American Tower: Don’t Fool Yourself, AMT Is A Long-Term ATM

Summary:

- American Tower is very well positioned to benefit from the growth in data usage from mobile carriers.

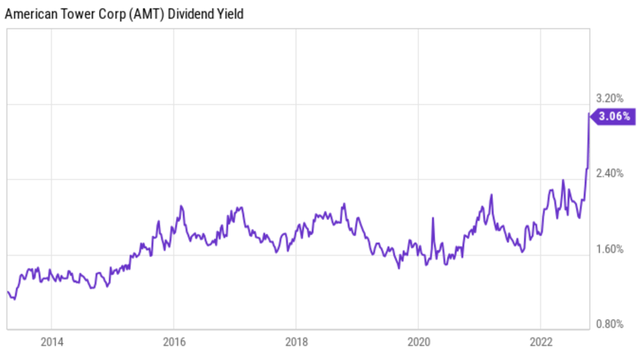

- American Tower offers a historically high dividend yield, and its dividend has been growing at a double-digit pace.

- Recent drop in share price presents a great opportunity.

Leonid Sorokin/iStock via Getty Images

Most investors have heard the maxim “be greedy when others are fearful”. This is, however, easier said than done, as fear is a powerful force that can even scare experienced hedge fund managers and analysts alike. That’s when it’s important to stick with one’s convictions. After all, if one liked a stock when it was expensive, then why should that thesis drastically change when that stock has traded down on short-term fears.

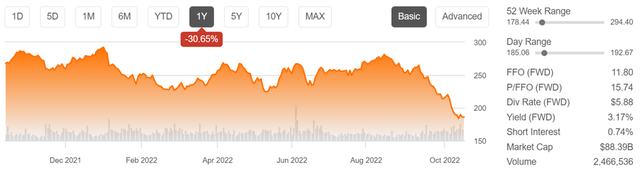

This brings me to American Tower (NYSE:AMT), which is now trading well below its near term high of $282 from as recently as August. As shown below, AMT has lost billions of market cap in a matter of just 2 months. In this article, I highlight why the market is being way too pessimistic around this stock and its future prospects.

Why AMT?

American Tower Corp. is one of the largest publicly-traded REITs by market cap and has a global presence. It’s focused on owning, operating, and developing multi-tenant communications real estate, with a portfolio of around 222K communications sites. It operates on the 6 continents of North & South America, Africa, Europe, Asia (India) and, Australia, covering 22 countries. AMT generated $10.2B in revenue in the trailing 12 months.

The cell tower industry in the U.S. is dominated by American Tower and Crown Castle Inc. (CCI). This comes with a massive economy of scale, as they enter long-term leases that include rent escalators with the top wireless carriers. This gives both players a more stable and predictable income stream than even that of most other REITs.

Importantly, like CCI, AMT has significant scale advantages, as it’s able to leverage its existing tower to add new tenants and equipment upgrades for little incremental cost. This is increasingly becoming the norm, as data use grows and existing network capacity becomes stretched.

AMT is living up to its promise with continued strong property revenue growth of 17% YoY to $2.6 billion during the second quarter, and it continues its expansion, building 1,500 high return towers during the quarter.

Looking forward, AMT has plenty of growth opportunities in both the U.S. and in the international markets. This could be driven in the near term by India, whose mobile carriers appear set to ramp up growth, as noted by Morningstar in its recent analyst report:

American Tower’s international growth has been depressed in recent years due to consolidation of mobile carriers in India, which led to exorbitantly high churn. We believe consolidation is now mostly past and that India can start contributing to strong international growth. Long term, we think prospects are bright in American Tower’s international markets, which are dominated by India, Brazil, Africa, and Mexico.

Many international markets are a decade behind the U.S. and are now building their 4G networks. Indian data usage has been growing 100% per year, and carriers have been substantially increasing spending to improve networks. Latin American countries now have over 200 million people in the middle class, making them potential smartphone users.

Potential headwinds to AMT include higher interest rates, which raise AMT’s cost of debt. However, it’s very reasonably leveraged, especially considering its durable income stream, with a net debt to EBITDA ratio of 5.8x. Also, AMT yields a respectable 3.2% and its 18% 5-year dividend CAGR is well above the most recent reported inflation rate of 8% for the month of September. As shown below, AMT current offers its highest dividend yield in its history.

Also, satellite connectivity may be perceived as an emerging threat to cell towers. However, technical limitations prevent them from becoming a credible long-term threat, as highlighted by Hoya Capital in a recent article:

Supply growth is almost non-existent in the US, and the relative scarcity of cell towers, combined with the absolute necessity of these towers for cell networks, has given these REITs substantial pricing power even as the number of potential tenants has dwindled down to just four national carriers over the last two decades.

We continue to be impressed by the pace of Low Earth Orbit satellite service deployment, but while there is some risk of disintermediation to towers if the mobility and power efficiency of satellite connections improve considerably, these LEO networks continue to face unavoidable physical and technical limitations which will continue to constrain the addressable market primarily to low-bandwidth mobile and rural home broadband applications where superior ground-based networks with superior capacity and latency are otherwise unavailable.

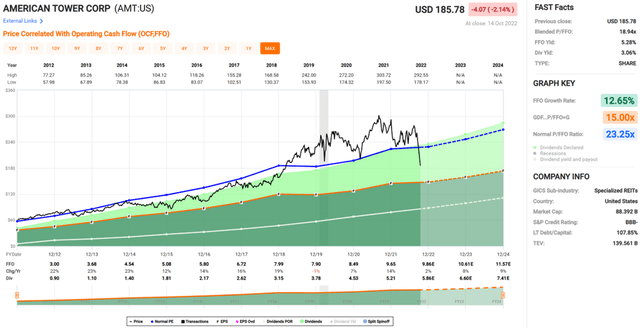

Turning to valuation, I find AMT to be attractively valued at $185.78 as its valuation has come back far down to earth, with a forward P/FFO of 15.7. This seems low considering the high quality nature of the enterprise and its growth prospects as mobile carriers roll out 5G to handle growing data intensity.

As shown below, this valuation sits well below AMT’s normal P/FFO of 23.3. S&P Capital IQ has a consensus Buy rating on AMT with an average price target of $281, and AMT could see very strong double-digit returns just by reverting to its mean valuation.

Investor Takeaway

American Tower is a leading global provider of wireless communications infrastructure and is very well positioned to benefit from the growth in data usage from mobile carriers. It offers a historically high dividend yield and its dividend has been growing at a double-digit pace. The stock is attractively valued and appears oversold. Investors shouldn’t fool themselves into thinking AMT is a bad stock for the long-run just because of recent share price weakness. AMT is a bargain at present.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!