Summary:

- American Tower Corporation is trading at a nice valuation, compared to previous ones, in line with its main competitors, Crown Castle.

- The company has outperformed Crown Castle in a 5-year period, and that’s why it is trading at a slightly higher AFFO multiple.

- International revenue growth is muted by non-organic revenue growth in the U.S., and unfavorable exchange rate fluctuations.

- The company reiterated its 12.5% annual dividend growth policy, which together with its present compelling valuation, is calling for a long position.

bjdlzx

During the past (many) weeks we have witnessed some serious turnaround in the sentiment of the stock markets. As always, this has created opportunities that even the recent positive reaction of the stock market didn’t have the chance to erase. In my opinion, one of these opportunities is found in American Tower Corporation (NYSE:AMT). I have to say I’ve always looked cell tower companies with much interest, although I never bought into them for various reasons. I think now might be the time to do so.

Q3 2022 earnings: Increased international property revenue, U.S. & Canada weighted down

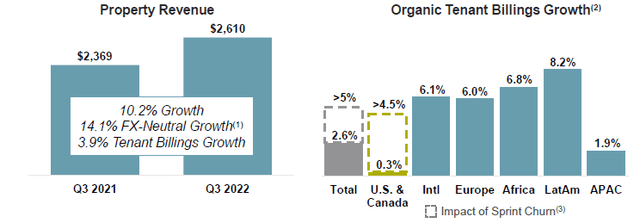

A few weeks ago, the company reported its Q3 2022 earnings, in which, property revenues appeared to increase by 10.2% on a YoY basis. Note, however, that this figure has been affected by some foreign currency exchange rate headwinds, as forex-neutral revenue increase reached 14.1%.

American Tower Corporation Property Revenue Increase (American Tower Corporation Q3 2022 Earnings Presentation)

At the same time, organic tenant revenues growth reached 3.9%, with Latin America being the hottest market, followed closely by Africa. What is interesting, though, is that at the international level, organic tenant billings grew at a rate of 6.1% on a YoY basis while for U.S. and Canada the respective figure was just 0.3%, heavily affected by the Vodafone Idea reserves and the T-Mobile / Sprint related churn.

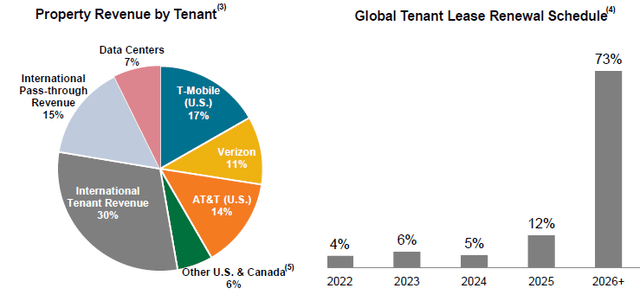

American Tower Corporation Property Revenue by Tenant and lease renewal structure, Q2 2022 (American Tower Corporation – Introduction to Tower Industry Presentation)

Revenue reduction of such magnitude is explained by looking to the graph listed above. As we can see, T-Mobile was responsible for 17% of AMT’s revenues, which is a significant chunk. But can international tenant billings growth replace T-Mobile’s churn, in absolute numbers?

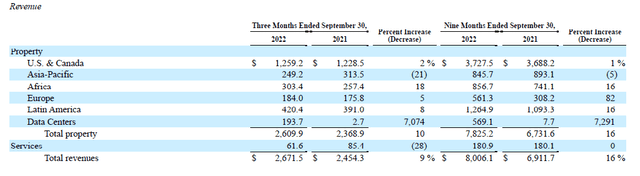

American Tower Corporation revenues per geographical segment (American Tower Corporation Q3 2022 10-Q)

As we can see in the table presented above, except for revenue increases attributable to Latin America, data center segment has also come out to support the thin growth found in the U.S. For the third quarter of 2022, we’re talking about approximately $270 million in revenue increase from Latin America, Africa, and Europe, which, should it been found in the U.S. and Canada segment, it would account for a revenue increase of 24% for that particular segment. Of course, the purpose of companies is to grow their revenues altogether, but my point is that what they’re currently losing in the U.S and Canada, they’re finding it elsewhere. In fact, U.S. and Canada, have the highest tower construction costs and revenue maintenance CapEx per building, which is something that affects local margins. Finally, as you can also see in the previous graph, the company has done a nice job laddering their lease maturities, as each year, only a small percentage of the company’s tenants have expiring leases, and these leases correspond to just a small fraction of the company’s annual revenues.

Lowering FFO but reiterating double-digit dividend growth

Companies with international exposure came across significant exchange rate headwinds during this quarter. However, as I wrote in a recent article about Netflix (NFLX), the good thing with exchange rates is that they can go both ways. And the truth is that central bank actions have distorted exchange rates to a large degree, but this policy has a specific line that central banks cannot cross, for the sake of international relations. I believe we’re really close to this line, and, the recent lower – than – expected inflation rate in the U.S. contributed towards a slight easing of the U.S. Dollar against Euro. I’m not specialized in FX trading, but I’m guessing that if a set of factors caused rates to move towards one direction, the opposite set of factors will move rates back, towards equilibrium.

This has had its effect on AMT’s AFFO, which, when adjusted for forex changes, it grew by 20 cents per share. However, exchange-rated fluctuations resulted in a mild decrease of 9 cents, from $9.74 to $9.65 per share. This didn’t discourage the company, however, to reiterate their 12.5% annual dividend growth policy. Right now, the company is paying $5.88 per share in dividends each year, which is greatly covered by the guided AFFO figure. From a dividend yield perspective, the company is rather tight, as annual dividend yield is currently standing at just 2.66%. However, using and compounding the 12.5% annual dividend growth rate, we reach a quite decent dividend yield of 4.8% in just five years.

AMT or CCI?

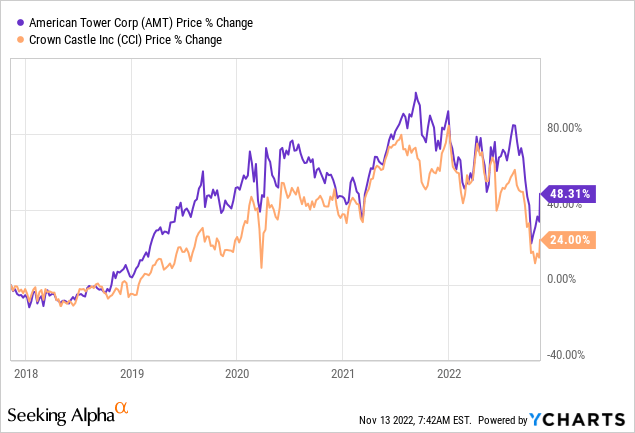

The tower industry is heavily concentrated in the U.S., with AMT and Crown Castle (CCI) having the lion’s share of all towers in the area. But why should one choose AMT over CCI?

Over a 5-year period, American Tower Corporation has outperformed Crown Castle significantly, although in smaller time frames, they have identical performance, give or take. From a revenue growth perspective, over a 5-year period, the two companies offer figures around 10%. American Tower Corporation is currently trading at 23 times its expected AFFO, while Crown Castle’s valuation is a little more conservative, at 18 times its expected AFFO. Needless to say that these multiples were much more elevated a few months ago. So, as expected, in a not so competitive market, things get to be shiny for both players, with AMT being just a little overvalued compared to CCI, but still with a large historic valuation potential.

Bottom Line

American Tower Corporation share price (Seeking Alpha)

The decrease in the share price observed in the past few months has created a window of opportunity for exposure in a REIT, different than others. T-Mobile / Sprint issue aside, should it not had been for exchange rate fluctuations, we would be talking about much better results today. Still, no one can argue that AMT’s Q3 2022 results were not that good. The gap in U.S. revenues is expected to be filled by international tenants and the newly acquired data centers. Of course, I wouldn’t buy this company for the dividend alone, as it is hardly decent as it is. However, the total return potential is huge, given historical P/AFFO multiples, and that’s why AMT is a buy from me.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article was written for information purposes only. You should not, in any case, take the contents of this article to be an urge to buy, hold or sell securities. Always perform your own research before investing in the stock market.