Summary:

- Apple has started engaging in out-of-control spending on media content.

- The tech giant is headed down a path where the media giant now loses $1.5 billion per quarter.

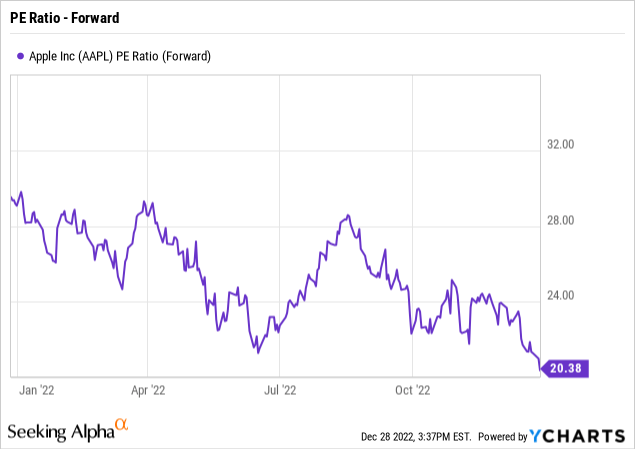

- The stock remains expensive at 20x forward EPS estimates with the spending ramp up despite weak growth.

Justin Sullivan

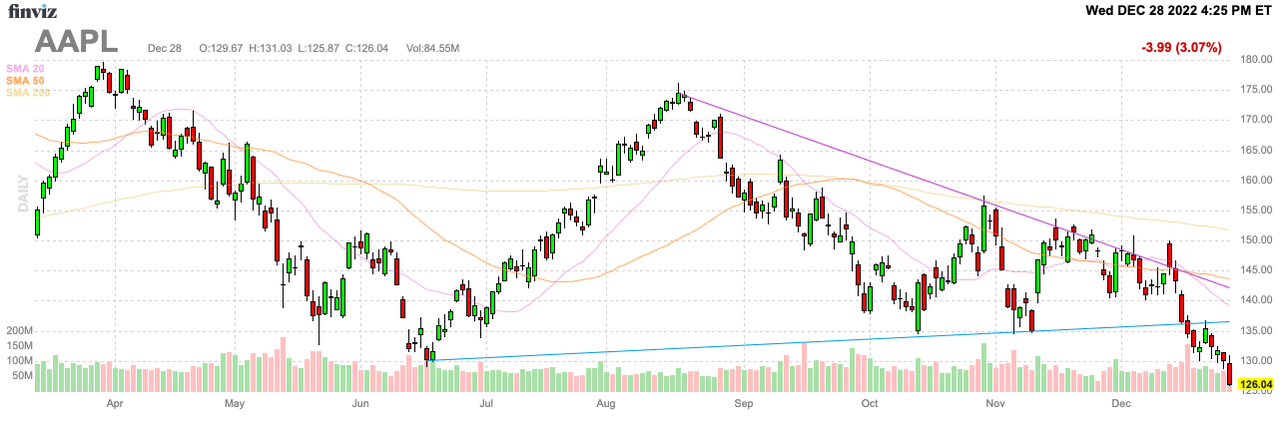

Apple (NASDAQ:AAPL) became the most valuable company in the world based on ruthless cost controls. Oddly, the tech giant changed the game plan with Apple TV+ spending excessive amounts on content without even becoming a market leader. My investment thesis remains Bearish on the stock under $130, but the view turns more Neutral below $120 and closer to $100.

Source: FinViz

Out Of Control Content

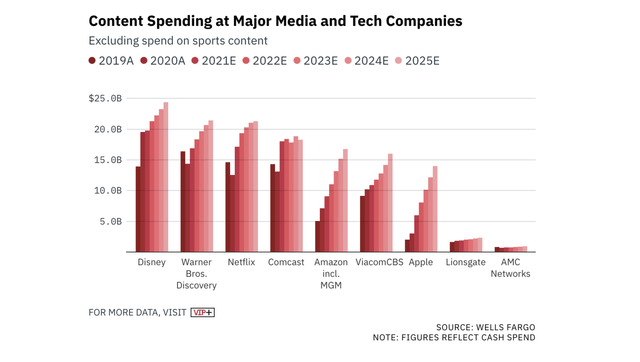

At the start of the year, Wells Fargo forecast that Apple was set to spend a whopping $8.1 billion on content this year. The research firm estimated that the tech giant was going to spend upwards of $15 billion by 2025, excluding sports content.

The crazy part is that Apple isn’t even forecasted to crack the top 5 media companies based on content spending. Disney (DIS), Warner Bros. Discovery (WBD) and Netflix (NFLX) are all forecast to top $20 billion in annual spending before counting the billions spend on sports content. Disney spends a combined $33 billion on content with over $8 billion for sports content such as the big NBA deal.

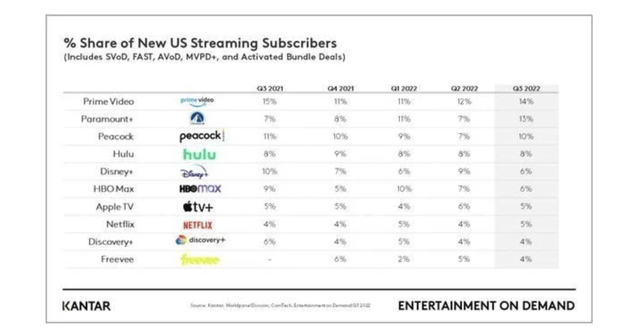

Kantar has Apple with 10% of the streaming market share, but the tech giant only captured 5% share of new U.S. streaming subscribers in Q3’22. Apple has a huge issue keeping subscribers after specific content is consumed considering the company lacks a major library.

The company recently hiked the subscription price of Apple TV+ to $6.99 from $4.99 per month. Apple hiked a bunch of other services covered in previous research while other media companies have cut back on hiking video streaming subscriptions in favor of shifting towards advertising.

The big increase in content spending going forward is the push into sports rights. Apple already has deals with MLB and the MLS and just missed out on the NFL Sunday Ticket. The MLS deal alone costs $250 million per year and is only a minimum payment guarantee.

Again, Apple appears headed towards out of control spending and a shift away from a business model built on developing superior products and services where the tech giant generates premium profits. The company is now paying large amounts for content without any guaranteed returns because Apple needs to produce the content in order to compete in streaming.

Disney recently had to hike the price of Disney+ to $10.99 a month. Despite a combined 200+ million subscribers and a robust ESPN+ package for sports, the media giant is now losing $1.5 billion quarterly on the DTC streaming service. The company had to bring back revered CEO Bob Iger in order to hopefully right the ship.

If the preeminent media company can’t even make a profit on DTC streaming services, one has to question why Apple is diving head first into the media space. Apple isn’t anywhere close to the leader in the space and players like Amazon (AMZN) and Google (GOOG, GOOGL) aren’t going to let this occur when these tech giants were left bidding on the Sunday Ticket while previous owner DTV (T) didn’t even want to bid at the previous $1.5 billion level.

Baird estimates Google has to sign up 2.25 million subs (some 50% above the DTV level of 1.5 million) in order to cover the Sunday Ticket cost estimated at $2.0 billion. By all accounts, Apple shareholders are lucky the company missed out on the Sunday ticket and didn’t boost annual content spending far above the current levels.

While Services hit a September quarter record of $19.2 billion with more than 900 million subscriptions, the services gross margin was 70.5%, down 100 basis points. Investors will want to watch gross margins as Apple expands the low margin Services business considering Disney lost $1.5 billion in the streaming area despite revenues reaching $4.9 billion.

Downtrend

With the iPhone 14 Pro production issues and delays in the AR/VR device, Apple investors are starting to lose faith in the stock. Apple has now fallen to 2022 lows of $126 and is the verge on dipping below the lows from 2021.

The stock traded at ~$80 pre-covid so shareholders still have a lot of gains in Apple over the last 3 years. The forward PE ratio is now more reasonable at 20x EPS targets, but investors could finally face the reality of the company only targeted at growing ~5% a year for the next 4 to 5 years.

A viable multiple for Apple remains around 15x EPS targets. Analysts forecast the company to earn $6.19 in FY23 now and a 15x multiple would place the stock at only $93.

Takeaway

The justification for the stock trading below $100 clearly exists with all of the problems going on with the company these days. Whether or not this occurs is a different story, but Apple appears very much on the path of being dead money for years, as proclaimed earlier this year.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.