Summary:

- We think McDonald’s is uniquely positioned to benefit from the current inflationary environment.

- The company runs a mostly-franchised business, meaning that most inflationary headwinds on the cost front may impact its operators as the corporate benefits from higher selling prices through franchise fees.

- McDonald’s offers tremendous value to the consumer, and its 2 for $2 offering is just one example. Consumers can’t get enough of Mickey D’s.

- We point to the high end of our fair value estimate range ($300 per share) given the momentum McDonald’s seems to have in the current environment.

- McDonald’s pays investors a savory ~2.4% dividend yield at the moment.

Alexander Farnsworth

By Valuentum Analysts

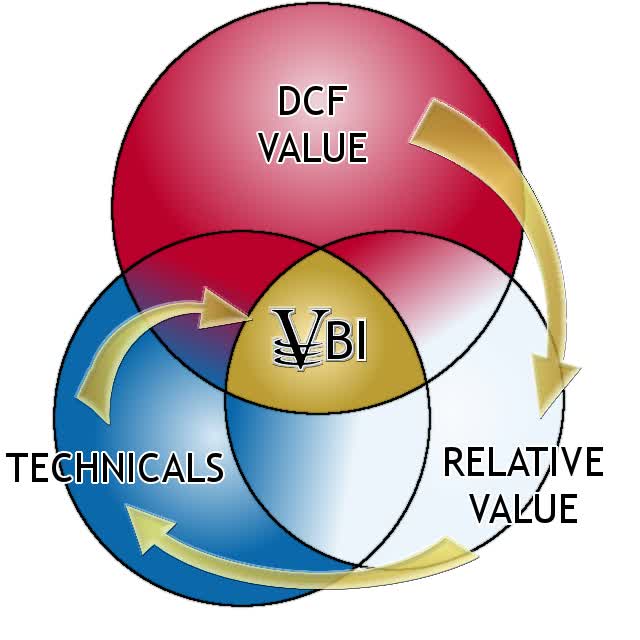

At Valuentum, we use discounted cash-flow analysis as the bedrock of our process. However, we also use relative valuation and technical and momentum indicators and blend that into an output called the Valuentum Buying Index rating, or the VBI rating. The image below shows the order of our systematic process.

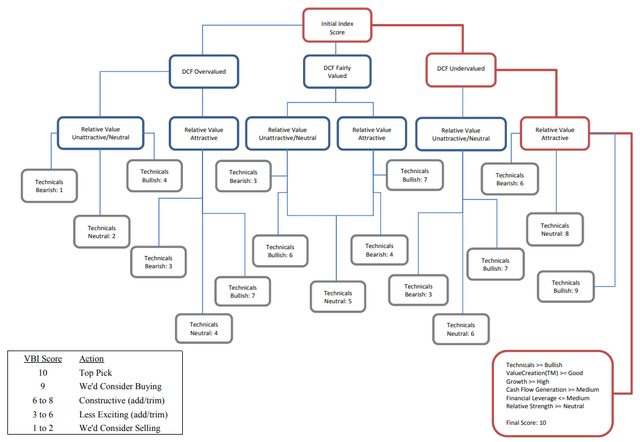

The center of the Venn diagram above, the Valuentum Buying Index (VBI) combines rigorous financial and valuation analysis with an evaluation of a firm’s technicals and momentum indicators to derive a rating between 1 and 10 for each company (10=best). Because the process factors in a technical and momentum assessment after evaluating a firm’s investment merits via a rigorous DCF and relative-value process, the VBI attempts to identify entry and exit points on what we consider to be the most undervalued stocks. (Image Source: Valuentum) The flow chart on how we rank stocks in our coverage universe. (Image Source: Valuentum)

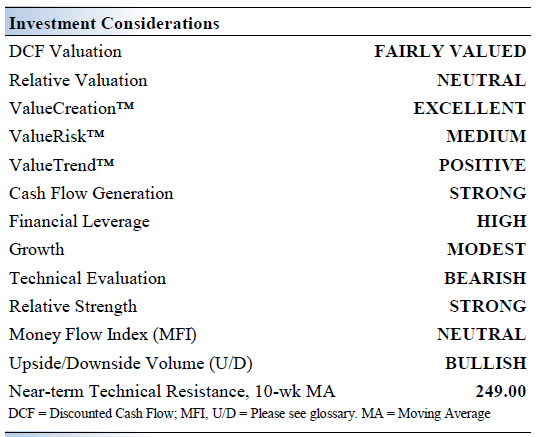

McDonald’s (NYSE:MCD) currently registers a 3 on the Valuentum Buying Index on the basis of three of its key investment considerations that we’ll talk about soon (and as shown in the image below). We use the Valuentum Buying Index to source ideas for the simulated Best Ideas Newsletter portfolio. Though we like McDonald’s a lot under any environment, we think it is uniquely-positioned to benefit from the current inflationary environment.

First, the company runs a mostly-franchised business model, meaning that most inflationary headwinds on the cost front may impact its operators as the corporate benefits from higher selling prices through franchise frees. Second, McDonald’s offers tremendous value to the consumer, and its 2 for $2 offering is just one example. Consumers can’t get enough of Mickey D’s. With that backdrop clearly stated, let’s now dig into our fundamental, cash flow and valuation analysis of McDonald’s.

McDonald’s Key Investment Considerations

Image Source: Valuentum

Home of the Big Mac, McDonald’s is the world’s largest quick-service restaurant brand. The firm’s management is extremely shareholder-friendly, returning billions to shareholders annually. McDonald’s has 40,000+ restaurants in ~120 countries. The company was founded in 1940 and is based in Oak Brook, Illinois.

At the end of December 2021, ~93% of the company’s worldwide restaurant locations were franchised. McDonald’s aims to generate a free cash flow conversion rate north of 90% in the near term, aided by the asset-light nature of its business model.

Though it will be hard to produce another gem to the same success as McCafe, we can’t rule McDonald’s out. Industry-wide traffic trends and competitive pricing in the US are worth noting as they relate to comp performance. McDonald’s seeks to franchise ~95% of its total restaurant count which should further support its financial performance.

McDonald’s is modernizing its stores and upgrading its digital operations, while encouraging its franchisee partners to do the same. The firm continues to optimize its menu while improving the in-store dining experience and digital order delivery experience. McDonald’s has a bright growth outlook.

Labor/wage market developments are worth keeping an eye on, and increasing competition from fast-casual and healthier menus is a permanent, structural change. McDonald’s is leaning on its pricing power to offset inflationary headwinds.

McDonald’s reported third-quarter 2022 results October 27, and we couldn’t have been more pleased with the results. Global comparable sales advanced 9.5%, easily beating the consensus forecast of 5.8%. Consumers continue to flock to its locations to find value-offerings, and many higher-income customers may be looking to trade down to its offerings. It recently raised its dividend payout 10%, and we management’s commitment to the payout.

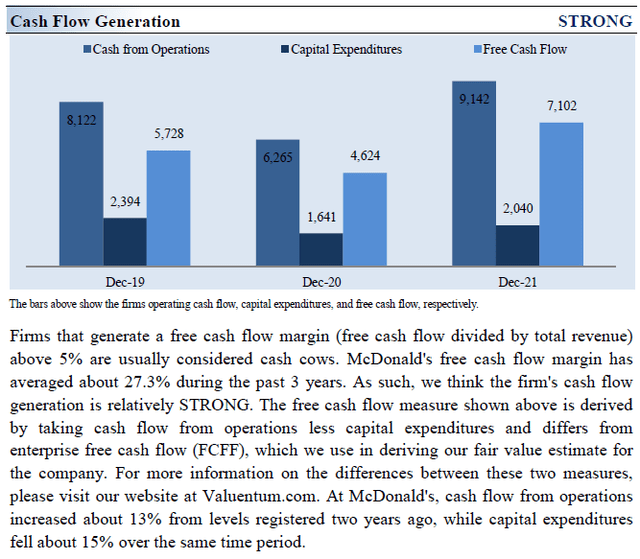

McDonald’s Cash Flow Valuation Analysis

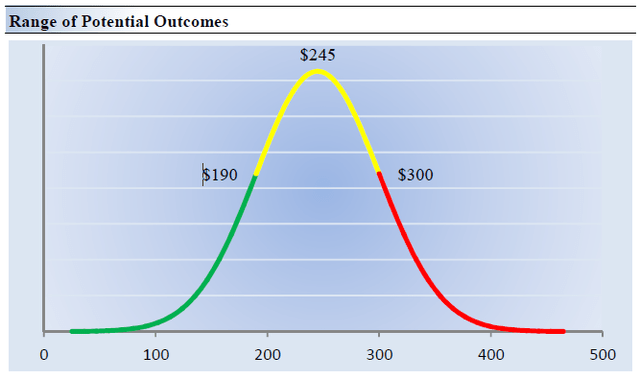

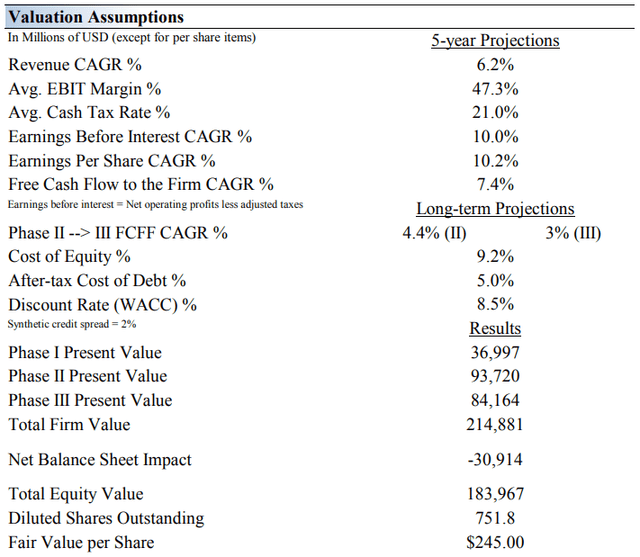

We think McDonald’s is worth $245 per share with a fair value range of $190-$300. Shares are priced at $258 at the moment, about in-line with the midpoint of our fair value estimate range. We point to the high end of our fair value estimate range given the momentum McDonald’s seems to have in the current environment.

The margin of safety around our fair value estimate is driven by the firm’s MEDIUM ValueRisk™ rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them.

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our valuation model reflects a compound annual revenue growth rate of 6.2% during the next five years, a pace that is higher than the firm’s 3- year historical compound annual growth rate of 3.4%.

Our model reflects a 5-year projected average operating margin of 47.3%, which is above McDonald’s trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 4.4% for the next 15 years and 3% in perpetuity. For McDonald’s, we use a 8.5% weighted average cost of capital to discount future free cash flows

Valuation Assumptions of McDonald’s (Image Source: Valuentum)

McDonald’s Margin of Safety Analysis

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate McDonald’s fair value at about $245 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for McDonald’s. We think the firm is attractive below $190 per share (the green line), but quite expensive above $300 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

That said, in light of current inflationary conditions, we wouldn’t be surprised to see McDonald’s do extremely well, pushing its fair value toward the higher end of the designated range. Investors may look for valuation upside potential, in our view.

Concluding Thoughts

McDonald’s has been executing well as of late. The company’s decision to make breakfast an all-day proposition reinvigorated comparable store sales growth (it has since ceased all-day breakfast, but the firm-wide momentum has continued), and its efforts to refranchise company-owned restaurants and pursue net annual G&A spending reductions are working wonders on its operating profit line. No other restaurant chain can stand toe-to-toe with its iconic brand, geographic reach, and scale advantages, and it has raised its dividend every year since first paying one in 1976, though it is not immune to industry-wide traffic and competitive pricing issues. McDonald’s continues to innovate and has a bright growth outlook.

McDonald’s is simply a fantastic restaurant concept. The company is executing its turnaround plan flawlessly, in our view. Its goal to become 95% franchised over the long run, however, should shield it from most operating problems (including inflationary pressures), but franchisees are a fickle bunch, and management will have to stay on its toes strategically especially given hurdles created by COVID-19. Consumer trends can change fast, and the restaurant now has a much larger net debt load, which is why its Dividend Cushion ratio is under pressure. Still, we like shares in this environment, and with a dividend yield of ~2.4%, the company is one of our favorite ideas.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.