Coca-Cola: There’s Little Reason To Own It

Summary:

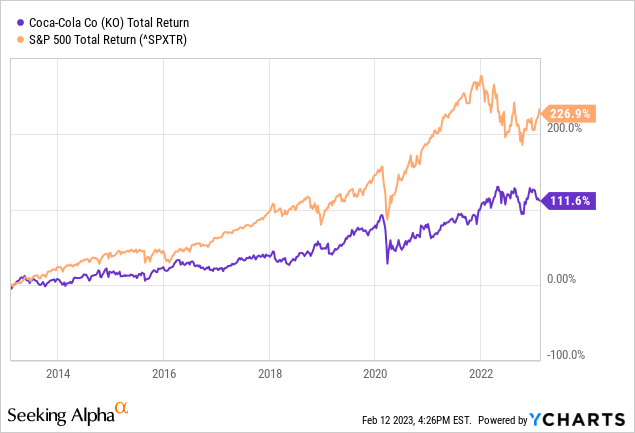

- Coca-Cola has underperformed the S&P 500 by a huge margin in the last 10 years, yet still trades at a lofty 24x P/E.

- Some investors are too focused on dividend growth and are ignoring that it’s mostly coming from an increasing payout ratio rather than higher earnings.

- Sugary drink taxes could be a major headwind to growth over the next decade.

- I believe KO will continue to underperform the broader market in the future.

Justin Sullivan

Coca-Cola (NYSE:KO) is a well-known company with a brands everyone knows. Many investors love it for the yearly dividend increases, and think that because Buffett owns it, it’s a great choice for a low risk, stable investment.

Unfortunately, as someone that owns this indirectly via Berkshire Hathaway (BRK.A) (BRK.B) I think KO is a poor investment choice that’s unlikely to match a market return, let alone outperform, in the next decade.

I believe KO’s valuation has remained elevated far above where it belongs due to a large investor base that owns it at a low cost basis and investor enthusiasm with dividend growth.

But KO has badly underperformed the S&P500 in the past decade (returns in the above chart include dividends) and with a lofty valuation of 24x earnings, I believe it will continue to underperform.

What would you pay for this business?

Forget that this is Coca-Cola for a second, and just look at their numbers.

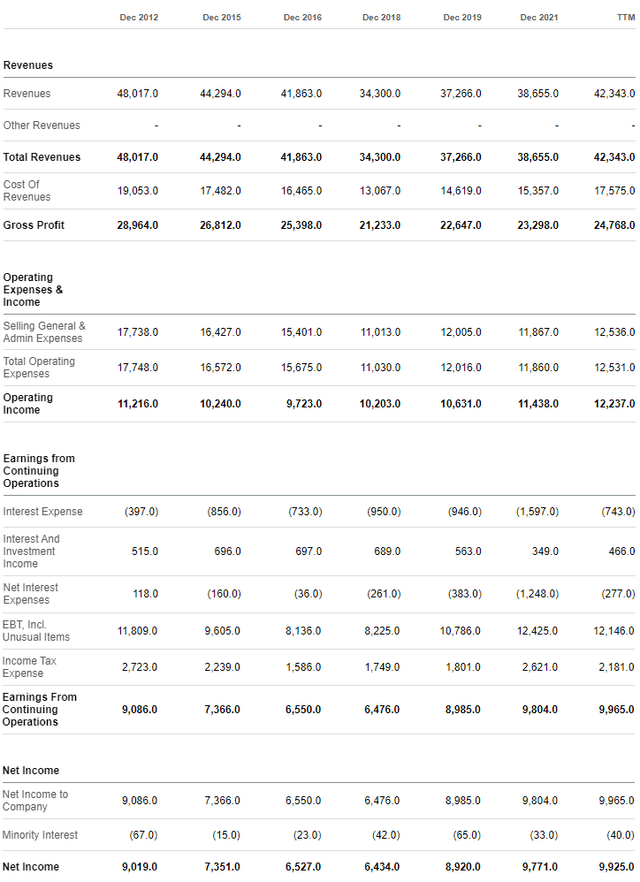

In a 10 year span, operating income is up just 9% and net income up 10%. These numbers look far worse in real terms, considering inflation was 30% over this 10 year period.

KO Financials (SeekingAlpha)

The numbers become even less impressive when you consider KO has done a few significant acquisitions during this time span, namely the BodyArmor acquisition for $6 billion in late 2021 and the purchase of Costa Coffee in 2018 for $5.1 billion.

What multiple should investors assign to a business that’s lost around 2%/year in real earnings power over the past decade (and had to do some decently sized acquisitions to do it?)

Key Risk – Sugary drink taxes

Going forward, I believe that a key risk for Coca-Cola will be sugary drink taxes being enacted across the globe, following the public health successes of tobacco taxes.

Wikipedia has an updated list of these taxes, which I believe will become more prevalent over the next decade as governments deal with the dual challenge of rising healthcare costs related to obesity and diabetes, along with higher budget deficits.

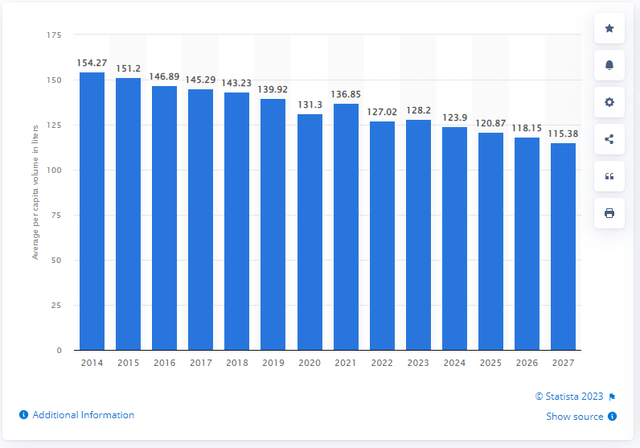

US Per Capita Soft Drink consumption (Statistica)

In the US, sugary soft drink consumption per capita has been steadily going down and is projected to continue to do so. Like the tobacco industry, soft drink makers will be able to increase prices to a point, but I do not think we’ll see this swing back to durable growth even with increased international expansion.

The Dividend

KO’s status as a “Dividend King” or “Dividend Aristocrat” is likely what attracts many investors to the stock. Entering this elusive club means a company has raised their dividend for at least the past 25 years. They will certainly not want to disappoint these investors and will most likely increase the dividend again when they report in a few days.

But the harsh reality is, buying any company primarily because of a dividend/distribution is a mistake. KO is no exception, especially when you look under the hood.

KO’s dividend has risen 73% since 2012, from a split-adjusted $1.02/year then to $1.76/year now.

This seems impressive until you realize that they’re just paying out a higher percentage of net income, from 51% in 2012 to 74% last year. To fund it, they’ve just stopped repurchasing shares.

There were 4,584 million diluted shares in 2012, which was reduced through buybacks to 4,229 million in 2018. But since they’ve stopped repurchases to focus on increasing the dividend, this has now risen steadily to 4,351 million shares as of Q3-22.

Conclusion

KO has performed well in 2022, with Q3 revenue growth of 11% driven primarily by pricing. In particular, volume performance was driven by strength in away-from-home channel, as COVID related reopening fuels restocking and increased activity. I expect another good report this week as these trends continue with the added benefit of a currency tailwind this quarter.

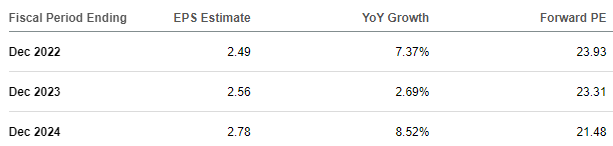

KO Earnings Projections (SeekingAlpha 2/12/23)

For some investors, this may be a good time to sell. Beyond recent strength, looking ahead, I just do not see a reason to purchase shares at current valuation levels, especially in an environment where you can now earn reasonable returns in investment grade corporate bond funds like the Vanguard Long-Term Corporate Bond ETF (VCLT).

Many KO shareholders like to brag that Warren Buffett owns shares, but he bought them in the 1980’s when it traded for a mid-teens P/E with a long runway for growth in front of it, and hasn’t added to the stake since, not even reinvesting dividends. I doubt Buffett has high expectations for KO’s future returns, and neither do I, and I believe investors can get far higher safe returns elsewhere.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Indirect ownership through Berkshire Hathaway