Apple: Short-Term Challenges, But Still Undervalued

Summary:

- Apple’s unmatched brand loyalty is a clear indication of the company’s intact market position and growth potential.

- While the company faces challenges in the short term due to macroeconomic conditions and other factors, management’s strong track record of success gives confidence in Apple’s ability to weather headwinds.

- My valuation suggests the stock is undervalued.

Shahid Jamil

Investment thesis

Apple’s (NASDAQ:AAPL) unparalleled brand loyalty, supported by a vast ecosystem of hardware, software, and services, led the company to build an untouchable competitive advantage. This has led to outstanding financial performance over the last decade. Apple’s ability to command premium pricing while maintaining high margins has made it one of the most profitable companies in the world. Moreover, a discounted cash flow [DCF] analysis suggests that AAPL stock is undervalued, indicating that the market has yet to appreciate the company’s growth potential fully.

Furthermore, positive consensus on long-term forecasts and expectations for the company’s revenue growth over the next decade further support my thesis. While there are risks associated with investing in any company, the strength of Apple’s brand loyalty, financial performance, and growth prospects outweigh any potential risks. Therefore, investors with a long-term outlook should consider adding Apple to their portfolio.

Company information

Apple was founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne in Cupertino, California. The first Apple computer, the “Apple I” was sold for $666.66 in 1976. The company has revolutionized the way people live with a sequence of innovative products. The Apple computer presented a graphical user interface, making computers handier. The iPod allowed users to carry their entire music collection in their pockets. The iPhone redefined the smartphone category by blending phone, music player, and computer functions into one device. Apple’s impact on the technology industry is also evident in other products such as the iPad, Apple Watch, and AirPods.

Tim Cook joined Apple in 1998 as Senior Vice President for Worldwide Operations. He became CEO of Apple on August 24, 2011, succeeding Steve Jobs, who had resigned due to health issues.

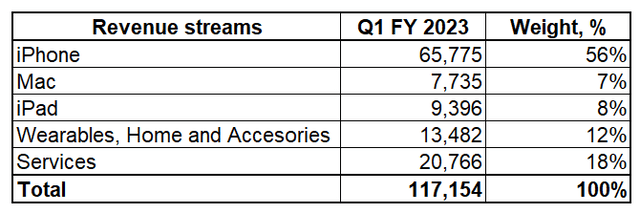

The company disaggregates its sales into five reportable segments: iPhone, Mac, iPad, Wearables, Home and Accessories, and Services. iPhone segment is the largest revenue generator for the company representing about 56% of sales in the last reporting quarter.

Financials are stellar

Examining a company’s financial performance over a period of time is crucial when making investment decisions. Looking at Apple’s financials over the past decade can provide valuable insights into the company’s growth trajectory, its ability to generate profits, and how it has weathered economic challenges.

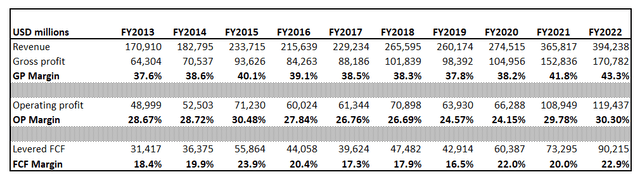

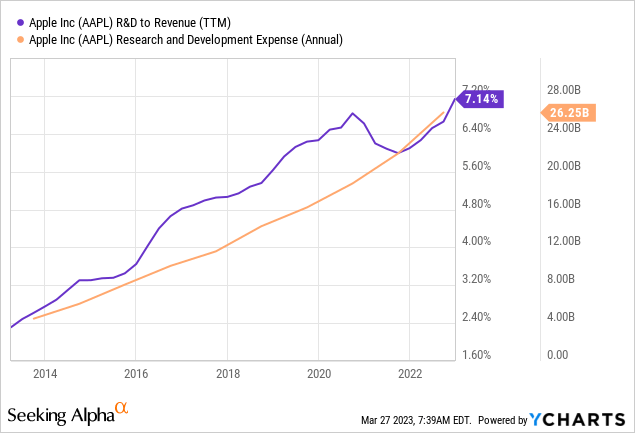

Over the past decade, Apple Inc.’s financial performance has been strong, with revenue growing from $170.9 billion in FY2013 to $394.2 billion in FY2022, a cumulative growth of 130.7%. This growth has been driven by the company’s flagship product, the iPhone, and its expanding Services segment. Gross profit has also seen significant expansion, increasing from $64.3 billion in FY2013 to $170.8 billion in FY2022, a cumulative growth of 165.6%. In addition, the company’s gross profit margin has consistently been in the high 30s to low 40s, with a current margin of 43.3%. Apple has been delivering these stellar results thanks to its ability to innovate, which would have been impossible without investing significant amounts in R&D.

Apple’s operating profit has risen from $49 billion in FY2013 to $119.4 billion in FY2022, with an operating margin varying from 24% to 31% over the past decade. Additionally, Apple has generated strong levered free cash flow [FCF], with a cumulative growth of 40.3% over the past decade. Furthermore, the company’s FCF margin has remained consistently above 15%, indicating a healthy ability to generate cash from its operations.

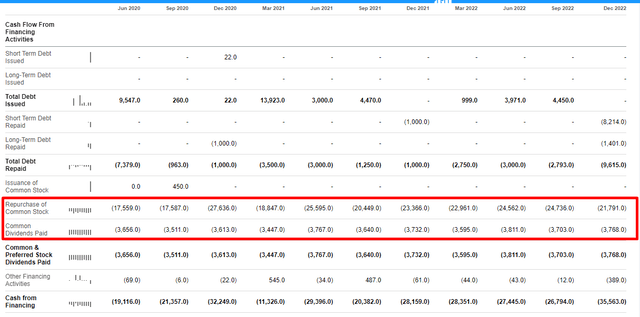

Between FY 2013 and FY 2022, Apple has also returned significant value to its shareholders via dividends and share repurchases. Over the last decade, the company paid out $129.4 billion in dividends, steadily increasing yearly. Additionally, Apple spent $582.0 billion over the same period on share repurchases, with the most considerable amounts occurring in FY2018 and FY2021. This focus on returning value to shareholders through dividends and share buybacks demonstrates Apple’s commitment to maximizing shareholder value.

Overall, Apple’s financials over the past decade display a company that has consistently delivered substantial revenue and profit growth, with a healthy ability to generate cash from its operations.

Seeking Alpha

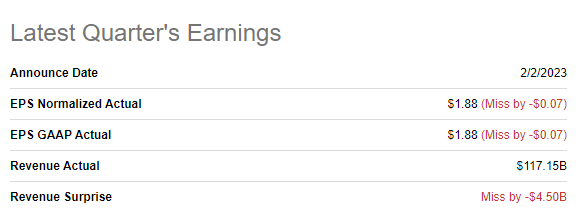

Apple announced its latest quarterly earnings on February 2, 2023. The company’s normalized EPS were $1.88, missing expectations by $0.07. The GAAP EPS was also $1.88, missing estimates by the same amount. Apple’s revenue for the quarter was $117.15 billion, but it missed revenue expectations by $4.5 billion.

During the quarter, revenue declined about 5% from the previous year, mainly due to pandemic-related restrictions on its Chinese factories that curtailed sales of the latest iPhone during the holiday season. However, Tim Cook assured analysts during the earnings call that production is now back where they want it to be, and they manage for the long term by investing in innovation and people. Apple also disclosed that it has more than 2 billion iPhones, iPads, Macs, and other devices in active use, which is likely to help the company sell more digital subscriptions and ads, fueling long-term revenue growth.

Due to global uncertainty, Apple’s management did not provide revenue guidance for the upcoming quarters. However, they shared some insights based on the assumption that the macro outlook and COVID-related impacts on their business remain the same from what they are projecting today for the current quarter. They expect their March quarter YoY revenue performance to be similar to the December quarter, with foreign exchange continuing to be a headwind. They also expect Services revenue to grow YoY while facing macroeconomic headwinds in digital advertising and mobile gaming. For iPhone, they expect their March quarter YoY topline performance to accelerate relative to the December quarter. However, for Mac and iPad, they expect revenue to decline double digits YoY because of challenging comparatives and macroeconomic headwinds. As a result, they expect the gross margin to be between 43.5% and 44.5%.

Despite the fact that the fact company is experiencing challenging quarters, I have high conviction that Apple will return to the growth trajectory given management’s strong track record of success and the company’s unique positioning with innovations. The positive consensus earnings estimates further reinforce this conviction for the next decade.

Valuation indicates undervaluation

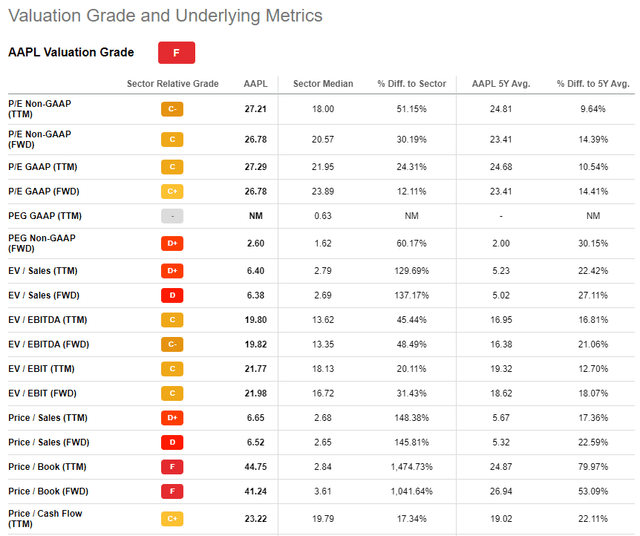

Some analysts and investors might argue that the company’s current valuation is significantly overvalued when looking at traditional valuation ratios. As per Seeking Alpha Quant valuation grades, Apple got the lowest possible grade of “F”.

While these ratios suggest that Apple’s stock may be overpriced, it is important to note that such ratios may not accurately reflect the company’s true value due to its unique market positioning and profitability. I believe we should follow holistic approach when valuing stocks, considering factors beyond traditional valuation ratios to determine the company’s fair value.

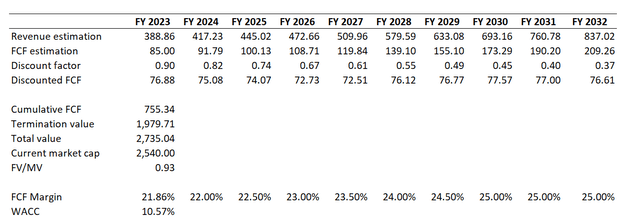

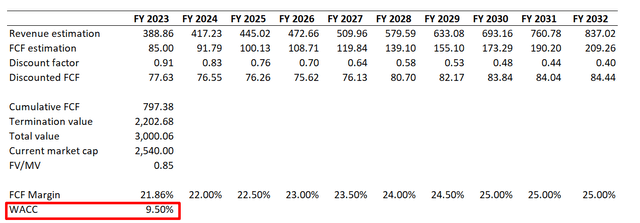

Thus, I prefer DCF analysis here because Apple is still a growth stock. First, I am also very conservative in my assumptions, not to overestimate future cash flows. Implementing the latest levered FCF margin multiplied by consensus revenue forecasts would be prudent enough for DCF modeling. I use historical data on FCF margin because selecting assumptions inconsistent with the company’s historical performance can lead to a misalignment between the model’s output and actual results. The second crucial assumption is a discount rate. It is essential to be prudent with the discount rate used in DCF modeling to ensure that the investment valuation reflects the underlying risk, so I use WACC estimated by GuruFocus. I assume that FCF margin will expand 50 basis points starting from FY 2024 and topping at 25% by FY2030. Incorporating all assumptions together calculations suggest that there is a 7% discount at the moment.

It is also important to note that Fed is almost done with rate hikes. I don’t expect that there will be an immediate pivot, but Morningstar expects Fed to begin cutting rates by the end of 2023. I consider this forecast as highly likely, so I would like to test my DCF calculations with lower WACC to understand how the stock price might react when Fed starts cutting rates. For my base case DCF scenario WACC was at 10.57%, for more optimistic scenario I loosened WACC by 107 basis points. In this case, the model suggests 15% undervaluation.

To conclude the valuation section, the calculations indicate that there is currently a 7% discount, which may change when the Fed starts cutting interest rates, which is expected by the end of 2023. Under a more optimistic WACC scenario, the DCF model suggests an undervaluation of 15%, which underscores the importance of being prudent with the discount rate.

Risks to consider

While Apple’s stock has many positive attributes, there are also several risks that investors should be aware of before deciding to invest. Firstly, a large portion of Apple’s revenue comes from a single product line, the iPhone. Therefore, any significant decline in iPhone sales due to increased competition or a decrease in demand could significantly impact the company’s overall financial performance. This risk is particularly pertinent given the growing competition in the smartphone market from companies such as Samsung, Huawei, and Xiaomi.

Secondly, Apple faces regulatory risks, particularly in the area of antitrust. The company has already faced scrutiny from regulators worldwide, including investigations by the European Union and the US Department of Justice. Any adverse regulatory actions could negatively impact the company’s reputation, financial performance, and long-term growth prospects.

Thirdly, as a global company, Apple is also subject to geopolitical risks. For example, the ongoing geopolitical tension between the US and China could lead to increased tariffs on Apple’s products or difficulties in accessing critical components. Similarly, political instability or regulation changes in key markets such as China could significantly impact Apple’s business operations.

Fourthly, Apple’s supply chain is complex, and the company relies on a limited number of suppliers for critical components. As a result, any disruption in the supply chain, such as natural disasters, production issues, or political instability in key supplier countries, could impact the company’s ability to produce and sell products, leading to lower revenues and profits.

Finally, there is always the risk of unforeseen events such as pandemics, natural disasters, or black swan events that could significantly impact Apple’s business operations and financial performance. The COVID-19 pandemic, for example, had a significant impact on Apple’s supply chain.

Bottom line

In conclusion, Apple’s intact brand loyalty, stellar financial performance over the last decade, undervaluation according to DCF analysis, and positive consensus long-term forecast all point towards a compelling investment opportunity. While risks are always associated with any investment, the potential upside of investing in Apple outweighs any potential downside. As such, it may be prudent for investors seeking long-term growth to consider adding Apple to their portfolios. The stock is an obvious long-term strong buy for me.

Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.