Summary:

- American Airlines posted some of its best financial results in the 4th quarter of 2022 compared to the rest of the industry.

- American Airlines is in contract negotiations with its pilots and flight attendants who are looking for hefty increases in compensation.

- American Airlines has both structural strengths and challenges that will impact its ability to generate strong profits in 2023.

Boarding1Now

In the fourth quarter of 2022, American Airlines (NASDAQ:AAL) posted some of its best financial results compared to the rest of the industry. The Ft. Worth based global carrier reported a 10% operating margin and a 6% net income margin in the 4th quarter. American execs have noted that results were buoyed by the strong demand especially in the domestic marketplace that has helped all U.S. airlines. Nearly two-thirds of AAL’s 4th quarter revenue came from its domestic system where yields were up over 34%, the strongest for any of its regions. Among American’s international regions, its transatlantic system, AAL’s 2nd largest global region behind its Latin region, benefitted from the extended summer transatlantic travel season which saw transatlantic revenue increase nearly fivefold from a depressed 2021. American is the largest carrier in Latin America and its results were also strong in that region. American’s Pacific network is still recovering but will be much smaller than it has been for years; the carrier lost billions of dollars over many years trying to fly routes which it deemed strategically necessary. However, they have withdrawn from a number of routes especially to China and Hong Kong, and say that, on a systemwide basis, they have redeployed the lowest performing 5% of their capacity to their most profitable routes; the results of those decisions are clearly obvious on their bottom line.

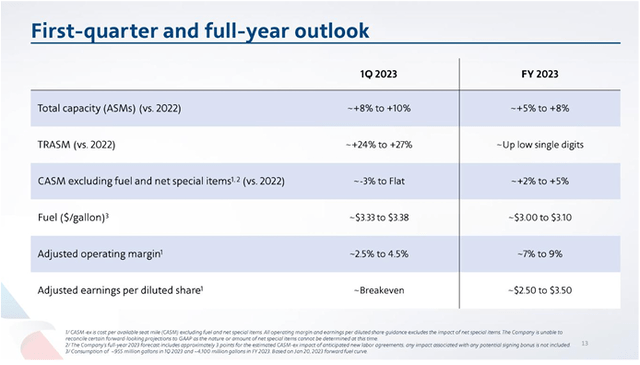

AAL income statement Dec 2022 (AA.com)

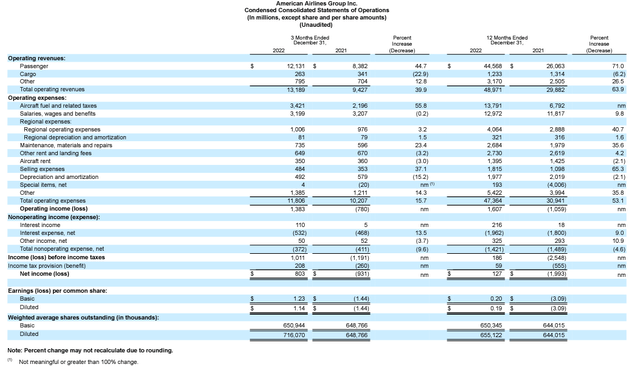

On the cost side, American’s labor costs were flat year over year for the quarter even though the carrier added 8% more capacity. Fuel, however, increased by over $1.3 billion or by 56% for the quarter on a 48% increase in the price per gallon of $3.50 for jet fuel for the quarter – and $3.54 for the year. While American’s revenue performance is strong, its revenue generating capabilities relative to its costs are not as good as some of its competitors.

American’s fuel bill for 2022 was $13.8 billion to generate $49 billion in total operating revenues, burning 3.9 billion gallons of jet fuel at $3.54/gallon.

Delta’s (DAL) fuel bill for 2022 was $11.5 billion to generate $50.6 billion in total operating revenues, burning 3.4 billion gallons of jet fuel at $3.36/gallon.

United’s (UAL) fuel bill for 2022 was $13.1 billion to generate $45 billion in total operating revenues, burning 3.6 billion gallons of jet fuel at $3.63/gallon.

American has touted the growth of its loyalty program and yet Delta’s partnership with American Express is yielding more revenue to the Atlanta-based airline than American gets from its partnerships. Delta also is saving three-quarters of a billion dollars per year on fuel because of its refinery. In order to move into a leadership position in the industry financially, American is going to have to overcome some of its structural disadvantages in terms of both revenue and costs.

On many fronts, American’s financials show a company that is growing into its non-fuel cost structure while deploying its capacity more effectively than it has in many years. While American’s core airline operation appears to be on stronger financial footing than it has been in years, there are a number of threats and opportunities to its finances.

AAL operating stats 4Q2022 (AA.com)

Labor costs are set to soar

To no one’s surprise in the United States, labor shortages were widespread throughout the pandemic era and have not fully eased in many sectors. In the airline industry, many employees chose to retire and some airlines offered incentives for them to do so given the uncertainty of how long the pandemic might last. In addition, pilots have to retire at 65 years of age so many simply reached the end of their career during the pandemic. Airlines obviously cut back hiring new employees as travelers sat on the sidelines as they waited out the pandemic. When travel returned rapidly in the spring of 2022, most airlines were not properly staffed for the levels of demand that quickly rebuilt. They spent much of the past nine months rehiring personnel even if they were not in a position to put those employees fully to use.

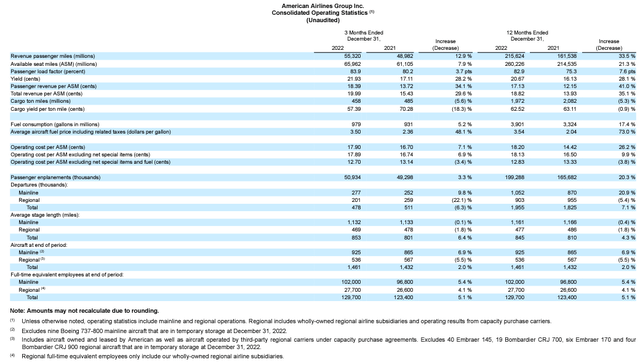

AAL labor groups Dec 2022 (AA.com)

Another clock that kept ticking during the pandemic was labor contract renewals. Airline labor relations are governed by the Railway Labor Act and, under the RLA, labor contracts become amendable but do not expire. Most airline labor negotiations were put on ice during the pandemic with the hope, from labor’s standpoint, that a return of revenue would allow labor negotiations to progress.

Because they are the highest paid airline employees, many airline labor contract cycles begin with pilots so that management has some idea of what is expected for other labor groups. The pandemic wreaked havoc on the supply of airline pilots as many young people saw no future in aviation and pursued other careers. As airline hiring ramped up after the pandemic, regional airlines were the first to struggle to staff their operations even as the major carriers that contracted for regional airline services pulled many pilots away from regional carriers. Shortages began to impact low cost airlines which do not offer the earnings potential to pilots that the global carriers that use widebody aircraft can. Regional airlines and many low cost carriers moved quickly to boost salaries with six figure bonuses now common at many regional airlines for captains that stay rather than going to larger airlines. The big airlines themselves are paying more than ever for regional airline services even as they are trying to staff their own operations.

Pilots at the large jet airlines see opportunity and managements recognize that they have to increase their salaries in order to continue to attract pilot candidates. United’s CEO stated a year ago that UAL would be the first of the big 4 airlines to sign a new contract with its pilots; the company and its pilot union released a contract proposal that included double digit percentage increases in salary but which were much smaller than some of the low cost carriers had offered. Just as United’s pilots were voting on their contract, American told its pilots that it would beat the United contract by a very small percentage but that was enough for United pilots to reject their deal and recall many of their union leaders that had brought the deal to them. There was little movement in the pilot contract negotiations until Delta announced in mid-December that it had reached an agreement with its pilots; not only was Delta’s agreement in principle the first of the big 4 that looked passable but it represented the potential end to a negotiation process that began in 2019. Delta’s AIP was worth more than twice per year what United had offered, agreeing to 34% increases in compensation over the four years of the contract including 18% on the date of signing as well as retroactive pay to cover some of the salary that was not increased during the pandemic. Delta pilots completed voting on their contract in February and the contract is now in effect, passing by three-fourths of Delta pilots. Shortly after the Delta pilots ratified their contract, American executives stated that the new Delta contract was a transformative moment in airline labor relations; indeed the Airline Pilots Association which represents Delta pilots valued the contract at roughly $1.75 billion more in compensation per year.

American’s CEO recently stated that he would match the pay increases that Delta was giving its pilots – but American’s pilot union quickly began the process to take a strike authorization vote, essentially sending the message to AAL management that they were not accepting the pay matching suggestion. While AAL’s offer is generous, many AAL pilots state that simply matching the DAL salary increases misses out on two major components of the Delta contract: retroactive pay and improvements in quality of life issues. Delta pilots sought and gained a number of improvements in how the airline can schedule them, including stronger protections should the company reroute them from the schedule which they bid. Delta also had one of the largest profit sharing payouts in all of corporate America pre-covid and the formula for calculating it remains in place as Delta is guiding to very strong profits in 2023; American’s CEO said they would match Delta’s profit sharing formula but AAL’s historic profit deficit to DAL means AAL pilots could be shortchanged on profit sharing even with the same formula.

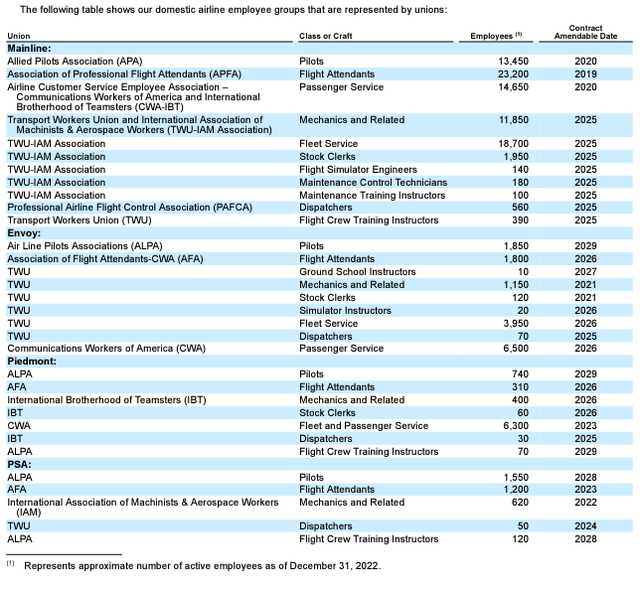

American’s guidance for 2023 shows that it expects to increase salaries for a number of labor groups during the year which partly explains why its margin guidance for the year is actually lower than it was in the 4th quarter of 2022, a typically a slower quarter from a revenue perspective. AAL’s guidance, however, notes that it does not include any retroactive payments.

American’s pilots are not the only labor group looking for a new contract. Just about as soon as American’s CEO Robert Isom said the company was willing to match Delta’s pilot rates, American’s flight attendant union said they wanted a rich new contract too. American’s flight attendants want a “me too” clause that would give them the same rates of increase as American pilots along with several other items including flight boarding pay which Delta gave to its non-union flight attendants last summer for the first boarding pay for flight attendants at a major U.S. airline; historically, U.S. airlines have paid flight attendants by the flight hour, meaning that they are only paid, like pilots, when the aircraft door is closed.

American’s pilots and flight attendants make up approximately 35% of American’s mainline workforce of just over 100,000 employees. AAL spent nearly $13 billion on salaries and benefits in 2022 for all of its mainline and wholly owned regional airline employees. Double digit increases in salary for one-third of AAL’s employees could add $2 billion or more to American’s costs on an annual basis. Most of its remaining large workgroups have contracts that will not become amendable for several years.

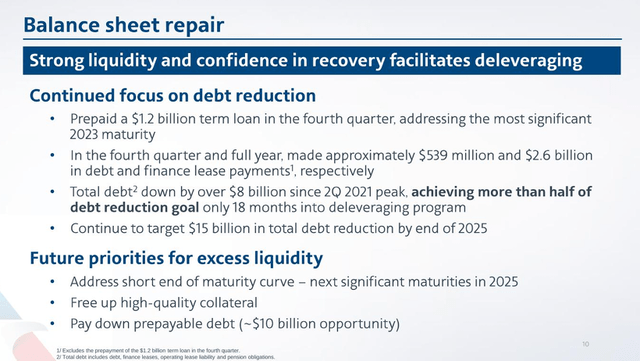

Balance sheet improvement is already underway

If American’s labor costs are set to rise, its capex and interest expenses are falling. Over the past decade, American has spent very heavily on hundreds of new aircraft, resulting in the youngest fleet among the big 4 U.S. airlines. American is now in a position to dramatically slow its fleet spending and it plans to take delivery of just 23 new aircraft from Airbus and Boeing (BA) in 2023, one of the lowest rates of aircraft deliveries for a major airline in years. AAL intends to supplement its new deliveries with reactivations of nine 737s that have been stored. AAL’s capex for each of the next two years will fall below $2.5 billion, a dramatic reduction after several years of fleet spending over $5 billion per year.

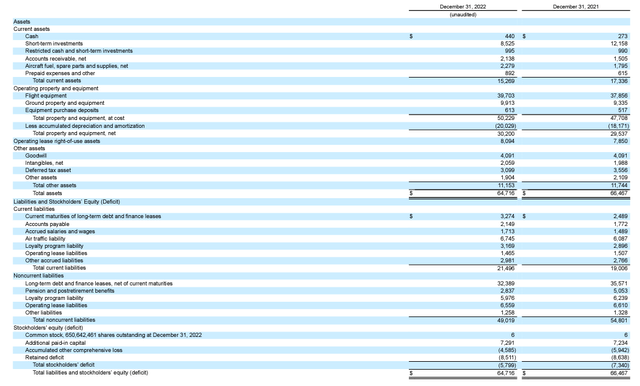

AAL balance sheet repair (AA.com) AAL balance sheet 4Q2022 (AA.com)

Notably, AAL has negative stockholder equity, a rarity even in the U.S. airline industry.

As AAL reduces its capex, it intends to use its cash to pay down its debt which is currently the highest in the U.S. airline industry. During many of the years that AAL engaged in heavy fleet spending, its earnings were at the bottom of the industry, leaving AAL’s balance sheet in tatters. American’s debt obligations are reduced for the current year and 2024 and are expected to increase again in 2025 unless they renegotiate some of their debt.

Strategic Challenges Remain

American has two key strategic challenges that could significantly impact its revenue strategies. The first of those challenges could be a decision on the Northeast Alliance (‘NEA’) that American has with JetBlue (JBLU). The NEA is a DOT-approved antitrust immunized joint venture involving parts of American and JetBlue’s operations in New York City and Boston. The Dept. of Justice, however, sued to blocked the arrangement, the case was heard in a Boston federal court, and a decision on the case could come at any time. However, the outcome of the NEA is complicated by JetBlue’s planned acquisition of Spirit Airlines (SAVE). That transaction is also being sued by the DOJ leaving JBLU in the unenviable position of having two major initiatives under the microscope of federal regulators – who are being joined by a number of states in one or both of the suits. Both JBLU strategies have significant implications for American, particularly given that it had previously downsized operations in NYC before the NEA but has since shifted resources back as part of the partnership and is also swapping takeoff and landing slots at both New York LaGuardia and JFK airports with JBLU. It is also possible that JBLU could choose to negotiate down the terms of the NEA in order to minimize objections to the SAVE acquisition but at this time, JBLU does not appear to be willing to change its strategies for either of the two initiatives. At the same time, AAL downsized operations at Philadelphia where it also has a hub. A negative outcome on the NEA could force AAL to return to some of the same strategies in the Northeast which were not financially optimal for them in the past. I discuss the challenges facing JBLU in this Seeking Alpha article.

The second area of potential revenue turbulence for American comes with its presence from Miami to S. America. For years, American had a partnership with Latam, the pan South American airline that has operations in a half dozen countries including its home country of Chile. American tried to form a joint venture with Latam but the Chilean government blocked those plans because of AAL and Latam’s overlap in Chile. Delta jumped in and offered to form a joint venture with Latam and also invest billions of dollars in the airline in the form of an equity investment plus buying excess assets and assisting with operational expenses. Latam was one of the early global carriers to file for reorganization during the covid era but the company reorganized in U.S. courts under chapter 11, Delta reinvested in the company which has now emerged from chapter 11, and the joint venture between Delta and Latam has been approved and is in place. Pre-covid, Delta, then the second largest domestic airline at Miami, added a number of domestic flights to Miami to support Latam’s multiple flights to S. America. Latam and Delta have both been cautious in re-adding capacity to the Miami-S. America market but Delta added two seasonal longhaul routes from New York JFK airport: to Rio de Janeiro – which is part of the Latam partnership and Buenos Aires – which is not a part of the partnership. Latam added a new route from Los Angeles to São Paulo, a route which American previously flew but dropped during covid. It is certain that Delta and Latam are looking at other opportunities to expand their partnership especially in Miami where American has a monopoly position among U.S. airlines to S. America. I wrote about Delta’s pre-covid arrangement to develop a partnership with Latam in this Seeking Alpha article.

American’s ability to withstand a competitive challenge in Miami is heightened because of the strong growth that Florida as a whole and the Miami area in particular is experiencing. In addition, JetBlue and Spirit Airlines are the two largest airlines at Ft. Lauderdale, from which both have operations to Latin America. The outcome of that merger could improve the competitive situation for American in S. Florida. Southwest Airlines previously also had a large operation at Ft. Lauderdale but has pulled back a number of routes in the midst of the brutal 3-way competitive environment just at Ft. Lauderdale.

The strong macroeconomic position that American has in Miami is mirrored in a number of its other hubs; American has a higher percentage of its operation in sunbelt states that either Delta or United. Even pre-covid, American began shifting resources to its hubs at Dallas/Ft. Worth and Charlotte, North Carolina. During the covid recovery period, economic growth in those areas has grown along with Phoenix where American has its southwestern U.S. hub. AAL’s hub at Washington National airport is slot-controlled which provides a competitive moat and is doing financially well, in contrast to its hubs in New York City and Chicago; AAL’s hubs in those two cities have funded much of the growth that has allowed the airline to shift resources to its sunbelt hubs – and are a big part of AAL’s shift of resources from the bottom 5% of its network to the top 5%.

American Stock is Still a Buy

American is just one of the three global U.S. airlines that are all enjoying one of the best periods financially relative to the rest of the industry in the forty plus years that the U.S. domestic airline industry has been deregulated. Low cost carrier and investor favorite Southwest (LUV) has been badly damaged because of their operational problems in late 2022; it is ironic that their crosstown rival, American, is now recording profits when Southwest posted heavy losses in the fourth quarter of 2022 and is not expected to post a profit in the first quarter of 2023. Southwest also faces multiple labor contract renegotiations and its pilots, flight attendants, and other workgroups are equally frustrated by the slow pace of LUV’s labor negotiations. I discussed Southwest’s current situation in this recent Seeking Alpha article.

AAL chart 10Mar2023 (Seeking Alpha)

The low cost carrier sector in the U.S. is struggling to absorb the high fuel and labor costs that the big 3 are increasingly able to pass on more successfully. Throughout the pandemic, analysts predicted that the low cost carriers would have an advantage because of their lack of longhaul international route systems but I correctly noted that low cost carriers need growing markets in order to grow their profits; the return of demand for air travel has been better captured by the big 3 – which carry about 60% of U.S. air travel – than by the low cost segment and the gap is likely to grow. This year, though, could see a very profitable big 3 and a marginally profitable low cost carrier segment, even after the big 3 settle their labor contracts.

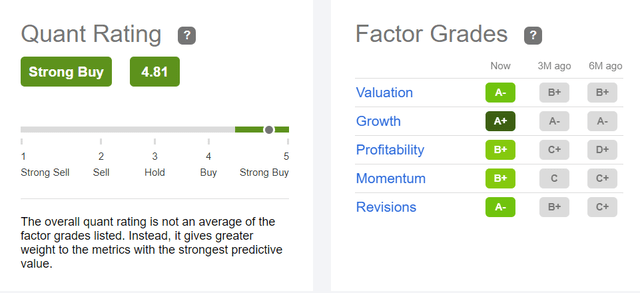

AAL quant rating 12Mar2022 (Seeking Alpha)

Wall Street analysts and even other Seeking Alpha authors do not see the potential that AAL has; both groups rate AAL as a hold. However, Seeking Alpha’s Quant Ratings tell a different story. SA’s Quant rating for AAL indicates a strong buy, in line with both DAL and UAL and higher than most of the rest of the airline industry.

As AAL continues to implement its strategies, investors should consider the strength and prospects at American Airlines.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.