Summary:

- Late January CVX bulls were disappointed as the post-earnings selloff continued on.

- Dip-buyers need to be wary about further earnings declines through 2024.

- Chevron’s operating performance may deteriorate as the underlying oil futures market weakens.

- A period of correction and consolidation is likely necessary to eradicate frothy optimism.

Mario Tama/Getty Images News

Chevron Corporation (NYSE:CVX) investors are faced with a critical decision after its post-earnings selloff persisted last week.

CVX was rejected at its November highs despite Chevron’s record $75B stock repurchase commitment. As a result, while CVX remains in an uptrend bias, the momentum has weakened significantly.

Astute sellers have likely used overly bullish sentiments to cut exposure and rotate away from oil & gas stocks. Accordingly, since November, the battered tech sector (XLK) has outperformed the energy sector (XLE).

The resurgence in growth and tech stocks likely sent investors in massive winners in 2022, like CVX, to cut further, anticipating a sustained recovery moving ahead.

Chevron also raised its dividend per share by 6% on top of its stock buyback. However, some investors might have questioned the credibility of its repurchase commitment, as there wasn’t a so-called “expiry” date.

Management argued that it doesn’t expect its upgraded war chest to be unusually different from its previous authorizations. It even went as far as justifying its ability to time the market with its past repurchases, highlighting that: “In the last 19 years, we’ve bought shares back lower than the market volume weighted average over that period of time.”

Despite that, we believe CVX investors need to expect an extended period of consolidation here. CVX’s valuation has normalized from its lows in July 2022. Why? We highlighted in our previous article that the market was probably right not to re-rate it, as growth could slow further.

Analysts have continued to mark down the prospects of Chevron and its industry peers through 2024. Accordingly, the industry is expected to post an earnings decline of 21.7% in 2023 and 8.6% in 2024.

Chevron is also not expected to be immune from the industry’s struggles to replicate its remarkable performance, as analysts expect an adjusted EPS growth of -18.6% and -7.5% in 2023 and 2024, respectively.

Therefore, we believe management wants to telegraph its credibility to the investors that it remains focused on generating cash and being prudent in its capital investments.

Average production growth in 2023 is expected to be “flat to up 3% at $80 Brent.” Given the lack of significant production growth, the underlying oil futures market needs to remain resilient.

Wall Street strategists are unsure whether Brent is on track to recover its $100 level. Russia’s ability to stay in the market, despite the bans by the G7 and EU has helped maintain stability in the underlying market.

China’s reopening from its COVID lockdowns will likely be a critical demand driver lifting energy bulls to buy the dips. However, the crucial question has always been whether the market will “ignore” the potential earnings growth decline through 2024, bolstering further market rotation away from energy stocks.

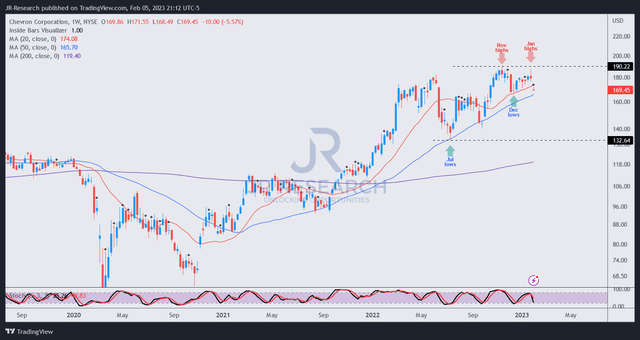

CVX price chart (weekly) (TradingView)

CVX investors are encouraged to pay attention to its price action and its underlying oil futures.

As seen above, January’s optimism was decisively pricked by sellers waiting for bulls to jump on the bandwagon in anticipation of a record year. Again, investors are reminded that the market is a forward-discounting mechanism.

Hence, it’s critical for investors to consider whether CVX still has legs to run and outperform in 2023, even as its earnings are expected to fall through 2024.

Moreover, its valuation of 5.6x has also normalized further toward its 10Y average of 6.3x from its July 2022 lows of 4.4x.

Investors looking to buy the dips must be cautious and watch these two levels closely: December 2022 lows and September 2022 lows. Buyers need to support these levels to “prevent” CVX’s uptrend bias from reversing, similar to the price action in the underlying oil futures (which has reversed into a downtrend).

If the price action fails to regain its upward momentum to form higher highs and break below its 50-week moving average or MA (blue line) decisively, CVX bulls should consider cutting more exposure and avoid buying the dips.

Investors who didn’t join the froth toward its 2022 highs should welcome a sustained period of correction and consolidation, allowing the market to “eradicate” these weak holders first before finding a robust bottom.

Rating: Sell (Reiterated).

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you’ll also gain access to exclusive resources including:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!