Summary:

- Pfizer demonstrates its leadership in the COVID franchise as it upgraded its FY22 guidance.

- However, we believe the market has de-rated PFE, as it anticipated a significant moderation in its COVID revenue moving ahead.

- We discuss why we expect PFE’s October lows to hold, with a material re-rating likely as Wall Street’s earnings projections have likely gotten highly pessimistic.

- Despite that, we urge investors considering adding exposure to be patient as a pullback seems imminent.

- Maintain Hold for now, but an entry point is looking increasingly closer.

Justin Sullivan

Thesis

Pfizer Inc.’s (NYSE:PFE) recent Q3 earnings release demonstrated how the company remains on top of its COVID franchise game, as it raised its FY22 guidance on its COVID vaccine (Comirnaty) sales while reiterating its guidance on its oral antiviral pill (Paxlovid).

Notwithstanding, we cautioned investors in our previous article explaining why patience is needed as its growth could decelerate moving ahead. Accordingly, PFE pulled back nearly 25% from its July highs to its recent October lows.

The steep selloff also attracted dip buyers to return quickly, as PFE has recovered nearly 15% from its recent lows. Hence, we believe it’s appropriate to update investors on whether they should follow the momentum surge as Pfizer looks to the endemic phase for its COVID franchise.

Management was keenly aware of the uncertainties surrounding Pfizer’s transition, coupled with its loss of exclusivity (LOE) through 2030. As such, it communicated a robust roadmap to supplant the LOE with business development progress and a pipeline of several potential approvals.

We noted that PFE continues to trade at a discount against the S&P 500 Pharma industry. However, we postulate that the discount is justified as the Street remains unconvinced with its earnings growth prospects through FY26, despite its pipeline developments.

However, we also noted that Pharma industry analysts have gotten so downbeat over the industry NTM prospects that net earnings revisions through October likely reached highly pessimistic levels.

As such, we gleaned that PFE’s reward/risk profile is relatively well-balanced, with a potential for re-rating if management could execute its medium-term outlook well.

Still, we are cognizant of the execution risks involved, given the likely moderation of its COVID revenue outlook in the medium term as the company ramps up the progress of its other commercial opportunities.

Maintain Hold for now, but we will be watching closely for a potential entry point, depending on the extent of the subsequent pullback.

Pfizer Is A Robust Execution Machine

Pfizer upgraded its COVID franchise revenue to $56B from $54B previously, as it saw a more robust performance from Comirnaty. Therefore, as we transition into the endemic phase, Pfizer’s leadership in the COVID space remains unquestionable.

Management has demonstrated its remarkable ability from R&D to commercialization for its COVID franchise under the capable leadership of CEO Albert Bourla. While management was reticent to provide COVID revenue guidance for FY23, we remain confident in its ability to transit successfully into the programs in its pipeline.

Pfizer highlighted it anticipated up to 18 potential approvals over the next 18 months. It also communicated that it projected $25B of risk-adjusted revenue to supplant its estimated $17B in LOE through 2030. Moreover, management highlighted that its $25B outlook didn’t include its COVID revenue.

Pfizer’s 2030 model looks credible, given its extensive pipeline and a well-crafted timeline for potential approvals. That shows that management is keenly aware of the need to be accountable to investors as it looks to mitigate the expected normalization of its COVID franchise revenue.

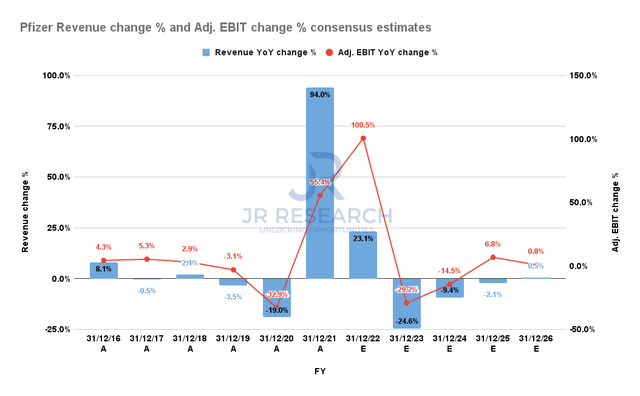

Pfizer Revenue change % and Adjusted EBIT change % consensus estimates (S&P Cap IQ)

However, the consensus estimates (bullish) suggest that Pfizer could deliver revenue growth of -24.6% in FY23, leading to a decline in its adjusted EBIT by nearly 30% YoY.

We believe the Street’s estimates are credible, reflecting moderation from its COVID-related revenue, as Pfizer awaits the commercialization lift from its pipelines over the next 18 months.

Therefore, the critical question is whether the market has priced in significant moderation in its operating performance in the next few years.

PFE’s Valuation Remains Reasonable

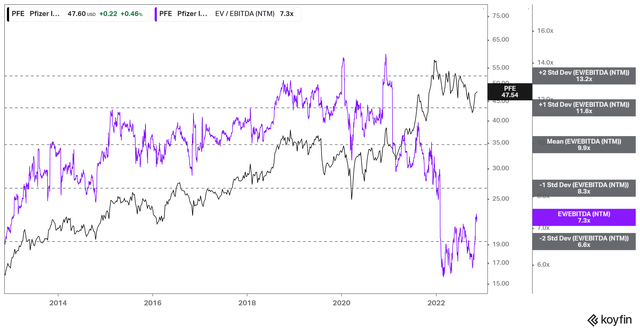

PFE NTM EBITDA multiples valuation trend (koyfin)

PFE last traded at an NTM EBITDA multiple of 7.3x, below its 10Y mean of 9.9x. Therefore, it’s clear that the market has de-rated PFE, as its earnings growth could continue to moderate over the next few years as its COVID-related revenue normalizes.

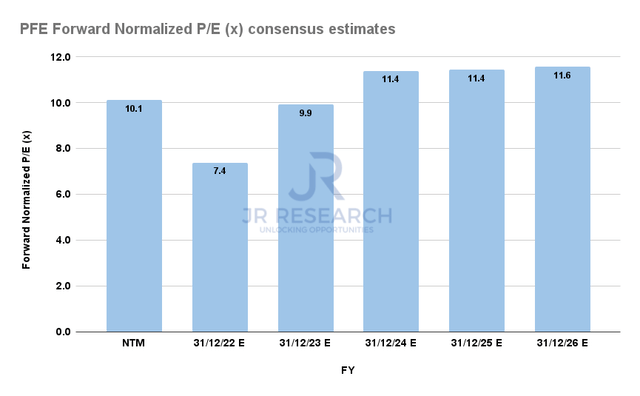

PFE Forward normalized P/E consensus estimates (S&P Cap IQ)

Accordingly, PFE last traded at an FY24 NTM normalized P/E of 11.4x. Still, it remains well below its industry forward P/E of 14x. However, it’s above its peers’ NTM median P/E of 9.9x. Therefore, we don’t see a significant bifurcation between its peers’ valuation to suggest a material re-rating.

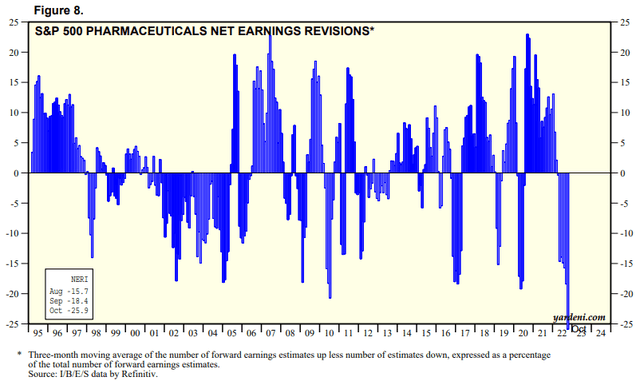

S&P 500 Pharma industry net earnings revisions % (Yardeni Research, Refinitiv)

However, we observed that analysts could have gotten overly pessimistic about the industry’s prospects over the next year as they sent the Pharma industry net earnings revisions spiraling markedly lower through October.

Hence, we postulate that a material re-rating in the industry moving forward could also lift PFE’s sentiments, helping it to revert to its historical averages.

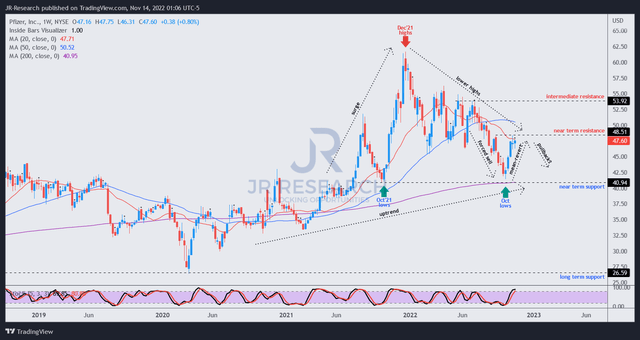

PFE price chart (weekly) (TradingView)

PFE remains in a medium-term downtrend but found robust support at its October lows, undergirded by the 200-week moving average (purple line).

Therefore, we believe it likely attracted long-term investors at its October lows to support PFE at its critical support zone. We are confident that those lows should hold.

Coupled with a more attractive valuation and a potential for re-rating, given analysts’ pessimism, investors who added at its October lows should remain on board.

However, we postulate that the sharp reversal is due to an imminent pullback, which could help improve the reward/risk profile for investors considering adding more exposure.

As such, we encourage investors to be patient as a potential entry in PFE draws closer.

Maintain Hold for now.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!