Summary:

- Cannabis stocks continue to burn as Mr. Market watches the inflation rate remain stubbornly high in September CPI/PPI.

- The Feds are not helping as well, with 86.5% of analysts projecting a 75 basis points hike and raised interest terminal rate in the upcoming November meeting.

- Federal legalization will remain convoluted as well, so investors should temper their expectations accordingly.

- Only long-sighted investors with lead-lined stomachs should add at these bottom levels, due to the massive uncertainty ahead.

Dimple Bhati

Investment Thesis

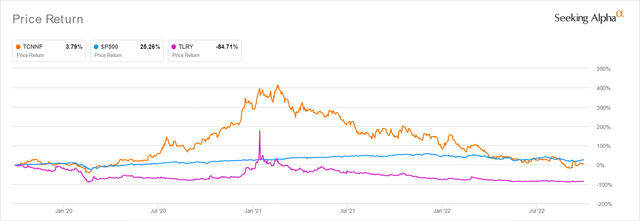

TLRY & TCNNF 3Y Stock Price

Post-reopening cadence and, probably, one foot into this painful recession, speculative stocks such as Tilray Brands (NASDAQ:TLRY) and Trulieve Cannabis Corp. (OTCQX:TCNNF) naturally underperformed against the wider market. The former had plummeted by -52.23% YTD, with the latter reporting a -60.09% and the S&P 500 Index a -20.62% plunge at the same time. Mr. Market continued to drastically correct high-growth stocks and previously over-inflated pandemic stocks to their current near-bottom levels. Combined with the Fed’s aggressive hikes through 2023, we do not expect things to improve for both companies, given their elevated long-term debts and minimal profitability.

Thereby, pointing to the unfortunate growth in their Stock-Based Compensation (SBC) and, consequently, share dilution ahead. TLRY reported $41.12M of SBC expenses in the last twelve months (LTM), indicating a massive increase of 221.31% sequentially, triggering a 12.61% growth in its share count at the same time. TCNNF did moderately better with an $18.03M SBC expenses in the LTM, though its sequential share dilution of 40.72% remains a big problem for long-term investors indeed. Though these are attributed to the latter’s aggressive acquisitions, things no longer look rosy as the macroeconomics deteriorates and equity funding dries up.

Nonetheless, there might be a silver lining, given the relatively elevated September CPI with increased spending on smoking products by 0.2% sequentially and 8.2% YoY, indicating the robust US consumer consumption trend for now. Assuming that discretionary spending remains strong through the recession, we expect to see TCNNF hold steady at these levels. In the meantime, we expect the path for Biden’s federal cannabis legalization to remain convoluted over the next two years. So, TLRY investors should also temper their expectations accordingly.

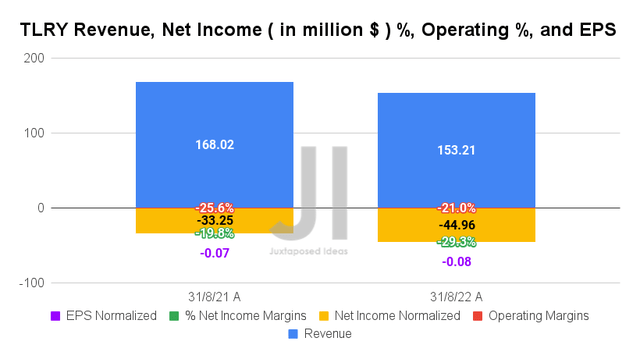

TLRY and TCNNF Continue With Their Cash Burn As Price Wars Intensify

In its latest earnings call, TLRY reported revenues of $153.21M, indicating inline QoQ though a decline of -8.81% YoY. In the meantime, there are some improvements in its operating efficiency, with margins of -21% in FQ1’23, compared to FQ4’22 levels of -64.9% and FQ1’22 levels of -25.6%. Nonetheless, the company continues to report a lack of net income profitability, with -$44.96M and net income margins of -29.3% in the last quarter. Thereby, explaining its FQ1’23 EPS of -$0.08.

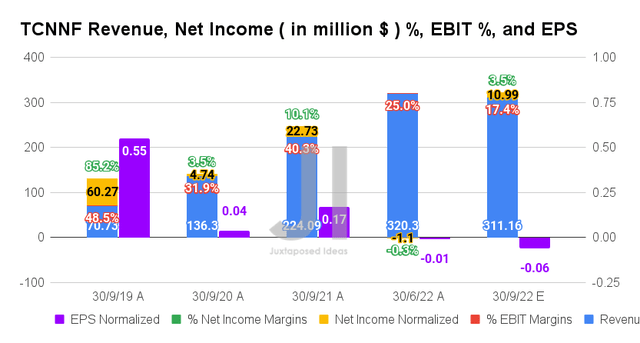

In the meantime, TCNNF is expected to report revenues of $311.16M and an EBIT margin of 17.4% in its upcoming FQ3’22 earnings call on 14 November, indicating a notable decline of -2.85% and -7.6 percentage point QoQ, respectively. Otherwise, a YoY growth of 38.85% though a drastic moderation of -22.9 percentage points, respectively. Thereby, impacting its profitability to net incomes of $10.99M and net income margins of 3.5%, indicating a decline of -51.64% YoY.

Though the declining profitability is partly attributed to TCNNF’s SBC and merger expenses, rising costs remain the biggest problem for the company, given the catastrophic fall in its gross margins from 75.9% in FY2019 to 58.9% by the LTM. Thereby, explaining its falling EPS thus far.

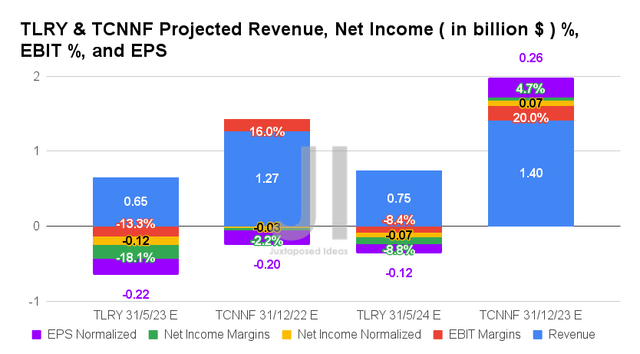

As a result of its financial underperformance thus far, TLRY’s forward performance has been massively downgraded by consensus estimates since September 2022, with -a 32.98% decline in its top-line growth while remaining unprofitable by FY2024. That is tragic indeed, since TCNNF is expected to report improved revenue growth by 2.94% through FY2023, though another drastic moderation in profitability by -80% since our previous analysis in May 2022.

It is apparent by now that the rising inflationary pressures and elevated operating expenses have decimated their margins, leaving TCNNF in a worse shape compared to the pandemic boom. The latter is expected to report EPS of -$0.20 in FY2022 and EPS of $0.26 in FY2023, comparatively weaker compared to its FY2019 levels of $1.54 and FY2021 levels of $0.84. Tragic indeed, since their stocks are unlikely to improve in the meantime as cannabis margins remain tight, due to the oversupply and intense pricing wars at state levels.

In the meantime, we encourage you to read our previous article on TLRY & TCNNF, which would help you better understand its position and market opportunities.

- Tilray: Hype Train Crashed

- Trulieve Cannabis: Time To Light It Up

- Trulieve Vs. Tilray: Legalization May Not Be A Game Changer After All

So, Is TLRY & TCNNF Stock A Buy, Sell, Or Hold?

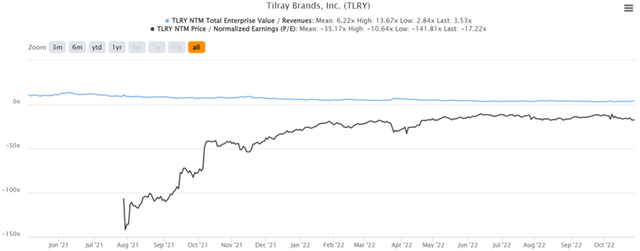

TLRY 2Y EV/Revenue and P/E Valuations

TLRY is currently trading at an EV/NTM Revenue of 3.53x and NTM P/E of -17.22x, lower than its 2Y EV/Revenue mean of 6.22x though massively improved from its 2Y P/E mean of -35.17x. The stock is also trading at $3.53, down -74.69% from its 52 weeks high of $13.95, though nearing its 52 weeks low of $2.65. Nonetheless, consensus estimates remain somewhat optimistic about TLRY’s prospects, due to their price target of $5.17 and a 46.46% upside from current prices.

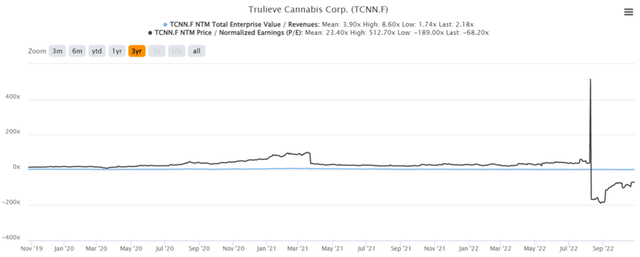

TCNNF 3Y EV/Revenue and P/E Valuations

In the meantime, TCNNF is trading at an EV/NTM Revenue of 2.18x and NTM P/E of -68.20x, lower than its 3Y mean of 3.9x and 23.40x. The stock is also trading at $10.66, down -69.32% from its 52 weeks high of $34.75, though at a premium of 28.58% from its 52 weeks low of $8.29. Nonetheless, analysts remain bullish about TCNNF’s growth story, due to their inflated price target of $35.01 and a 228.42% upside from these bottom levels.

Combined with the factors discussed above, we rate both stocks as Hold, since current floor levels may not hold through if inflation continues to soar. Investors should buckle up for the rough ride ahead. In the meantime, those with higher risk tolerance and long-term trajectory may attempt to add TCNNF in the single digits, given the massive rally upon federal legalization by speculatively 2024. However, they should also size their portfolios accordingly in the event of massive volatility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.