Summary:

- In its recent FYQ1 2023 earnings report, Apple Inc. just reported its first earnings miss since 2016. The ongoing headwinds could persist.

- Although for a stock like Apple, I urge investors to delineate near-term noises with long-term fundamentals.

- Simple and timeless principles developed by Benjamin Graham show it to be a textbook example of a perpetual compounder.

- Its valuation (~26x FWD P/E) could be off-putting. But you will see that it is actually not that far off from the P/E that Graham would pay.

- The large position held by Warren Buffett, arguably Graham’s most famous mentee, serves as a strong support to this thesis.

Justin Sullivan/Getty Images News

Q1 recap and thesis

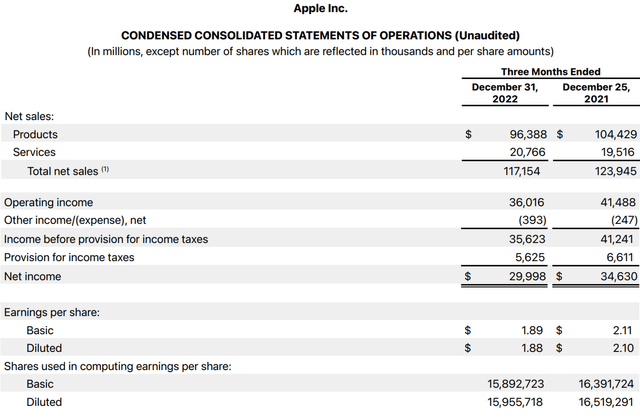

Apple Inc. (NASDAQ:AAPL) just released its fiscal Q1 2023 earnings report (“ER”) earlier this month. By this time, investors must already have fully digested all the details. Thus, here I will just point out a few things that are most relevant to the core thesis of this article. Revenue dialed in at $117.2 billion, a 5% decrease YoY. And earnings per diluted share dialed in at $1.88. Both the top and bottom lines missed consensus estimates narrowly. It is the first time that Apple has missed the Zacks consensus estimates since 2016. And the revenue decline is also the biggest annual quarterly revenue drop since 2016. As such, there is no wonder that some analysts have used words like “dismal” to describe its Q1 ER.

Furthermore, looking ahead, I do see a few headwinds persisting and keeping pressure on AAPL’s earnings. These issues include the strong dollar, production problems in China for the iPhone 14 Pro and Pro Max, and the also the possibility of an overall economic slowdown both in the U.S. and China.

Although for a stock like Apple, I urge investors to delineate near-term noises with long-term fundamentals. In the long term, I see a company with hugely popular products, a powerful growth curve ahead, and a very shareholder-friendly board. And in the remainder of this article, I will apply a few simple and timeless principles developed by Benjamin Graham to examine all these aspects. And finally, in case you are concerned about its valuation (indeed, an FWD P/E around 26x could be off-putting), you will see that it is actually not that far off from the P/E that Graham would pay.

AAPL: how would Benjamin Graham read its Q1 report?

In his classic book entitled The Intelligent Investor, Benjamin Graham described a few simple rules to help investors pick winning stocks. These rules transformed stock investing from a speculating to a rational decision process the way I see things. And they are briefly summarized below (more details can be found in my earlier article):

- Is the company large, prominent, and conservatively financed? The specific metrics to look for are stable financial strength, consistent capital structure, and a long record of continuous dividend payments.

- Especially, Graham emphasized the importance of dividend records – for good reasons. In his own words, he thinks “a record of continuous dividend payments for the last 20 years or more is an important plus factor in the company’s quality rating”.

- Has the company demonstrated an adequate level of Earnings Growth in the past? For defensive investors, growth is not the key and “adequate” is enough. In Graham’s mind, a minimum increase of at least one-third in per-share earnings in the past ten years is adequate enough.

- Finally, are the valuation multiples moderate? As a value investor to the core, he emphasized countless times that you should have some margin of safety.

In the remainder of this article, I will examine AAPL against these rules to illustrate its long-term prospects.

AAPL: is it large, prominent, and conservatively financed?

In the case of AAPL, I will just say that it is a large and prominent company – as an assertion without any need for justification.

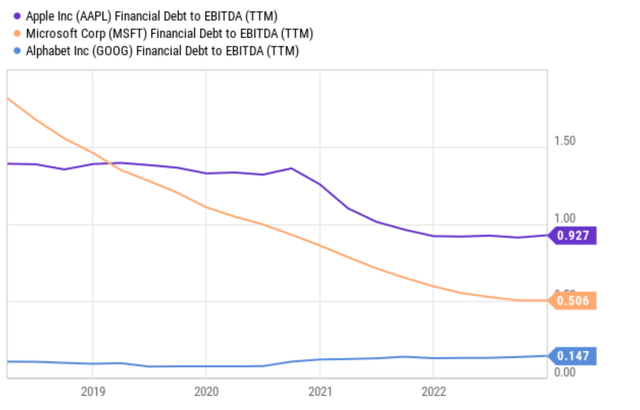

And I will directly move onto the third question – is it conservatively financed? The answer obviously can be more involved and subjective depending on the metrics you use (e.g., debt-to-equity ratios, debt-to-assets ratios, or interest coverage) and also the benchmark you chose. However, I see AAPL as one of the most conservatively financed companies out there considering its strong operating performance, cash flow, and debt levels. The chart below probably is sufficient to make the point. When compared to other extremely conservative peers like Microsoft and Google, AAPL’s debt-to-EBITDA ratio is only 0.147x. A fraction of Microsoft’s 0.506x and Google’s 0.927x, which are already overly conservative by themselves.

AAPL: does it have a strong dividend and growth record?

AAPL does not have the 20-year track record that Graham would like to see as the company only started paying a dividend in 2012.

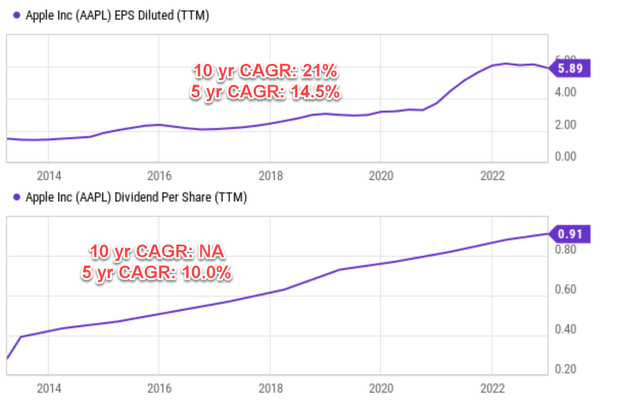

However, I see it as an excellent dividend stock with robust growth and a very shareholder-friendly board. In the past 5 years, it has been growing its dividend payout per share at a CAGR of 10.0%. And its growth rate in the past 10 years would not be too meaningful. Again it started at a quite low base in 2012 ($0.09 per share), and the CAGR would be astronomically higher on this basis. Its board of directors just declared a cash dividend of $0.23 per share of common stock for Feb 2023. Its CFO, Luca Maestri, commented in the ER that “Apple generated $34 billion in operating cash flow and returned over $25 billion to shareholders during the quarter.” The dividend is supported by strong profitability and earnings growth. Its EPS growth rates have been even higher than the dividend growth rates as seen. Its EPS has increased at a CAGR of 21% in the past 10 years and 14.5% in the past 5 years.

Graham’s rule requires an increase of one-third in 10 years, translating into ~3% CAGR. Thus, AAPL’s earning growth, measured by dividend or EPS growth, far exceeds this requirement.

Source: author based on Seeking Alpha data.

AAPL’s valuation

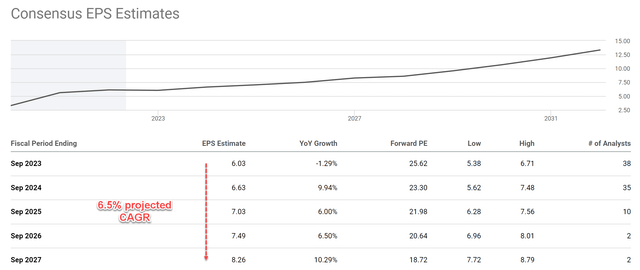

Finally, as aforementioned, a value investor to the core, Graham emphasized countless times that you pay a reasonable price no matter how good the company is. Here I will examine AAPL’s valuation by the so-called Graham P/E, which says that a reasonable P/E for a good stock (a stock that met all the above requirements) should be around 8.5x plus twice the expected annual growth rate. In AAPL’s case here, consensus estimates project its EPS to grow at a 6.5% annual rate in the next 5 years: from $6.03 in 2023 to $8.26 in 2027.

Source: author based on Seeking Alpha data.

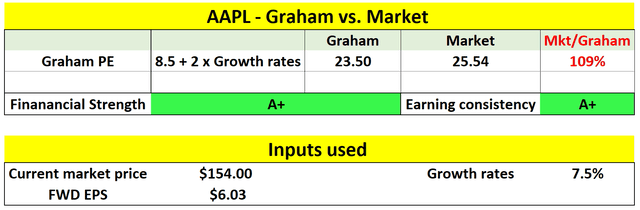

My view is that these estimates are a bit too conservative either judged by its historical growth record or its ROCE (return on capital employed). As repeatedly mentioned in my other articles, AAPL has been maintaining a ROCE of over 100%. And thus, even a 5% reinvestment rate could lead to 5% organic real growth (100% ROCE * 5% reinvestment rate = 5% real growth). Adding an inflation escalator of 2.5% could easily push the nominal growth rate to 7.5%. And AAPL has demonstrated the pricing power to far outpace inflation in the past.

Based on a 7.5% growth rate, the Graham P/E for AAPL would be 23.5x (which equals 8.5 + 2 * 7.5). As of this writing, AAPL’s current market P/E of 25.5x (on an FY1 FW basis), which is only about 9% above the Graham P/E.

Source: author based on Seeking Alpha data.

Risks and final thoughts

To recap, I do see a few headwinds persisting in the near term. Issues like the strong dollar and production problems in China could keep pressuring AAPL’s earnings in the next year or so. In particular, AAPL relies heavily on suppliers and manufacturing partners around the globe, leaving the company exposed to ongoing disruptions and delays in its supply chain.

Many bears have also argued that another risk is its dependence on a few key products such as its iPhones. Such dependence could make the company vulnerable to market fluctuations and changing consumer preferences. However, I do not view the company as an iPhone maker or even a hardware business myself. I see a powerful transformation into a service company with a stable subscriber (and growing) basis. As a matter of fact, AAPL’s Services Segment just reported an all-time revenue record of $20.8 billion in the Q1 ER. The installed base has also just crossed the 2 billion active devices market, also hitting an all-time high for all its major product categories.

All told, for a perpetual compounder like Apple, I urge investors to delineate near-term noises with long-term fundamentals like what Graham would have done (or like what Buffett is doing).

Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.