Summary:

- The recent decline in the American Tower Corporation share price provides an opportunity to buy the stock cheaply, as the dividend yield is now at historically high levels.

- American Tower is engaged in wireless communications and is growing rapidly due to the increased use of wireless technology.

- Management has an excellent track record of operating the business.

- American Tower stock’s valuation shows value and suggests the stock is worth buying.

curioustiger

Introduction

American Tower’s (NYSE:AMT) share price has fallen since its all-time high in the third quarter of 2021. The stock is a real estate investment trust (“REIT”), and investors see opportunity with this lower share price, while dividends are still expected to rise sharply in the coming years.

The company operates in the global wireless communications infrastructure. Because wireless technology is an everyday use, the company sees recurring growing revenues for leasing their infrastructure. This makes revenue less sensitive to economic fluctuations.

American Tower is growing steadily and the outlook is also positive. The dividend per share is up 17% annually, and the company can easily maintain its dividend payout. Although debt is somewhat on the high side, steadily growing profits provide enough cushion. Current market conditions (high inflation, increased interest rates) could temporarily dampen the stock price, but one thing is certain: the low stock price provides opportunities to buy cheaply for the long term.

Strong Financial Performance

The fourth quarter earnings report will be released on Feb. 23. So this section focuses on the third quarter earnings report and past performance.

The company is in the wireless infrastructure sector, which is growing rapidly as more users are wirelessly connected to their providers. The increasing use of smartphones, tablets, laptops and other devices will drive the growth of wireless communications, leading to more demand for communications infrastructure.

5G is hot topic, and the global 5G infrastructure market is expected to grow at a CAGR of 69% from 2022 to 2030. However, American Tower only develops and leases its towers and does not lease 5G equipment. This allows American Tower to be versatile in its tower specifications. Overall, the communications infrastructure market is expected to grow at a CAGR of 15% during the same period due to the increase in the use of streaming data, the increasing use of smartphones and the evolution of new applications that increase the demand for more mobile data traffic.

American Tower operates in a growing market and receives recurring growing income from its communications towers. Its towers can be leased to one to three tenants, providing a return on investment of 3% to 24%.

Third-quarter results showed 10.2% growth in property revenue, with currency-neutral growth of 14.2% and 3.9% growth in tenant billings thanks to contributions to new assets and organic leasing. EBITDA rose 5.8% (8.6% on a forex-neutral basis), but adjusted operating assets fell 3.3% as Vodafone Idea Limited and Sprint-related churn contributed 6% to 8% as headwinds to adjusted EBITDA and adjusted operating asset growth, respectively. American Tower raised its revenue forecast for 2022 to $10.44B from $10.37B due to higher pass-through and straight-line rent increases, but partially offset by Vodafone Idea Limited reserves and forex headwinds.

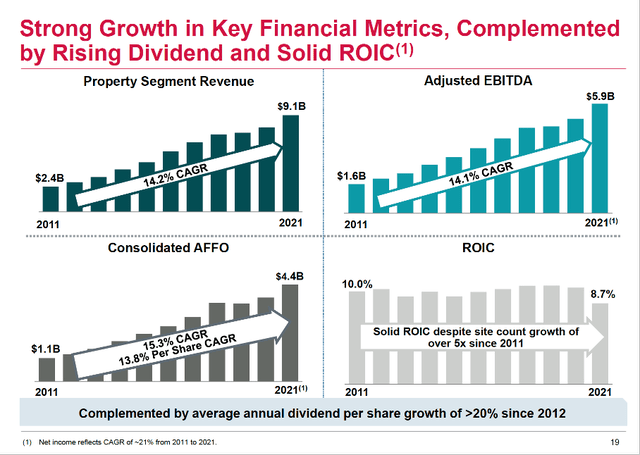

Historically, the company has shown strong financial performance, as property revenue and adjusted EBITDA have increased at a CAGR of 14% over the past 10 years. Adjusted operating income per share also increased at a CAGR of 14%. The company is well-managed and has a good track record of executing business well.

Growth in Key Financial Metrics (AMT’s 3Q22 Presentation)

Dividends And Share Repurchases

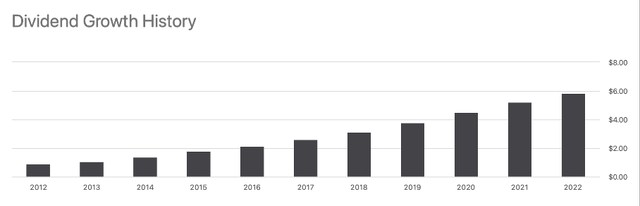

American Tower’s dividend has risen steadily over the years, and the dividend per share continues to rise strongly. Over the past 5 years, the dividend has increased 17% annually and next year it is expected to rise from $5.84 to $6.58 per share, representing strong growth of 13%.

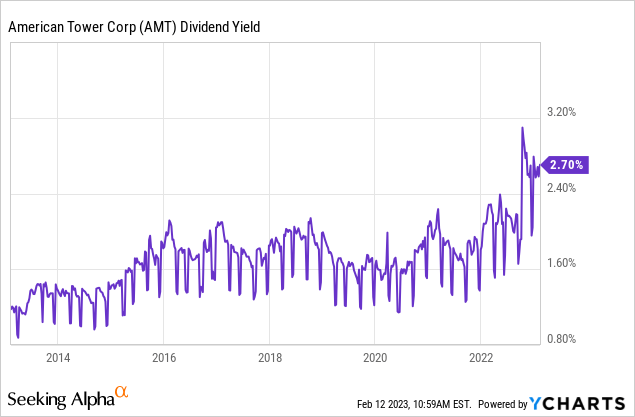

Although the dividend yield is “only” 2.9%, the recent stock price decline provides opportunity to buy the stock cheaply, as the dividend yield has consistently been below 2% in recent years.

Dividend Growth History (Seeking Alpha AMT Ticker Page)

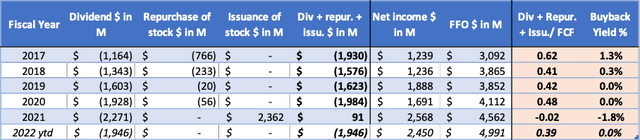

A deeper dive into the cash flow statements shows that the dividend is well-covered by the company’s funds from operations. The company can easily manage its dividend payout, as the payout equals about 40% of FFO generated.

Net income is expected to hit a record high as the earnings report for the final quarter of fiscal 2022 is released. This will be determined on Feb. 22.

AMT’s Cash Flow Highlights (SEC and author’s own calculations)

Stock Valuation

Lastly, we look at the stock’s valuation because it is an important part of the buying decision.

YCharts could not show us the graph of price versus funds from operations, so I have to get creative. The dividend per share is a component of great interest to REIT investors. The dividend payout ratio for REITs is 90% of net income, so I use the dividend per share to get an understanding of the stock’s valuation.

The chart shows that the dividend yield is high now compared to previous years. On average over the past 5 years, the dividend yield has been 1.8%.

The dividend per share for 2024 is estimated at $7.37. At the average dividend yield of 1.8%, we arrive at a “fair or average” share price of $409. That seems unreasonable in this climate of high interest rates. But I believe stock prices tend to return to their averages under normal market conditions.

Now interest rates are rising sharply because inflation figures are high. For the next few years it is guessing what the stock price will do, but from the chart, the stock price seems undervalued and offers strong growth potential when inflation returns to the 2% level. The stock is worth buying for the long term.

Conclusion

The recent decline in the share price provides an opportunity to buy American Tower Corporation stock cheaply, as the dividend yield is now at historically high levels. American Tower is engaged in wireless communications and is growing rapidly due to the increased use of wireless technology. The communications infrastructure sector is expected to grow at a CAGR of 15% through 2030, and American Tower is well-positioned for further growth.

Management has an excellent track record of operating the business. Adjusted FFO grew at a CAGR of 14% over the past 10 years. Q3 earnings were also strong but lagged due to Vodafone Idea Limited and Sprint-related churn and forex headwinds. These headwinds are temporary, and American Tower revised upward its revenue estimates for fiscal 2022.

American Tower Corporation increased its dividend per share by 17% a year and analysts estimate that the dividend will continue to rise in the coming years. The stock’s valuation shows value and suggests the stock is worth buying.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.