Summary:

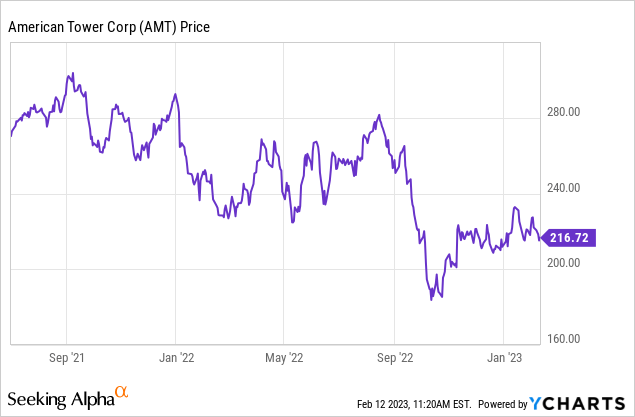

- American Tower Corporation is now down nearly 30% from its all-time high.

- The demand for towers is continuing to benefit from the increase in mobile data usage.

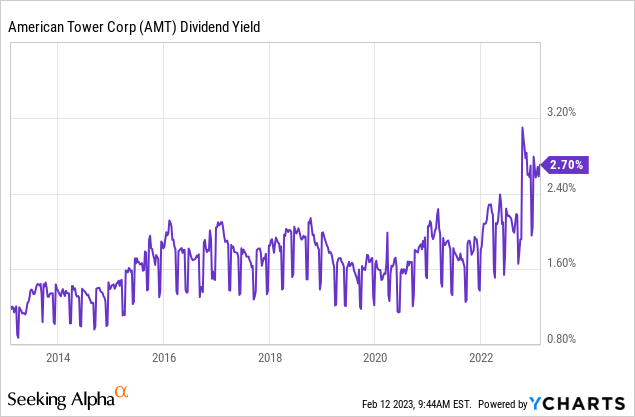

- Dividends payout have been increasing steadily every year, and the current yield is now near historical highs.

- The current valuation seems attractive considering the yield and its historical averages.

- I rate American Tower Corporation stock as a buy.

imaginima

Investment Thesis

American Tower Corporation (NYSE:AMT) is one of the best real estate investment trusts (“REITs”) in the market, with reliable dividend growth. The company has been struggling in the past two years, and the share price is now down nearly 30% from its all-time high in 2021. This is largely due to the Fed’s Fund Rate increasing which caused dividend companies to sell off as their yield is now less attractive on a relative basis.

However, as inflation starts to slow down, many have suggested rates are now near the top, which should help the sentiment of dividend stocks. The company’s fundamentals remain solid, and it continues to benefit from the increasing need for connectivity. The current dividend yield is also near a historical high while valuation is discounted on a historical basis. I think the current price should offer solid upside potential, therefore, I rate American Tower Corporation as a buy.

Why American Tower?

American Tower is a company that owns and operates communications real estate. The company generates revenue by leasing its properties and facilities to customers like AT&T (T) and Verizon (VZ). It currently owns approximately 223,000 communication sites across the globe. This creates a huge moat as it is nearly impossible for another company to build such a massive portfolio of sites in a short period of time, not to mention the amount of capital required to do so. The company also has long-term contracts with customers that are hard to win over.

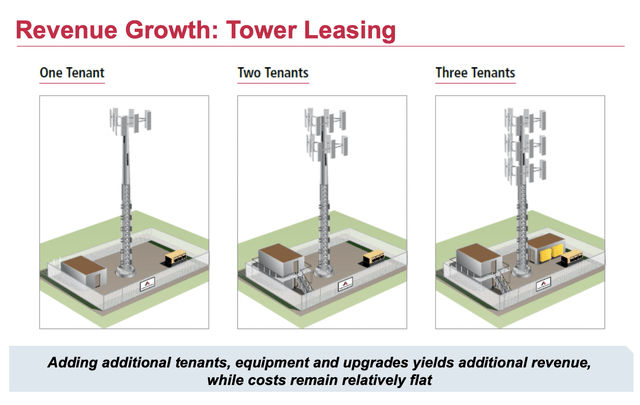

The unit of economics for towers is actually very compelling. While it requires a huge amount of capital at the start for construction, the incremental costs onwards are extremely low. Maintenance cost isn’t that expensive and some recurring costs and expenses such as power & fuel costs are passed on to the tenants. The operating expenses of having one or three tenants are also essentially the same which provides strong operating leverage. This makes American Tower an extremely profitable company.

Secular Tailwinds

American Tower continues to benefit from strong secular tailwinds such as increasing data usage, which in turn increases customers’ investment in more communication sites. Thanks to IoT (internet of things), more and more products are now connected. According to the company, the number of IoT devices is forecasted to grow from 248 million in 2022 to 581 million in 2027, representing a CAGR (compounded annual growth rate) of 19%. While their data traffic is also expected to grow from 1GB per month to 2.7GB per month, or a CAGR of 22%. The increasing adoption of IoT should be a strong growth driver moving forward.

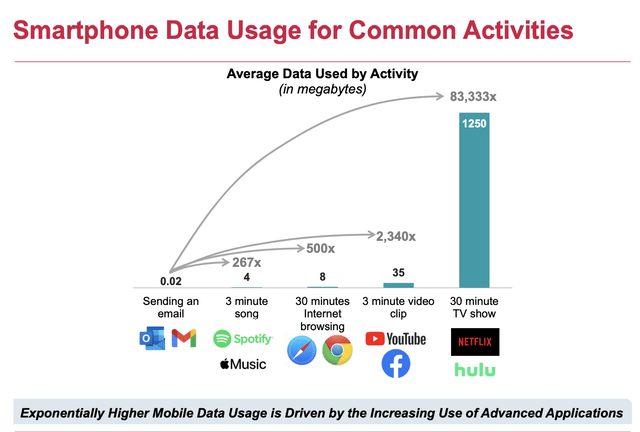

As the capability of mobile phones increases, data usage also increases, as advanced applications require substantially higher data usage. According to the company, watching a 3-minute video clip uses nearly 9 times more data compared to listening to a 3-minute song. Due to the increasing popularity of Netflix (NFLX), TikTok, and mobile gaming, U.S. mobile data traffic is also expected to grow at a CAGR of 22%%. On the international end, a lot of emerging countries now finally have access to more sophisticated phones for an affordable price, which should also boost data usage. I believe mobile data growth will be a huge tailwind.

Dividends and Valuation

Despite the drop in share price, American Tower’s dividends have been continuing to increase. Back in December, the company once again raised its quarterly dividend from $1.47 to $1.56, representing a solid increase of 6.1%. This brings the 5-year dividend CAGR to 17.47%, which is very impressive (for a more concrete context the dividend doubled in the past 5 years). The forward dividend yield is now 2.88%. From the first chart below, you can see the current yield is near historical highs. With the interest rate likely to come down, this is getting more and more attractive.

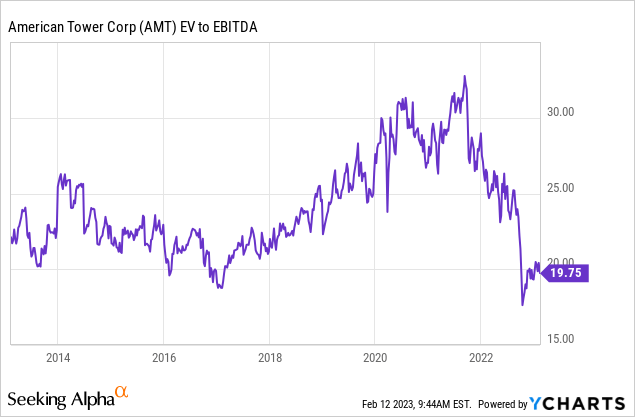

After the 30% pullback, American Tower’s valuation is looking compelling in my opinion. The company has a bunch of debt, therefore, I am using the EV/EBITDA ratio as my preferred metric as it takes the debt into account. It is currently trading at an EV/EBITDA ratio of 19.75x which is relatively cheap. From the second chart below, you can see that the current ratio is near a 10-year low. This represents a 13.9% discount compared to the 10-year median of 22.93x. The multiple is also below peers such as Crown Castle (CCI) which has an EV/EBITDA ratio of 20.36x. Yet, Crown Castle’s revenue growth rate is actually lower at just 6.7%. I believe American Tower Corporation is undervalued, and the current price offers meaningful upside potential.

Investors Takeaway

I believe the pullback offers long-term investors a great buying opportunity. American Tower Corporation’s latest earnings results continue to be strong, with revenue up 8.8% to $2.7 billion and net income up 12.9% to $820 million. It also raised guidance and now expects revenue growth for the fiscal year to be 14.6%. The next earnings report is expected on February 23 pre-market.

American Tower Corporation has strong fundamentals, and the increase in data usage should continue to be a solid tailwind moving forward. The dividend continues to increase and the yield is now near all-time highs. Yet the valuation remains discounted with multiples below both historical and peer levels. I believe American Tower Corporation is now attractively priced, and I rate AMT stock as a buy.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.