American Airlines: Not Priced For The Recovery

Summary:

- American Airlines reported strong Q4’22 numbers and guided to a massive EPS in ’23.

- The airline guided to 2023 EPS of $2.50 to $3.50 with plenty of catalysts for higher profits in the years ahead.

- The stock is crazy cheap at only 2x operating cash flows and 5x midpoint ’23 EPS targets.

santirf/iStock Editorial via Getty Images

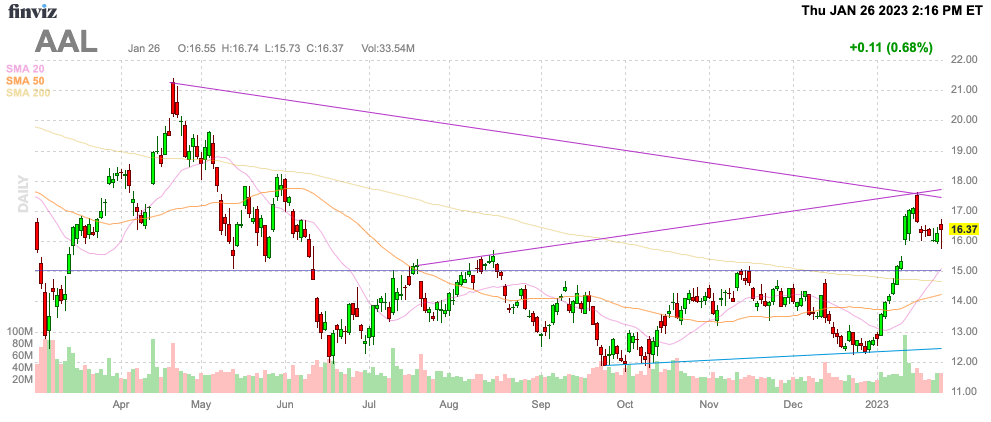

Despite guiding up Q4’22 targets a few weeks back, American Airlines Group (NASDAQ:AAL) hardly rallied. Now the airline has guided to robust profits in 2023 that easily soar past analyst estimates, yet the stock still hasn’t rallied much. My investment thesis is ultra Bullish on the stock trading at only $16, with profits back to the 2019 levels.

FinViz

Massive 2023 Ahead

The airline posted a strong Q4, mostly in line with preliminary guidance from a couple of weeks back. American Airlines earned an amazing $1.17 per share in the quarter compared to the $1.15 back in Q4’19 when the airline had less debt and diluted shares outstanding.

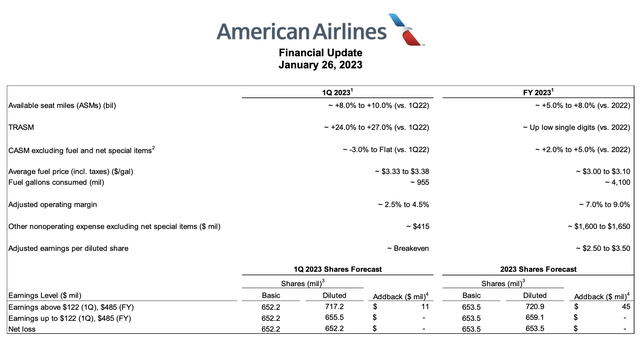

The company guided to the following metrics for 2023, focused on the $2.50 to $3.50 EPS for the year. Note, analyst EPS estimates were still down at only $1.89.

American Airlines Investor Update

While the market appears unconvinced by the 2023 EPS guidance, one needs to understand that American Airlines already generated $2.4 billion in pre-tax profits over the last 3 quarters. The airline earned the following EPS each quarter in 2022:

- Q4 – $1.17

- Q3 – $0.69

- Q2 – $0.76

- Q1 – ($2.32)

In total, American Airlines earned $2.62 per share over the last 3 quarters. Considering the guidance for flat earnings in Q1’23, the low-end guidance for the year doesn’t even require the airline to grow EPS in the year ahead.

The 2023 guidance only forecasts a midpoint operating margin of 8%. Over time, American Airlines could push for a double in the operating margin, leading to substantially higher profits.

The company is guiding to nonoperating expenses of $1.6 billion for the year, amounting to ~$400 million per quarter in net interest expenses. American Airlines had about half those expenses in 2019 at $0.8 billion for the year, with interest expenses running at about $1.0 billion annually.

On top of the operating margins, the airline has nearly a $1 EPS upside from just returning interest expenses to the 2019 levels. American Airlines is looking at a $4+ EPS with an adjusted operating margin only in the 8% range.

While the market is focused on a potential global recession, American Airlines isn’t seeing any slowdown in travel demand after consumers were shut inside for multiple years around the globe. On the Q4’22 earnings call, CEO, Robert Isom, forecasted robust demand for 2023 supporting the high end of EPS targets:

Demand remains strong and our revenue performance is in line with our expectations following our strong holiday performance. Post-holiday bookings are off to a strong start. In fact, this is our best ever post-holiday booking period with broad strength across all entities and travel periods. Demand for domestic and short-haul international travel continues to lead the way. We expect a strong demand environment to continue in 2023 and anticipate further improvement in demand for long-haul international travel this year.

All of these numbers are being achieved without capacity returning to the 2019 level in 2023. American Airlines guided to 2023 capacity at only 95% to 100% of 2019 levels, with 5% to 8% capacity growth YoY from initial low levels to start 2022.

Debt Issue Quickly Disappearing

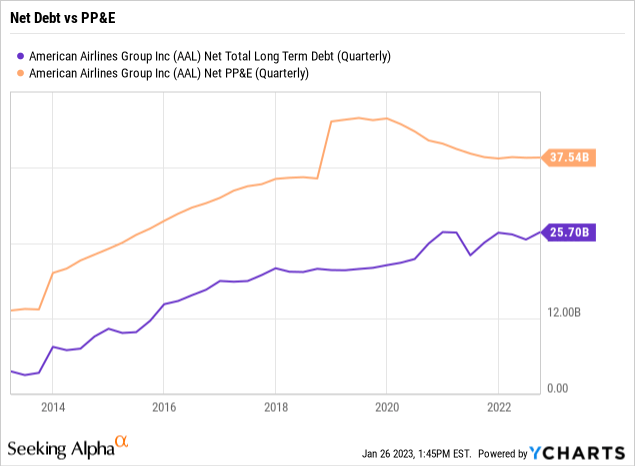

When a company starts averaging $0.8 billion worth of pre-tax profits on a quarterly basis, any debt issue will quickly start fading away. American Airlines has about $25 billion in net debt now, due in large part to buying a ton of new airplanes prior to the covid shutdowns.

The airline has reduced total debt by $8 billion since the peak in mid-2021, but American Airlines hasn’t yet made a material reduction in net debt. The airline ended 2022 with a total cash balance of nearly $10 billion and plans to keep total liquidity between $10 and $12 billion or order to have the liquidity to survive another shutdown, though unlikely to repeat like 2020 again.

American Airlines is guiding towards 2023 operating cash flows of $5.5 billion, with free cash flow of $3.0 billion. Considering the current liquidity position already at $12 billion, the airline should be able to utilize the majority of the FCF to repay debt, if not more.

The stock shouldn’t trade at 2x operating cash flows and 5x midpoint 2023 EPS targets. Airlines have traditionally traded at closer to 8x to 10x forward EPS targets while the industrial transport sector is closer to 15x EPS targets. Ultimately, a very profitable airline should trade closer to the industrial transport sector, especially once American Airlines has reduced debt levels back to pre-covid levels.

Takeaway

The key investor takeaway is that an airline is never a risk-free trade, but the industry is far more profitable than the market perceives. As American Airlines repays a ton of debt over the next few years, the stock will gain more appeal.

Investors should use the ongoing weakness to continue loading up on a cheap airline stock with an impressive profit profile.

Disclosure: I/we have a beneficial long position in the shares of AAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.