360 DigiTech, An Even Cheaper Chinese Tech Stock Than Alibaba

Summary:

- Solid growth, a 30% profit margin, a 9.5% dividend yield, an iron-clad balance shield, and a P/E of just over 2x, nothing of this seems to matter.

- Large parts of the company growing fast like the capital-light part and the more recent SME part, the capital heavy part isn’t growing much, and this is a deliberate shift.

- Not regulation, nor the threat of delisting seems to be the root cause, but a wider geopolitical concern and investors selling at any price.

peshkov/iStock via Getty Images

The Q4 figures from 360 DigiTech (NASDAQ:QFIN) almost don’t matter at all anymore as the shares are already so cheap, it’s difficult to imagine what could get them out of their funk one way or another.

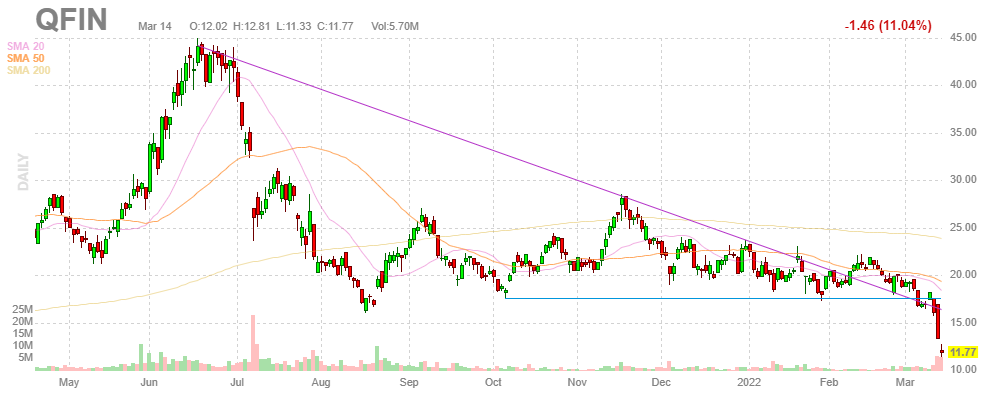

The shares have been buffeted by forces mostly beyond their control. First, by a regulatory onslaught in China that cut a rally to $40+ short, and now investors are scared of the shares being delisted from US exchanges and the wider geo-political landscape. We’ll get to that below, first the Q4 figures.

FinViz

Q4 figures

The company is already insanely profitable with a profit margin of 36.2% (non-GAAP and 34.7% GAAP) in 2021. The shares are trading just over 2x earnings, so we aren’t even sure how much the quarterly performance actually matters.

The shares have been trading on these kinds of depressed multiples for as long as we have been following the company, although not quite this depressed, with every new quarter bringing even better figures and lower valuation multiples.

For good measure:

- Capital heavy is the segment where loans are facilitated through guarantees (hence there is a big item called Revenue from releasing of guaranteed liabilities as loans are repaid or investors are compensated in case of a default) so the company assumes a credit risk.

- Capital-light is the segment where the company assumes no or minimal credit risk but provides all kinds of services (AI-based risk assessments, etc.).

- SME lending was only launched last year (the company’s main business is consumer lending) but this is rapidly growing, another 16% in Q4 sequentially to RMB9.3B comprising 13% of the total loan book already.

Total loan origination increased 40.4% in Q4 to RMB96.9B. Up until this year, the company has steadily shifted its loan origination and revenue towards the capital-light segment and more recently towards the newer SME (small and medium-sized company) segment.

The capital-light segment now makes up 53.5% of loan origination, and this displayed growth of 120% y/y. However, in order to adapt to a regulatory onslaught that started last year, the part of origination and revenue from capital-light will remain fairly constant in 2022.

The capital heavy segment isn’t shrinking in revenue terms (RMB2.71B versus RMB2.56B a year ago) but it’s growing much less fast compared to the capital-light segment.

However, the capital-light segment experienced some difficulties in Q4 due to a shortage of overall funding supply and the 24% interest rate cap. Some other points of interest

- There was a minor uptick in delinquencies, but this doesn’t seem to come anywhere near a threshold that should trigger alarms.

- The leverage ratio (risk-bearing loan balance/shareholder equity) remains at a low 4.3x (versus 6.6x a year ago). The company is well capitalized.

- The funding cost was 7% (and management expects this to be stable going forward). They also use ABS for funding (RMB6.5B in 2021 up 282%), which is cheaper at 5.47%.

- The company increased the capital base of their microlending subsidiary to RMB5B.

- The company generated RMB2B in cash from operations and total cash holdings were RMB9.6B (non-restricted RMB6.1B), up from RMB7.6B a year ago in part due to the capital increase for the microlending subsidiary.

- Some 20% of net earnings are going to the $0.26 per ADS dividend for a whopping 9.5% yield.

What we can conclude is that the company’s shift from capital-heavy to capital-light is still on track but temporary issues are putting some sand in the wheels here, and they are likely to continue this year. SME still keeps growing briskly though.

And more importantly, the company is still very profitable even though the average pricing of the loan portfolio dropped 200bp as a result of the 24% interest cap with 70% of loans already under that cap. They will easily meet that standard mid this year.

Customer acquisition cost increased from RMB305 in Q3 to RMB390 in Q4 per approved credit line but this is a price well worth paying for targeting bigger ticket items (that is, bigger loans RMB150K-RMB200K rather than the average RMB10K for average borrowers) and more creditworthy customers.

Net profit disappointing growth:

- Take rate decline as a result of the 24% rate max.

- Funding shortage for capital-light origination.

Both are temporary though, and given the overall profitability of the company could hardly be responsible for yet another selloff of the shares.

Improvements

The company is targeting bigger SME customers (up to RMB250K rather than the average RMB50K) and is targeting specific segments like the tobacco and alcohol retail segments which have a great need of funds during Chinese New Year.

This seems to have been successful as 20%+ SME lending was directed to this segment in Q4. SMEs also now have their own app rather than having to use the 360 DigiTech app.

In consumer lending, there is also a shift towards better quality and bigger customers, an outflow of the 24% interest rate cap. The platform also continues with improvements like:

- The AI risk management system to assist the hunt for bigger, less risky borrowers.

- Extent AI application to other areas of risk management like community detection, hierarchical federated learning and risk management strategy automation.

- Improved platform diagnostics.

Valuation

The company has very solid growth in loan origination (40.4% in Q4, a guided 15%-26% for 2022), generates lots of cash, has an iron clad balance sheet and a very high (30%) net profit margin, the shares provide a 9.5% dividend yield and the shares trade at 2x earnings.

The shares are valued as if the company is living on borrowed time and the end is in sight, while all performance indicators tell a diametrically opposed story. This is clearly nuts and it isn’t easy to explain, here are some elements:

- Chinese competitors are also very cheap

- There was a regulatory onslaught in China last year

- There is fear of the ADS delisting

- There is a wider geopolitical fear after China seems to have chosen Russia’s side in the war with Ukraine.

Regulation

The big scare last year was Chinese regulation, but here is management (Q4CC):

We expect to see a much clearer regulatory framework for the entire industry in 2022, which should allow industry participants to be more focused on long-term business development.

This seems to be bearing out. The company’s app was removed from the app store last year but restored, and they made a concerted effort for this not to happen again.

These efforts have paid off with the company winning a number of security awards and certifications, from the CCRC (China Cybersecurity Technology and the Certification Center), from SGS (ISO 27701) from the Information Security Management System (ISO227001) and a recommendation from MIIT (the Ministry of Industry and Information Technology) on their privacy protection.

The company is also managing the 24% interest cap pretty well, it will have an impact on the take rate as there was a 200bp decline in the average price of loans but this has already been mostly absorbed.

It’s difficult to imagine regulation is responsible for the death spiral valuation of the shares.

Delisting

A scary news story about the possible delisting of Chinese ADRs took another 10%+ bite out of the share price on the morning they were going to announce Q4 earnings and we wonder why. The alarming news item mentioned five Chinese ADRs, but not QFIN.

At issue is the HFCAA, (Holding Foreign Companies Accountability Act), which enables the SEC the power to delist companies if that company fails to allow US regulators to review their company audits for three-straight years.

This isn’t exactly a new risk, from the company’s last year 20F (our emphasis):

The Holding Foreign Companies Accountable Act, or the HFCA Act, was enacted on December 18, 2020. The HFCA Act states if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for three consecutive years beginning in 2021, the SEC shall prohibit our shares or ADSs from being traded on a national securities exchange or in the over-the-counter trading market in the U.S.

So even if this risk actually materializes, the company has basically three years to work out a remedy, like:

- Hire a US-based accountant (instead of Deloitte Touche Tohmatsu Shanghai).

- Seek alternative listing, the most obvious candidate here is Hong Kong.

The latter seems a no-brainer, and management was already onto this almost two years ago, although curiously enough, nobody asked about the prospects of this on the CC.

Geopolitics

However, the scary news story about hints of delisting five Chinese ADRs also took a considerable bite out of the shares of JD.com and other Chinese ADRs which actually already have dual listing already.

Given the general Chinese ADR selloff, even if it seemed to be caused by the news about the five Chinese ADRs in the crosshairs of the SEC, do seem to be part of investors no longer willing to tolerate any China risk, no matter how cheap the shares or how good the companies in question are performing (pretty good, in the case of JD.com and, as we tried to show above, QFIN).

The SEC communication about these five Chinese ADRs was just the latest excuse for a general selloff in Chinese ADRs as investors nerves have been frayed by waves of Chinese regulatory onslaught, Sino-US trade wars, doubts about VIEs, and now the dramatic turn for the worse in the geopolitical picture.

Conclusion

The shares of QFIN are priced as if the company is in a death spiral, and this could hardly be further from the truth. There was some temporary headwind in earnings, but the company still grew earnings and is already insanely profitable.

It has also seemed to have digested the heavy handed Chinese regulatory onslaught pretty well, and the ADRs are in no immediate danger of delisting, the company has years to arrange an alternative listing.

But given that even companies which are performing well and have a dual listing already were selling off, like JD.com, we don’t think this is it. Investors are giving up on Chinese ADRs and there are too few buyers, even of QFIN at 2x earnings and producing a 9.5% dividend yield.

Investors seem to fear a complete breakdown in relations with China and some sort of economic separation, where Western investors wouldn’t even be able to buy shares in Hong Kong.

While we can’t rule that out, it’s a possibility that seems fairly improbable to us at this stage, and more than priced in already.

Disclosure: I/we have a beneficial long position in the shares of QFIN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you are interested in similarly small, high-growth potential stocks you could join us at our marketplace service SHU Growth Portfolio, where we maintain a portfolio and a watchlist of similar stocks.

If you are interested in similarly small, high-growth potential stocks you could join us at our marketplace service SHU Growth Portfolio, where we maintain a portfolio and a watchlist of similar stocks.

We add real-time buy and sell signals on these, as well as other trading opportunities which we provide in our active chat community. We look at companies with a defensible competitive advantage and the opportunity and/or business models which have the potential to generate considerable operational leverage.