billion to $10 billion by 2027, but the most important concept is the size of the top customers in this sector with up to $7 billion of related TAM.

Source: Morgan Stanley presentation

According to CEO Fermi Wang on the FQ4’22 earnings call, Ambarella has customers with programs offering revenue opportunities in the billions now:

We are engaged in discussion at multiple customers where the lifetime revenue of any one program could be more than 20x higher than what we have experienced in the past.

The company even forecasts the radar technology bought along with Oculii provides a potential Lidar disruptor due to substantially lower costs. In addition, the adaptive AI software technology promises to provide breakthrough technology. For once, Ambarella appears on the cusp of actually building business on top of current opportunities versus the past business of rotating from one program success to another with no momentum.

Ambarella already has won $700 million in automotive projects with another pipeline of $1.1 billion through FY28. As with some of the Lidar companies, the market will probably start valuing these companies based on the $1.8 billion pipeline on top of a FY23 revenue base with over 50% of the business in non-CV chips unrelated to automotive.

Interestingly Priced

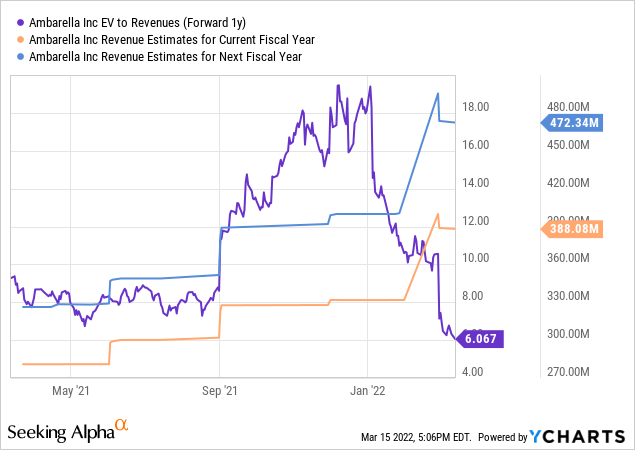

The biggest problem with Ambarella the prior couple of months was the stock trading at 20x forward sales estimates. The market was delusional on the actual risk in the business model whether either via the company running into supply chain issues or technology problems. The stock now trades at just 6x forward sales targets for a more reasonable valuation to new investors.

If Ambarella reports a couple of quarters of flat revenues, the market isn’t likely to rush into the stock. The market cap is down to just $3 billion here with a plan of generating 30% operating margins on a $1 billion revenue total in the future. For now, the base case is for FY23 revenues jumping to $388 million followed by another 20%+ jump to $472 million.

The company does have a high concentration of current business and employees in China. The recent fears around the Chinese stocks listed in the U.S., potential sanctions on the economy from helping Russia or even Covid shutdowns are all potential risks to consider before snapping up Ambarella.

Takeaway

The key investor takeaway is that Ambarella is far more reasonably priced for the opportunity in computer vision technology in the automotive sector. Investors should use this weakness to start building a position in this chip stock.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market during March Madness 2022, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.