Summary:

- Most analysts see Apple as a hold or buy, I prefer to be a contrarian.

- Apple is priced for perfection but given its history, it is very unlikely it will keep growing linearly.

- A high valuation, high recent growth and profitability, make the stock very risky for a limited reward.

Nikada/iStock Unreleased via Getty Images

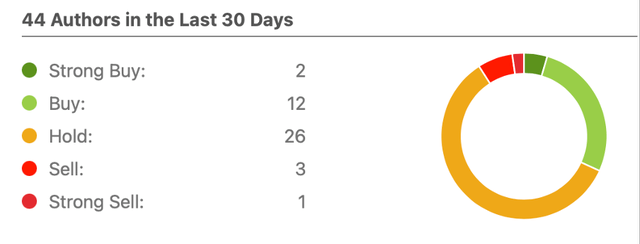

I recently looked at Apple (NASDAQ:AAPL) and was surprised that most articles rated the stock as a hold or buy, with only 4 sell ratings out of 44, of which just one as a strong sell.

Apple stock SA authors rating breakdown (Seeking Alpha)

I see Apple as a strong sell and overvalued for 2 very simple reasons: A high valuation and slower than expected growth ahead.

Let me start by discussing what is currently priced in the stock, elaborate on how it is unlikely those expectations will be met and conclude by showing how the risk of investing in Apple is high while the reward is low. Not a situation I like to be in when it comes to investing.

What Is Priced In

A look at EPS estimates is a straightforward way to see what are the expectations priced in a stock. My issue with EPS estimates is that those are usually linear in nature and too short-term for investing purposes. Most analysts make only two-year estimations because those are Wall Street’s standards and even when they make those, it is usually based on past trends.

Apple stock EPS estimates (Seeking Alpha)

The consensus is that Apple will see flat earnings for 2023 as we have seen a slower quarter, but going forward analysts expect Apple will simply continue to grow at approximately 10% per year. Of course, if 2023 is just a pause growth year and growth resumes onward, Apple deserves the current valuation of 25. If so, earnings are expected to double over the next 7 years, and the stock should follow, all else equal.

However, I’ve been following Apple for a while and I know that linearity is not how Apple’s business works. In 2016 I considered Apple a buy because Wall Street’s expectations were of no growth ahead based on just one year with declining revenues and stagnant iPhone sales (2015). The P/E ratio was 10 and few liked Apple’s outlook. Now in 2023, after two great years of strong growth, Wall Street might be too exuberant.

Apple 10 year revenue (annotations by author) (Seeking Alpha)

Especially after a few years of good growth, it is common for Apple to deliver a decline in revenues and consequently profits. In just 3 years, from 2019 to 2022, Apple has enjoyed 51% revenue growth. We can certainly attribute part of that growth to the increased savings due to stimulus, increased used of gadgets like phones and less spending on eating out or travelling. But, in line with historical cycles for apple, I would argue one should expect a significant decline in revenues and profits in the coming years.

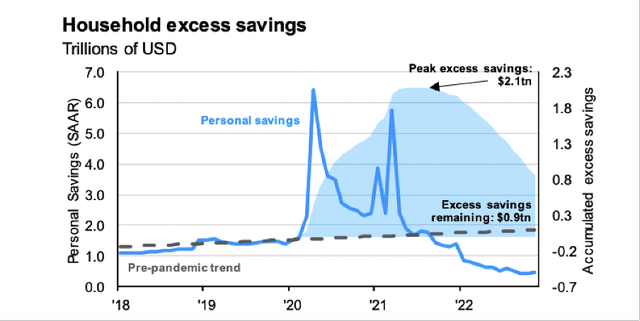

Apple’s revenue decline has just started and is still small with revenues declining 5.5% and profits declining 13% for the December 2022 quarter compared to 2021. The expectations are for the decline to be temporary but with excess pandemic savings mostly depleted given that consumers in the US spent more than $1 trillion in 2022, and some of that spending surely went to Apple, I don’t think Apple will deliver on the exuberant growth expectations Wall Street has.

Consumer savings accumulated (JP Morgan Asset Management)

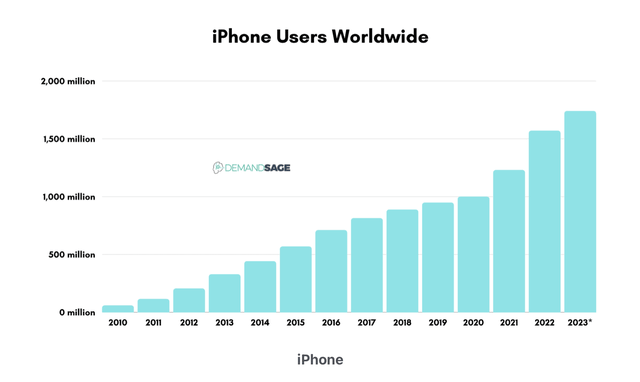

On the bullish side, Apple could always come up with some new surprising product, increase service revenues to compensate for slower sales or simply keep a stable high plateau of sales as users replace some of the more than 2 billion devices in use. However, all these bullish expectations are mostly linearly sourced from the amazing last two years where Apple did grow its service revenue and had amazing iPhone sales.

In my opinion, after many bought their new iPhone in the last two years, also given the current macroeconomic uncertainties and certain lower consumer liquidity due to no stimulus and higher interest rates, I don’t think Apple will manage to keep sales flat or growing. At least not year after year as the estimates suggest.

iPhone users worldwide (Demandsage)

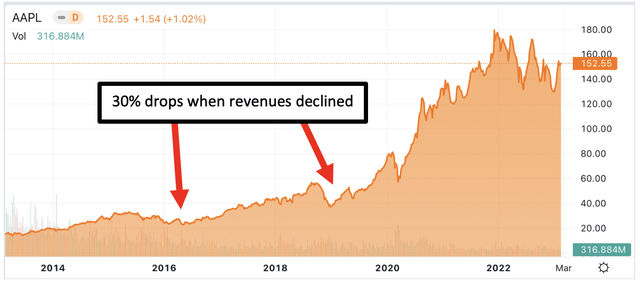

If my bearish thesis proves correct, Apple stock will be revalued and decline significantly as it has been the case in the past where the stock fell significantly every time there was a hiccup in revenue.

Apple stock price 10 year chart (annotations by author) (Seeking Alpha)

Apple Stock Valuation – What Happens When A Growth Stock Slows Down

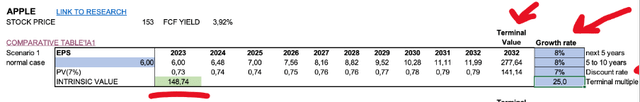

The following is pretty much what Wall Street is currently pricing in for Apple stock. I have flat EPS for 2023 at $6 followed by continuous growth ahead. I have used a discount rate of 7% and a terminal multiple of 25.

Apple stock exuberant valuation (Author)

(Note: PV calculates only the dividend payout, buybacks are included into the growth rate of EPS)

I find the above as priced for perfection because to justify the current price, Apple should keep on growing without hiccups over the next decade, the multiple has to remain as is, investors should be happy with a 7% return and that only if the expectations above are met.

Given the cyclicality explained above, me remembering 2016 when Apple was trading at a P/E ratio of 10 or even 2018 when the market was scared about Apple’s China exposure, I think the chances of Apple meeting the above linear growth expectations over the next decade are extremely slim.

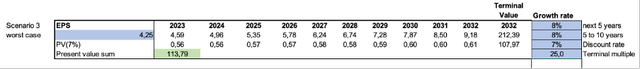

If I am more conservative than the market, expect a bad year ahead where EPS drops to $4.25, which would still be better than 2020 earnings, the present value of Apple stock drops to $113 implying a 25% decline. (2020 net income $57.4 billion – current number of shares outstanding – 16 billion – EPS on current number of shares = $3.58)

Apple stock conservative valuation (Author)

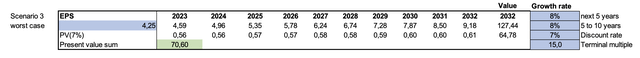

But we investors know that if earnings drop, Wall Street will start implementing the short-term situation into its linear models and thus the valuation will likely drop too. If the P/E ratio drops from 25 to 15, the present value drops to $70, for a decline of more than 50%.

Apple stock valuation (Author)

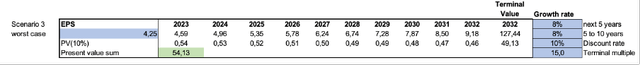

If I push this further, and expect an investment return of at least 10% as a respectable investor should do, then the present value of Apple stock drops to $54.

Apple stock worst case valuation (Author)

Conclusion

It is straightforward; in case Apple delivers on rosy expectations, the stock price could hit $277 in 10 years that, alongside the dividend, should give you a return of around 7%. If Apple’s historical business cycle kicks in, we see a recession and decreased spending in general, the picture could change significantly, valuations would fall and I would not be surprised to see Apple stock in double digits sometime the coming years. Thus, with limited upside and noteworthy downside, Apple is a strong sell.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.