Summary:

- Arrival has reorganized its business in a shift to cut costs and start production as its liquidity dries up.

- Arrival announced $513M in cash plus a $300M ATM equity program in August, but by the end of Q3, Arrival backed away from the ATM and reported $330M in cash.

- The startup has also paused its car and bus projects to favor van production, but it has already missed some start-of-production deadlines.

- Arrival’s convertible note trades in distress at just under 31, and combined with the liquidity profile and UPS’ option to walk away, the company may struggle to stay afloat.

ipanacea/iStock via Getty Images

Arrival (NASDAQ:ARVL) is a far cry from the original production, vehicle, and revenue targets that it outlined for investors to garner a $13 billion valuation on its first trading day after originally being valued at $5.4 billion. The EV startup’s recent moves to cut costs, delaying timelines while in a dire need for cash overshadow the company finally producing its first production verification vehicle at the end of Q3. Arrival has run very low on cash with little to show for it, and both shares and its convertible note signal that the company may struggle to stay afloat.

What Went Wrong?

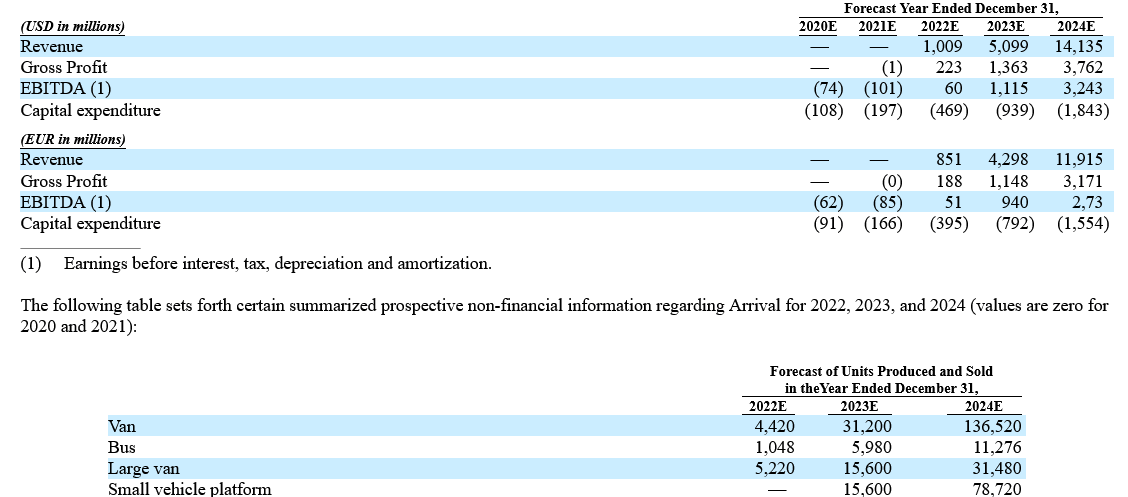

Arrival went public via a SPAC deal touting some of the fastest growth rates in the entire EV industry — commencing deliveries and reaching $1 billion in revenues by 2022, projecting 400% y/y growth to $5 billion in 2023 before jumping another 180% y/y to $14 billion in 2024. As it currently stands, the company is on track to produce less than 25 vehicles this year.

Arrival’s original projected financials and growth targets are shown below.

Arrival

Arrival also targeted nearly 10,000 units combined of Van and Large van production in 2022, with total deliveries across the two reaching nearly 168,000 by 2024. Given Arrival’s targeted maximum annual capacity of 10,000 vans per microfactory, the company’s original plans predicted reaching full-scale in at least 17 microfactories just for both van lines. Again, as it stands, Arrival is likely to have two operational (at maximum three) by 2023 — Bicester and Charlotte/Rock Hill.

Arrival only has limited orders — its order book consists of UPS (UPS) 10,000-plus-10,000 deal, as well as a deal with LeasePlan for 3,000 vehicles and a five bus deal with Anaheim Transportation Network. Arrival touts over 149,000 non-binding vehicle orders and MOUs representing more than $6 billion in revenue, if all vehicles are indeed delivered. In order to deliver such a backlog by 2025, for example, Arrival would need to have around 10, maybe 12, microfactories operating at maximum capacity by 2024, requiring about $600 million to reach that scale — Arrival does not have that cash, and plans to cut costs and pause car and bus production signal that expanding to multiple microfactories is not a high priority. The pause of bus production impacts ATN’s order.

Arrival has been an execution story since the SPAC deal, given the massive valuation, unique approach to production via the microfactories, and a lack of production and deliveries at the time — Arrival had to prove to the market that it could deliver, and to date, it hasn’t. And the outlook for the startup is only getting more bleak.

Market Losing Confidence, Fast

Arrival has made several substantial changes to its operating model and production plans that have concurred with the market losing confidence in its ability to execute and its ability to stay afloat.

Arrival isn’t only bad news — the startup has reached a major milestone with the production of its first production verification vehicle at Bicester. With this, Arrival is moving closer towards production at scale and customer deliveries; however, production is still delayed from original targeted dates. Arrival only targeted delivery volumes of about 20 vans this year, which could decrease if the company uses vehicles for continued testing and validation.

However, Arrival has made quite a few significant moves that highlighted its need for cash as well as its struggle to execute.

In July, Arrival “proposed a reorganisation of its business,” in an effort to realign costs and reach 2023 targets using its cash on hand — this move implies around a 30% reduction in spend and up to the same percentage reduction in headcount.

In August, during its Q2 earnings call, Arrival noted that it had established an ‘at-the-market’ equity program for the sale of up to $300 million in stock to “operate the business through at least 2023 without needing to raise additional capital, other than through the ATM.” Arrival planned on raising $90 million in 2022 and $210 million in 2023 — however, the company has already walked back on plans to use the ATM for funding, given the company’s current share price. Tapping into the full value of the ATM would incur about 63% dilution to shares, hence the shift away.

In late October, Arrival announced a shift to focus on the US market, producing in Charlotte’s microfactory. Arrival also updated on its cash balance — in August, Arrival announced cash on hand of $513 million plus the $300 million ATM in for over $800m in total liquidity; however, Arrival now has just $330 million in cash and no plans to use the ATM. As a result, Arrival’s quick evaporation of liquidity and its relatively thin amount of cash on hand compared to its needs suggest that the company runs the risk of bankruptcy if it cannot find outside funding. Arrival’s 2026 convertible notes corroborate this view, trading in distress — the $320 million notes (converting for 84.2105 shares, or ~$11.88 per share) last traded at 30.93 at a 37.89% yield.

The Industry Can Walk Away

Another risk that recently surfaced in great detail is the fact that the industry can, and potentially will, walk away from an investment should it not be meeting its targeted timelines. Ford (F) and Volkswagen (OTCPK:VWAGY) recently made the decision to pull out of Argo AI, their jointly-backed autonomous vehicle startup, after Argo AI has failed to attract new investors and missed targeted timelines to bring robotaxis public in 2021.

Argo AI was a high-profile name in the autonomous vehicle industry, raising $3.6 billion from its two OEM backers while testing in three major cities, two of which were with ride-hailing firm Lyft (LYFT). The widely unexpected move for Argo AI demonstrates that there is always the possibility for large players to walk away, and drop investment plans due to delays or struggles to commercialize and develop technology. For Arrival, the recent move from Ford and VW highlights the fact that UPS has the option to leave, a move which would significantly impact the company.

Arrival has noted that the UPS order, for 10,000 vans plus the option for an additional 10,000 more, representing a total value of $1.2 billion, “constitutes substantially all of the current orders for Arrival vehicles.” Any modification of the order could significantly impact liquidity or cash flow, as per Arrival. The order, when signed, said that the vans “need to be delivered” by 2026. Arrival is on the cusp of beginning deliveries to UPS, but UPS has other options that it can choose for vans, such as GM’s BrightDrop (GM). UPS can modify or cancel its Arrival order at any time, and Ford and VW have now shown that the industry may not be willing to wait any longer.

Outlook

Shares of Arrival have lost over 95% in the past year as the EV startup struggles to get production up and running, as it has delayed its car and bus project and cut costs to focus on van production. Arrival has a significant order book and a substantial order with logistics giant UPS that represent over $6 billion in revenue potential, but the company has not yet gotten production running at scale yet. Shares trading below $1 as well as its convertible notes trading in distressed territory at just under 31 suggest that the market has quickly lost confidence in Arrival. Liquidity is rapidly thinning, and the recent move by Ford and VW to pull out of Argo AI demonstrates that the industry does not have to wait, and major backer UPS has the option to do the same. Given Arrival’s liquidity position and inability to raise funding via its ATM program or via more debt, the startup may struggle to stay afloat.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.