Summary:

- Analysts on Wall Street and Seeking Alpha have finally soured on Apple Inc.

- I expect the Services segment to regain its strength as Macro conditions improve. It is a question of when and not if.

- Making a sell recommendation is easier than answering the “what next” question.

- Technical indicators show Apple is approaching oversold conditions while retaining a strong support in the $140s.

Scott Olson

Apple Inc. (NASDAQ:AAPL) is up more than 15% year-to-date amidst the 2023 NASDAQ rebound. However, a combination of factors, including ongoing dependencies on China, questions about its service business, and worsening inflation worries have recently brought into question the stock’s prospects. I present a few reasons why Apple stock is far from a sell, even at what may look like a lofty valuation and tough macro conditions. Let us get into the details.

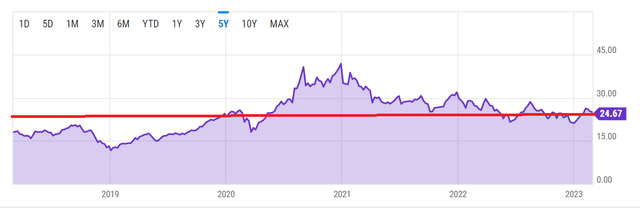

Historical Valuation

Apple’s average multiple over the last 5 years has been around 24, almost the same as the current forward multiple as shown below. Obviously, the Zero Interest Rate Policy (“ZIRP”) played a massive role in almost all the stocks trading at higher valuations till 2021, but even now, the market is trading at a multiple of about 30. I’d rather own Apple at a forward multiple of 24 than a basket of unknowns at a higher multiple in the name of spreading my risks.

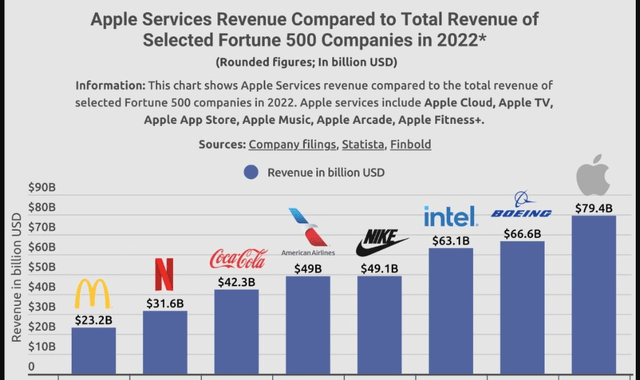

Services

There are some who believe the Services slowdown is long-lasting, like in the Barron’s article linked at the beginning. There are also some who believe the slowdown is cyclical, as covered by Seeking Alpha here. I tend to agree with the latter camp. Sure, there is a slowdown in growth, but when your revenue from a single segment is larger than the combined total annual revenue of The Coca-Cola Company (KO) and McDonald’s Corporation (MCD), the law of large numbers is expected to catch up.

Below are the reasons I believe Apple’s services will continue growing and getting bigger:

- Slowdown in advertising played a big role in the slowdown. However, if you believe this is a permanent trend, you are likely mistaken. Digital ads are still chipping away at traditional advertising and in all likelihood, advertising decline is temporary.

- Price increases have so far not faced backlashes and this is happening across many components of the service business over the last few months including App Store, Apple TV+, and Music.

- Enterprise market is still in its early stages.

- Apple has gone about the service business the right away. Services tend to have lower margin compared to products. However, when services are leveraged with products, customer stickiness is enhanced. Cisco Systems, Inc. (CSCO) for example, is going about this in the reverse way where it has established itself as a services player and the transformation into being product led is harder. However, a product-led company blending services that enhance its product experience is much easier, as shown by Apple’s ramp-up in Services revenue.

Apple Services (appleinsider.com)

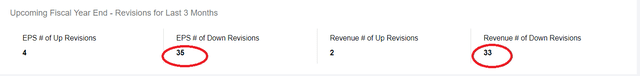

Toned Down Expectations

Earnings estimates have steadily been coming down for most stocks and the market in general. Apple is no exception as shown below, as downward revisions have vastly outnumbered upward revisions with a 9:1 ratio on EPS and 16:1 on revenue.

AAPL Estimates (seekingalpha.com)

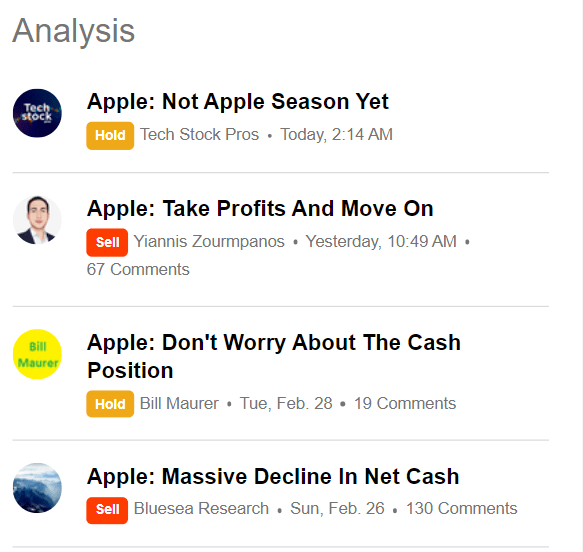

Additionally, as someone who has been following Apple and Seeking Alpha for a long time, I don’t recall ever seeing Apple not having a single recent (last 10 articles) buy rating on the platform. The last 10 Apple articles on Seeking Alpha have the following ratings:

- Holds: 5

- Sell: 3

- Strong Sell: 2

Now, that does not make Apple stock a buy by and of itself, but as a contrarian, I tend to monitor the crowd, so I can see if the other side of the trade makes more sense. When expectations are lower, it makes it easier for a stock to rise up should the actuals come in even slightly better.

AAPL SA (seekingalpha.com)

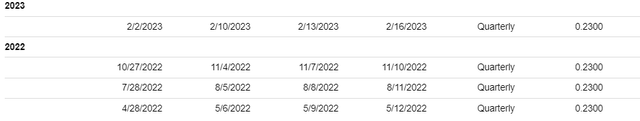

Upcoming Dividend Increase

Who can blame investors if they forget that Apple pays a dividend when the stock (capital gains only) has outperformed the market by more than 3 times since the dividend was initiated? But, as hard as it is to believe, Apple is likely to announce its 10th consecutive annual dividend increase, as I covered here. While Apple can afford a much bigger dividend increase, I expect Tim Cook’s cautious nature to once again take the center seat and expect the new annual dividend to be $1.00 per share, tops, from the current 92 cents per share shown below. This does not make an immediate impact to your overall returns, but do not underestimate the power of increasing dividends over time.

Opportunity Cost or Opportunity Lost

The other big question in my mind is, if one were to sell Apple here, where do the funds get deployed? Cash and savings accounts may look attractive now but may not be so for the long term. Now, if you are like me, you may be looking at a like-for-like replacement. The good and bad news for Apple shareholders is there isn’t any other Apple around. I mean, show me another company/stock with the following characteristics:

- Brand name

- Relative moderate valuation

- Pays a dividend

- Still has plenty of growth avenues

- Sells what are now essentially commodities but at a premium

- Is more or less unrivalled in key areas of business

- Has an enviable balance sheet

- Has a mature adult, who is still just 62 after 10 years in the position, as the CEO

Well, you get it. The only stock that comes close in my mind is Microsoft Corporation (MSFT) but that stock is trading at a higher multiple than Apple at this point. Apple’s stock may be trading at a slight premium compared to fellow tech giants like Alphabet Inc. (GOOG) and Meta Platforms, Inc. (META), but as a business, Apple does not have nearly as many nor serious challenges as those two names.

In short, making a sell recommendation is easy, but the opportunity cost of chasing a strong stock like Apple may make it worth holding on through tough times.

Technicals

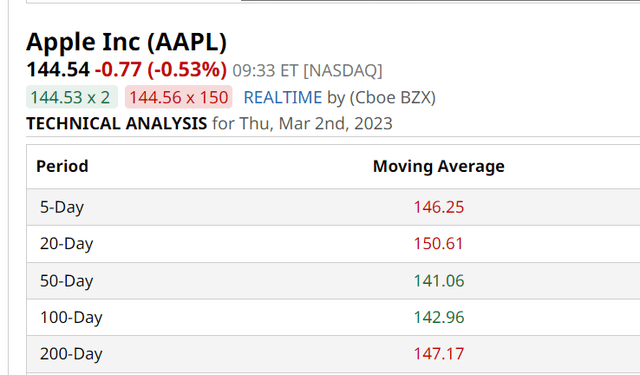

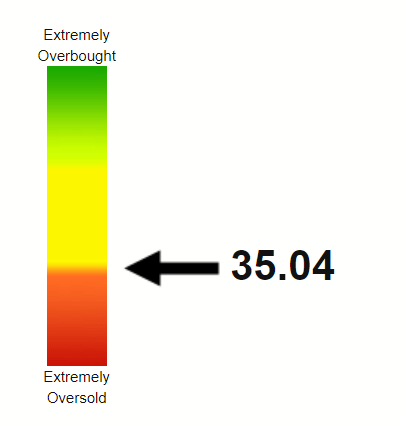

Lastly, I monitor a few technical indicators to determine short-term direction and trend.

- The fact that Apple’s current price is very close to almost all the commonly used moving averages shows that the stock has a strong support in the $140s.

- Apple’s Relative Strength Index (“RSI”) is very close to the textbook oversold condition, with a reading of 35. The stock is shaky pre-market – I won’t be surprised to see the RSI dip to 30 and below over the next few days.

AAPL Moving Avgs (barchart.com) AAPL RSI (stockrsi.com)

Conclusion

With a price-earnings/growth (“PEG”) ratio of 3 based on a forward multiple of 24 and expected earnings growth of 8%, Apple Inc. is a bit too elevated for my liking here to go all in. But it is almost blasphemous for me to recommend a sell rating on what is now a mass consumer brand selling products and services at a premium price. I rate Apple Inc. stock a buy, but using a step-ladder approach:

- Start nibbling at $140 (or right now, too, if you need Apple in your portfolio)

- Go harder in $130s

- Go all in should you be lucky enough to see $120s, as that would represent a PEG in the low to mid 2s, which is a deserved premium for what is in all likelihood the safest brand and company in the world

Disclosure: I/we have a beneficial long position in the shares of AAPL, GOOG, META, MSFT, KO, MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.