Summary:

- Texas Instruments Incorporated reported solid quarterly results which reflected the anticipated slowdown in growth as a result of inventory corrections.

- The share price dropped on the following trading day, as the outlook was slightly lower than analysts’ expectations.

- Texas instruments continues to show impressive cash generation capabilities and returns large amounts of cash to shareholders through an increasing dividend and share repurchases.

- I continue to believe that Texas Instruments is a good long-term investment, but the current valuation does not leave much room for upside potential.

- I calculate a fair Texas Instruments Incorporated share price of $187 based on FY24 EPS expectations and believe it is better to wait out for now.

William_Potter/iStock via Getty Images

Introduction

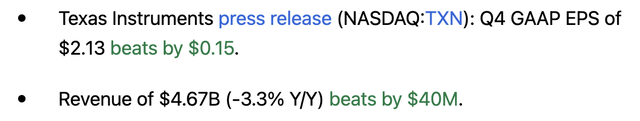

On January 24, 2022, Texas Instruments Incorporated (NASDAQ:TXN) (“TI”) released its 4Q22 and FY22 results and managed to beat both top and bottom-line estimates by analysts. Despite the beat, the TXN share price fell by 1.5% during the trading day and lost some additional percentages over the following couple of days. This was primarily the result of a rather disappointing outlook, as the company is increasingly feeling the consequences of a slowing economy and inventory corrections by its customers.

At the same time, ASML Holding N.V. (ASML) released its financial results the following morning and reported that its customers (primarily chip producers such as Intel (INTC), TSMC (TSM), and Samsung (OTCPK:SSNLF)) expect a recovery by the second half of 2023. So, the semiconductor industry might already start to recover quite soon, which would be good news for TI.

As a semiconductor manufacturer, TI is exposed to the highly cyclical semiconductor industry, and with the current economic slowdown it was already expected that TI was going to see this in its financial results, so expectations were already lowered. As an investor in TI, it is, therefore, very important to not be spooked by a revenue growth slowdown, or even decrease, as the long-term growth trajectory is not impacted by this near-term weakness. This is why I concluded the following in my initial coverage of the company:

I rate Texas Instruments a solid buy. I do recommend starting with a smaller position and slowly buy more as time passes, since we do not know where the economy is headed, and lower stock prices are highly likely.

(For a more in-depth look into Texas Instruments products and business model, I recommend reading my initial coverage of the company.)

So, how would you have done if you bought back then? At the moment of writing this article, you would be up approximately 7.5%. More important now is how the recently released earnings results impact the outlook for TI. Let’s see how they did and decide whether this changes my rating on the company.

Quarterly and FY22 results

Texas Instruments Incorporated reported 4Q22 revenue of $4.67 billion. This was down 11% compared to 3Q22 and decreased by 3% compared to the year-ago quarter. This drop in revenue was as expected and reflected the slowing demand and tough macroeconomic environment. TI saw a decrease for all end markets except for automotive, as this is seeing continued semiconductor growth due to an increase in semiconductor demand as electric cars and autonomous driving features simply require more semis per car. Also, the automotive sector is still recovering from a semi-shortage witnessed during the covid years. The main reason for the drop in demand in all other end markets is due to a correction in inventories, according to TI.

If we take a look at the individual end markets for TI, we can see that most weakness was to be found in both communications equipment and enterprise systems, as these saw a decline in revenue of approximately 20%. These two segments combined account for only 13% of FY22 revenue for TI, so the impact on total revenue performance was limited. Still, these are quite significant decreases, but, again, not unexpected.

The personal electronics market was down by the mid-teens with broad-based weakness. The segment accounted for 20% of FY22 revenue. The industrial market segment fell by approximately 10%, and automotive saw revenue grow by mid-single digits. These two are most important for TI, as they account for a combined 65% share of FY22 revenue, up 3% from the previous year. Luckily, results for these segments were rather resilient, and as a result, TI saw only a 3% decline YoY.

It is not by accident that the industrial and automotive segment accounted for the largest part of FY22 revenue. TI has divested many business segments over the last decade as they wanted to focus their resources toward the end markets for which they saw the most growth potential. During the latest earnings call, management once again confirmed the bullish thesis for these segments as the continued shift among customers remains strong:

Our industrial and automotive customers are increasingly turning to analog and embedded technologies to make their end products smarter, safer, more connected and more efficient. These trends have resulted and will continue to result in growing chip content per application, which will drive faster growth compared to our other markets.

It is safe to expect these business segments to account for an increasing part of total revenue over the next couple of years as TI remains focused on these growth industries. I agree with management, and am pleased to see TI focusing on these growth areas as these will also be solid revenue drivers.

Gross profit for the fourth quarter was $3.1 billion, or 66% of revenue. The gross margin did decrease by 3.2% YoY mainly due to lower revenue and higher Capex.

Net income for the quarter was $1.96 billion, resulting in an EPS of $2.13. This included an $0.11 benefit that was not included in guidance. As they beat the consensus by $0.15, this would have been an $0.04 beat without this benefit.

Overall, the fourth quarter results did not offer many surprises and showed pretty much what was already expected – a slowdown as a result of a slowing economy and customers correcting their inventories.

Now, if we look at the FY22 results, we can see that TI still managed to increase revenue over the full year by a little over 9% to $20 billion, and considering the economic deterioration this is quite strong. Gross profit was $13.77 billion and net income came in at $8.75 billion. Capex for the full year totaled $2.8 billion or 13% of revenue. As a result, the free cash flow for FY22 was $5.9 billion, or 30% of revenue. According to TI, the strong continued free cash flow margins reflect the strength of the business and they expect that growth of free cash flow per share is the primary driver of long-term value.

Despite the difficult operating environment and deterioration of the economic climate in the second half of the year, TI still managed to increase EPS by 14%.

One final point to discuss is the CHIPS Act. During the last quarter, TI already accrued $350 million on the balance sheet due to the 25% investment tax credit for investments in U.S. factories. As TI has many investments planned for the next couple of years to expand or build new factories, it should see more tax benefits within this period. It is a positive sight to already see the tax benefits impact the balance sheet. In the end, this should give TI the possibility to either increase expansion plans without the need to spend more cash or it could strengthen the balance sheet with the received tax credits. This poses a strong tailwind for TI.

Balance sheet & dividend

TI has a strong balance sheet as of the end of the latest quarter, with $9.1 billion in total cash and equivalents and $8.8 billion in total debt. The company did issue $800 million in debt during the quarter and the weighted average coupon now stands at 2.93%. The balance sheet looks solid and gives Texas Instruments Incorporated plenty of room to continue repurchasing its shares and investing in the business.

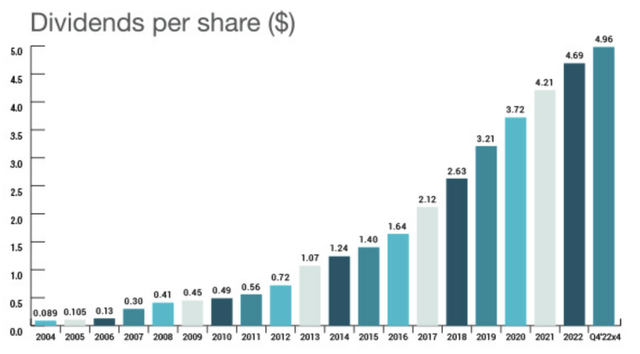

Over FY22, the company returned $7.9 billion of cash to shareholders in the form of dividends and share repurchases. While this is higher than the reported free cash flow over the last 12 months, this does not worry me, as the balance sheet of TI allows for more returns. In addition to this, TI increased the dividend by 8% during the fourth quarter meaning the company now has a track record standing at 19 years of consecutive dividend increases. The recent 8% increase is a nice hedge against high inflation.

Texas Instruments dividend history (Texas Instruments)

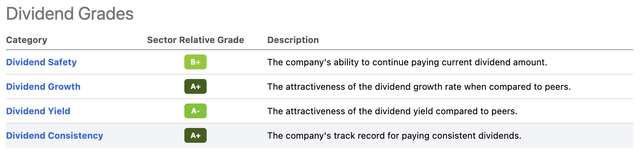

As a result, TI now has a forward yield of 2.85%, which is already very decent, but considering that it has grown its dividend at a 17% CAGR over the last 5 years makes it a very appealing choice for dividend growth investors. As shown above, Texas Instruments Incorporated has a strong dividend history, and a 48% dividend payout ratio leaves it with plenty of upside potential while protecting the dividend against a possible downturn. With TI expected to see strong growth over the remainder of the decade, I expect the same for the dividend. Texas Instruments gets solid dividend ratings from Seeking Alpha as well, as shown below.

Texas Instruments dividend grades (Seeking Alpha)

Outlook & Valuation

So, what can we expect from TI going forward?

So far, we have not seen anything that justifies a drop in the TXN share price following the results. Financial results reflect an already expected slowdown and TI still reported decent cash flows. It was the outlook that caused the drop aftermarket. Whereas Texas Instruments Incorporated saw significant pressure on growth as a result of margin corrections, this is not expected to disappear for the first quarter of 2023. TI expects that its customers continue to reduce inventory and therefore expects a weaker than seasonal decline with the exception of Automotive.

Turning to our outlook for the first quarter, we expect TI revenue in the range of $4.17 billion to $4.53 billion and earnings per share to be in the range of $1.64 to $1.90.

The drop quarter-over-quarter will be no surprise to anyone, but the outlook for the first quarter was not quite as expected. Analysts guided for revenue of $4.42 billion and EPS of $1.87. These are both within the range given off by management but on the high end. I do not think the outlook is bad necessarily, and honestly expect TI to outperform analysts’ guidance based on industry trends.

According to Seeking Alpha, analysts currently guide for revenue of $4.37 billion for 1Q23 with EPS of $1.80. This represents an 11% decrease in revenue and a 25.5% decrease in EPS YoY. Current estimates for 2Q23 guide for an even worse decrease YoY but analysts see a recovery for the second half of 2023 as guided by industry giant ASML. As a result, FY23 expectations are for revenue of $18.21 billion (a decrease of 9% YoY) and EPS of $7.64 (a decrease of 21% YoY).

This means TI is currently valued at a forward P/E of almost 23x, which I believe is not cheap although on par with its 5-year average valuation. With the company projected to grow its EPS by low double digits for the years after, I believe a 22x P/E is warranted for TI considering its business strength, industry dominance, and cash generation and return. This means TI is trading near fair value and does not offer much upside potential in the near term. Based on FY24 EPS expectations and a P/E of 22x, we would arrive at a fair value estimate of $187. Based on the current share price, this would result in a 7.6% return over the next 2 years.

Risks

As for the risks, not much has changed since my previous coverage of the company. This is what I said back then:

For the long-term, I honestly do not see many downside risks for TI. Its market position is strong, and it is focused on strong growth areas such as industrial and automotive. The near term is a different story, with the current economic slowdown we are witnessing. A serious economic slowdown and potential recession will appear to be a problem for TI as well. A drop in consumer spending will result in a drop in the sales of personal electronics and, potentially, automotive. These drops in spending will have an impact on the demand for products of TI. Yet again, I will state, this is no company-specific problem and for sure no long-term issue.

The economic weakness is now clearly visible in the financial results and near-term growth outlook for the company. Automotive continues to be resilient, but as this is a highly important business segment for TI, a slowdown for this industry could result in more downside than currently anticipated. Still, the automotive industry has multiple secular tailwinds behind it, so I believe for now it should be of no concern for investors.

Conclusion

Overall, I believe this last quarter shows the strength of the business of Texas Instruments Incorporated, and I continue to believe that the company is very well-positioned for continued long-term growth and could be a real compounder, as it has a dominant market position, is exposed to the right secular trends, and is a real cash flow machine. While growth may stall for a few quarters going forward as well, I believe this trend will turn by the second half of 2023, as pointed out by ASML management. TI continued to report very strong cash flows and margins were relatively resilient.

For long-term investors, I see absolutely no issues, and my thesis as described in my initial coverage on TI remains the same. This is what I wrote back then:

The company has a great moat within the industry which it can leverage to keep growing. Management knows how to select the best growth opportunities (and how to drop weaker ones) and has great exposure to the automotive and industrial segments. The dividend and buyback history form an extra safety net for shareholders, with a current yield above 3%. Strong growth is on the horizon and investors who can look through the near-term volatility and market drops, will be able to reap the rewards over the next decade.

The one thing that has changed is the Texas Instruments Incorporated valuation. As a result of economic weakness, the company is reporting lower EPS and revenue numbers, and as the economy is somewhat unpredictable over the coming 6 months, I chose to be a bit more careful and conservative. The current valuation of Texas Instruments does not allow for much upside from current levels and I, therefore, recommend waiting out for now. Based on current FY24 EPS estimates the current share price only offers about 7.5% upside potential as I calculate a price target of $187 per share.

While I have absolutely no doubts about the strength of Texas Instruments Incorporated, the valuation simply does not offer much upside. If you have an investment horizon of at least 5-10 years, the company might be interesting from a dividend growth perspective, and I believe the company is a relatively safe bet due to its industry dominance and importance. True quality companies rarely trade cheap, and the same might be the case for TI.

For now, I plan to wait out for a better entry point. Due to a lower-than-expected outlook for FY23 and a 7% increase since my previous article, I rate Texas Instruments a hold for now.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.