Summary:

- Revenue should benefit from the recovery in China and increasing adoption of the company’s high-efficiency boilers.

- While the Residential heater business is expected to be slow, inventory destocking in this business is almost complete and AOS has higher exposure toward replacement demand which is usually resilient.

- Margins should benefit from lower steel and raw material costs.

- Valuation is below the historical average.

Kameleon007

Investment thesis

A. O. Smith Corporation (NYSE:AOS) is expected to benefit from the recovery in demand in China and the continued adoption of its high-efficiency condensing boilers in FY23. While weak demand from the residential heater business due to slow end markets is a concern, the company derives 80-85% of its revenue from replacement demand making it somewhat resilient during a macroeconomic slowdown. The company’s long-term growth prospects also look encouraging with good traction of its high-efficiency products as well as its solid balance sheet which can support inorganic growth.

Margins are expected to benefit from lower steel and other non-steel costs, and volume leverage in the rest of the world segment from China’s reopening. Moreover, the valuation is lower than the historical average. Therefore, I recommend buying AOS stock.

Revenue Analysis & Outlook

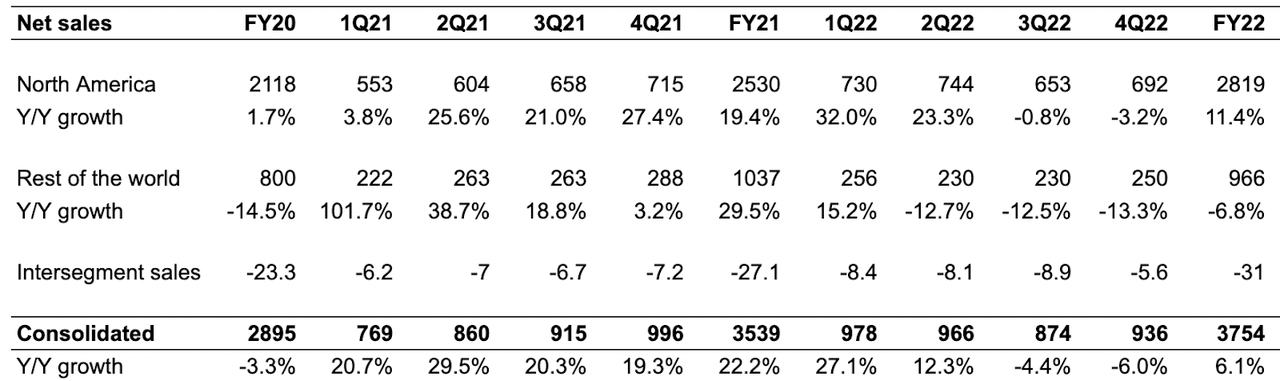

In January of this year, I wrote a bullish article about AOS. At that time the company was facing inventory destocking from its channel partners and I argued that this destocking was nearing its end. The company has reported its 4Q22 results since then and management talked about normalizing inventory levels on its 4Q22 conference call, driving stock outperformance. While consolidated revenue was down 6.1% YoY to $936 million, it was still higher than the consensus estimate of $919 million.

A. O. Smith’s historical revenue growth (Company data, GS Analytics Research)

Looking forward, while the weakening residential market in the US is a concern, the recovery in China and increased adoption of the company’s high-efficiency boilers should offset this headwind.

Since the second quarter of last year, demand from the Chinese market was down due to Covid-19 related shutdowns. The Chinese market represents a large portion (~87%) of the Rest of the World segment revenue, and hence the segment witnessed a 6.8% YoY decline in FY22. As Chinese authorities have now lifted their zero Covid-19 policy, a recovery in economic activity and pent-up demand is expected to boost revenue growth for this segment.

Additionally, the North American boiler business should continue to witness outperformance as compared to the end market due to the increased adoption of the company’s high-efficiency condensing boiler. Moreover, the North American water treatment business should benefit from pricing increases and the megatrend of healthy and safe drinking water.

On the other hand, while the softness in the residential market is expected to put pressure on revenue growth in FY23, the good news is that the company generates 80-85% of its revenue from replacement demand, which tends to be resilient even in challenging times. Also with inventory destocking almost complete in the residential channel, there is one less headwind.

Overall, I expect AOS, to report flat YoY revenue growth in FY23, with higher revenue growth in the latter half of 2023 once comparisons start to ease. The medium to long-term prospects are also good and the company should see revenue growth post FY23 owing to a recovery in the end markets and increased adoption of high-efficiency units. Over the last three years, the company spent a total of $264 million on R&D, resulting in various new product developments such as the recent launch of the CREST boiler and Voltex heat pump. I believe the company should continue to develop new and efficient products and benefit from the adoption of high-efficiency units. Moreover, the company’s healthy balance sheet, with net cash of $137 million (as of 4Q22), positions the company attractively to grow inorganically.

Margin Analysis & Outlook

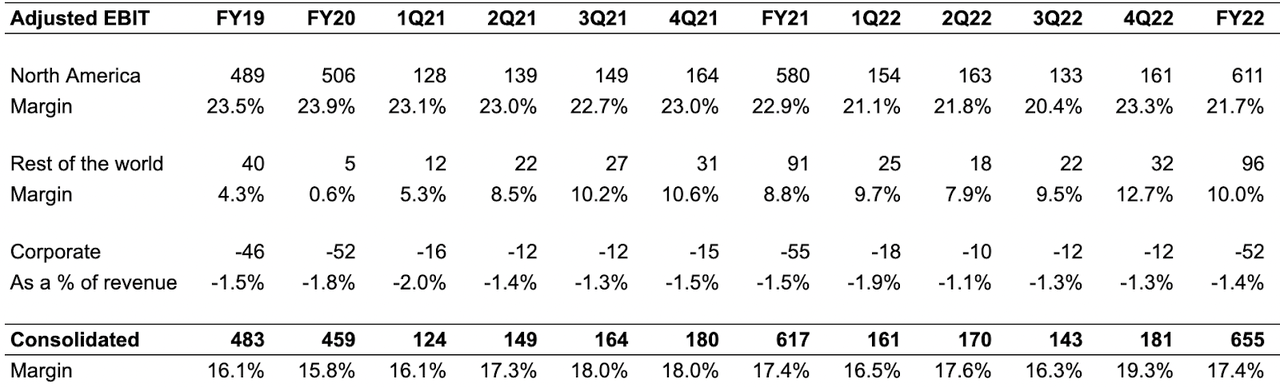

After experiencing a 170 bps Y/Y decline in adjusted EBIT margin for 3Q22, the company saw a rebound in 4Q22 with adjusted EBIT margin expanding by 130 bps Y/Y to 19.3%. This improvement was driven by a decline in steel prices, resulting in an improved price/cost relationship, primarily in the North America segment. Additionally, the Rest of the World segment’s adjusted EBIT margins improved by 210 bps Y/Y due to lower incentive and selling expenses.

AO Smith’s historical margin performance (Company data, GS Analytics Research)

Looking ahead, the North America segment’s margins are expected to continue benefiting from lower steel costs. While the segment faced margin headwinds from higher steel prices during the first three quarters of 2022, this improved in 4Q22 and is anticipated to further improve in 1Q23. Although other non-steel costs remain elevated, they have begun to stabilize and I expect them to decline in FY23 as the supply chain constraints ease. Additionally, the Rest of the World segment faced significant headwinds due to lower volumes in the last three years, resulting in margin underperformance. With the reopening of the Chinese market, the Rest of the World segment is expected to benefit from volume leverage in FY23 and beyond.

Although management has guided margin improvement for FY23, I believe they have been conservative in their projections for both segments. For the North America segment, management expects margins to be at 23%, which only includes a decline in steel costs and not a decline in other non-steel costs. Since I believe there is a good chance of other non-steel costs declining as well, the segment can perform better than the guidance. Similarly, for the Rest of the World segment, management has guided for a flat Y/Y margin of 10% for FY23, despite the anticipated volume leverage due to the lifting of the zero-COVID policy in China. Therefore, I believe the company can do better than expected and management may revise their guidance upwards in the coming quarters.

Valuation and conclusion

The stock is currently trading at a forward P/E ratio of 20.14x based on the FY23 consensus EPS estimate of $3.32 and 18.62x FY24 consensus EPS estimate of $3.59, which is below its five-year average forward P/E of 21.82x. The company also has a good dividend yield of 1.79% and a history of increasing dividends regularly. Despite the expectation of flat revenue growth for the year, I am bullish on the stock due to its solid long-term growth prospects, the potential for positive surprises on the margin front, and an attractive valuation.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is written by Pradeep R.